As the third quarter of 2024 wraps up, it’s time for an update on the digital technology innovation within healthcare ecosystems. By the end of Q2, Galen Growth reported a 5% year-over-year increase in global funding, spurred by growing investor enthusiasm for AI-driven solutions. Q3 continued this strong trajectory, securing another USD 6.1 billion across 325 deals, bringing the year-to-date total to USD 20.1 billion across 1,136 deals worldwide. With digital health funding on track to surpass the 2023 total of USD 24 billion, Q3 shifted towards growth-stage investments, following early-stage and late-stage preferences in Q1 and Q2, respectively. A deep dive into key regions shows the U.S. leading with USD 3.6 billion across 186 deals, Europe with USD 1.7 billion across 67 deals, and Asia Pacific with USD 461 million across 46 deals. Exit activity gained further traction, closing at USD 4.6 billion, while partnership-building efforts slowed as ventures prioritised fundraising. In this evolving landscape, proof points such as clinical evidence are becoming increasingly crucial in shaping partnership and investment decisions.

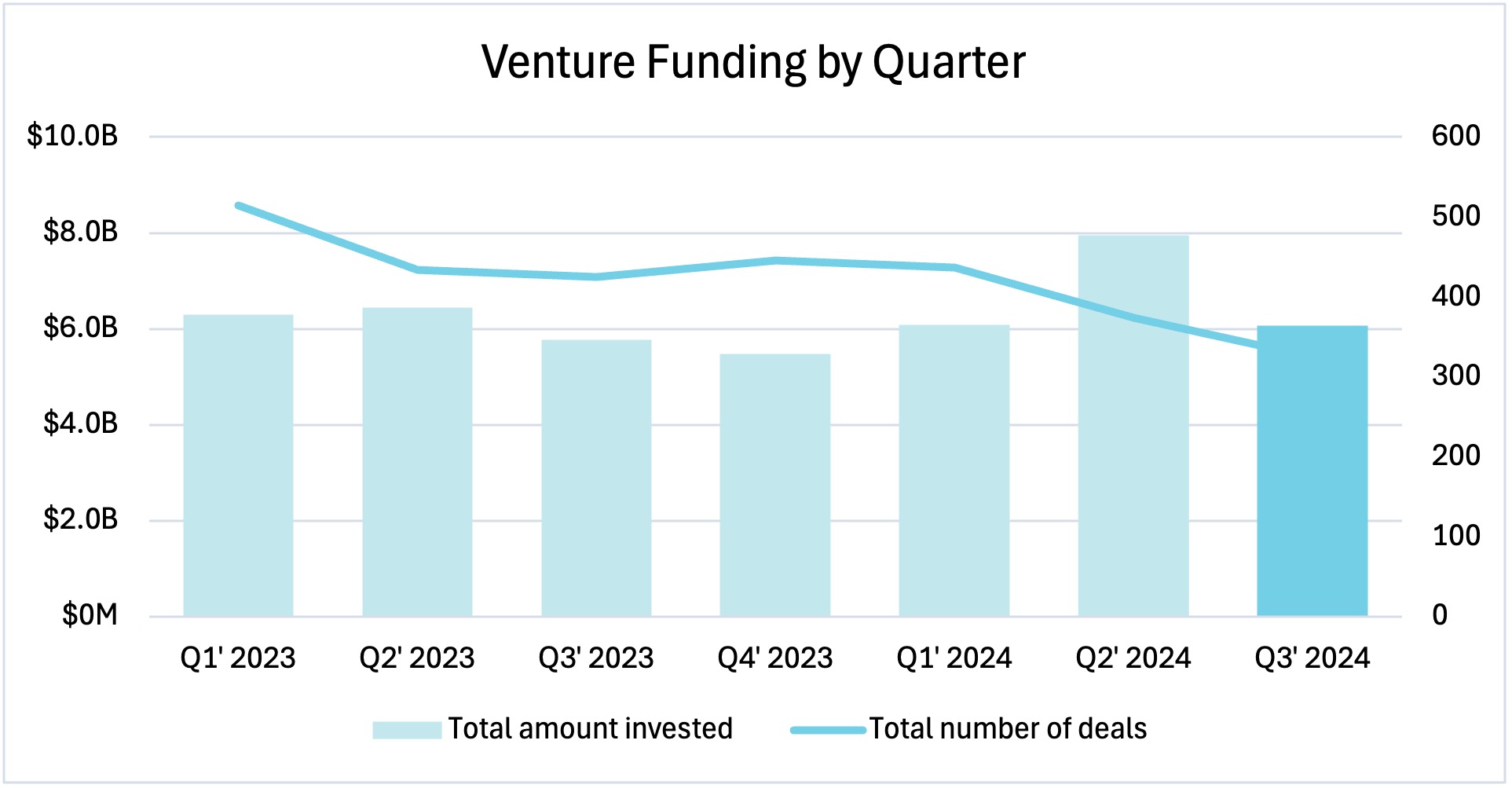

Venture funding was weaker in Q3 but still on track.

Venture funding continued to show strength in Q2 and Q3 of 2024, surpassing the levels seen in 2023. With USD 20.1 billion raised in the first three quarters, funding is on pace to exceed the 2023 total of USD 24.0 billion, already achieving 84% of last year’s value.

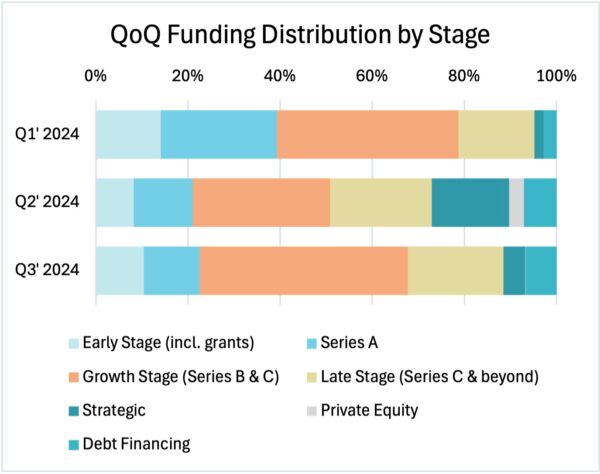

Focused shifted to Growth-Stage funding in Q3

At the beginning of 2024, Seed and Series A funding rounds were prevalent, accounting for nearly 40% of the total funding value. However, there was a notable shift towards large-ticket late-stage and strategic funding rounds in Q2. By Q3, more than 40% of the funding was allocated to growth-stage rounds, suggesting that investors are prioritising companies that have already demonstrated some success and are now looking to expand further.

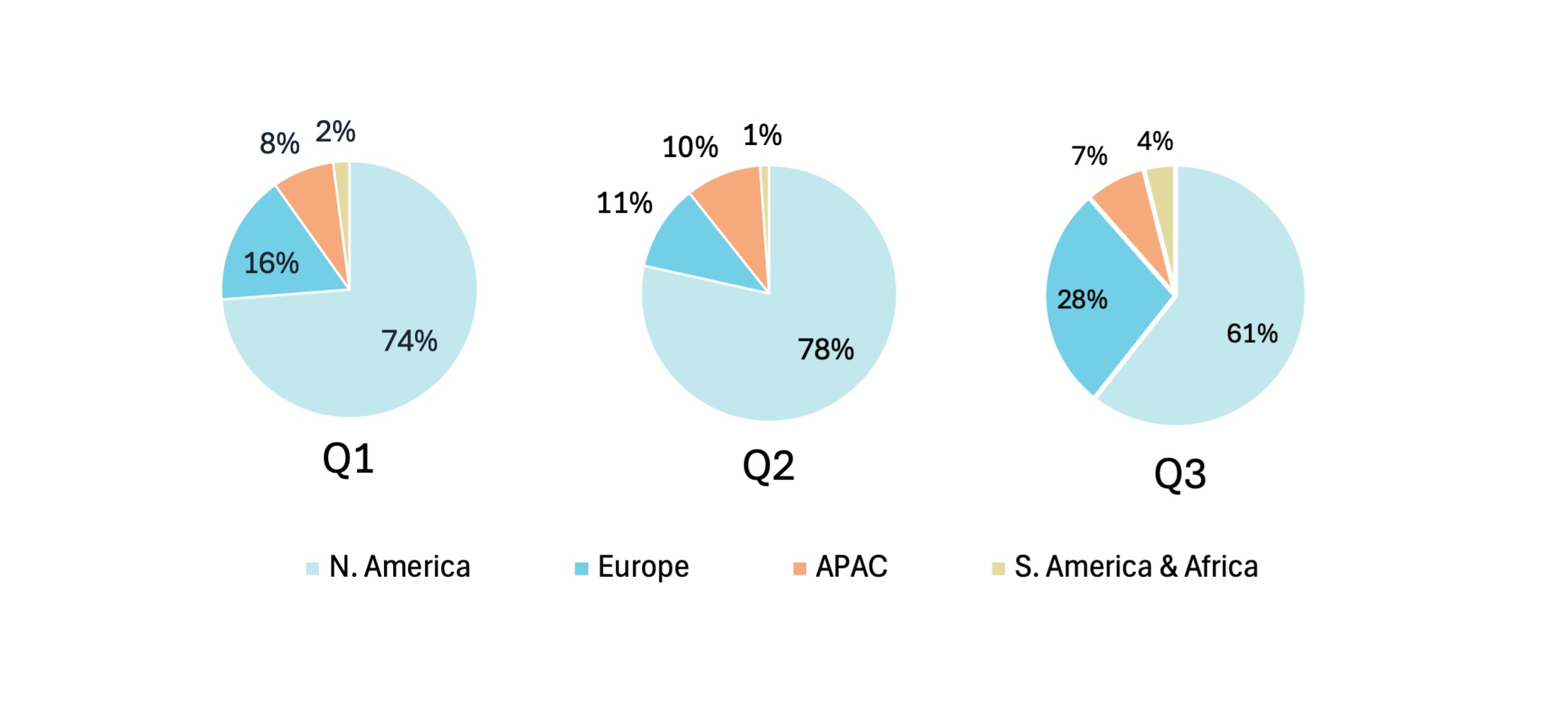

Q3 Highlights the growing focus on European-founded ventures.

In Q3 2024, there was a noticeable shift in digital health funding towards European-founded ventures, which captured 28% of the total funding deployed. This trend highlights a growing confidence in the European digital health ecosystem, driven by the implementation of regulation to reimburse digital health solutions and the maturing of ventures, which attract more substantial investments as they demonstrate their potential to scale and impact the healthcare sector.

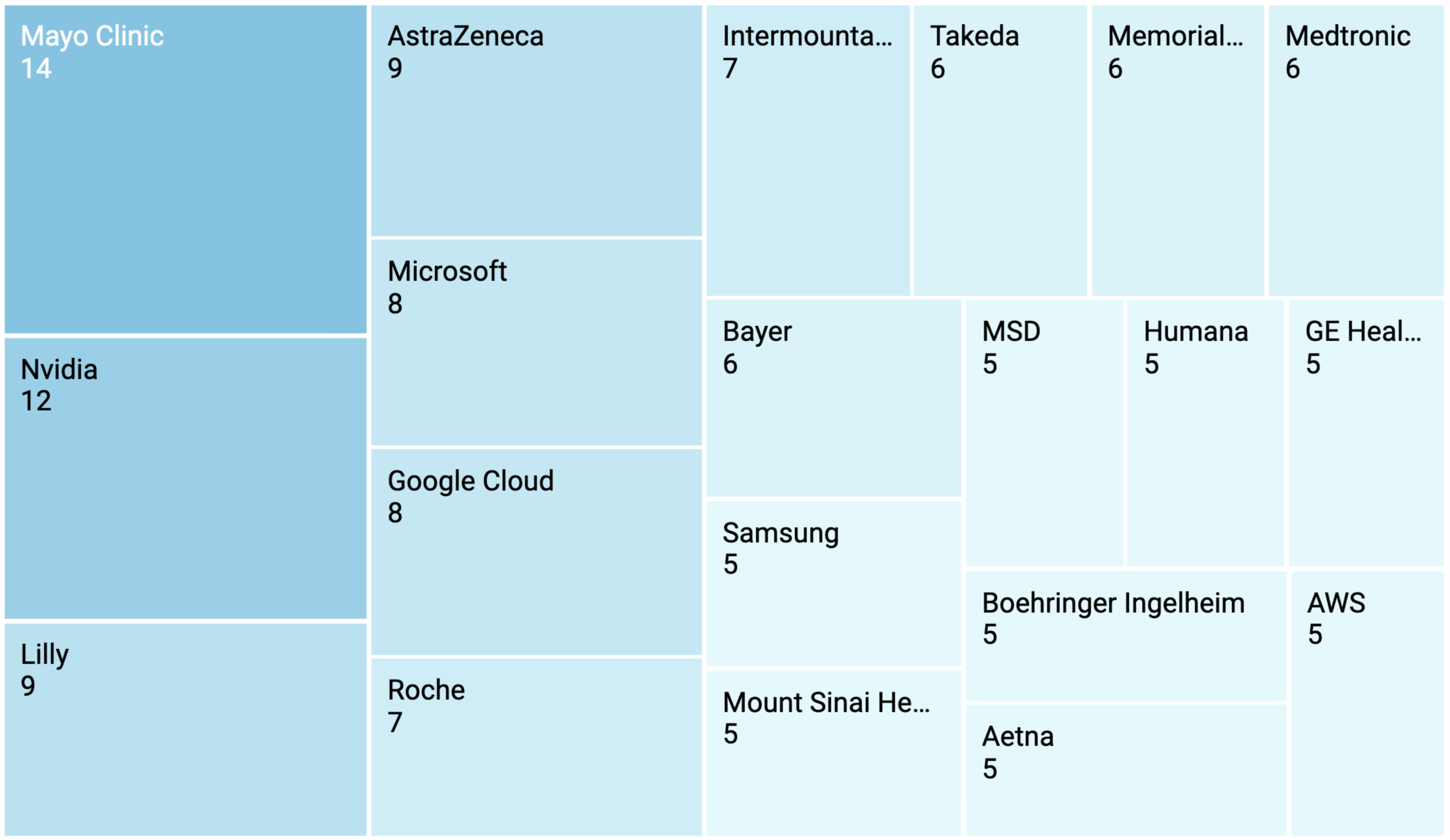

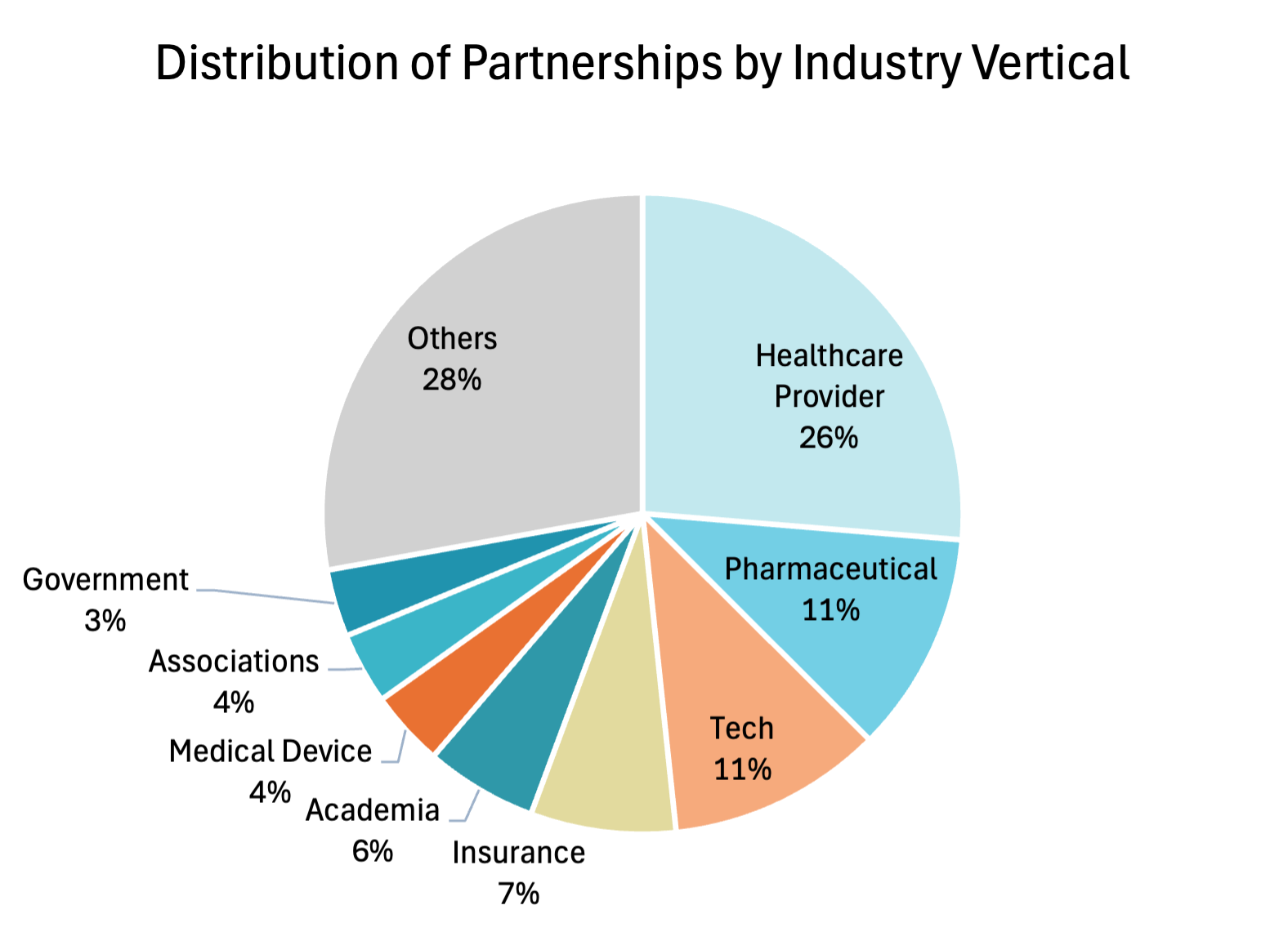

Most active Industry Partners in Q3 for Digital Health Ventures

Health systems and hospitals (i.e., healthcare providers) remained the most active industry vertical in entering into partnerships with digital health ventures in Q3, capturing 26% of all partnership announcements (read Galen Growth’s special report on U.S. Health Systems). Pharma and Tech companies took second and third place, with insurance companies capturing only 7% of the new partnership announcements in Q3.

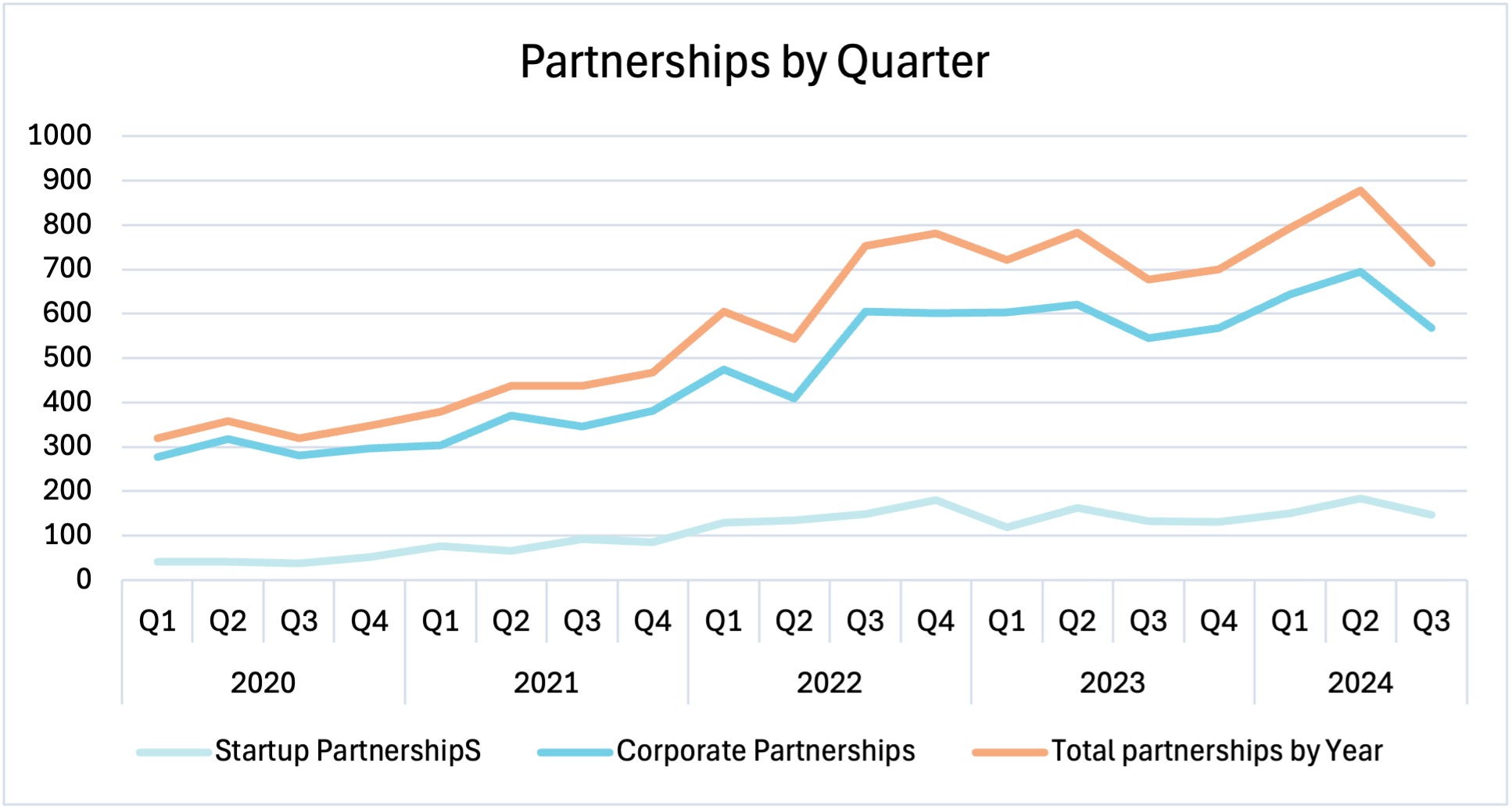

Partnerships slowed in Q3

While partnerships surged in Q2, Q3 has seen a noticeable slowdown in partnership announcements. This shift reflects a strategic pivot by digital health ventures towards securing funding in the improved financial environment. Companies are prioritising fundraising efforts over forming new partnerships in a deliberate move to strengthen financial positions and drive long-term growth.

Top-funded digital health clusters in Q3 by region

| North America | Medical Diagnostics | $691M (19%) |

| Europe | Wellness | $413M (25%) |

| Asia-Pacific | Medical Diagnostics | $243M (53%) |

Top-funded digital health therapeutic areas in Q3 by region

| North America | Oncology | $910M (25%) |

| Europe | Mental Health | $406M (24%) |

| Asia-Pacific | Oncology | $262M (57%) |

In Q3, the digital health landscape saw a noticeable shift in investor attention, with the Medical Diagnostics cluster emerging as a favoured target for funding. This pivot follows an H1 trend that concentrated heavily on TechBio (read Galen Growth’s report on TechBio), potentially indicating a rebalancing of investment priorities within the sector.

Meanwhile, Oncology made a strong comeback, regaining its leading position in the U.S. market, a testament to the enduring interest in cancer-focused innovations. In Europe, Mental Health solutions experienced a significant rebound, echoing the resurgence seen in the U.S. during H1.

Get data-driven insights

All charts from this report come directly from Alpha Edge, the data analytics tool in HealthTech Alpha. HealthTech Alpha is the premier platform for actionable intelligence in the digital health landscape. Sign up for your account today.