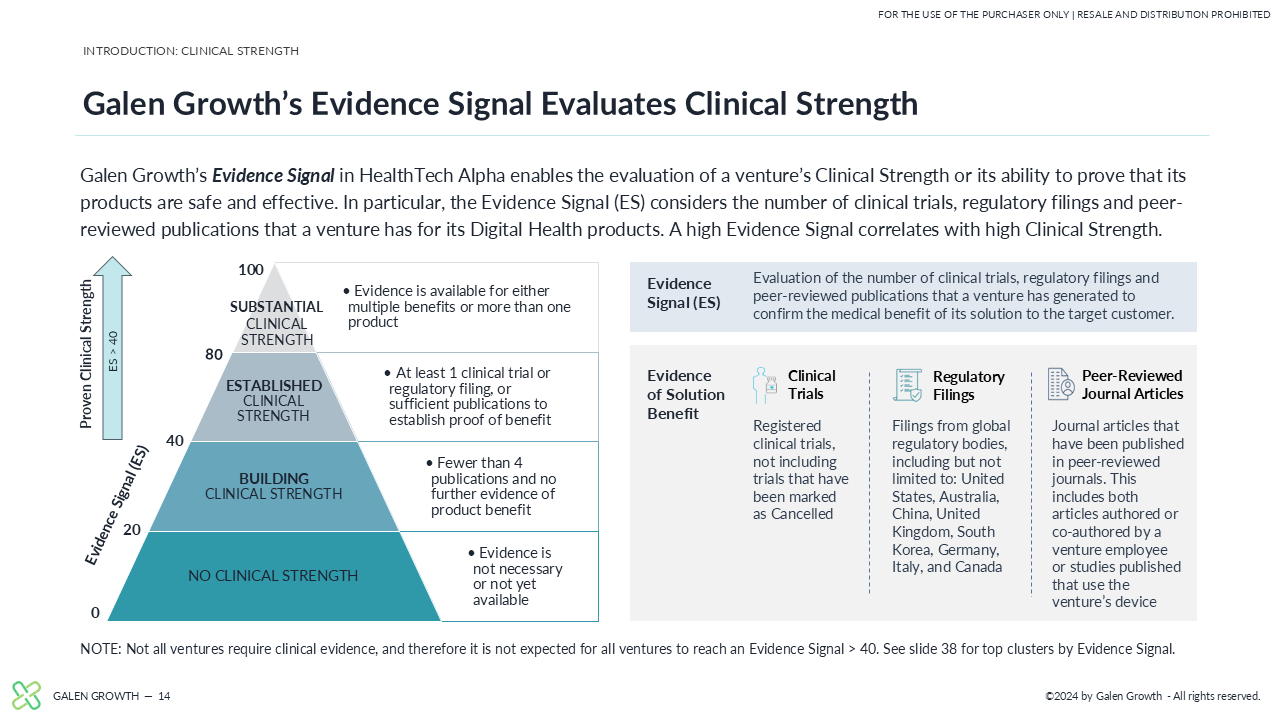

While a great idea and good business acumen have scaled strong Digital Health companies over the past decade, there is a shift in focus to proof points, with Clinical Strength being a priority data point. Galen Growth first published its industry-leading research report in 2022 looking at the Clinical Strength of a Digital Health venture by evaluating a venture’s clinical trials, regulatory filings, and peer-reviewed publications.

Powered by HealthTech Alpha, our proprietary data platform, we offer unmatched, data-driven insights into the global Digital Health sector.

Key insights from the Clinical Evidence report

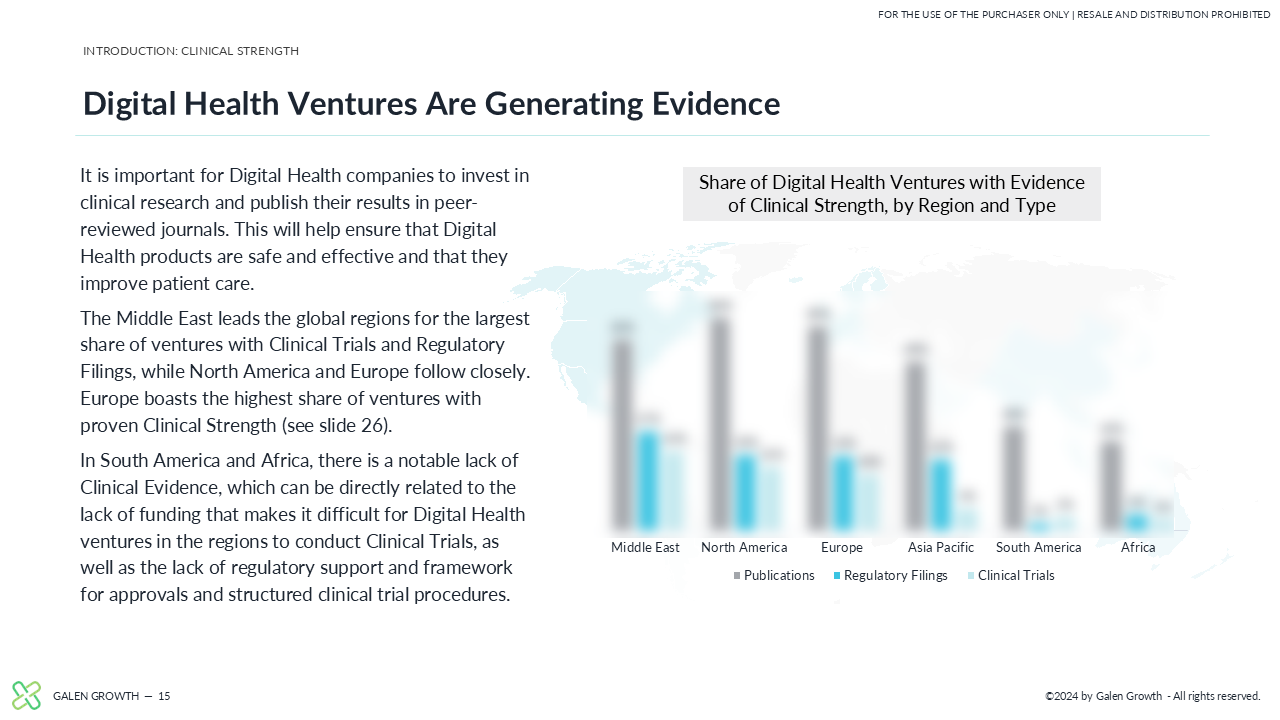

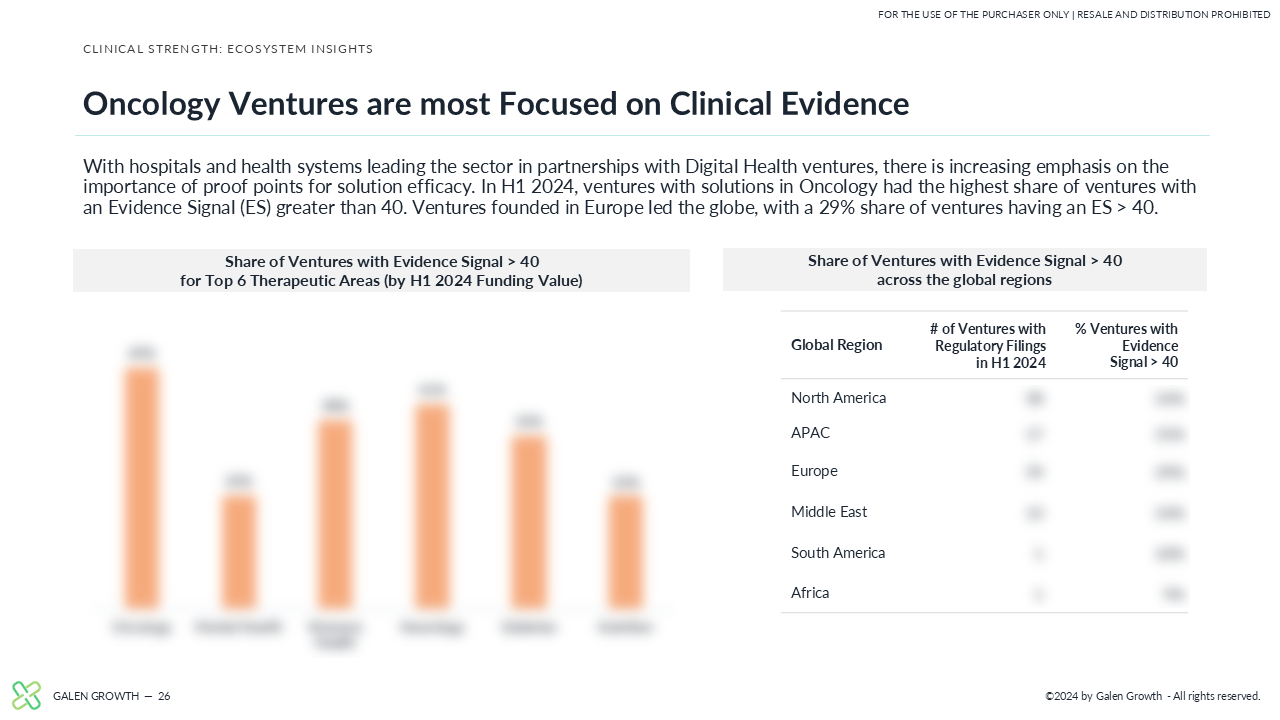

There is a shift in focus in Digital Health to proof points, with Clinical Strength being a priority data point. Across the globe, 24% of all private Digital Health ventures have proven Clinical Strength through Clinical Trials, Regulatory Filings, or Peer-Reviewed Publications.

The regulatory landscape for Digital Health is becoming more favourable across the globe, with the FDA releasing the Digital Health Policy Navigator in January 2022 and the German DiGA program growing to over 50 successful applications. With a 29% share of ventures boasting proven Clinical Strength, Europe takes the top spot, while the Middle East and North America tie at 24% for the second place in the share of ventures with Clinical Strength.

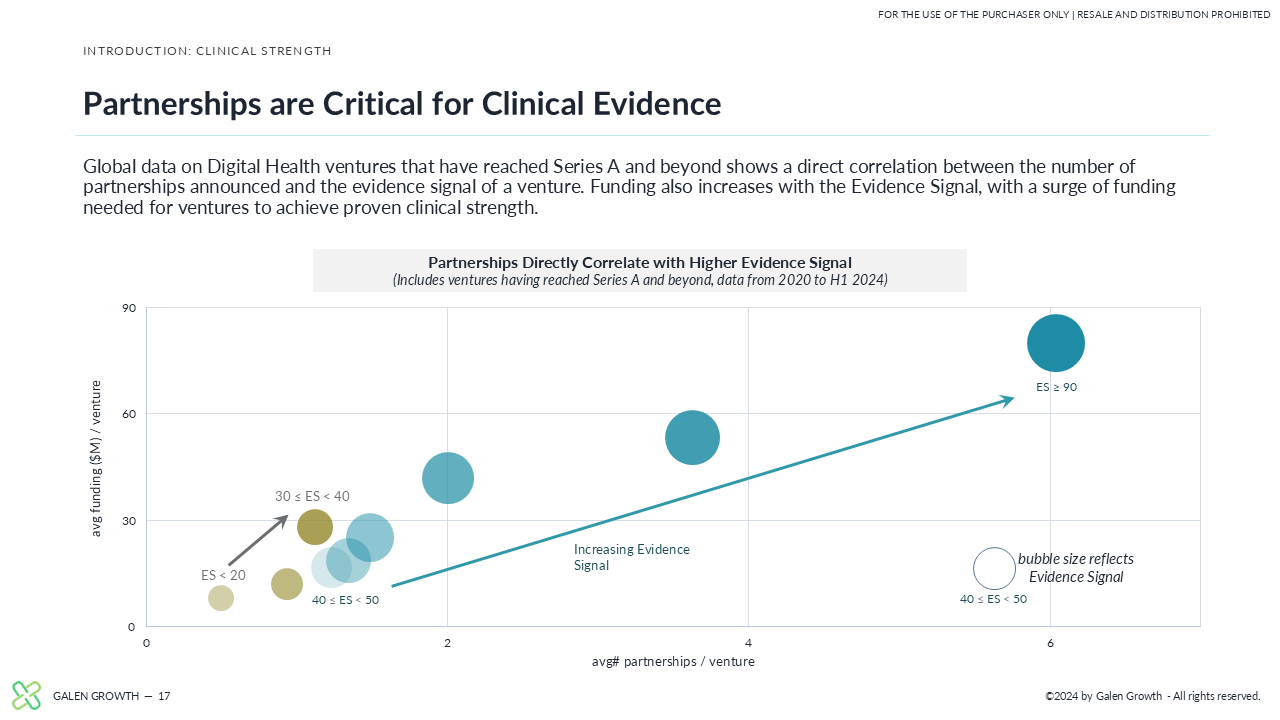

Digital Health ventures can benefit from partnerships that provide them with access to patients, funding, and medical knowledge. In the top 5 Digital Health Clusters (by % of ventures with Clinical Strength), ventures with proven Clinical Strength have at least a 1.5x higher share of partnerships than those without Clinical Strength. Clinical Trials top the list, with 85% of ventures having proven Clinical Strength actively partnering.

Navigating health-related apps, software, and devices remains a challenge, with healthcare providers and payers requiring proof points of the product’s benefit to the intended user. HealthTech Alpha has catalogued over 32,000 products (mobile apps, software, and devices) developed by private ventures focused primarily on Digital Health. 31% of the Digital Health apps were developed by ventures that have proven Clinical Strength.

Within the Medical Diagnostics Cluster, 78% of Growth- and Late-Stage ventures have proven Clinical Strength. 95% of the cumulative funding value in H1 2024 deployed to ventures in this cluster went to ventures with proven Clinical Strength. The current interest in generative AI for healthcare has led some investors to shift their focus to AI-driven ventures, often overlooking the crucial aspects of clinical robustness.

Ventures and Companies Covered in the Report:

The “Clinical Strength in Digital Health Innovation Report” report includes data on the following companies:

Sword Health, TMRW Life Sciences, Doccla, Mojo Vision, Relation Therapeutics, Big Health, Mika, Remix Therapeutics, Relay Therapeutics, Clarius Mobile Health, UltraSight, mPath, Moleculight, Thorough Future (透彻未来)

Read our blog featuring this analysis.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| ABOUT GALEN GROWTH | |

| INTRODUCTION: 10 pages, 7 charts, 2 tables | |

| ECOSYSTEM INSIGHTS: 10 pages, 13 charts, 2 tables | |

| CLUSTER FOCUS: 3 pages, 2 charts | |

| KEY INFORMATION | |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level