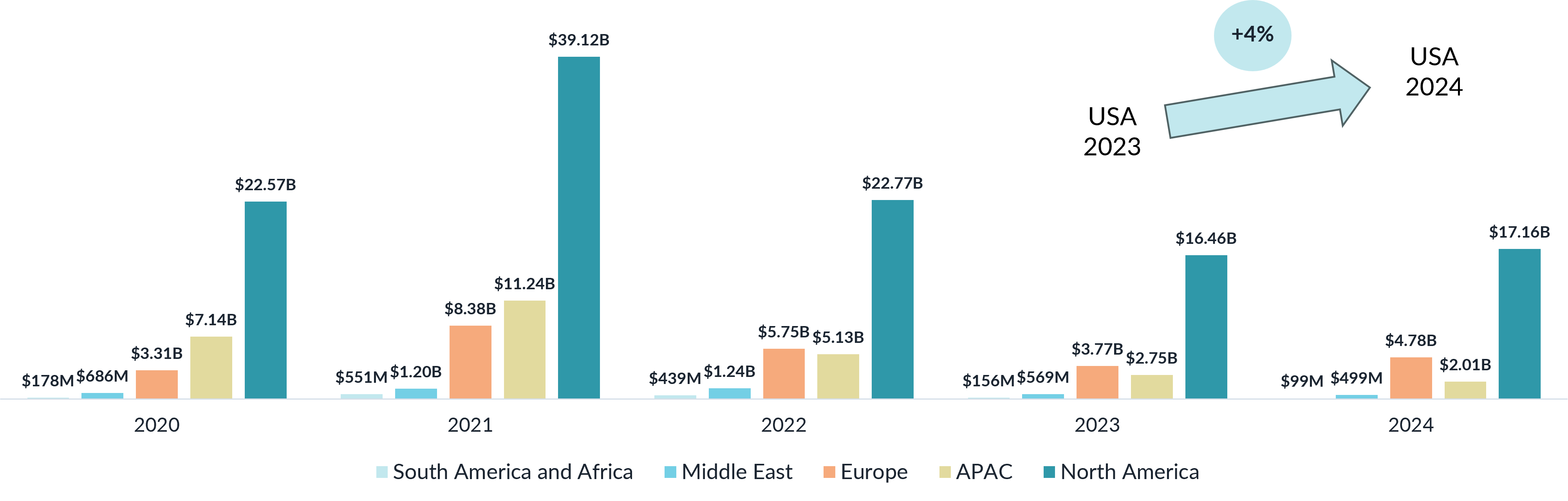

In 2024, the United States digital health funding continued to dominate the global ecosystem, leading the advancement of digital health innovation. Amid a complex political and economic landscape, the sector demonstrated resilience with an encouraging 4% year-over-year (YoY) increase in venture capital (VC) funding for digital health, halting the downward trend seen in recent years. With AI-driven innovation and TechBio ventures taking the lead, the U.S. digital health sector set the stage for transformative advancements in healthcare delivery.

This blog explores five key trends that shaped the U.S. digital health landscape in 2024, focusing on funding dynamics, partnerships, and technology adoption.

All data in this blog is from HealthTech Alpha – a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform.

U.S. Digital Health Funding Increases, Breaking the Downhill Slide

In 2024, the U.S. digital health sector recorded a modest yet significant 4% YoY increase in VC funding, reaching $17.2 billion. This surge highlights the growth of 2024 digital health funding and reflects the sector’s ability to grow amidst challenges. The U.S. retained its leadership in the industry, contributing 70% of the total global venture capital funding in digital health for the year.

The uptick in funding reflected a continued focus on scalable, innovative solutions addressing healthcare system needs while innovating to increase the speed of drug development and meet patient expectations.

The most active investors in U.S. digital health ventures in 2024 were Andreessen Horowitz, General Catalyst, Flare Capital, Alumni Ventures and Khosla Ventures.

Global Top 5 most active VC investors in 2024

| Investor | # of Digital Health Deals in 2024 | Recently Participated Investment | Total Deal Value |

| Andreessen Horowitz | 26 | Soda Health | $50 million |

| General Catalyst | 25 | Infinitus | $52 million |

| Flare Capital | 16 | HealthifyMe | $20 million |

| Alumni Ventures | 14 | Oshi Health | $10 million |

| Khosla Ventures | 11 | Centaur Labs | $16 million |

Digital Health Funding Activity Slows in Q4 Amid Political Transition

While the overall digital health funding figures for 2024 were encouraging, the last quarter saw a slowdown in activity. Deal volume and partnership announcements tapered off in Q4 as stakeholders across the sector awaited clarity on the incoming political administration’s healthcare policies.

This pause reflects the significant influence of federal healthcare priorities and regulatory frameworks on digital health investments. The new administration’s stance on AI in healthcare, reimbursement for digital solutions, and interoperability standards will likely shape the sector’s trajectory in 2025 and beyond.

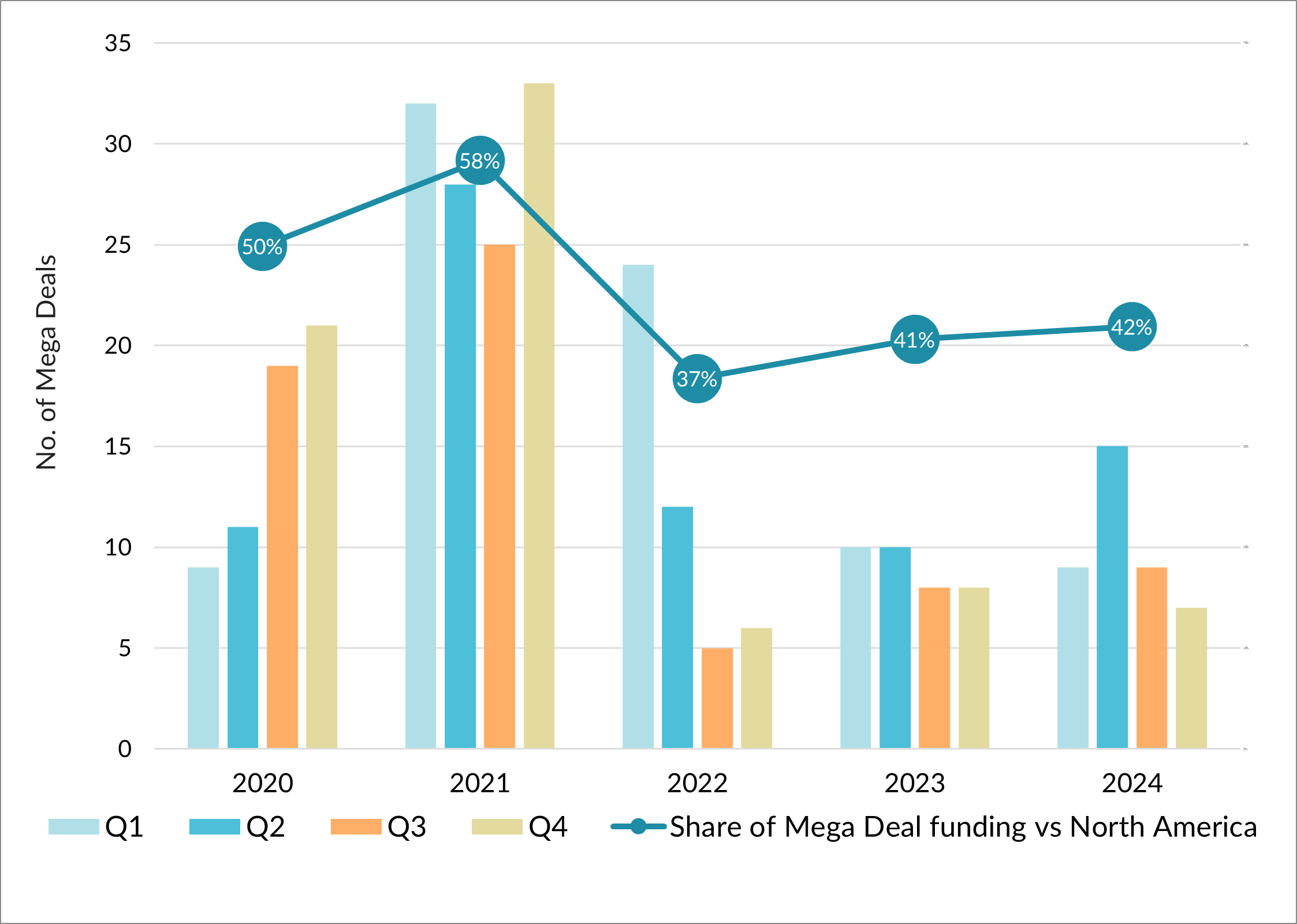

Mega Deals in Digital Health Drive Funding Growth

One key contributor to the U.S. digital health funding rebound was an increase in mega deals—transactions exceeding $100 million. In 2024, the U.S. led the world in high-value deals, demonstrating a growing appetite for ventures with established market fit and scalability.

Mega deals underscored the sector’s maturity and the strategic focus of investors in U.S. digital health. These large-ticket investments often targeted AI-enabled platforms in TechBio, Medical Diagnostics or Health Management Solutions, reflecting priorities in advancing personalized medicine and operational efficiency. Notable examples included the $372M Series D funding round for Formation Bio and the diagnostics venture Freenome, with a $254M Series E funding round.

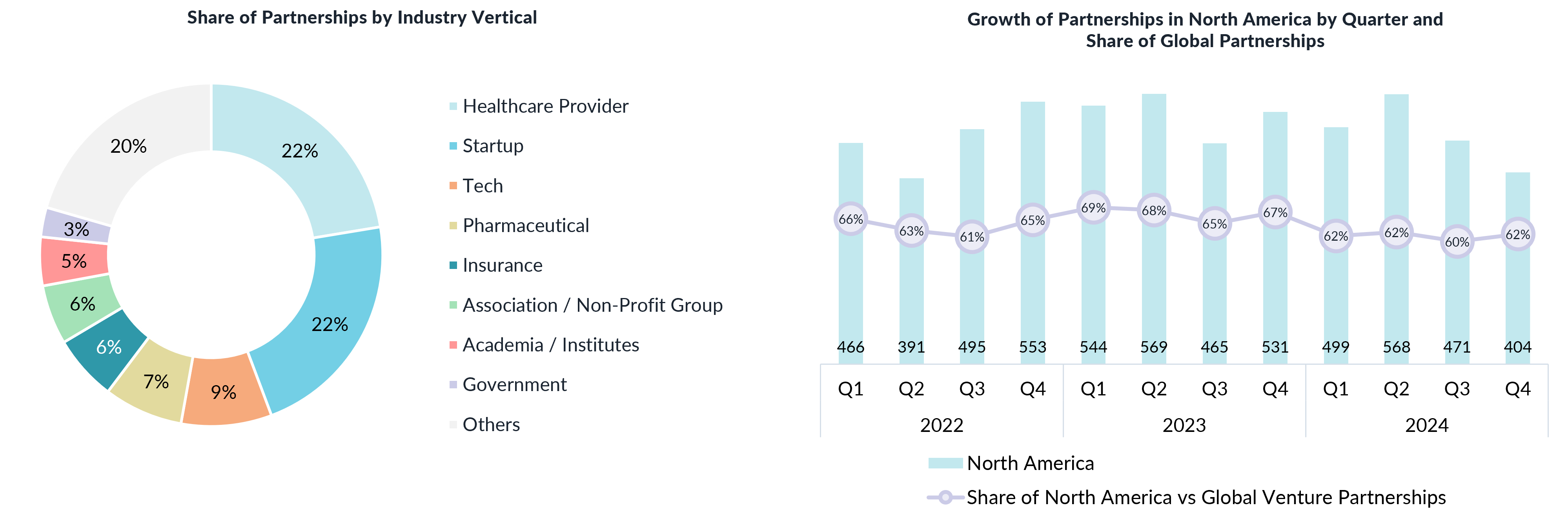

Partnerships in Digital Health are Strong in H1 2024

The first half of 2024 was a strong period for partnerships in the U.S. digital health sector, with collaborations in Q2 matching the same quarter in the previous year. Over 1,067 digital health partnerships were disclosed by mid-year, driven by healthcare providers seeking to integrate advanced solutions into existing care models and venture-to-venture partnerships. Big Tech companies remain a preferred partner for digital health ventures, with an increasing number of ventures looking to implement advanced AI solutions into their products. An example is the strategic collaboration announced between eClinical Solutions and Snowflake in December 2024 to address some of the challenges of managing clinical data.

Key areas of digital health partnerships in 2024 included:

- AI Implementation: Partnerships aimed at incorporating AI tools into diagnostics, hospital management, and predictive analytics.

- Platform Expansion: Venture-to-venture collaborations aim to eliminate point solutions and increase access to a larger breadth of digital solutions for a patient or healthcare provider.

- Clinical Research: Ventures joining forces with academic institutions and pharmaceutical companies to accelerate drug development.

However, digital health partnership activity slowed in the latter half of the year, mirroring the funding trends. Stakeholders shifted their focus to solidifying earlier agreements and scaling implemented solutions.

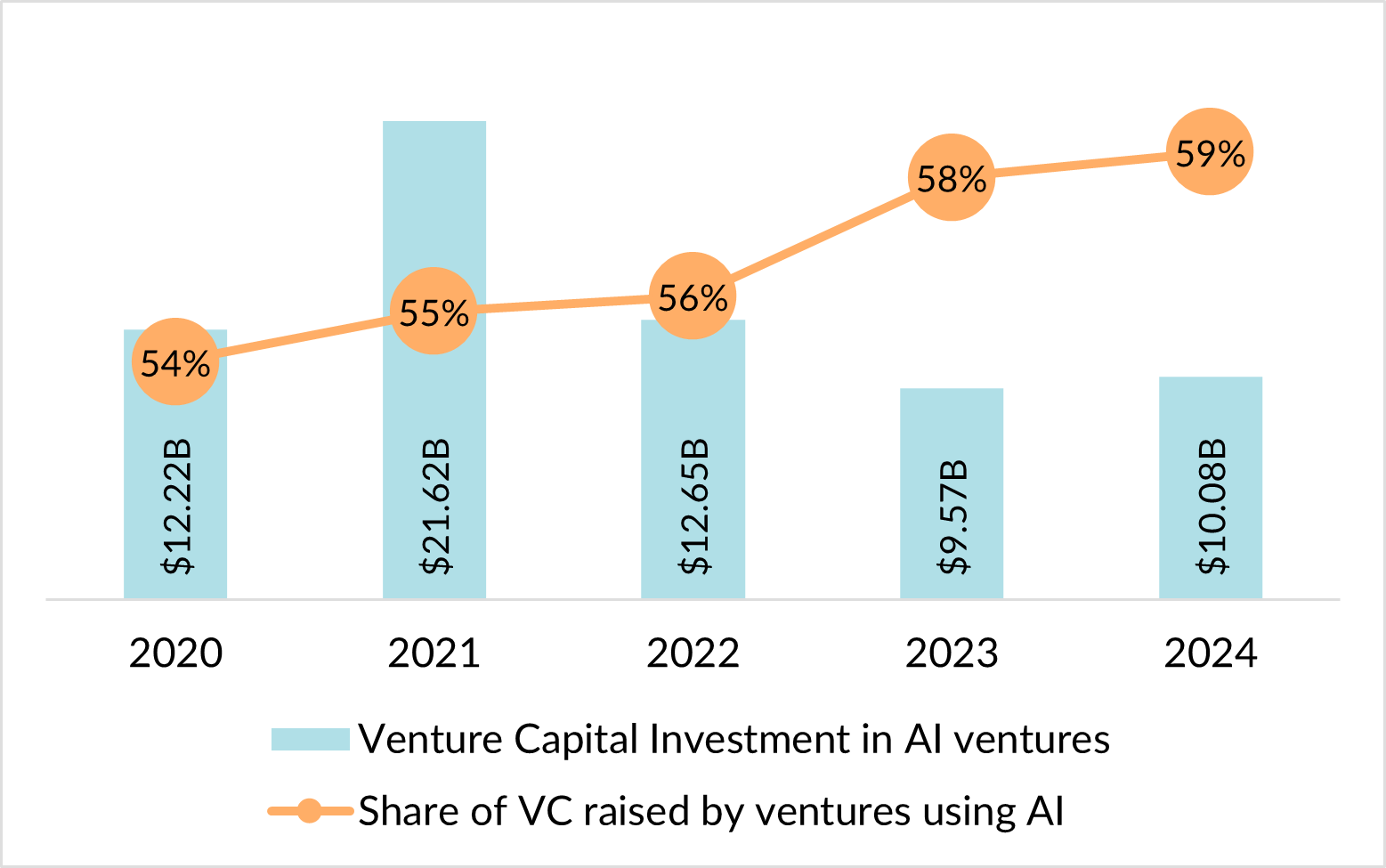

AI Dominates U.S. Digital Health Funding

Artificial Intelligence (AI) remained at the core of U.S. digital health innovation in 2024, capturing 58% of total funding and solidifying AI healthcare as a transformative force. The substantial investment in AI-driven solutions highlights the technology’s critical role in reshaping healthcare.

Key Applications of AI in U.S. Healthtech:

- TechBio (incl. Drug Discovery): 44% of digital health funding in the U.S. for ventures leveraging AI technology was deployed to ventures in the TechBio cluster. Xaira Therapeutics captured the largest deal in 2024 with $1.0B of committed capital for its founding and growth. Machine learning models accelerated the identification of viable drug candidates, reducing R&D costs and timelines.

- Diagnostics: AI-powered platforms enhanced accuracy and efficiency in detecting diseases, particularly in oncology and cardiovascular health. 16% of digital health funding in the U.S. for ventures leveraging AI technology was deployed to ventures in the Medical Diagnostics cluster. Freenome secured the most significant deal for AI ventures in this cluster, with $254M deployed in February 2024.

- Operational Efficiency: 14% of digital health funding in the U.S. for ventures leveraging AI technology was deployed to ventures in the Health Management Solutions cluster. AI tools optimized workflows in hospitals, reducing administrative burdens and improving resource allocation. Abridge, which uses Large Language Models to improve clinical documentation efficiencies, raised a $150M Series C round in February 2024.

Investor enthusiasm for AI ventures reflects confidence in their transformative potential. As ethical frameworks and regulatory standards for AI adoption mature, the U.S. is well-positioned to maintain its leadership in this domain.

Oncology and TechBio: Leading Therapeutic and Healthtech Clusters

Oncology: Addressing Critical Healthcare Needs

With $2.44B of funding, the oncology sector emerged as the top-funded therapeutic area in 2024, reflecting the advances in oncology diagnostics and treatment options using solutions that leverage AI technology. Scorpion Therapeutics captured one of the largest deals for ventures focused on oncology, closing a $150M Series C round in July 2024. Mental Health rose again into the second-place spot, with $1.94B of funding. AI played a pivotal role, with solutions in both therapeutic areas focused on enabling precise diagnostics and developing drugs faster and with more precision using AI advancements.

TechBio: Driving Research and Development

TechBio, also known as Research Solutions, led the digital health clusters in funding, demonstrating the U.S.’s commitment to improving the speed of biomedical research and moving toward more precision therapeutics. The sector leverages advances in generative AI and large-scale molecule databases to drive breakthroughs in drug discovery, clinical trials, and disease management. Mirador Therapeutics captured a mega deal in TechBio in 2024, closing a $413M round in September.

These clusters underscore the U.S. digital health sector’s focus on addressing complex healthcare challenges through innovation and collaboration.

The Path Ahead: U.S. Digital Health in 2025

As we look to 2025, several trends are likely to shape the U.S. digital health sector:

- Policy Clarity: The Trump administration brings significant reforms to healthcare, but little impact is expected until Q2 of 2025 as the new administration settles in and outlines its policies, moving beyond election rhetoric. Once established, the administration is anticipated to focus on significant healthcare reforms, including updated regulations to modernise the sector.

- Expansion of AI Applications: Beyond diagnostics, AI is expected to play a growing role in diagnostics, patient engagement, and operational efficiency.

- Further Consolidation: In 2024, 70% of global M&A activity in digital health involves venture-to-venture transactions, highlighting the growing trend of startups joining forces to strengthen market positions and streamline operations. With an increased number of mega-deals and continued funding stress, conditions are ripe for further consolidation among digital health ventures in the U.S.

- Digital Obesity Care Platforms: The rise of GLP-1 medications is transforming obesity care, fostering growth in digital platforms providing treatment and support. In 2024, global funding deployed to ventures focused on obesity care increased by 40%, reflecting strong investor confidence in this sector. This trend positions obesity care platforms for significant growth, driven by innovative solutions and escalating consumer demand.

More digital health predictions for 2025 can be found in Galen Growth’s blog.

Conclusion: The U.S. as a Global Digital Health Leader

The U.S. digital healthcare technology sector’s performance in 2024 highlights its resilience, innovation, and leadership in U.S. digital health, from AI healthcare breakthroughs to advancements in 2024 digital health funding and partnerships. From AI-driven solutions to oncology breakthroughs, the sector demonstrated its capacity to address complex healthcare challenges and drive transformative change.

With increased digital health funding in 2024 and a focus on U.S. digital health partnerships, the U.S. is poised to lead the global healthcare revolution by leveraging its strengths and addressing challenges. Stakeholders across the ecosystem must continue to collaborate, innovate, and adapt to ensure sustainable growth and improved patient outcomes.

Don’t stop here. Have you read Galen Growth’s Digital Health 2024 Funding and Key Trends: Resilience, Recovery, and the Road Ahead? Download the report today to stay ahead of advancements in AI healthcare in the U.S. and newly announced digital health partnerships and mega deals transforming the industry!

All data in this blog is from HealthTech Alpha – a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform.