- H1 2024 Digital Health funding closed at $12.4B across 719 deals

- Q2 2024 funding is up on Q1 by 34%

- Robust M&A activity with 95 acquisitions in H1 2024

- Mega rounds share is 37%

- Performance mainly driven by the US which is 10%

- Europe manifests as the second most invested region in Digital Health

- Partnership activity is flat with Health Systems still the driving share

- Venture-to-venture (V2V) partnership activity share is 33%

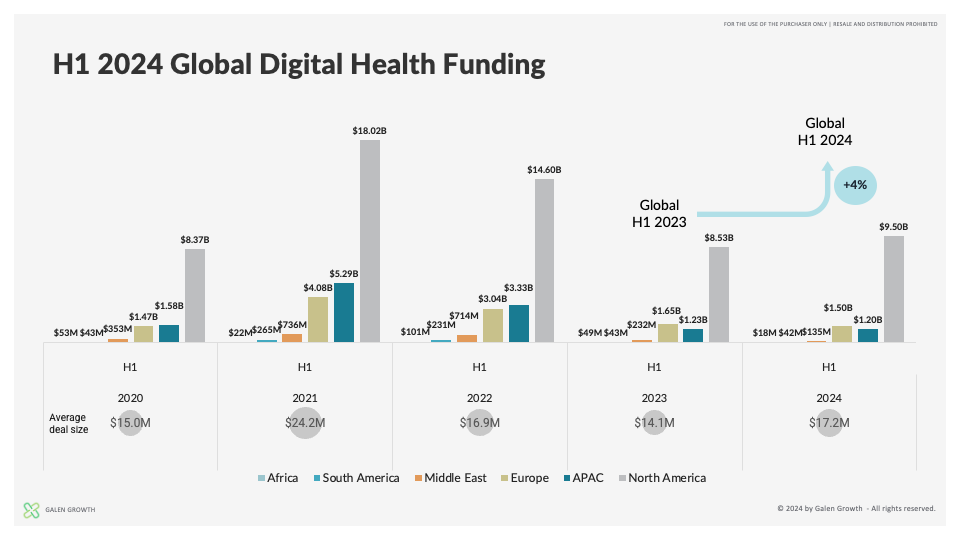

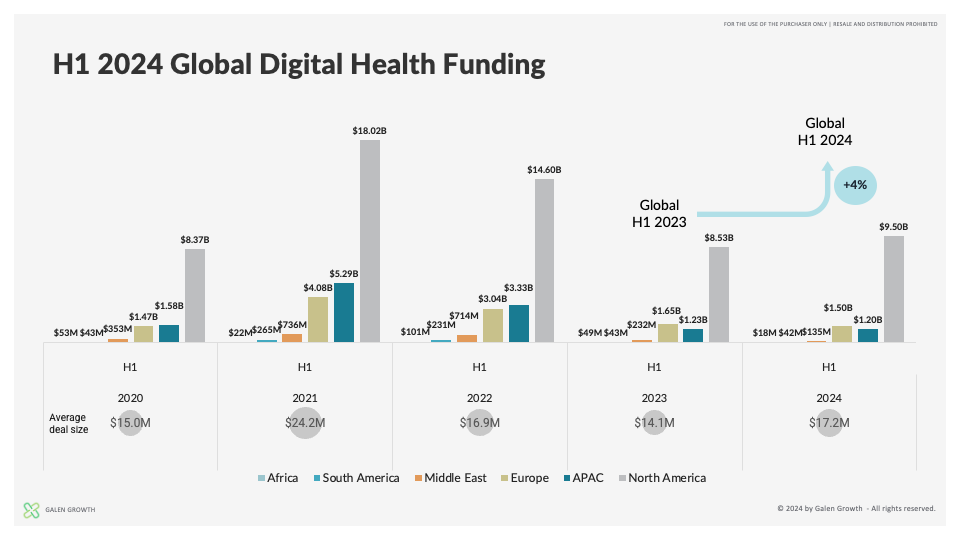

H1 2024 Digital Health funding demonstrated strong performance, with $12.4 billion invested across 719 deals. This development defied expectations of a prolonged funding winter and demonstrated remarkable resilience and growth. With Q2 2024 outperforming Q1 ($7.1 billion vs. $5.3 billion), Digital Health funding has shown sustained investor confidence and increasing momentum.

Key areas such as Generative AI, Health Management Solutions, Medical Diagnostics, and Research Solutions (aka TechBio) have emerged as focal points, reflecting the sector’s dynamic evolution. The first half of the year also witnessed an increased focus on mega deals, robust M&A activity, and strategic partnerships, highlighting the ongoing consolidation of the Digital Health market globally.

H1 2024: Resilience and Growth

Digital Health funding demonstrated remarkable resilience in the first half of 2024, with a total investment of $12.4 billion across 719 deals, up 5% vs H1 2023. This robust performance challenges the prevailing narrative of a funding winter, instead showcasing sustained investor confidence in the sector. The second quarter outpaced the first, with $7.1 billion invested compared to $5.3 billion in Q1, up 34%, indicating growing momentum.

Over 1,600 investors participated, with 50 making more than three investments in this six-month span. This marks an increase from the previous year, when 47 investors reached this threshold, suggesting renewed confidence and a growing core of committed Digital Health investors. For more insights on identifying key investors in this space, refer to the methodology for identifying core investors.

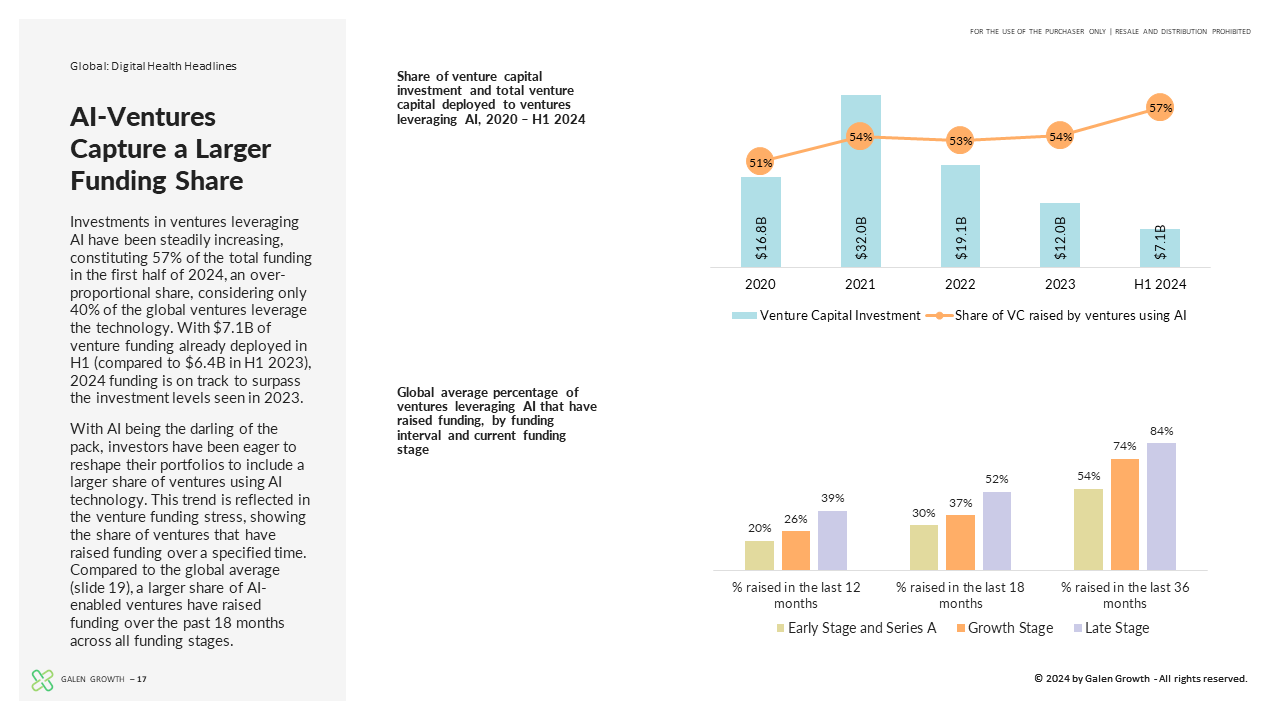

Quarterly funding reached its highest level since 2022, with mega-rounds (deals exceeding $100 million) accounting for 37% of total funding – the highest proportion since 2021. Generative AI and AI-enabled companies are gaining investor and corporate attention, particularly in Health Management Solutions, Medical Diagnostics, and Research Solutions (aka TechBio). 56% of the venture capital in the sector was deployed to AI-enabled companies, although they make up only 40% of the venture ecosystem. The integration of AI in healthcare continues to drive innovation and attract significant investment.

The US and other North American countries maintained their leading position in Digital Health total funding deployed, while Europe retained its position as the second most funded region. To receive a detailed regional breakdown and analysis, subscribe to our regional half-year reports.

Each of these indicators suggests that Digital Health funding bottomed out in 2023 and is now poised for more robust growth in the period ahead.

Mega Deal Investments

Large size mega deals played a significant role in the Digital Health funding landscape during the first half of 2024, demonstrating a growing appetite for large-scale investments in promising companies. H1 2024 saw 26 mega deals (deal value ≥ $100 million) totalling $4.9 billion, which accounted for 39% of the overall funding in the Digital Health sector. This represents a 9% increase from H1 2023, which recorded 24 mega deals amounting to $4.5 billion.

| Date | Venture Name | Lead Investor(s) | Amount (US$ m) | Stage | Country |

| 23 Apr 24 | Xaira Therapeutics | ARCH Venture Partners, Foresite Labs | $ 1,000.0 | Strategic | United States |

| 26 Apr 24 | Formation Bio | Andreessen Horowitz | $375.0 | Series D | United States |

| 15 Feb 24 | Freenome | Roche | $ 254.0 | Series E | United States |

| 30 Apr 24 | PharmEasy | MEMG | $ 216.0 | Series G1 | India |

| 30 Apr 24 | Blackrock Neurotech | Tether | $ 214.3 | Strategic | United States |

| 16 Apr 24 | Accuhealth | Sunstone Partners | $ 200.0 | Private Equity | United States |

| 26 Jun 24 | Foodsmart | The Rise Fund | $ 200.0 | Series D | United States |

| 13 Feb 24 | BioAge Labs | Sofinnova Partners | $ 170.0 | Series D | United States |

| 26 Jun 24 | Sidecar Health | Koch Disruptive Technologies | $165.0 | Series D | United States |

| 23 Feb 24 | Abridge | Lightspeed Venture Partners, Redpoint Ventures | $ 150.0 | Series C | United States |

| 11 Apr 24 | Cohesity | IBM, Nvidia | $ 150.0 | Series F | United States |

| 25 Jun 24 | EvolutionaryScale | Lux Capital, Daniel Gross, Nat Friedman | $142.0 | Seed | United States |

| 1 Feb 24 | Lightship | undisclosed | $ 135.6 | Series D | United States |

| 28 May 24 | Koios Medical | undisclosed | $ 130.0 | Debt Financing | United States |

| 4 Jun 24 | SWORD Health | Sapphire Ventures, Sozo Ventures, and others | $ 130.0 | Series D1 | Portugal |

| 18 Jun 24 | Talkiatry | Andreessen Horowitz | $ 130.0 | Series C | United States |

| 21 Jun 24 | BillionToOne | Premji Invest | $ 130.0 | Series D | United States |

| 8 May 24 | TaiDoc Health (太医管家) | Shanghai International Group Asset Management, and others | $ 127.1 | Series B | China |

| 2 May 24 | Transcarent | General Catalyst, 7wire Ventures | $ 126.0 | Series D | United States |

| 13 Mar 24 | Zephyr AI | Revolution | $ 111.0 | Series A | United States |

| 21 Feb 24 | Medical Microinstruments | Fidelity Management & Research Company | $ 110.0 | Series C | Italy |

| 29 Mar 24 | Rightway Healthcare | undisclosed | $ 108.8 | Series D | United States |

| 23 Jun 24 | METiS Therapeutics | CICC | $100.0 | Series C | United States |

| 16 Jan 24 | DecisionRx | The Carlyle Group | $ 100.0 | Debt Financing | United States |

| 6 Mar 24 | Claroty | Delta V | $ 100.0 | Strategic | United States |

| 2 May 24 | Karius | Khosla Ventures, and others | $ 100.0 | Series C | United States |

The increase in total funding also moved the average mega deal size to its highest since 2019 reaching $191 million.

The geographical distribution of these mega deals highlights the continued dominance of the United States in attracting substantial investments. Of the 26 mega deals, 22 were secured by U.S.-founded companies, underscoring the country’s robust Digital Health ecosystem and investor networks. Asia Pacific and Europe followed two mega-deals in each region.

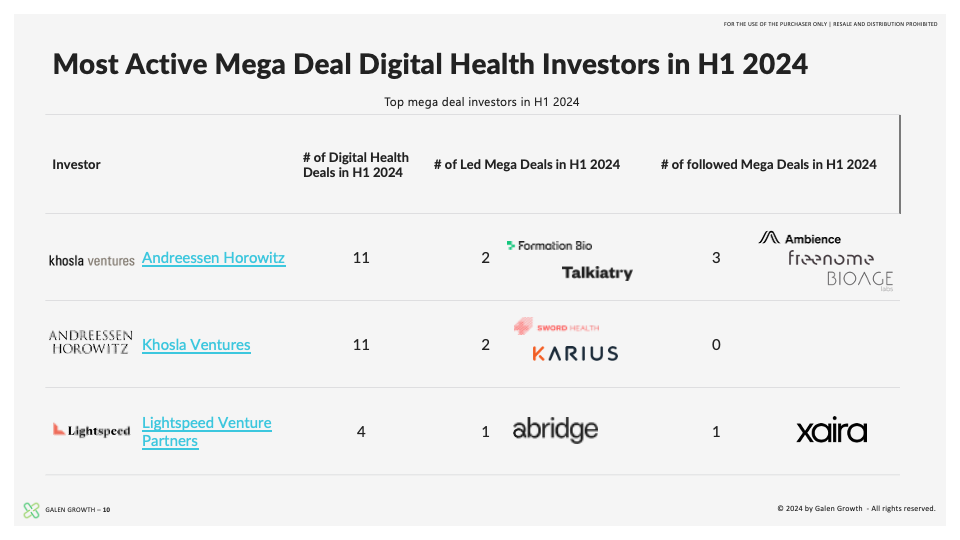

Notable investors participating in these high-stake investments included prominent venture capital firms such as Andreessen Horowitz, Khosla Ventures, and Lightspeed Venture Partners. Despite the overall market fluctuations, their involvement signals ongoing interest from top-tier investors in the Digital Health sector.

Acquisitions and Sell-offs

Mergers and acquisitions (M&A) activity in the digital health sector remained robust in H1 2024, with 96 deals completed. This figure represents a slight increase of 2% from the 94 deals recorded during the first half of 2023, indicating a stable M&A environment. The sector maintained a consistent pace, averaging 15 M&A transactions per month, demonstrating ongoing consolidation and strategic repositioning within the industry.

| Company | Event | Outcome | Acquirer | Acquisition value |

| Invitae | Bankruptcy | Assets Sold | LabCorp | $ 239.0 million |

| Better Therapeutics | Bankruptcy | Assets Sold | Click Therapeutics | undisclosed |

| Pixium Vision | Bankruptcy | Assets Sold | Science Corporation | undisclosed |

| Coala Life | Bankruptcy | Assets Sold | PMD Device Solutions | $350 thousands |

| HealthBeacon | Bankruptcy | Acquired | Hamilton Beach Brands | undisclosed |

| Cue Health | Bankruptcy | AS Motion Filed | – | – |

| Medfield Diagnostics | Bankruptcy | – | – | – |

| Calmark | Bankruptcy | – | – | – |

| Akili | Delisted | Acquired | Virtual Therapeutics | $ 34.0 million |

| LumiraDx | Delisted | Assets Sold | Roche | $ 295.0 million |

| C4X Discovery | Delisted | Re-registered as private company | – | – |

| Asensus Surgical | Delisted | Acquired | Karl Storz | $ 95.3 million |

| Sharecare | Delisted | Acquired | Altaris | $518 million |

Several noteworthy transactions stood out during this period:

- Altaris Capital Partners acquired and delisted Sharecare, a digital health company, for $518 million. This move took Sharecare private, allowing for more flexibility in its strategic direction.

- Roche completed its acquisition of LumiraDx’s point-of-care technology platform for $295 million. This deal followed a partnership announced in July 2022, which focused on integrating LumiraDx’s Platform into clinical trial settings to support decentralised clinical trials. The acquisition represents a strategic move by Roche to strengthen its position in the point-of-care diagnostics market. z

H1 2024 also saw a trend of companies delisting from stock markets. In addition to Sharecare, eight other companies chose to delist, including Nemaura Medical, Semantix, and Acutus Medical. These companies moved to the Over-The-Counter (OTC) Stock Market after failing to meet NASDAQ requirements, highlighting the challenges faced by some Digital Health companies in maintaining public listings.

The period also witnessed notable bankruptcies and asset sell-offs, reflecting continued market consolidation:

- Click Therapeutics acquired assets from the bankrupt Better Therapeutics, potentially strengthening its position in the digital therapeutics space.

- LabCorp, a leading global life sciences company, acquired some assets from Invitae, a genetic testing company. This move likely aims to expand LabCorp’s genetic and genomic testing capabilities.

The elevated activity of se M&As and asset acquisitions reflect the dynamic nature of the Digital Health sector, with companies adapting to market conditions and consolidating resources.

Partnerships with Corporates in H1 2024

The Digital Health sector witnessed an almost unchanged collaborative environment during the first half of 2024, with 1,730 partnerships recorded. This represents a slight 2% decrease from the 1,773 partnerships established in the same period of 2023. Several key players and sectors maintained robust engagement in collaborative initiatives.

Healthcare providers (health systems and hospitals) emerged as the primary drivers of partnerships, forging 306 collaborations. This underscores the necessary and growing integration of digital solutions in traditional healthcare settings as providers seek to enhance patient care and operational efficiency through technological innovations. The pharmaceutical and tech industries were runners-up, contributing 127 and 126 partnerships, respectively.

Nvidia stood out as the most prolific collaborator among individual companies, disclosing nine partnerships in the first half of 2024. This aligns with Nvidia’s increasing focus on healthcare AI applications, leveraging its expertise in graphics processing units (GPUs) and artificial intelligence to advance medical imaging, genomics, and drug discovery.

Partnerships Between Digital Health Ventures in H1 2024

The Digital Health sector witnessed a notable increase in collaborative efforts during the first half of 2024 through venture-to-venture (V2V) partnerships. 588 partnerships were formed between digital health ventures, accounting for 33% of all disclosed collaborations. This represents a modest growth from the 559 partnerships recorded in H1 2023, indicating a continued trend towards strategic alliances within the industry.

These collaborations predominantly occurred within specific clusters, with Medical Diagnostics and Health Management Solutions emerging as particularly active. The concentration of partnerships within these clusters suggests a focus on leveraging complementary technologies and expertise to enhance diagnostic capabilities and improve health management systems.

H1 2024 Digital Health Funding Snapshot in the United States

The U.S. maintained its dominant position in the global Digital Health funding arena during the first half of 2024, attracting $9.5 billion across 405 deals, up 14% YoY. This marked a substantial increase from the first half of 2023, where $8.3 billion were invested across 445 deals.

United States Digital Health Funding by Stage

The distribution of funding across various stages reveals a healthy ecosystem supporting companies at different growth phases:

- Early-stage deals: 132 deals (32% of all deals)

- Series A: 88 deals

- Series B: 65 deals

- Series C: 42 deals

- Series D & Beyond: 35 deals

- Other Stages: 43 deals across various other stages.

Our upcoming H1 2024 Digital Health Key Trends in North America report will focus more on the funding trends in the United States. Subscribe to be notified about the report.

H1 2024 Digital Health Funding Snapshot in Europe

Despite a decrease in funding in H1 2024 to $1.52 billion across 158 deals, Europe’s Digital Health sector manifested its position as the second most funded region in the world. Funding decreased by 10% as compared to the first half of 2023 where $1.68 billion was invested.

Europe Digital Health Funding by Stage

Europe’s H1 2024 Digital Health funding landscape showcases a diverse range of investment stages, indicating a healthy and maturing ecosystem.

- Governmental Grants: 15 grants

- Early-stage funding: 79 deals (50% of all deals)

- Series A: 33 deals

- Series B: 11 deals

- Series C: 11 deals

- Series D and beyond: 4 deals.

- Additionally, 5 deals across other stages.

Our upcoming H1 2024 Digital Health Key Trends in Europe report will focus in depth on the key areas of Digital Health in Europe. Subscribe to be notified about the report.

H1 2024 Digital Health Funding Snapshot in Asia Pacific

Asia Pacific’s Digital Health sector experienced a slight decrease in the first half of 2024, attracting $1.17 billion across 118 deals, down 7% from $1.25 billion in the first half of 2023. Amid the continuous funding winter in China, the region fell behind Europe as the world’s third most funded region for Digital Health.

APAC Digital Health Funding by Stage

The distribution of funding across various stages in Asia Pacific’s Digital Health sector reflects a balanced ecosystem supporting companies at different growth phases:

- Early-stage deals: 38 deals (31% of all deals)

- Series A: 23 deals

- Series B: 19 deals

- Series C: 11 deals

- Series D & beyond: 14 deals

- 13 deals across other stages

Our upcoming H1 2024 Digital Health Key Trends in Asia Pacific report corroborates these trends, noting the region’s strength in diagnostic technologies and patient-centric digital solutions. Subscribe to be notified about the report.

Conclusion

The first half of 2024 has firmly demonstrated that the Digital Health sector is resilient and evolving, with substantial investments and strategic collaborations continuing to drive innovation and growth. The $12.4 billion funding across 719 deals underscores renewed investor confidence and an appetite for critical areas such as AI-enabled technologies, Health Management Solutions, and Medical Diagnostics.

Despite the geopolitical challenges and a stagnant IPO market, the sector’s robust M&A landscape and increasing mega deal activity reflect a maturing ecosystem poised for continued advancement. As Digital Health ventures in the US, Europe, and Asia Pacific push the boundaries of healthcare innovation, the groundwork laid in H1 2024 promises a dynamic and transformative future for the industry.

With the ecosystem in a holding pattern for much of 2023 and Q1 2024, the mid-year insights must be a relief to the Digital Health venture c-suite, which seeks funding to continue to grow, and to investors, who seek market confidence, as valuations capitulate and the consolidation shake-out reaches a hiatus.

This good news should not mean a return to the heady FOMO days of 2021 and 2022 but calls for careful and informed decisions driven more by proof points, and facts, and less by opinion.

Subscribe to be notified when our unmatched data-driven, no-bias, no-hype upcoming Regional Key Insight Reports are released.

Get our strategic guidance for enterprise companies with our Galen Growth Advisory services.

Join HealthTech Alpha, our proprietary Digital Health venture analytics platform at app.healthtechalpha.com.

And last but not least, stay connected in our Galen Growth community and all our research by subscribing to our updates.