TL;DR

- Global digital health funding rebounded to $25.1 billion in 2024, marking a 5.5% year-on-year increase.

- Europe saw the highest regional growth, with funding surging by 27% from 2023, while the US retained its dominance, contributing $17.2 billion in funding.

- Artificial Intelligence (AI) ventures captured a 58% share of total funding, highlighting critical role of AI in healthcare innovation.

- Partnerships in Digital Health hit record levels in the first half of 2024 but declined significantly in the latter half.

- Healthcare providers (health systems and hospitals) remain the primary drivers of partnerships, forging a 21% share of all collaborations.

Read the full report for in-depth insights into global trends and opportunities.

Digital Health Funding Rebounds in a Resilient Sector

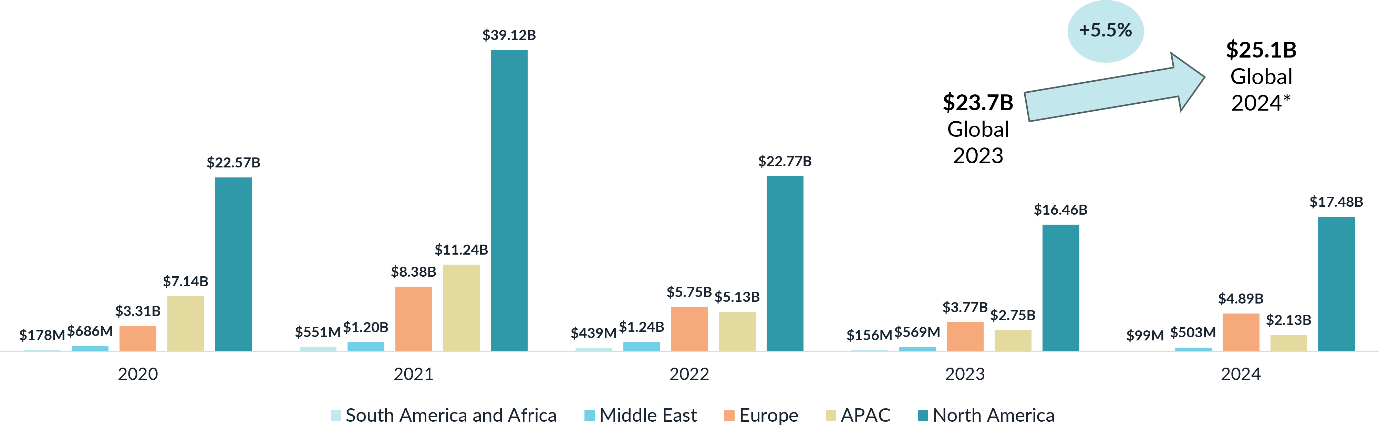

The digital health sector marked a significant turnaround in 2024, rebounding from two consecutive years of funding decline. Global investments reached $25.1 billion across 1,623 deals, a modest yet encouraging 5.5% increase year on year. This revival underscores the sector’s adaptability in navigating economic headwinds and regulatory complexities.

Global Digital Health Venture Funding

*Exit deals such as IPO, SPAC and M&A are not included in funding values. Funding values can include post-exit grants, strategic and debt-financing rounds for 2024.

Europe’s Digital Health Funding emerged as the standout performer, surging by an impressive 27%, making it the fastest-growing region. While the US maintained its dominance in overall funding volume, its growth was relatively subdued at 4%. Asia-Pacific and the Middle East faced setbacks, with funding declining by 27% and 12%, respectively.

The resurgence, however, is not without its challenges. Digital Health Partnerships, which peaked in Q2 with record-breaking collaborations, declined by 29% in the year’s second half. Additionally, the sector continues to grapple with regulatory hurdles and slow adoption of reimbursement frameworks.

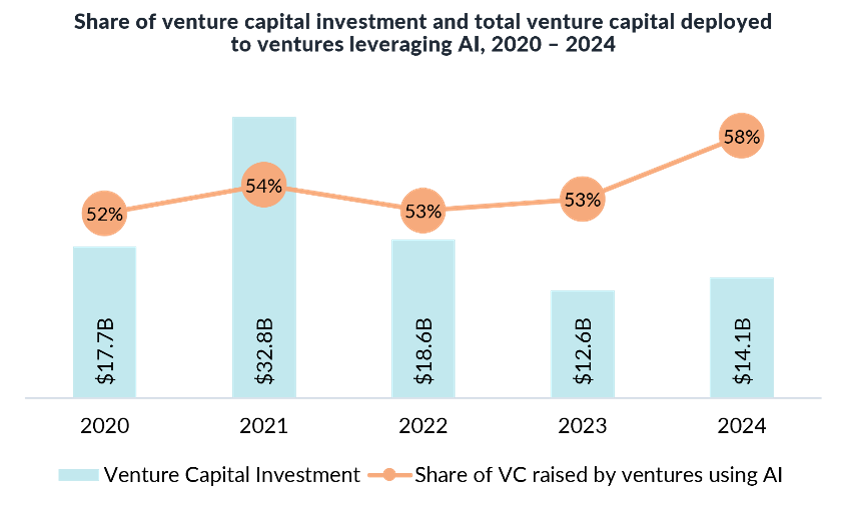

The AI Revolution in Healthcare

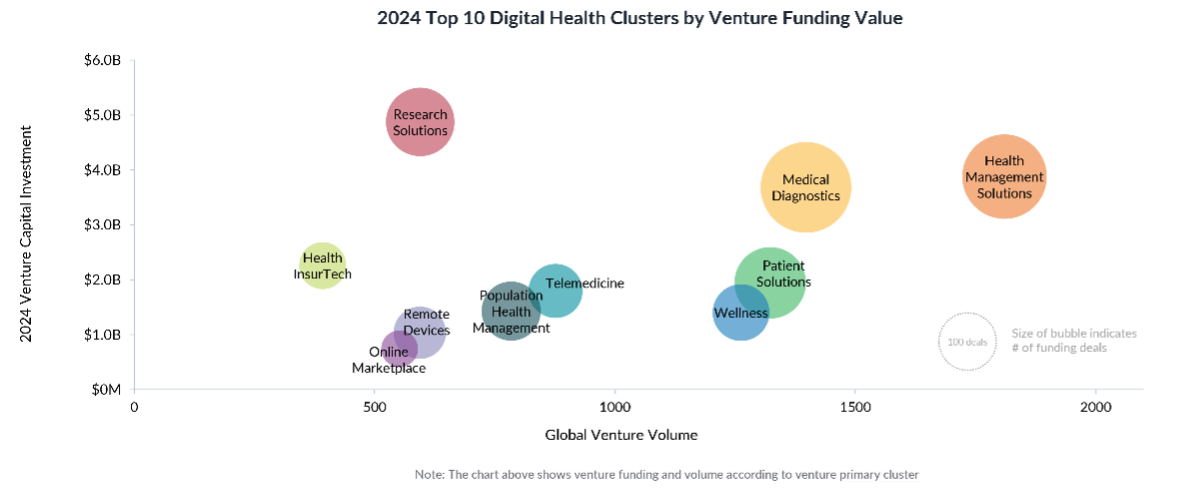

Artificial Intelligence (AI) remained the cornerstone of healthcare innovation in 2024, capturing 58% of total venture funding. Investments in AI-driven ventures reached $14.1 billion, reflecting heightened investor enthusiasm for AI’s transformative potential . Key focus areas included medical diagnostics, health management solutions, and research solutions (aka. TechBio).

Notably, ventures focused on TechBio (19%), Health Management Solutions (16%), and Medical Diagnostics (14%) outperformed other clusters, securing nearly half of the total funding. The substantial investment in these three clusters emphasises the surge in AI-driven research and healthcare tools.

Generative AI, a subset of AI technologies, accounted for less than 5% of private digital health ventures globally, indicating untapped potential and room for growth. As an example, Abridge, which uses Large Language Models to improve clinical documentation efficiencies, raised a $150M Series C round in February 2024.

Regional Trends and Investment Insights

Europe: A Rising Star

Europe’s digital health funding increase to $4.8 billion signals a growing investor appetite for digital health innovation in the region. The doubling of mega-deals (transactions exceeding $100 million) further emphasises Europe’s emergence as a competitive player. Flo Health was one of the European-founded digital health ventures that closed a $200 million mega-deal in July 2024.

US: Maintaining Leadership

Despite hitting a three-year low in Q4 2024, the US’s digital health funding volume remained robust at $17.2 billion. The region’s continued dominance in mega-deals underscores its critical role in shaping the global digital health landscape. The $1B of funding committed to founding Xaira Therapeutics was the largest deal recorded in 2024 for US-founded ventures.

For more insights on 2024 US Digital Health Funding, read Galen Growth’s regional blog for the US.

Asia-Pacific and the Middle East: Struggling for Momentum

Asia-Pacific’s digital health funding decline of 27% reflects the region’s challenges in maintaining investor confidence, while the Middle East experienced a 12% drop amidst geopolitical uncertainties. PharmEasy was the top-funded APAC digital health venture in 2024, closing a $216 million Series G1 round in April.

Digital Health Funding 2024 by Key Clusters and Therapeutic Areas

Top Clusters

– Research Solutions (TechBio): Retained its top position, attracting $4.77 billion in funding.

– Health Management Solutions: Recorded modest growth of 2% year-on-year.

– Medical Diagnostics: Saw a substantial 21% increase, driven by AI advancements.

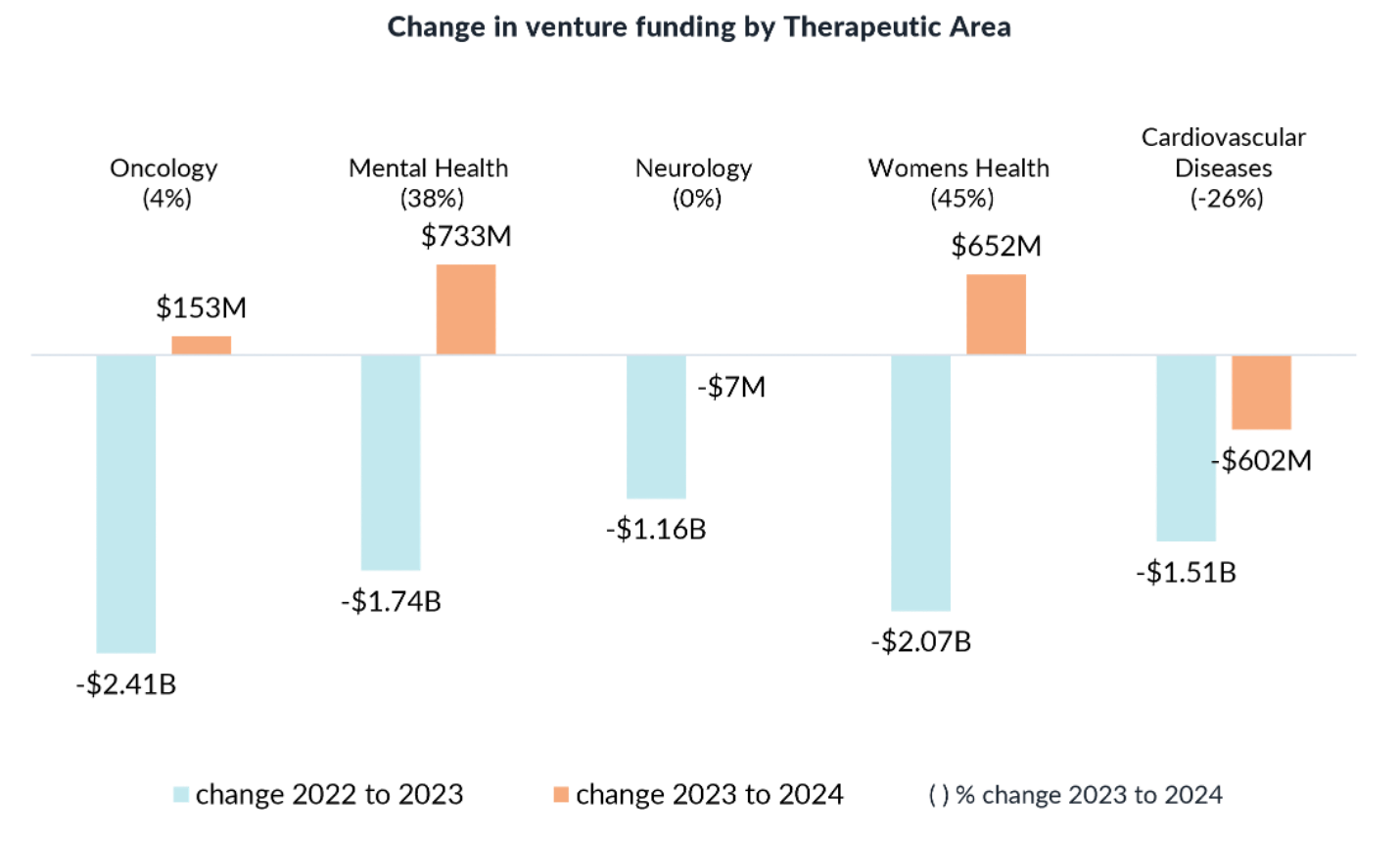

Therapeutic Priorities

Among the five highest-funded therapeutic areas, mental health and women’s health were the fastest-growing, with funding increases of 38% and 45%, respectively. These areas reflect a growing emphasis on addressing unmet healthcare needs through digital solutions. In mental health, Talkiatry captured a $130 million mega-deal in June 2024.

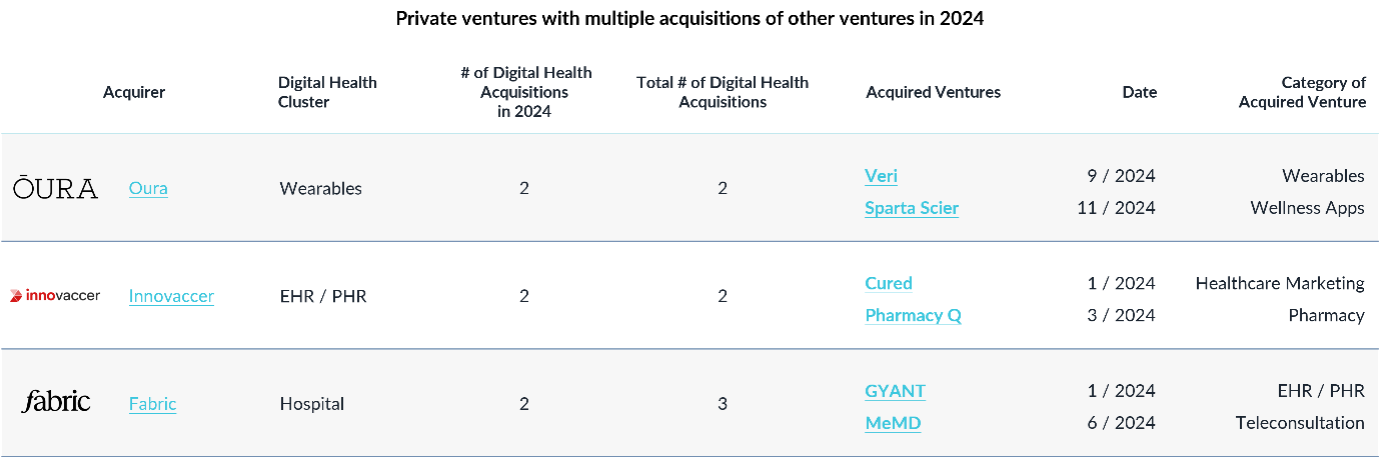

Mergers, Acquisitions, and the Road to IPOs

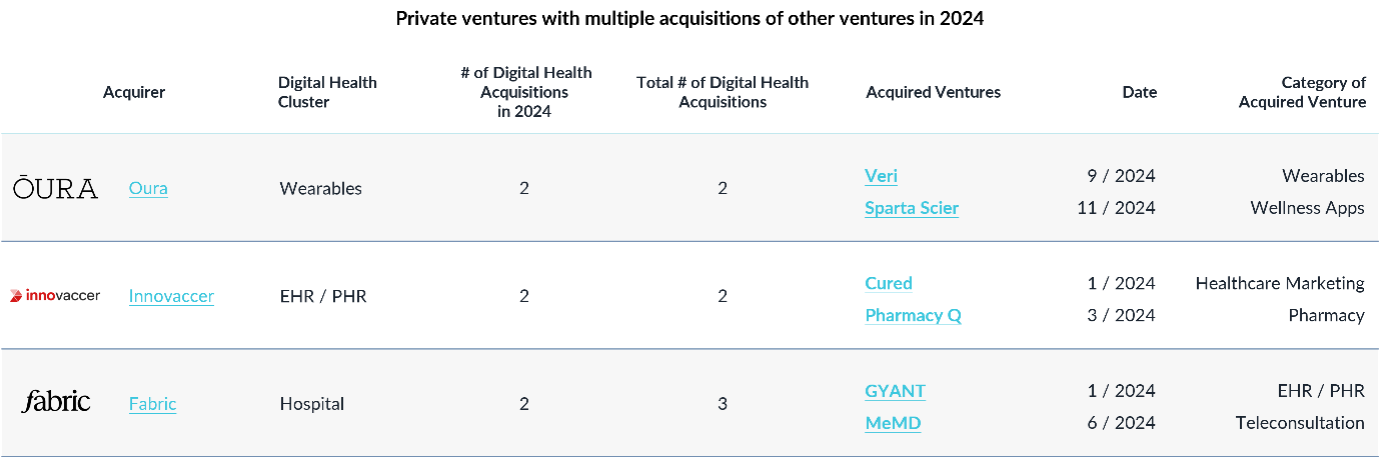

M&A activity rose by 5%, with 69% of the 200 deals being venture-to-venture acquisitions. This trend signals ongoing consolidation within the sector as companies seek scalability and market share.

Oura, Innovaccer, and Fabric were examples of digital health ventures that made multiple acquisitions in 2024.

IPO activity, while subdued compared to pre-pandemic levels, shows promise for 2025. Companies demonstrating robust business models and scalable solutions are poised to capture investor interest in the coming year.

Methodology: A Data-Driven Approach

This analysis is based on data from Galen Growth’s HealthTech Alpha platform, which tracks over 680 million data points and monitors 14,500+ digital health ventures globally. The report focuses on pre-exit funding activities, excluding corporate subsidiaries and post-exit events. Proprietary algorithms and an industry-standard taxonomy were employed to categorise ventures and clusters.

Why This Matters

For Industry:

Understanding these trends is crucial for adapting to a dynamic market. The focus on AI and therapeutic innovation offers pathways to enhance patient outcomes and operational efficiencies.

For Investors:

The rebound in funding and the rise of mega-deals indicate renewed confidence in the sector’s potential. However, careful evaluation of venture scalability and market fit remains essential.

For Startups:

Navigating funding challenges while demonstrating clinical validation and scalability will be pivotal for attracting investments in a competitive landscape.

Call to Action

For a comprehensive analysis of global digital health trends, download the full report from Galen Growth. Gain deeper insights into funding dynamics, regional trends, and emerging opportunities to make informed decisions in 2025 and beyond.