Global Overview of Digital Health Funding in 2024

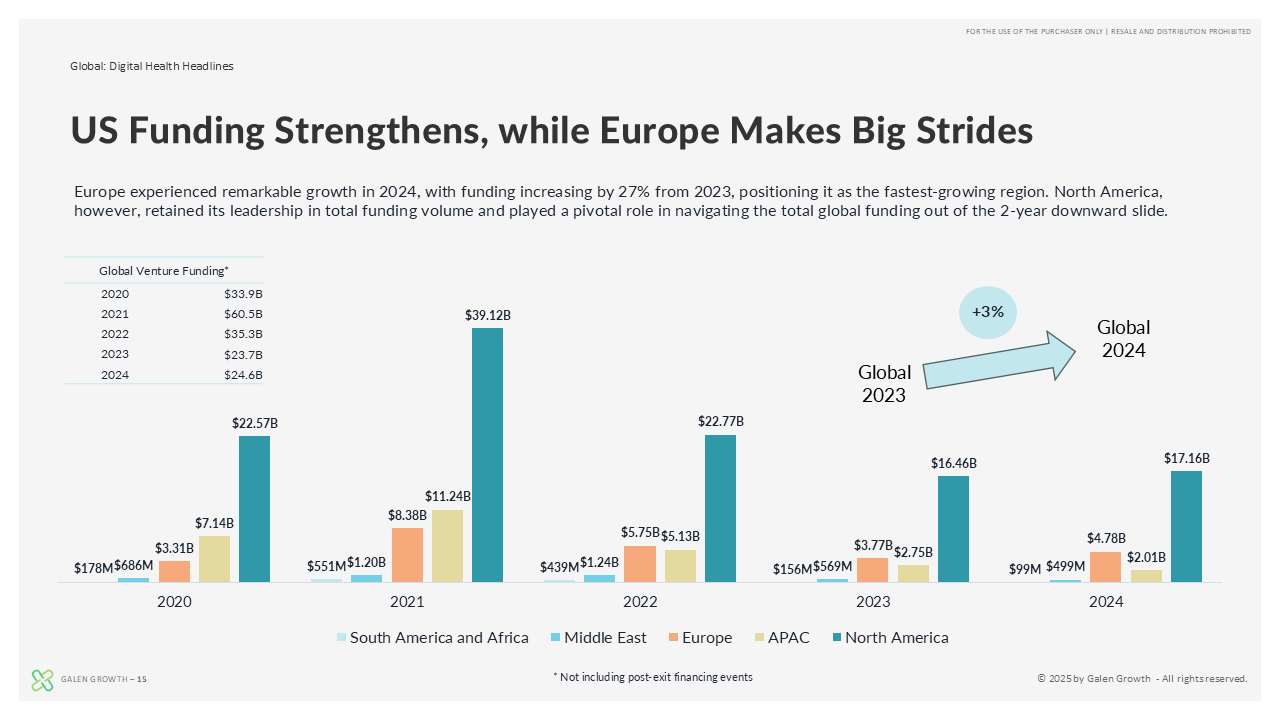

Digital Technology Innovation in healthcare funding witnessed a modest recovery in 2024, signalling a gradual resurgence after a two-year decline. The sector attracted $25.1 billion globally, reflecting a 5.5% year-on-year increase across more than 1,600 deals. The United States led the way, contributing a notable 69% of all funding invested globally, while Europe experienced a 29% increase in funding year on year. Asia Pacific, meanwhile, saw a 19% decline in venture funding, marking it as a region facing challenges in growth within this domain. This article, which uses data from our Digital Health 2024 Funding and Key Trends: Resilience, Recovery, and the Road Ahead report, provides a comprehensive overview of digital health funding trends in the Asia Pacific region during 2024.

The ecosystem also saw notable developments in terms of funding trends:

- Mega Deals: Representing 38% of global funding, the year featured 54 significant transactions totalling $2 billion.

- AI-Driven Solutions: Nearly half (49%) of digital health innovations were AI-driven, highlighting the growing reliance on cutting-edge technologies to transform healthcare delivery.

- Health Systems: Funding for health systems accounted for 21% of the total, demonstrating a continued focus on streamlining patient care and operational efficiency.

- Venture M&A: Exit activity surged, with a 5% uptick in mergers and acquisitions, underscoring the consolidation efforts across the digital health landscape.

This backdrop sets the stage for a closer look at how the Asia Pacific region continued to mature in the digital health space in 2024.

Asia Pacific: Funding Landscape in 2024

Asia Pacific (APAC) emerged as the third most significant region for digital health funding globally, with $2 billion raised across 244 deals in 2024. APAC witnessed a 19% decline in digital health funding in 2024 compared to the $2.8 billion recorded in 2023, with China being the main contributor to the decline. Despite this dip, APAC continued to attract substantial investments in critical healthcare domains, particularly oncology and medical diagnostics.

Key Highlights from 2024

- Funding Allocation:

- In 2024, oncology emerged as the top-funded therapeutic area, attracting $434 million in venture funding, followed by geriatrics ($291 million) and neurology ($220 million).

- Notably, funding for neurology and women’s health saw declines of $262 million and $139 million, respectively, compared to 2023.

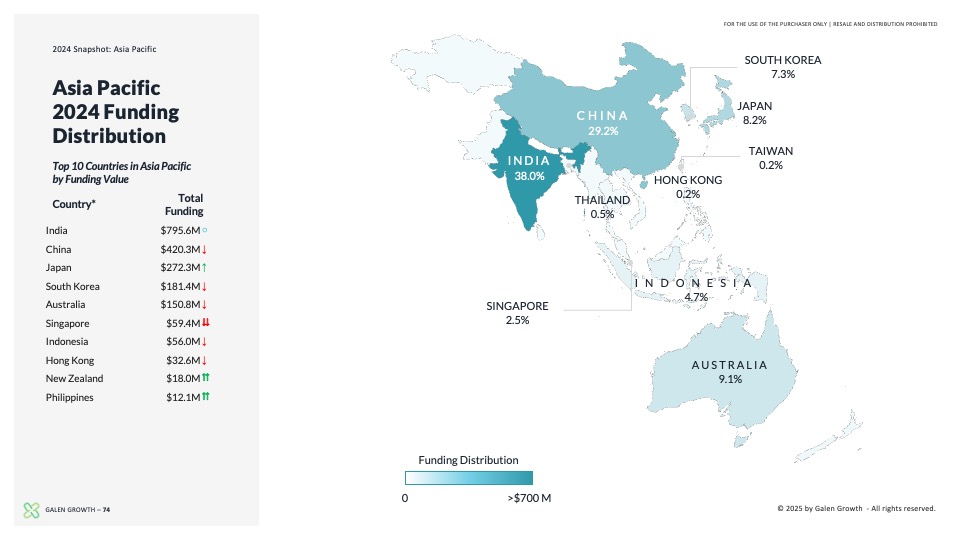

- Geographic Distribution:

- India led the APAC region, securing $795.5 million, a slight dip of 2% year on year, representing 38% of the total funding.

- China followed with $420.3 million (29%), down 39% year on year, highlighting the significant challenges of the country.

- Other key contributors included South Korea ($181.4 million), Australia ($155.9 million), and Japan ($127.3 million). Singapore, once a main driver of funding in Southeast Asia, has dropped to a slim $59.6 million.

- Top Clusters:

- Medical diagnostics, including AI diagnostics, and population health management were among the leading digital health clusters, accounting for 29% and 24% of funding, respectively.

- Other significant areas included Research Solutions (aka TechBio) and online marketplaces, which accounted for 22% of total funding.

The top funded startups in 2024 were PharmEasy, TaiDoc Health and Lunit.

| Date of Investment | Startup Name | Inc. Country | Funding Stage | Funding Amount |

| April 2024 | PharmEasy | India | Series G1 | $216 million |

| May 2024 | TaiDoc Health | China | Series B | $127 million |

| April 2024 | Lunit | South Korea | Debt Financing | $124 million |

The most active investors in 2024 were Qiming Venture Partners, KB Investment and SBI Investment.

| Investor Name | Number of deals in 2024 | Preferred Stage | Preferred Country | Last Investment |

| Qiming Venture Partners | 6 | Growth Stage | China | Matwings (天鹜科技) |

| KB Investment | 5 | Growth Stage | South Korea | Emocog (이모코그) |

| SBI Investment | 4 | Growth Stage | Japan | Preferred Networks |

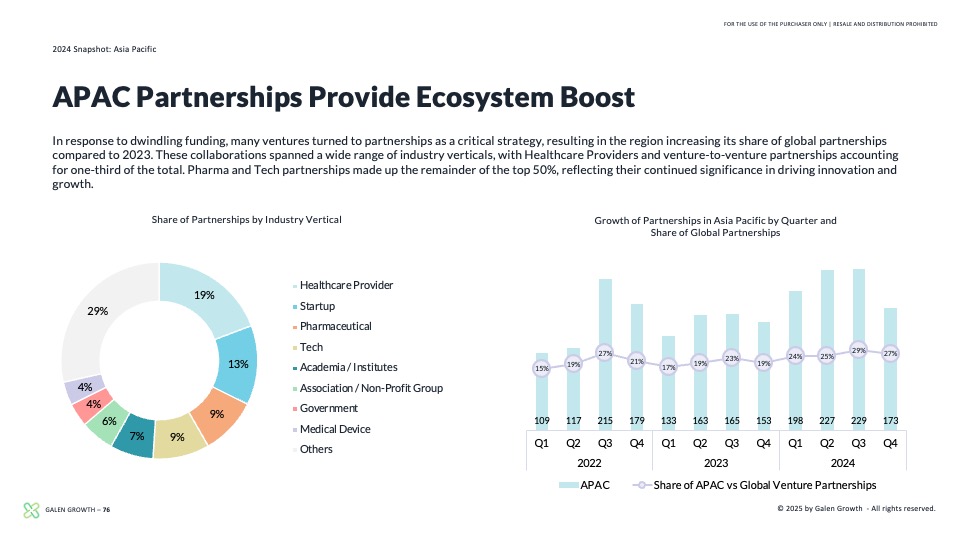

Partnerships as a Growth Driver

In response to declining funding, partnerships have become a strategic avenue for sustaining growth and innovation. The APAC region has notably increased its share of global partnerships, leveraging collaborations across a wide range of industry verticals:

- Healthcare Providers: Are the most prolific partnership builders, representing 19% of partnerships, collaborations with providers were critical in driving innovation and enhancing patient outcomes.

- Startups and Tech Firms: Venture-to-venture collaborations accounted for 13%, while partnerships with tech companies made up 12%, emphasising the role of technology in reshaping the healthcare landscape.

- Pharma and Academia: Pharma-tech collaborations and academic partnerships contributed significantly, each accounting for 9% of the total.

Growth Trends

- Partnership activity saw consistent growth across the quarters, with APAC’s share of global partnerships rising from 15% in Q1 2022 to 27% in Q4 2024.

- The surge in partnerships underscores a collective effort to pool resources and expertise to address pressing healthcare challenges and potentially find a path to profitability.

Geographic Distribution of Funding in 2024

- India:

- Retained its top position in funding value, driven by its growing adoption of digital health solutions.

- Oncology and population health management were key focus areas for investments.

- China:

- Focused on scaling medical diagnostics and AI-driven healthcare tools.

- Partnerships with tech giants and research institutions have been pivotal in driving adoption.

- Australia and Japan:

- Both countries demonstrated strong growth in Research Solution collaborations and research-driven initiatives.

- Investments were channelled toward advanced diagnostics and AI-enabled healthcare solutions.

Challenges and Opportunities

While the decline in overall funding presents challenges for the sector, it also opens doors for innovation and strategic collaboration. The rise of AI-driven solutions and the emphasis on population health management indicate a shift toward more targeted and efficient healthcare delivery. Furthermore, the growing reliance from partnership building highlights the importance of a collaborative ecosystem to drive sustainable growth.

Conclusion

Overall, 2024 proved to be a year of mixed fortunes for digital health funding in the Asia Pacific region. While funding levels have declined, the region is pivoting toward partnerships and targeted investments in high-impact areas like oncology and medical diagnostics. The continued decline in funding while a growing focus on collaboration and technological advancements will undoubtedly shape the future of healthcare in the region.