Complementary but Not Critical

The Digital Health revolution has been steadily gaining momentum, catalyzed by the urgent demands of the Covid-19 pandemic. This momentum is fueled by breakthroughs in data analytics, AI/ML models, and cloud computing. Simultaneously, outdated health systems and overburdened professionals underscore the critical need for change. Big Tech companies like Amazon, Google, Microsoft, and Apple have shown keen interest in tapping into the lucrative healthcare market. While their direct involvement has been limited, their potential to drive innovation and improve healthcare delivery cannot be underestimated. These tech giants bring immense expertise in data management, artificial intelligence, and user-centric design, all of which are crucial for the advancement of digital health solutions.

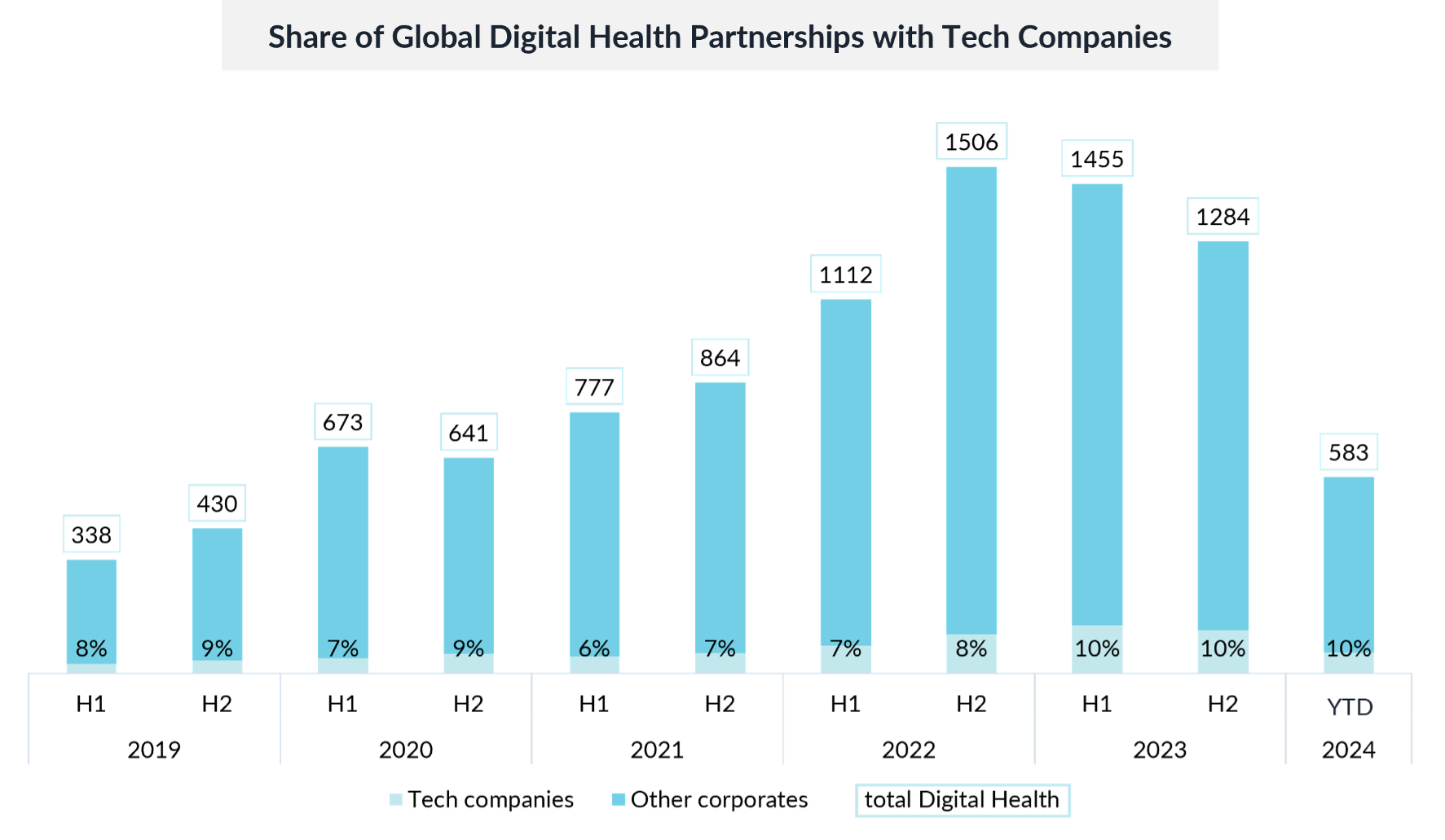

Growth of Tech Partnerships Outpaces Industry Average

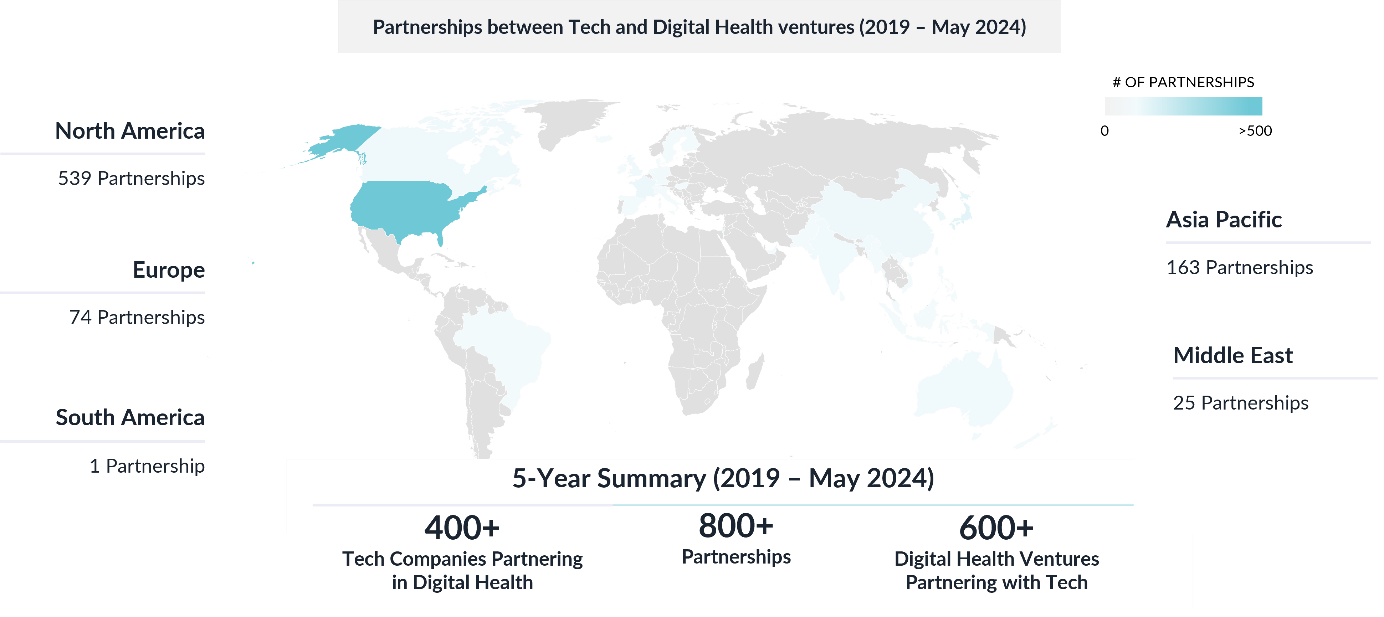

Digital health ventures and Tech companies have formed a staggering number of partnerships over the past five years, with a compound annual growth rate (CAGR) of 32%. This rapid growth outpaces the non-technology corporate average growth rate in digital health of 29%. Notable partnerships in the first half of 2024 include collaborations between LPixel (エルピクセル), iRhythm, and Atropos Health, highlighting the increasing importance of these partnerships in driving innovation and improving healthcare outcomes.

Big Tech’s involvement, while not yet dominant, has the potential to significantly accelerate and amplify innovation in the field. Amazon‘s moves into pharmacy distribution and healthcare services delivery, despite the challenges, are indicative of their intent to play a more direct role. Other tech giants could leverage their consumer technology platforms, AI capabilities, and cloud scale to drive adoption and commercialization of promising Digital health solutions.

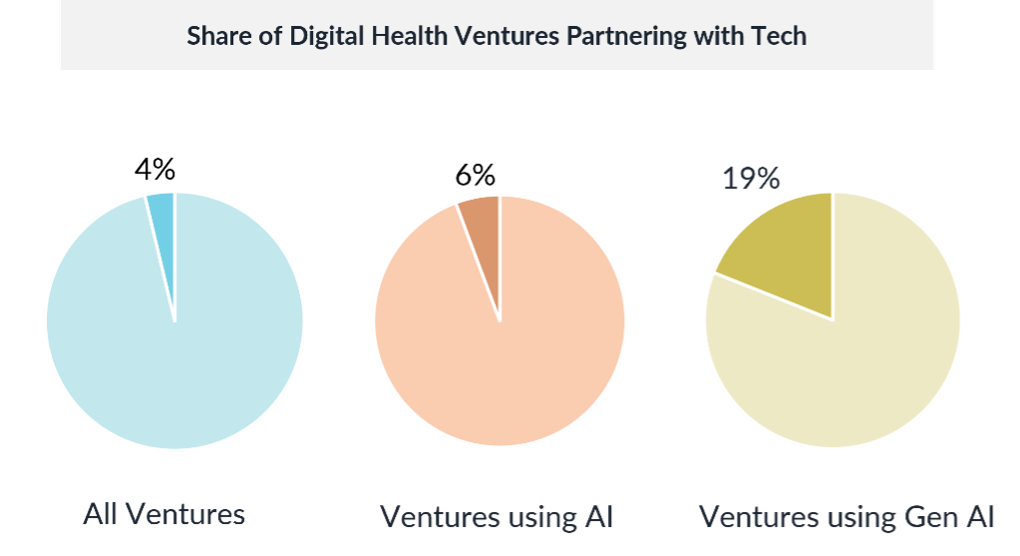

Advanced Computing is Opening Doors for Tech

Although Big Tech’s AI and advanced foundation model capabilities hold significant potential, only 4% of digital health ventures worldwide are currently partnering with Tech companies. This share increases slightly to 6% for ventures implementing AI technology. Even among ventures exploring the potential of generative AI, 4 out of 5 have not yet entered into partnerships with Tech.

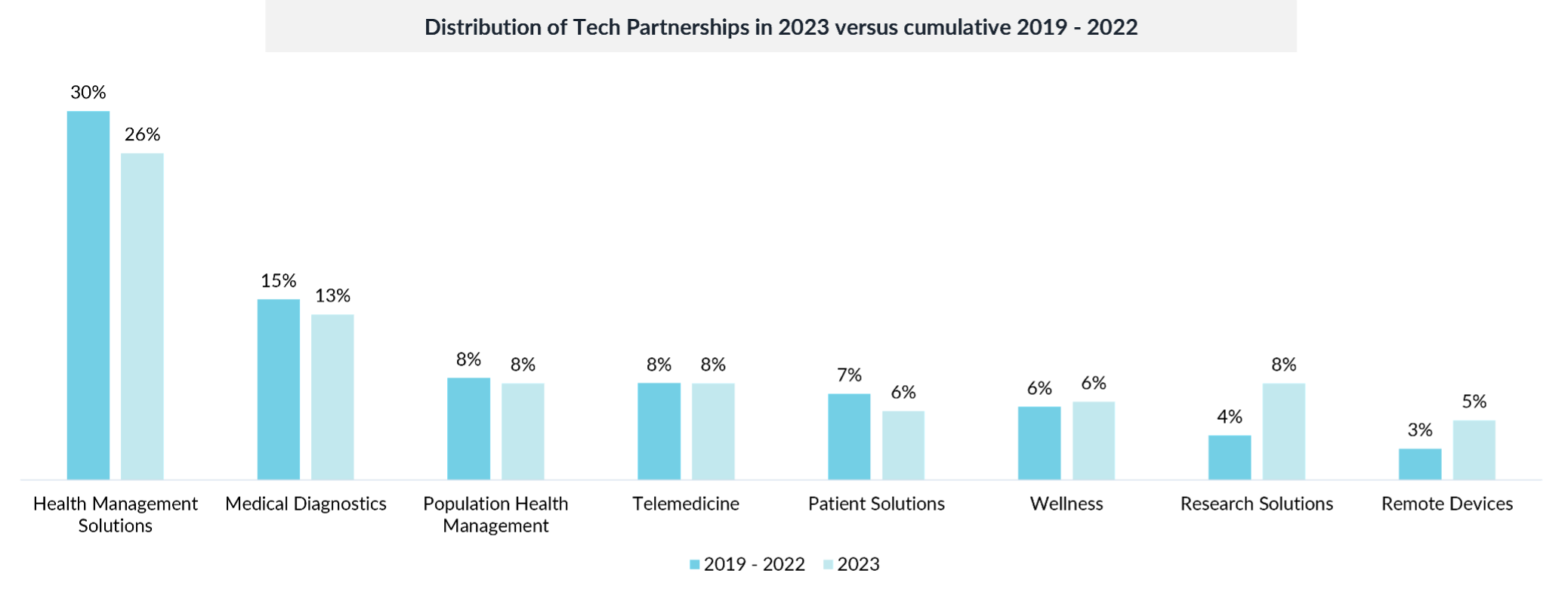

Navigating the intricate landscape of patient-centric healthcare, with its stringent regulations and complexities, often appears at odds with the fast-paced, consumer-centric approach favored by tech giants. Rather than direct patient engagement, most Big Tech firms have directed their healthcare efforts toward health data analytics, AI model development, and cloud infrastructure provisioning. These areas have been particularly prominent in the top two digital health categories for partnerships between digital health ventures and Tech over the past 5 years: Health Management Solutions and Medical Diagnostics. Notably, in 2023, Tech companies exhibited a heightened interest in Research Solutions (also known as TechBio) due to the growing emphasis on foundation models in drug discovery.

However, the parallel path between Big Tech and healthcare has not hindered the growth of innovation in healthcare. The rise of nimble startups, backed by robust foundation models and cloud services from non-Big Tech providers, has catalysed a vibrant digital health ecosystem. Innovative solutions spanning telehealth, remote monitoring, clinical decision support, and patient engagement are flourishing – largely without heavy reliance on the tech behemoths.

Is Europe Healthcare Missing Out on the Tech Boom?

Much of the current disruption by Big Tech in healthcare is concentrated in the United States. Amazon’s acquisition of PillPack in 2018 for pharmaceutical distribution, the One Medical acquisition in 2022 for primary care, and participation in the LillyDirect platform are all exclusive to the US market. Alphabet partners with US-founded ventures for 71% of its digital health collaborations. Over the past five years, tech companies have partnered with US-founded ventures for 67% of their digital health collaborations, while ventures from the Asia-Pacific region capture 20% of the partnerships. Europe lags behind with only 9% share of the Tech partnerships. The lack of a European tech champion is contributing to the sub scale take up on digital health innovation in Europe in contrast with US and APAC.

Tech is an Active Investor in the Health Innovation Ecosystem

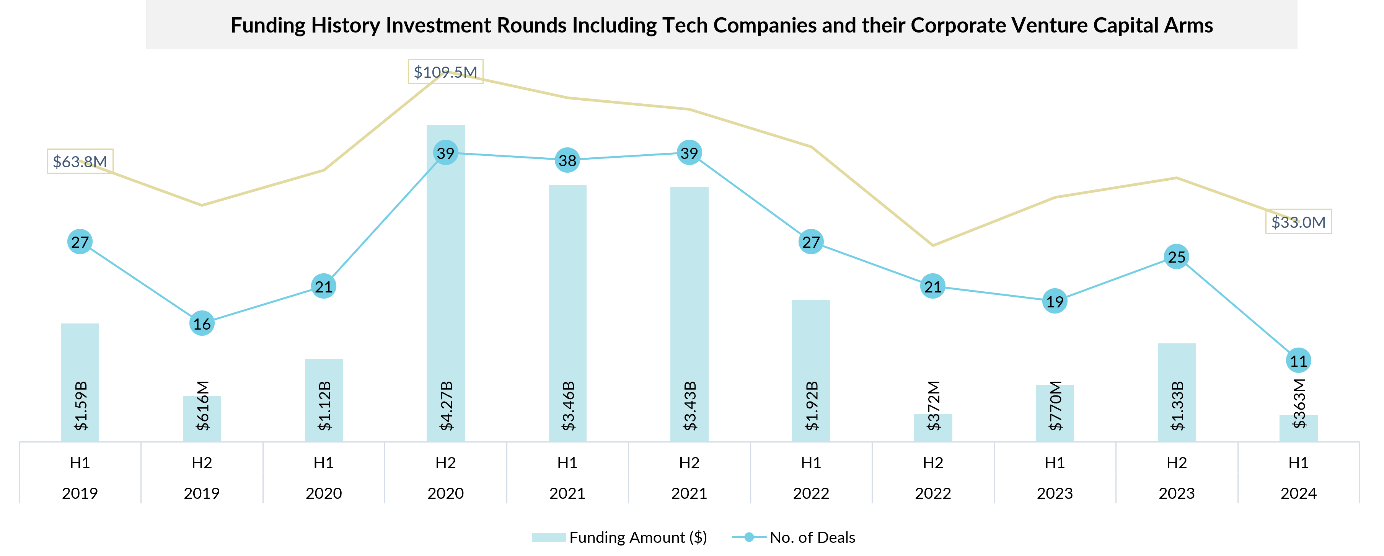

Large technology companies play a significant role not only through partnerships but also via venture capital investments in digital health. GV (Google Ventures) leads the way with more than 160 investments in the sector. Collectively, Tech companies and their affiliated corporate venture capital (CVC) arms have injected over $19 billion into digital health ventures over 280+ venture capital deals between 2019 and May 2024.

While Tech investment in digital health are primarily focused on gaining a return on investment, Tech firms have also noticed the strategic value in acquiring ventures to expand reach or open doors within healthcare. Tech companies have acquired more than 55 digital health ventures, with nearly 30% of them focusing on Health Management Solutions.

Tech Complements Digital Health, but it Does not Shape the Trajectory

Despite the allure of healthcare data monetization, the core innovation engine of digital health appears set to maintain its trajectory even without significant intervention from Big Tech. Ultimately, Big Tech’s role in digital health innovation is likely to be complementary rather than critical. Although partnerships can harness their resources and capabilities, the patient-centric nature and regulatory rigor of healthcare require a balanced approach.The true catalysts of digital health breakthroughs will continue to be the startups, academia, and incumbent healthcare organizations attuned to the unique nuances of this field.

There is More to Discover

Explore the intersection of Big Tech and Digital Health in our comprehensive Global Digital Health Innovation Report. This report, powered by HealthTech Alpha, the leading Digital Health private market data, intel, and insights platform, uncovers the key focal areas for Tech companies in the Digital Health space, including partnerships and investment trends globally.

Explore all Tech partnerships with Alpha Edge

With Alpha Edge on HealthTech Alpha, users can explore all partnerships between technology companies and Digital Health ventures in real-time. Alpha Edge is a tool that delivers real-time business intelligence insights created through filtered lists in HealthTech Alpha. Its ability to provide real-time data updates allows users to make informed decisions swiftly and confidently, ensuring they stay ahead of the curve in today’s dynamic Digital Health market landscape. By empowering users to visualize key metrics, track performance trends, and perform ad-hoc analysis, Alpha Edge streamlines the data analysis process, saving time and driving efficiency.