- Q1 2024 Digital Health funding closed at $5.1B across 347 deals.

- M&A is the predominant exit route.

- 480 partnerships were announced in Q1 2024.

Overview

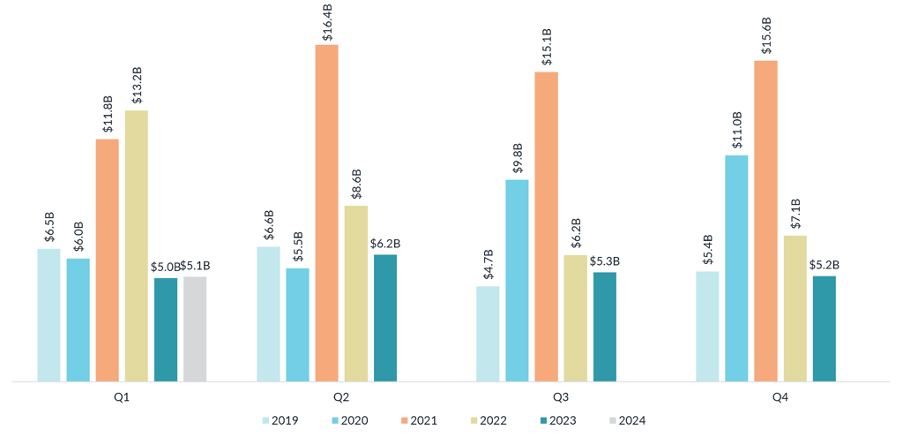

Q1 2024 marks a stagnation of the Digital Health funding decline witnessed in 2023. The first quarter recorded $5.1 billion across 347 deals. The previous year was a great reset in Digital Health, marked by consolidation, a notable shift in investment dynamics, and increased adoption of new technologies such as Generative AI.

The United States continues to drive Digital Health funding in Q1 2024, with North America closing at $3.8 billion, matching the previous year’s first quarter. Additionally, Digital Health funding in Europe reaches $853 million in Q1 2024, surpassing the same period in the previous year by 22%.

Overall, Q1 2024 sets a cautiously positive stage for how the Digital Health landscape could fare in the remainder of the year.

Venture Capital in Key Markets Deployed by Quarter (2022 – Q1 2024)

Map Q1 2024 deals and partnerships within HealthTech Alpha

We have created complimentary Hubpages, only available in HealthTech Alpha, where you can access a detailed breakdown of all Digital Health venture deals and partnerships recorded during the first quarter of 2024. Delve into the data behind the latest trends and notable deals shaping healthcare technology’s future.

Q1 2024 Digital Health Funding

Q1 2024 Digital Health Exits (M&A and IPO)

Q1 2024 Digital Health Partnerships

High-Value Deals Return in Q1 2024

Q1 2024 saw $5.1B invested across 347 deals in Digital Health globally. Investment levels were similar to the previous quarter ($5.2B) and the first quarter of 2023 ($5.0B). Despite more investment deployed, the deal volume declined by -20% in Q1 2024 compared to the same period last year, indicating that larger funding rounds are having a comeback. The average deal size increased by 30% to $16.5M in Q1 2024.

Global Venture Capital Funding Deployed by Quarter (2019 – Q1 2024)

Q1 2024 Digital Health Funding Trends by Region

North America Remains Stable

North America reached $3.8B invested in Q1 2024, an increase of 12% compared to $3.4B in Q4 2023. Compared to last year’s period, funding in the first quarter matched that of Q1 2023.

North America Digital Health funding remains almost exclusively driven by the United States. 98% of the deployed capital was raised in the United States, while just 2% of the funding was closed in Canada.

Freenome represented the largest deal in North America in Q1 2024 – a Series E round of $254M led by Roche, with the participation of prominent investors, including Andreessen Horowitz, BrightEdge, ARK Invest, ArrowMark Partners, Artis Ventures, Bain Capital Life Sciences, Quest Diagnostics, and others.

Top 10 Digital Health Deals by Funding Value, North America, Q1 2024

| Venture | Country of Initial Incorp. | Primary Category | Stage | Date | Deal Value |

| Freenome | United States | Omics Related Diagnosis | Series E | 2 / 2024 | $254M |

| BioAge Labs | United States | Drug Discovery | Series D | 2 / 2024 | $170M |

| Abridge | United States | Physician / Clinic | Series C | 2 / 2024 | $150M |

| Lightship | United States | Decentralised Clinical Trials | Series D | 2 / 2024 | $136M |

| Zephyr AI | United States | Drug Discovery | Series A | 3 / 2024 | $111M |

| Rightway Healthcare | United States | Care Coordination | Series D | 3 / 2024 | $109M |

| DecisionRx | United States | Prescriptive Analytics | Debt Financing | 1 / 2024 | $100M |

| Claroty | United States | Cybersecurity | Strategic | 3 / 2024 | $100M |

| Harbor Health | United States | Integrated Solutions | Series B | 1 / 2024 | $96M |

| Frontier Medicines | United States | Drug Discovery | Series C | 2 / 2024 | $80M |

Europe

In Q1 2024, Europe’s Digital Health funding surged to $853M. Notably, this marked a 52% increase compared to Q4 2023, when funding levels dipped to $560M, representing its weakest quarter since 2020. Compared to Q1 2023, where total investment stood at $700M, funding in Q1 2024 increased by 22%. The growth trajectory is fueled by the entrance of international investors, an evolving regulatory environment, and governmental support, all contributing positively to the sector’s development.

Medical MicroInstruments, an Italy-based venture that provides surgical systems, raised the largest deal in Europe: a $110M Series C financing round led by Fidelity Management & Research Company.

Top 10 Digital Health Deals by Funding Value, Europe, Q1 2024

| Venture | Country of Initial Incorp. | Primary Category | Stage | Date | Deal Value |

| Medical Microinstruments | Italy | Telesurgery | Series C | 2 / 2024 | $110M |

| Pelago | United Kingdom | Digital Therapeutics | Series C | 3 / 2024 | $58M |

| Genomics PLC | United Kingdom | Omics Related Applications | Series D | 1 / 2024 | $45M |

| Bioptimus | France | Bioinformatics | Seed | 2 / 2024 | $38M |

| Relation Therapeutics | United Kingdom | Drug Discovery | Seed | 3 / 2024 | $35M |

| Enterprise Therapeutics | United Kingdom | Drug Discovery | Series B2 | 1 / 2024 | $33M |

| Onera Health | Netherlands | Remote Monitoring Devices | Series C | 1 / 2024 | $33M |

| Quantum Surgical | France | Telesurgery | Seed | 3 / 2024 | $32M |

| Aqemia | France | Drug Discovery | Series A1 | 1 / 2024 | $32M |

| Aktiia | Switzerland | Remote Monitoring Devices | Series B | 2 / 2024 | $31M |

Asia Pacific Contracts Further

In Q1 2024, venture capital investment in APAC totalled $379M – the lowest total investment this region has witnessed in the past five years. This represents a significant decline compared to the previous quarter, Q4 2023, which closed at $1.1B, reflecting a sharp -65% decline quarter-over-quarter. Additionally, comparing year-over-year investment, funding in Q1 2024 declined by -12% compared to Q1 2023, which closed at $432M.

As recently reported by the World Bank, private investment, not just in Digital Health but across industries, is affected by the overall slower growth of Asian economies. Factors such as debt, trade barriers, and policy uncertainties in Asia contributed to this trend. Moreover, higher interest rates by the U.S. Federal Reserve and other major central banks compared to pre-pandemic levels and China’s transition to a more balanced growth plan further impact economic growth.

Throughout 2023, funding in APAC Digital Health exhibited wide fluctuations by quarter, ranging from $432M to $1.1B. Given the unprecedented fluctuations witnessed in the previous year, observing how the APAC investment landscape unfolds in 2024 will be intriguing.

Ultrahuman, an India-based venture that develops wearable technology, secured the largest deal in this region—a $35M Series B financing with the participation of Blume Ventures, Steadview Capital, Nexus Venture Partners, Alpha Wave, and Deepinder Goyal.

Top 10 Digital Health Deals by Funding Value, APAC, Q1 2024

| Venture | Country of Initial Incorp. | Primary Category | Stage | Date | Deal Value |

| Ultrahuman | India | Wearables | Series B | 3 / 2024 | $35M |

| Aillis (アイリス) | Japan | Diagnosis Tools | Series D | 3 / 2024 | $33M |

| DPM (数字精准医疗) | China | Medical Imaging | Series C | 1 / 2024 | $28M |

| Leapstack (栈略科技) | China | Health Insurance | Series C1 | 1 / 2024 | $28M |

| Zeno Health | India | Online Pharmacy | Series C | 2 / 2024 | $25M |

| AITRICS (에이아이트릭스) | South Korea | Hospital | Series B | 3 / 2024 | $20M |

| CureSkin | India | Health / Symptom Checker | Series B | 3 / 2024 | $20M |

| Sonder | Australia | Corporate Health | Series B1 | 1 / 2024 | $16M |

| Manteia (Manteia) | China | Medical Imaging | Series B | 1 / 2024 | $15M |

| Bertis (베르티스) | South Korea | Omics Related Diagnosis | Pre-IPO | 2 / 2024 | $15M |

Middle East Funding Falls Short Under Geopolitical Uncertainty

In the Middle East, venture capital funding plummeted to $22M in Q1 2024, an 81% QoQ drop compared to the $116M invested in Q4 2023. Additionally, total investment in Q1 2024 declined by 55% year-over-year compared to Q1 2023, which closed at $50M.

Geopolitical uncertainties, particularly in Israel, the primary driver of health investments in the Middle East, are significant contributors to the slower development of private investment in the first quarter.

Despite the immediate challenges, the health technology sector remains resilient. DigitalOwl, an Israel-based venture providing an AI-powered platform for Health Claim Management, raised the highest funding in Q1 2024, with the Reinsurance Group of America investing $12M.

Top 5 Digital Health Deals by Funding Value, Middle East, Q1 2024

| Venture | Country of Initial Incorp. | Primary Category | Stage | Date | Deal Value |

| DigitalOwl | Israel | Health Insurance | Series B | 1 / 2024 | $12M |

| Fijoya | Israel | Corporate Health | Seed | 3 / 2024 | $8M |

| QuantHealth | Israel | Bioinformatics | Series A1 | 1 / 2024 | $2M |

| Neurolief | Israel | Digital Therapeutics | Strategic | 1 / 2024 | undisclosed |

| Clinicy | Saudi Arabia | Physician / Clinic | Series A | 1 / 2024 | undisclosed |

Challenges and Pressures on Growth Stage Ventures Worldwide

Funding pressures on growth stage ventures (Series B and C) continue to mount as these ventures struggle to secure investments. By the end of the 1st quarter, the average time without funding for Series B and Series C ventures stood at 34 months, highlighting the acute pressures these ventures face.

The immediate challenge for growth ventures in the current private investment market stems from a shift in investor sentiment and declining valuations due to adjusted revenue multiples. This shift is further influenced by a series of high-profile bankruptcy cases, which have led investors to adopt a more profit-driven strategy compared to the growth-at-all-cost strategy of previous years. Notable examples include Pear Therapeutics, Babylon Health, Olive AI, and Cano Health,, which declared bankruptcy in 2023.

Despite these challenges, funding of growth stage investment rounds grew by 32% quarter-on-quarter compared to Q4 2023, with the number of Series B and Series C deals totalling 89, the highest since Q2 2022. The new injection of funding has alleviated some pressure. The chart below shows that the share of growth stage ventures that have secured funding in the 18 months increased by 1 to 6% for APAC, North America and Europe.

While valuations are yet to capitulate, funding challenges push ventures towards critical points. Of the 347 deals closed globally, 57 (16%) were Series extensions. Ventures are also seeking alternative funding sources, including venture debt, with $144M of debt and convertible notes funded across 21 deals in Q1 2024.

Historical Share of Growth Stage Digital Health Ventures that have raised funding in the previous 18 months, by quarter

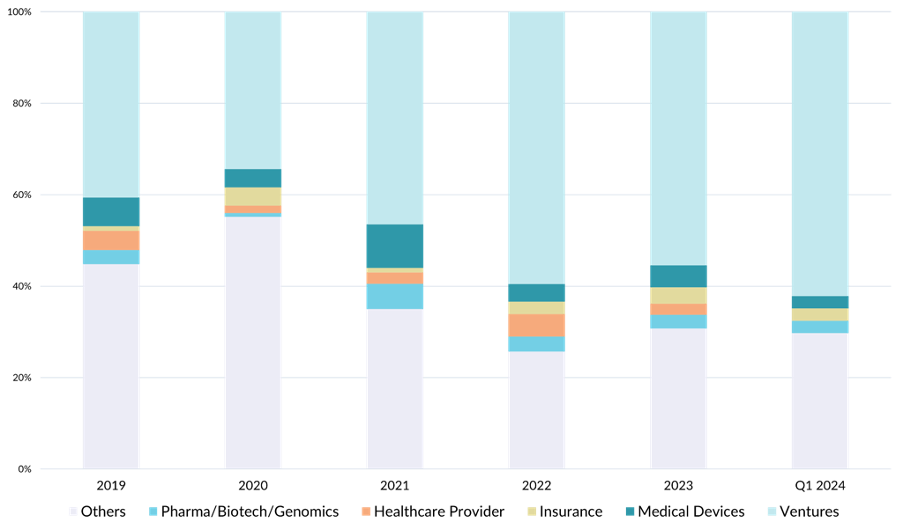

Digital Health M&A dominates in Q1 2024

In the first three months of 2024, 41 venture exits were reported, comprising 38 M&As, 2 IPOs, and 1 SPAC. Exit activity in Q1 2024 declined by 21% QoQ as compared to Q4 2023, which witnessed 52 exits, all of which were M&A. Additionally, compared to Q1 2023, which saw 52 exits (50 M&A, 1 IPO, 1 SPAC), exit activity in Q1 2024 decreased by 21% YoY.

In 2024, public market debuts, particularly in the US, have been notably absent amidst an underwhelming public market performance and delisting of companies. In Q1 2024, three digital health companies – Veradigm, Science 37, and Better Therapeutics – delisted from NYSE and NASDAQ, while others like Amwell, Clover Health, and 23andMe received warnings for potential delisting.

However, despite the current market conditions, several companies, including Lyra Health, Hinge Health, Datavant, and Maven, are gearing up for an IPO once the market stabilises.

Venture-to-venture acquisitions remain the most popular exit route, with over 60% of acquisitions within Q1 2024 occurring between ventures.

With minimal IPO and SPAC activity, investors are looking to acquisitions to yield financial returns. Last year, we published a report analysing MOIC – Multiple on Invested Capital – a metric illuminating returns against initial investment. Several exits in 2022 and 2023 yielded indicative MOIC metrics exceeding 5x, underlining the sector’s financial resilience.

Acquisition Share of Digital Health Ventures by Vertical

Q1 2024 Digital Health Funding Deployed to Top Clusters for GenAI

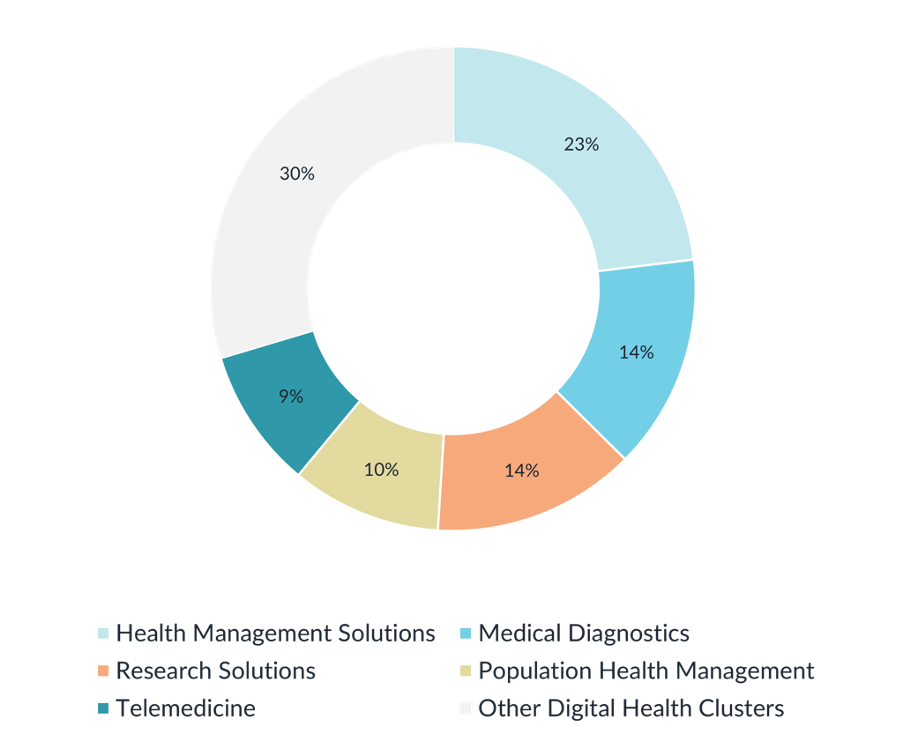

Galen Growth’s industry reference Digital Health taxonomy classifies ventures by their solution types into categories and clusters to analyse overall trends. Galen Growth’s “Generative AI in Digital Health: Hype or Reality” report published in Q4 2023 pinpointed that among the 17 Digital Health Clusters in our taxonomy, the focus clusters for implementing Generative AI solutions are: Health Management Solutions, Medical Diagnostics and Research Solutions. These 3 clusters have emerged as the top-funded clusters in Q1 2024, capturing 51% of the funding value deployed.

Health Management Solutions, which encompasses clinical workflow and prescriptive analytics solutions for healthcare providers, emerged as the highest-funded cluster in Q1 2024, with $1.1B invested across 59 deals. The largest deal within this cluster was raised by DecisionRx, a $100M credit facility with Carlyle, which was also the largest deal in North America for Q1 2024. Artisight, a Chicago-based venture which harnesses artificial intelligence and IoT sensors to ease clinical workflow, closed the second largest deal, a $42M Series B round in Jan 2024, which saw the participation of health system and strategic investors, including NVIDIA.

The second highest funded cluster in Q1 2024 is Medical Diagnostics. Medical Diagnostics, which includes ventures providing technologies for medical imaging, omics-related diagnosis, and other diagnosis tools, attracted $698M across 48 deals. Freenome, which develops liquid biopsy tests and a multi-omics platform for early cancer detection, raised the largest deal in this cluster. This $254M Series E round, which was also the most significant deal globally in Q1 2024, was led by Roche and saw the participation of many prominent investors, including Andreessen Horowitz, BrightEdge, ARK Invest, ArrowMark Partners, Artis Ventures, Bain Capital Life Sciences, Quest Diagnostics, and more.

Share of Q1 2024 Funding Value for the Top-Funded Digital Health Clusters

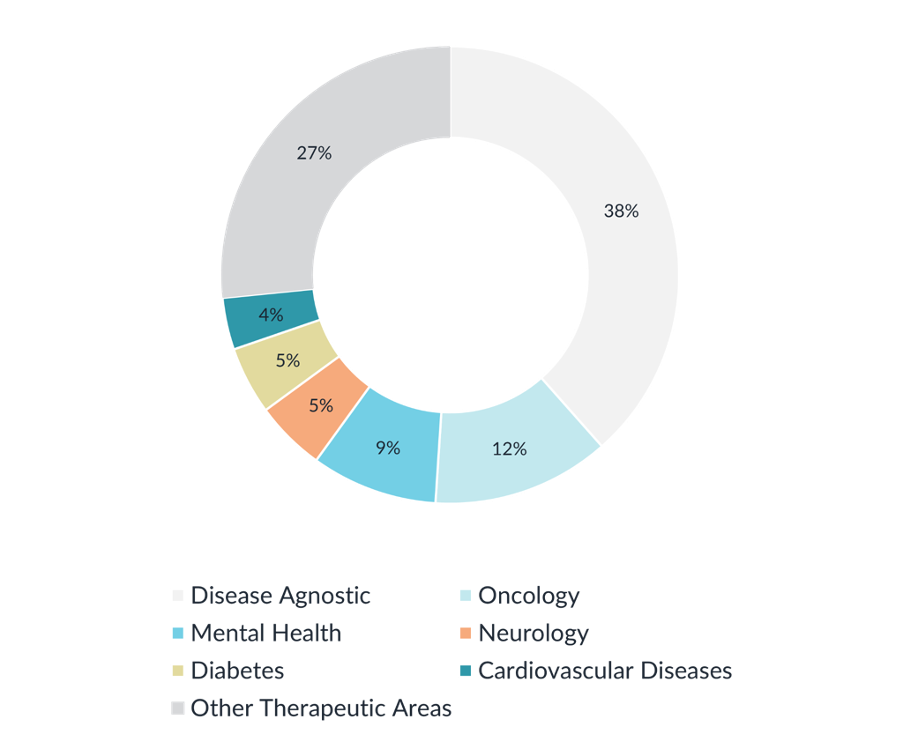

Oncology and Mental Health Emerge as Highest Funded Therapeutic Areas in Q1 2024

Across therapeutic areas, Oncology and Mental Health emerged as the highest-funded therapeutic areas in Q1 2024. The top 5 therapeutic areas – Oncology, Mental Health, Neurology, Diabetes and Cardiovascular Diseases – represented over 70% of total investment in Q1 2024.

The highest-funded therapeutic area, Oncology, saw $817M invested. Compared to Q1 2023, Oncology went from #4 to #1, which can be attributed to the $254M Series E round raised by Freenome, the largest deal globally in Q1 2024. Zephyr AI, which develops infrastructure and machine learning algorithms to harness data for therapeutic interventions in oncology and cardiometabolic diseases, secured $111M in a Series A round, which saw the participation of Revolution Growth, Eli Lilly, Jeff Skoll, EPIQ Capital Group, and others.

Mental Health fetched significant investment in Q1 2024 and ranked the second-highest therapeutic area for the quarter, with a total of $580M invested. Harbor Health, which offers teleconsultations across a range of therapeutic areas, including behavioural health and wellness, raised $95.5M to expand primary and Specialty Care, led by General Catalyst and followed by Alta Partners and 8VC.

With the enormous growth in GLP1 drugs as well as the introduction of the LillyDirect platform in January by Eli Lilly to offer services “direct-to-consumer”, Galen Growth expects to see a flurry of activity in the Obesity / Nutrition / Wellness areas to support patients during and after their treatment. At the same time, Wellness and Nutrition solutions for weight loss may be negatively affected and need to shift focus to the new market conditions.

Share of Q1 2024 Funding Value for the Global Top Funded Therapeutic Areas

Artificial Intelligence in Healthcare Takes Center Stage

In Q1 2024, nearly half of all deals (49%) were closed by ventures that employ artificial intelligence in their solutions, with $2.8B invested across 171 deals. Within deals closed by ventures providing AI solutions, 8% of these deals (14 deals) were closed by ventures that employ Generative AI. Globally, an estimated 4,000 Digital Health ventures are powering their services through Artificial Intelligence, as observed in our analysis of AI and Generative AI developments in Digital Health.

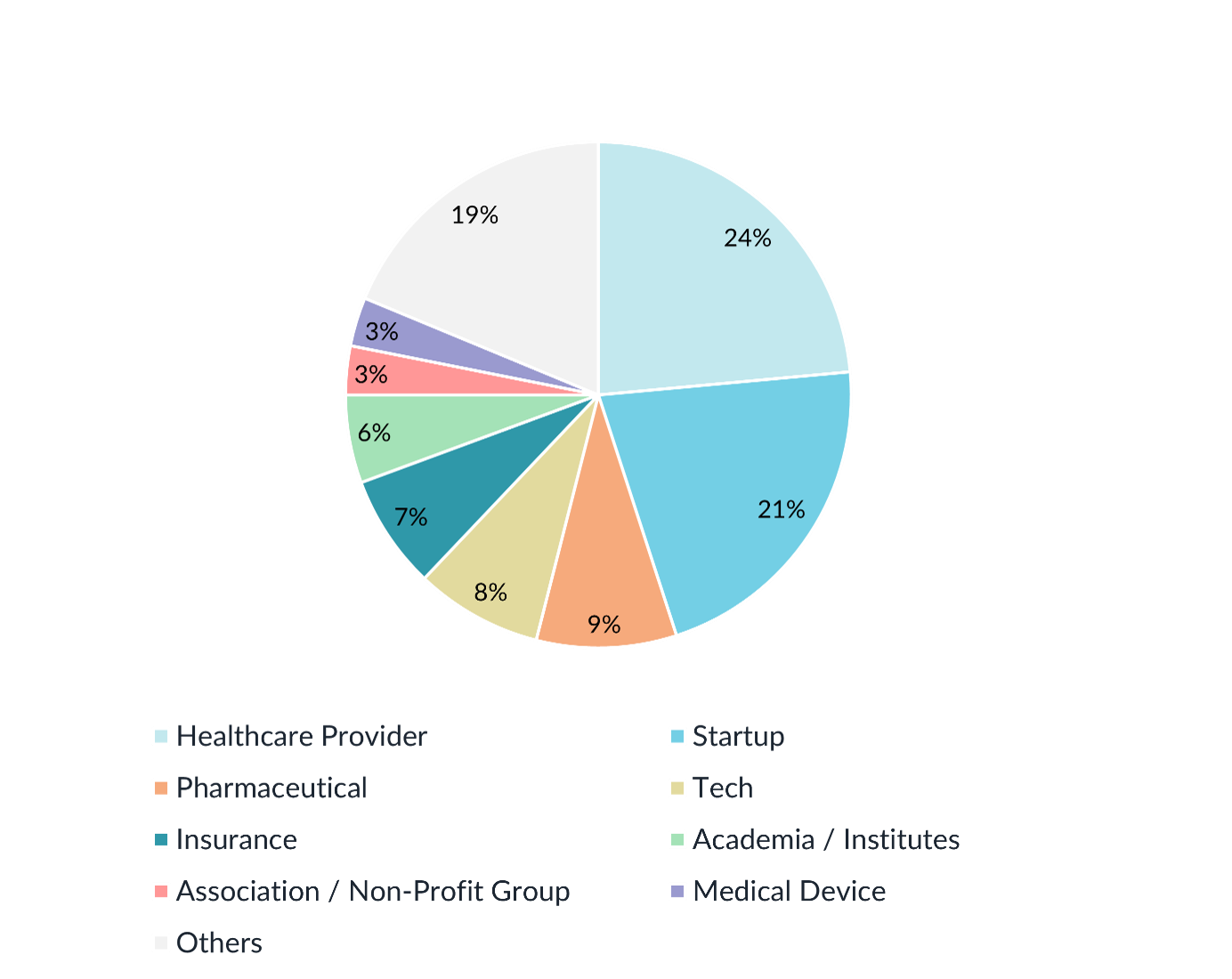

Healthcare Providers Lead Digital Health Partnerships

The first quarter of 2024 saw 480 venture partnerships across industry verticals. Following the 2023 trend, Hospitals and Health Systems (Healthcare Providers) represent nearly a quarter (24%) of all Digital Health partnerships established in Q1 2024. Venture-to-venture partnerships were the second most common, representing 21% of partnerships. Pharmaceutical, Tech and Insurance companies represent <10% each of partnerships announced in Q1 2024.

Share of Partnerships by Industry Vertical, Q1 2024

Setting the Stage: The Funding Landscape for Digital Health in 2024

Amidst the global stagnation of Digital Health investments, this comprehensive snapshot sheds light on how Digital Health ecosystems are driving growth worldwide.

Looking ahead, several pivotal factors will influence the trajectory of Digital Health in the upcoming quarter and the latter half of the year.

- Geopolitical uncertainties, particularly in the Middle East, are poised to continue impacting investment sentiments and market dynamics in the short term.

- Persistent high interest rates, projected until the end of the year in some regions, may pose challenges to robust economic growth, potentially affecting private investments in the Digital Health sector, especially in developing regions such as the Asia Pacific region.

- Strengthening of the public market, could lead to an uptick in public market debuts by the end of the year, potentially also igniting larger funding rounds.

Our next milestone in assessing the health of the global Digital Health ecosystem is our mid-year analysis, slated for presentation in July 2024, powered by HealthTech Alpha, the premier private market platform for Digital Health worldwide. Stay tuned for insights and updates on the evolving landscape of Digital Health.