Galen Growth’s annual HealthTech 250 analysis spotlights promising early-stage Digital Health ventures globally, with an emphasis on solving critical healthcare pain points.

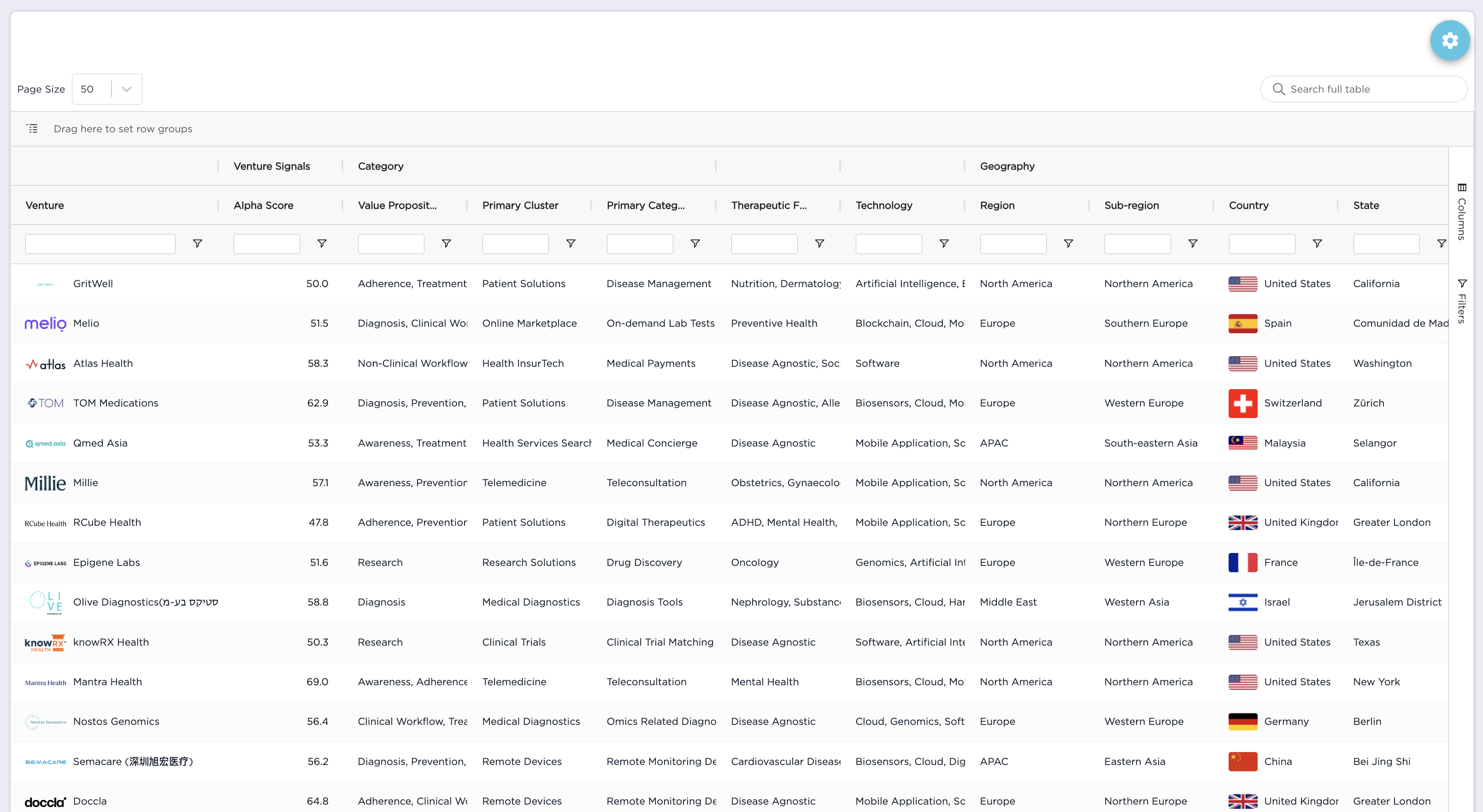

Since 2017, Galen Growth has diligently tracked and reported on global Digital Health innovation. Our HealthTech Alpha platform harnesses unparalleled data, intelligence, and insights, enabling us to uniquely evaluate, pinpoint, and spotlight the most promising early-stage Digital Health ventures globally. With access to over 650 million data points and our exclusive venture signals analytics, we are thrilled to unveil our second edition of HealthTech 250 – The Most Promising Early Stage Digital Health Ventures in 2023, along with our comprehensive data and analyses for each venture.

This year’s ventures span across all regions driving Digital Health innovation – North and South America, Asia Pacific, Europe, the Middle East and Africa. Covering the entire patient journey, they offer solutions from preventive measures to reimbursement, represented through 39 out of our 58 different Digital Health categories.

Through our cutting-edge platform, HealthTech Alpha—the largest aggregator for Digital Health ventures worldwide with a database of over 14,000 ventures—we’ve refined our selection algorithm from last year. This algorithm ranks ventures based on various indices, including our proprietary Alpha Score, recent partnerships, thematic relevance, clinical evidence, key team composition, regulatory endorsements, and clinical efficacy. It also considers market maturity and the overall volume of ventures in key geographical areas, resulting in a weighted distribution of ventures.

Click on view all ventures (bottom of the table) to open the entire HealthTech 250 as a venture matrix in HealthTech Alpha. (If you are new to HealthTech Alpha and don’t have a login, create one for free here.)

Methodology

This annual HealthTech 250 of 2023 analysis is a result of our data-driven computation combined with the renown expertize of our Galen Growth research team.

The evaluation algorithm is driven by a set of metrics focused on the venture’s alignment with the year’s top trending Digital Health topics, their investments, and partnership engagements with key stakeholders within the ecosystem. The HealthTech 250 exclusively showcases promising early-stage ventures, including those up to and including Series A funding, each incorporated within the past 5 years.

Our methodology follows a two staged approach, consisting of a i) waterfall followed by a ii) weighted analysis and geography normalization consisting of 7 metrics.

- Venture incorporated between 2019 and today

- Venture raised funding no higher than Series A

Stage 2: Weighted Analysis

We applied weighting to our HealthTech Alpha proprietary indices and scores in accordance with their relevant importance.

- Metric #1: 25.0% – 2023 Relevance – the venture’s relevance to the top trending Digital Health topics of 2023

- Metric #2: 16.7% – Alpha Score – our proprietary maturity assessment of Digital Health Ventures

- Metric #3: 16.7% – Clinical Evidence Signal

- Metric #4: 12.5% – Funding value percentile, graded based on other ventures in similar funding stages

- Metric #5: 12.4% – Funding velocity

- Metric #6: 8.4% – Partnership Signal

- Metric #7: 8.3% – Partnership velocity

Most Featured Topics of 2023

Every year, HealthTech Alpha analyzes hundreds of thousands of news articles and posts from hundreds of trusted sources across 18 languages globally. In this year’s edition of ‘HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2023,’ we’ve incorporated 500 thematic keywords that dominated discussions throughout the year. These 500 thematic keywords can be clustered across 25 topics, providing an insightful representation of the pulse of Digital Health in 2023.

Generative AI

Amidst the surge of ChatGPT and large language models (LLMs), Artificial Intelligence (#1) and Generative AI (#6) stood out as the most discussed topics in 2023. Early adopters of Generative AI, also known as GenAI, are leveraging this innovative technology in diverse ways to enhance healthcare outcomes. These applications include: i) improving accuracy and precision in diagnosis and treatment, ii) enhancing healthcare efficiency by automating tasks currently performed by humans, and iii) reducing drug development costs. Earlier this year, we dedicated a research publication to explore the topic ‘Generative AI – Hype or Reality.’

Ten of the HealthTech 250 companies are among these early adopters, utilizing Generative AI technologies to provide solutions for their partners.

Oncology, Mental Health, Obesity and Women’s Health

Discussions within Digital Health are increasingly focusing on specific therapeutic solutions. Notably, four of the 25 prominent topics of 2023—Oncology (#2), Mental Health (#3), Obesity (#9), and Women’s Health (#10)—centered around distinct therapeutic areas. Particularly, sectors like Drug Discovery (#8), Early Detection (#16), and Precision Medicine (not represented in the 25 topics) experienced significant traction in 2023 and supported the traction of these four therapeutic domains. The discourse surrounding Obesity surged notably due to the growing focus on the GLP1 drug class.

Fifty of the HealthTech 250 companies are offering solutions across these four therapeutic domains.

Analysis

Record-breaking partnerships

The Digital Health landscape experienced a surge in partnerships, boasting over 1,700 collaborations announced this year—an impressive 7.6% increase from 2022 and an astonishing 69% leap from 2021. These partnerships reflect a burgeoning trend driving innovation across diverse healthcare sectors. For ventures, these partnerships serve as crucial conduits, granting access to specialized resources and expertise vital for navigating the intricate terrain of healthcare innovation.

Amidst this growth, these partnerships not only signify industry expansion but also underline the industry’s realization of the mutual benefits derived from collaborative endeavors. As the Digital Health ecosystem evolves, these alliances become increasingly indispensable, fueling collective advancement and ushering in a new era of transformative healthcare solutions.

The HealthTech 250 ventures have announced a total of 107 partnerships in 2023. Uwill, a campus mental health, on-demand counseling provider announced a total of 10 new partnerships this year alone, exclusively with Academia. Healthcare Providers were the most active partners to Digital Health ventures. Of the 107 partnerships with the HealthTech 250 ventures, 43 were announced with Healthcare Providers. Such partnerships are generally targeted to increase clinical evidence around their solutions.

Eight of the HealthTech 250 ventures announced partnerships with pharmaceutical companies. In September, Atropos Health announced a partnership with Johnson & Johnson Innovative Medicine (formerly known as Janssen Pharmaceuticals). Lindus Health, a London (UK) based provider of an end-to-end platform supporting decentralised, hybrid or site-based clinical trials, announced partnerships with Bonafide Health and Georges Medicines.

Most-represented clusters

Galen Growth has developed the industry-standard taxonomy that defines Digital Health, now adopted as the industry standard by numerous corporations. Each venture is categorized with a minimum of one primary category and up to four supporting categories. For detailed insights into our taxonomy, visit the Knowledge Page on HealthTech Alpha.

The majority of ventures analyzed in this year’s assessment fall within the Drug Discovery (10%), Medical Imaging (9.6%), and Prescriptive Analytics (8.0%) categories. The prominence of Drug Discovery at the top signifies a stark contrast to last year’s HealthTech 250, where the research cluster did not rank within the top 5 most represented categories.

Drug Discovery constitutes a Digital Health category within the Research Solutions Cluster, emerging as the largest segment among the HealthTech 250 ventures in 2023, encompassing 25 Digital Health ventures (10%). Globally, the Research Solutions cluster remains relatively youthful, housing nearly 600 ventures, with nearly 30% of these ventures incorporated within the last five years.

MindRank AI (德睿智药) stands as a notable player within this cluster, pioneering PharmKG™️, a comprehensive AI-driven drug discovery platform, alongside Molecule Pro™️, a specialized drug design platform. Notably, in July, the company secured a Series A extension (Series A1) amounting to $20 million, further fueling its innovative initiatives.

Additionally, Qubit Pharmaceuticals, a physics-oriented drug discovery firm, entered a strategic partnership with quantum computing company PASQAL. This collaboration aims to harness the power of quantum computing to expedite the discovery process for novel drugs, signifying a significant advancement at the intersection of physics and drug discovery within the digital health landscape.

The Medical Imaging Digital Health category resides within the broader Medical Diagnostics cluster, encompassing Medical Imaging, Diagnosis Tools, and Omics Related Diagnosis segments. Collectively, these segments contribute to a total of 50 ventures (20%) listed in the 2023 HealthTech 250.

Among these, EarliTec Diagnostics stands out as a company dedicated to developing diagnostic and therapeutic solutions for children affected by Autism Spectrum Disorder (ASD) and associated developmental disabilities. Notably, in June 2023, they received FDA 510(k) Authorization for their products EarliPoint and EarliPoint System, marking a significant milestone in their regulatory journey.

Similarly, Nox Health, a company specializing in sleep health diagnostics, has significantly bolstered its scientific contributions in 2023. They have co-authored five publications this year, reflecting an enhanced focus on scientific research and knowledge dissemination within the realm of sleep health diagnostics.

The Prescriptive Analytics Digital Health category, a segment within the Health Management Solutions (HMS) cluster, ranks as the third most represented category in this year’s HealthTech 250. This analytics approach is increasingly embraced by Health Systems, offering decision-making support tools via Chatbots and Generative AI, aiming to streamline physicians’ workflows. Earlier this year we delved in depth into US Health Systems and their touchpoints with Digital Health.

PreciseDx, a Cancer Risk Stratification company, delivers patient-specific risk information by analyzing morphology features, enhancing personalized treatment and outcomes. In November, PreciseDx published their research on the Analytical Validation of the PreciseDx Digital Prognostic Breast Cancer Test for early-stage breast cancer in the peer-reviewed journal Clinical Breast Cancer.

Funding and investors

With over 14,000 Digital Health ventures worldwide, this industry is rapidly maturing. Following a record-breaking year marked by soaring funding and headline-grabbing developments, the sector has attracted increasing interest. As of October this year, over $44 billion in venture capital funding has been deployed. Dive deeper into the trends and funding of 2023 by exploring our latest blog, ‘Unpacking Digital Health Funding Trends: Q3 2023 Insights,’ published in October 2023.

The 2023 HealthTech 250 ventures collectively raised a total of $1.38 billion over the past 12 months. Especially the months from February to May of this year have been robust, with a total of $896 million in venture capital funding raised. In April 2023, Orbital Therapeutics, an AI drug discovery company focusing on RNA-based medicines, secured $270.0 million in a Series A funding round. This round was spearheaded by Arch Venture Partners and joined by Andreessen Horowitz and Newpath Partners. Apart from Orbital Therapeutics, Seismic Therapeutics was another drug discovery company utilizing artificial intelligence for their research that raised over $100 million. They secured $101 million in a Series A funding round in February 2023, led by Lightspeed Venture Partners.

The 2023 HealthTech 250 were accountable for approximately 10% of all venture deals globally. By volume, the 2023 HealthTech 250 closed a total of 117 deals in the past 12 months (trailing). Globally, over the same period, we witnessed a total of 1,279 disclosed venture funding transactions in Digital Health ventures.

Target therapeutic areas

HealthTech Alpha currently tracks 79 therapeutic areas that are targeted by Digital Health ventures. Globally, Mental Health (7%) and Oncology (6%) represent the largest therapeutic areas, by volume of ventures. Apart from the Disease Agnostic ventures, which feature solutions with no specific therapeutic area focus (25.6%), Oncology (14.8%) and Mental Health (7.6%) represent the highest count of winners of the HealthTech 250.

For over five years, Digital Health ventures focusing on Oncology have consistently attracted significant amounts of venture capital funding. However, in our H1 2023 report, there has been a notable decline of 68% from H2 2022 to H1 2023, with only $259M raised in venture capital for the first half of this year. Despite this decline in funding, Oncology ventures continue to forge impactful partnerships. Since January 2023, there have been 345 announced partnerships between Oncology-focused Digital Health ventures and corporations.

Among our 2023 HealthTech 250, 39 ventures concentrate on Oncology. Six out of these 39 have showcased evidence by utilizing their solutions in research clinical trials. From this subset, Scorpion Therapeutics, Blue Note Therapeutics, and Faeth Therapeutics stand out, achieving the highest Alpha Score in HealthTech Alpha this year, signifying a robust maturity level among these ventures. Notably, in September, Scorpion Therapeutics announced the commencement of their second clinical trial for Non-Small Cell Lung Cancer.

Mental Health ventures were also prominently featured in last year’s HealthTech 250 list. This year, these ventures constitute 7.6% of all HealthTech 250 ventures. Throughout the COVID-19 pandemic, considerable attention has been directed toward Mental Health solutions, particularly in the realm of virtual care through Telepsychiatry. However, Digital Health for Mental Health is rapidly evolving and expanding.

In this year’s HealthTech 250, there are 7 Digital Therapeutics ventures specifically targeting Mental Health. Moreover, numerous ventures are innovatively combining the Digital Therapeutics approach with Virtual Care. For instance, Arcade Therapeutics (formerly known as Wise Therapeutics) is addressing mental health concerns by melding cognitive neuroscience with engaging games. On the other hand, Ciba Health is amalgamating Virtual Care with Digital Therapeutics to cater to various diseases beyond depression and anxiety.

Additionally, Kranus Health, an approved DiGA Digital Health venture, has introduced a Men’s Health-focused virtual care platform, emphasizing issues such as erectile dysfunction along with associated Mental Health aspects. These ventures exemplify the diverse and innovative approaches within the Mental Health segment of the digital health landscape.

Conclusion

As the industry expands, partnerships signify not only industry growth but also underscore the realization within the sector of the mutual benefits derived from collaborative endeavors. With the Digital Health ecosystem evolving, these alliances become increasingly indispensable, fostering collective advancement and ushering in a new era of transformative healthcare solutions.

Flashcards

“Flashcards” serve as a dynamic tool specifically crafted to streamline the creation of presentations within HealthTech Alpha. This tool enables the creation of dynamic PowerPoint presentations or PDF documents, incorporating comprehensive details pertaining to ecosystems, portfolio scouting endeavors, or venture-related information.