In 2024, Europe’s digital health sector cemented its position as a global powerhouse of innovation and investment. Amid challenges such as evolving reimbursement frameworks and political instability, the region recorded the fastest year-over-year (YoY) digital heath funding growth worldwide, fueled by advances in artificial intelligence (AI) being realised in healthcare, strategic mega deals, and a strong focus on oncology and research solutions (TechBio).

Here, we dive deep into the trends that defined Europe’s digital health landscape in 2024, exploring the interplay of funding, AI healthcare innovation, and digital health partnerships that positions the region at the forefront of digital healthcare technology advancements.

All data in this blog is from HealthTech Alpha – a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform.

Europe Led Global Digital Health Funding Growth in 2024

Europe emerged as the fastest-growing digital health region in 2024, achieving a remarkable 27% YoY increase in funding compared to 2023. This growth outpaced the global funding recovery of 5.5% YoY and demonstrated the region’s resilience and attractiveness to investors. While North America maintained the highest funding volume, Europe contributed $4.8 billion of the global $25.1 billion total, reinforcing its position as a critical player in the global digital health ecosystem.

This surge in funding can be attributed to a combination of investor confidence, maturing digital health ventures, and increasing focus on scalable solutions. European ventures also benefited from growing governmental support and strategic public-private partnerships prioritising innovation and healthcare transformation.

The most active investors in European Digital Health ventures in 2024 were Bpifrance (government), Octopus Ventures, Khosla Ventures, Wellington Partners, and Cathay Innovation.

| Investor | # of Digital Health Deals in 2024 | Type | Recently Participated Investment |

| Bpifrance | 14 | Government | Aqemia |

| Octopus Ventures | 7 | Venture Capital | Little Journey |

| Khosla Ventures | 5 | Venture Capital | Sword Health |

| Wellington Partners | 4 | Venture Capital | Aignostics |

| Cathay Innovation | 4 | Venture Capital | Bioptimus |

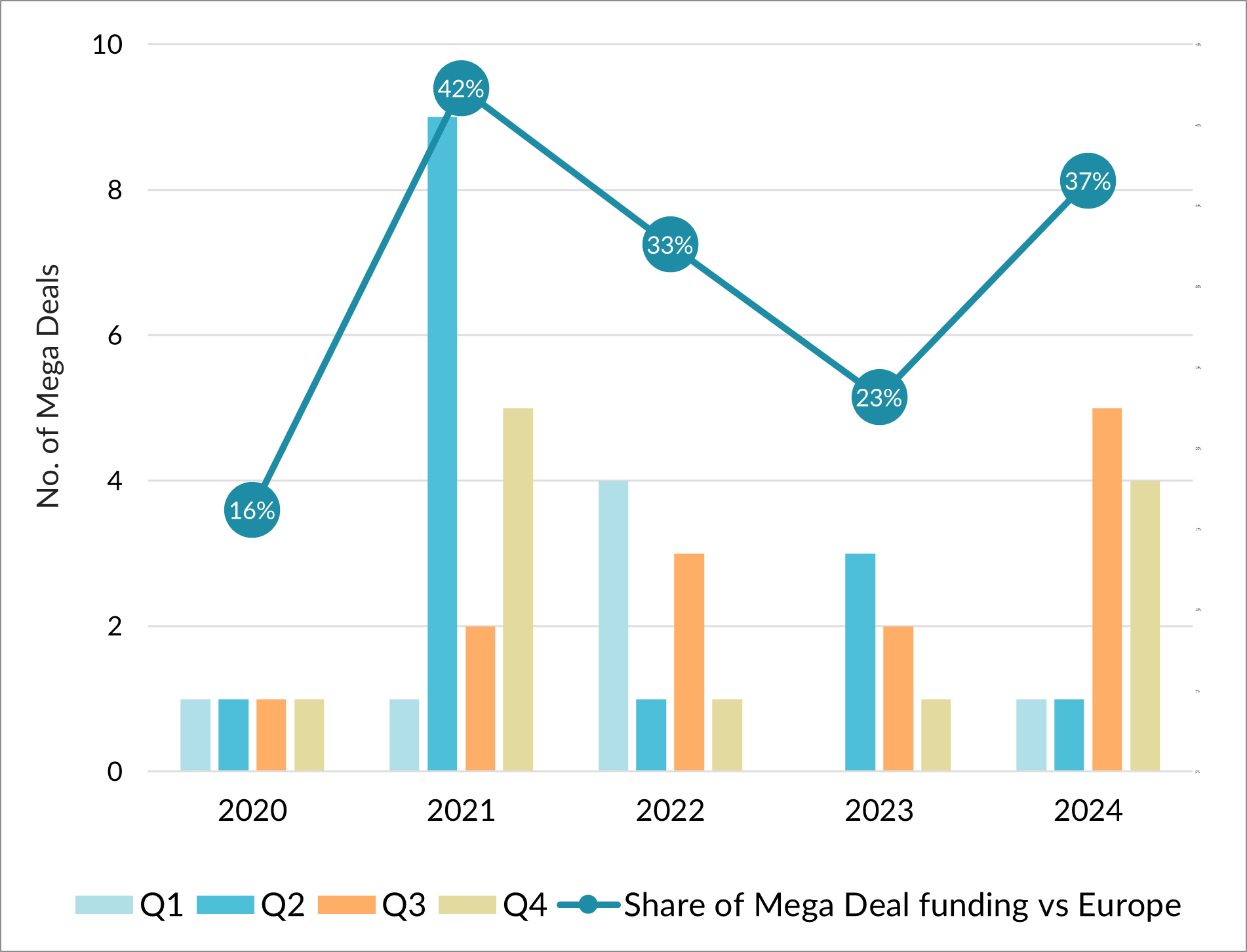

Digital Health Mega Deals Boosting Europe’s 2024 Funding

A key driver of Europe’s funding success in 2024 was the substantial rise in mega-deals—transactions valued at $100 million or more. These deals nearly doubled year-on-year in the region, accounting for 37% ($1.74B) of the $9.4 billion invested globally through such high-value transactions.

Mega-deals underscored the maturity of European ventures as investors increasingly sought companies with proven scalability, market readiness, and technological innovation. Notable examples of mega-deals in Europe included $200M for Flo Health in July, Caresyntax closed a $180M round in August, Alan raised a $193M Series F in September, and in November, Ōura announced the closing of its $200M Series D round along with a $200M Series H round for EGYM. Each deal indicates possible expansion for the ventures by giving them capital to enter into acquisition deals.

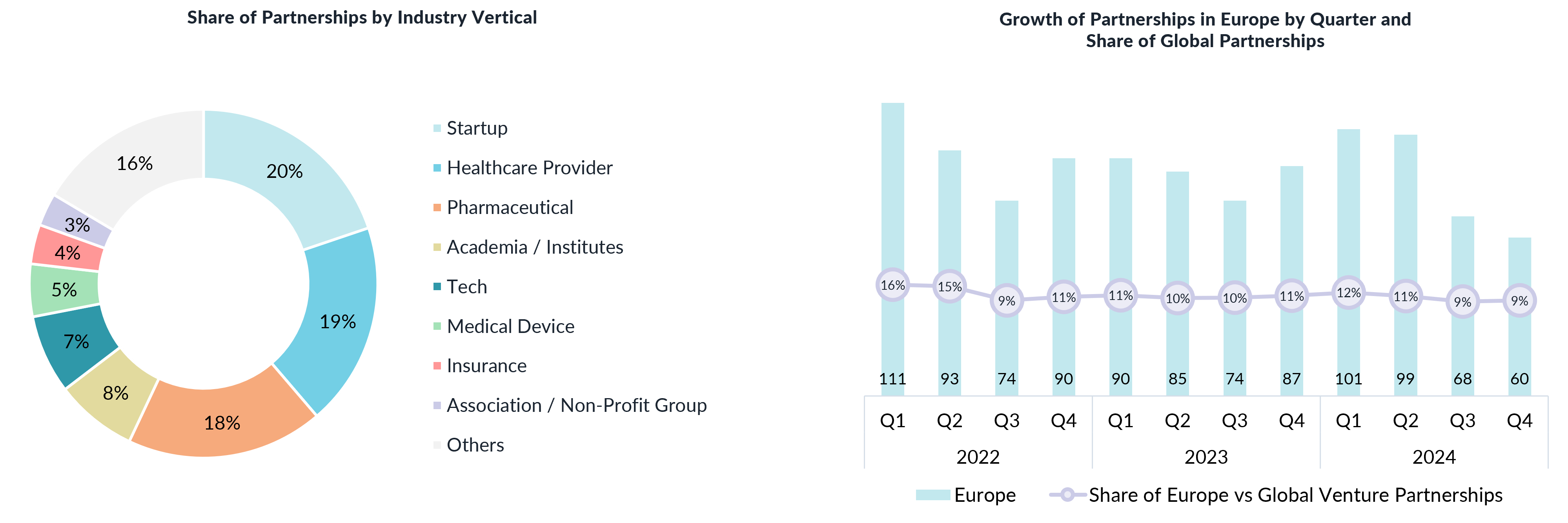

Digital Health Partnerships: A Year of Contrasts in Collaboration

Partnerships played a pivotal role in shaping Europe’s digital health landscape in 2024. The year’s first half saw a record-breaking surge in partnerships, with over 1,720 collaborations recorded in Q2 alone. Healthcare providers and startups led this wave, forging alliances to enhance patient care, optimise operational efficiency, and integrate innovative technologies into traditional systems.

However, the year’s second half marked a decline in partnership activity, with a 29% drop by year-end. This shift focuses on consolidating and leveraging existing synergies rather than initiating new collaborations. Despite the slowdown, partnerships remained a cornerstone of the region’s digital health strategy, with healthcare systems accounting for 21% of all collaborations.

The top 3 most active corporates in announcing partnerships in 2024 with European Digital Health ventures were AstraZeneca (7 partnerships), Eli Lilly (4 partnerships), and GSK (3 partnerships).

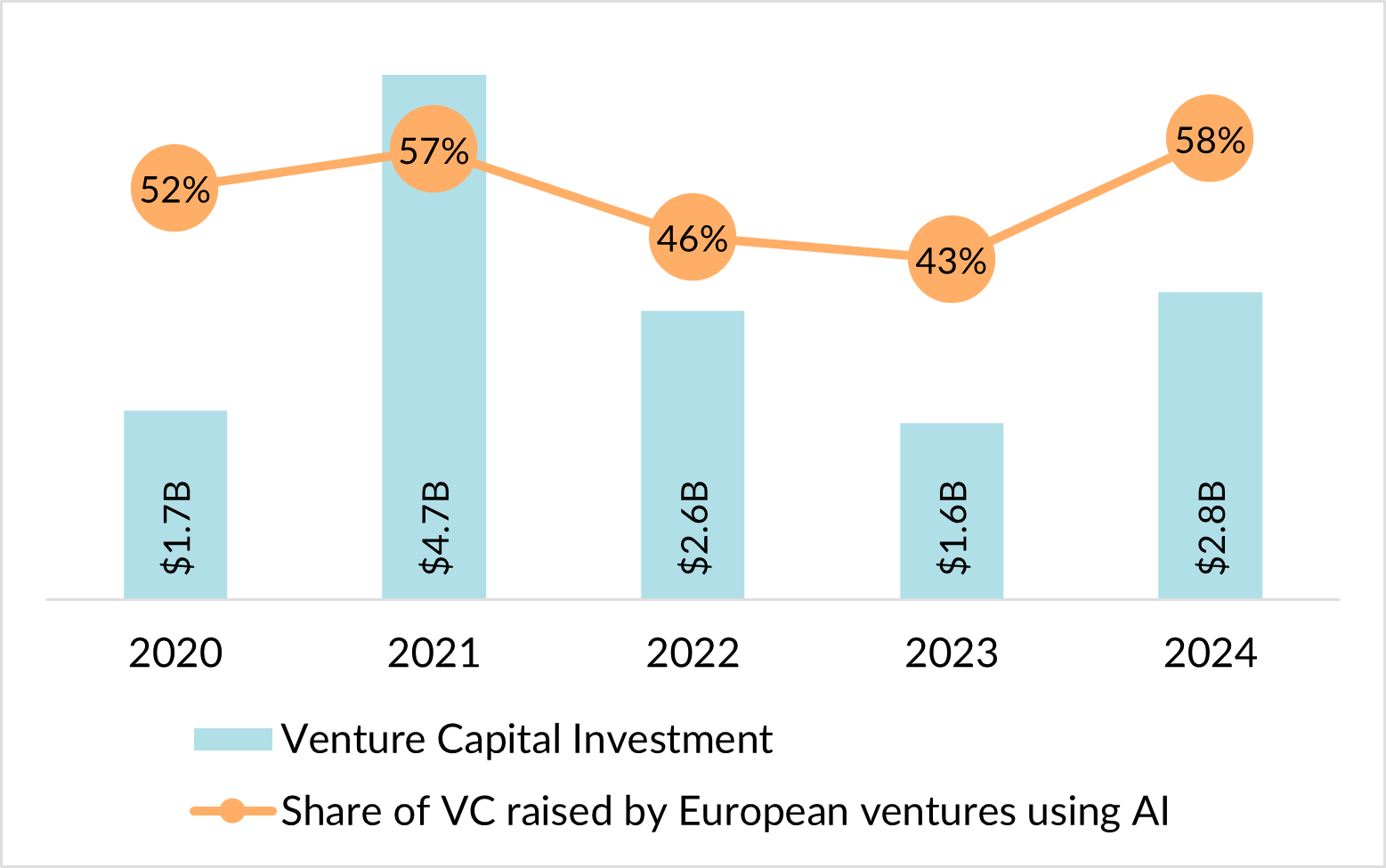

AI in Healthcare for Europe Underpinned Digital Health Funding

Artificial intelligence (AI) took centre stage in Europe’s digital health evolution, capturing 58% of the region’s total funding. This overrepresentation highlights AI’s transformative potential in healthcare, from streamlining operations to revolutionising diagnostics and treatment personalisation.

Key areas of AI application in European digital health innovation, along with relevant ventures closing funding rounds in 2024 included:

- Medical Diagnostics: AI-powered tools that improve diagnostic accuracy and efficiency. Vara, a Swiss developer of breast-cancer screening solutions closed a $8.9M Series A2 round in October.

- TechBio: Advanced algorithms expedited the identification of viable drug candidates, reducing costs and accelerating timelines. Healix, a UK TechBio company using generative AI to accelerate development of therapeutics for rare diseases raised $47M in a Series C funding round.

- Health Management Solutions: AI-driven platforms optimised resource allocation, patient engagement, and data-driven decision-making. French medical data platform Lifen closed a $8M Series C1 round in September 2024.

Investors displayed heightened enthusiasm for AI-enabled ventures, reflecting growing confidence in their ability to address pressing healthcare challenges and deliver measurable outcomes. Europe’s emphasis on ethical AI and regulatory alignment further strengthened its leadership in this domain.

Oncology and Research Solutions Dominate Funding

Oncology ($810M) and Research Solutions (TechBio, $4.77B) emerged as the top therapeutic area and digital health cluster in Europe’s digital health ecosystem in 2024. These sectors collectively captured nearly half of all venture capital deployed, underscoring their critical role in addressing global healthcare needs.

Challenges and Opportunities Ahead

Despite its achievements, Europe’s digital health sector faces challenges that must be addressed to sustain growth:

Funding Pressures

While mega-deals highlighted investor confidence, 27% of early-stage ventures in Europe have not secure funding over the past 18 months. With valuations stabilising post-pandemic, alternative financing models and increased governmental support may be necessary to bridge the financial gap.

Reimbursement Frameworks

Inconsistent reimbursement pathways for digital therapeutics and digital health solutions remain a barrier to widespread adoption. Initiatives like DiGA in Germany and PECAN in France are examples of promoting standardised, value-based reimbursement models to ensure accessibility and scalability.

Scaling Innovations

Europe’s access to growth-stage funding and commitment to collaboration remains a challenge and will be critical in overcoming these hurdles. Scaling digital health solutions beyond pilot phases and ensuring reimbursement within Europe has previously been a challenge that has led to many ventures moving operations to the U.S. when focusing on growth.

Looking Ahead: Digital Health Predictions for 2025

As we move into 2025, digital health across the globe is poised for further transformation. Digital Health Predictions for 2025 show key focus areas:

- Expansion of AI Applications: Beyond diagnostics, AI is expected to play a growing role in diagnostics, patient engagement, and operational efficiency.

- Further Consolidation: In 2024, 70% of global M&A activity in digital health involves venture-to-venture transactions, highlighting the growing trend of startups joining forces to strengthen market positions and streamline operations. With an increased number of mega-deals and continued funding stress, conditions are ripe for further consolidation among digital health ventures in Europe.

- Digital Obesity Care Platforms: The rise of GLP-1 medications is transforming obesity care, fostering growth in digital platforms providing treatment and support. In 2024, global funding deployed to ventures focused on obesity care increased by 40%, reflecting strong investor confidence in this sector. This trend positions obesity care platforms for significant growth, driven by innovative solutions and escalating consumer demand.

More digital health predictions for 2025 can be found in Galen Growth’s blog.

Conclusion: Europe as a Global Digital Health Leader

Europe’s 2024 digital health achievements reflect a vibrant ecosystem driven by innovation, collaboration, and resilience. From AI breakthroughs to oncology advancements, the region has set a benchmark for digital health transformation. Digital health funding trends indicate a positive outlook.

By addressing its challenges and leveraging its unique strengths, Europe is well-positioned to continue making strides in global digital health. As stakeholders continue to align efforts, the future of digital health in Europe holds immense promise for improving patient outcomes and much needed redefining of healthcare delivery.

Don’t stop here. Have you read Galen Growth’s Digital Health 2024 Funding and Key Trends: Resilience, Recovery, and the Road Ahead? Download the report today to stay ahead of advancements in AI healthcare in Europe and newly announced digital health partnerships and mega deals transforming the industry!

All data in this blog is from HealthTech Alpha – a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform.