TL;DR

- Europe counts over 3,500 ventures and 3,000+ early-stage investors in Digital Health. 26.5% of these investors have made at least three investments since 2019.

- Early Stage investors are crucial for startup development; since January 2019, 33% of venture capital and 85% of deals in Europe have focused on early-stage rounds.

- Since 2019, 1,900 unique investors have participated in 1,472 early-stage deals in Europe, injecting a total of $7.1 billion.

- Galen Growth highlights The Most Impactful Early Stage Investors, driving Digital Health innovation in Europe.

- Top 5 clusters for Most Impactful Early-Stage Investors: Medical Dx, TechBio, and Patient Solutions.

- Leading disease areas for Most Impactful Early Stage Investors: Oncology, Women’s Health, and Mental Health

- Europe has a promising startup ecosystem, but can Growth Stage investors meet the demand?

Europe’s Digital Health Investment Surge

The European Digital Health ecosystem, with its deep talent pool, is still maturing compared to the US but has recently outpaced the Asia Pacific region and is rapidly gaining momentum. With more venture capitalists showing interest, the funding landscape is evolving quickly.

Traditionally, strong governmental support (example: Horizon Europe, an ambitious €100 billion research and innovation programme) has been counterintuitive to the venture capital landscape, as innovators relied heavily on non-dilutive governmental funds rather than risk capital from venture capitalists. However, in more recent years, the ecosystem has shifted more towards venture capital investments as local and international investors have expanded their presence in the region. Among the more than 3,000 investors and over 3,500 digital health ventures in Europe, 927 funds (26.5%) have invested at least three times since 2019. Of these 927 active funds, 604 have made at least one investment in digital health within the past 18 months, demonstrating robust support for the ecosystem.

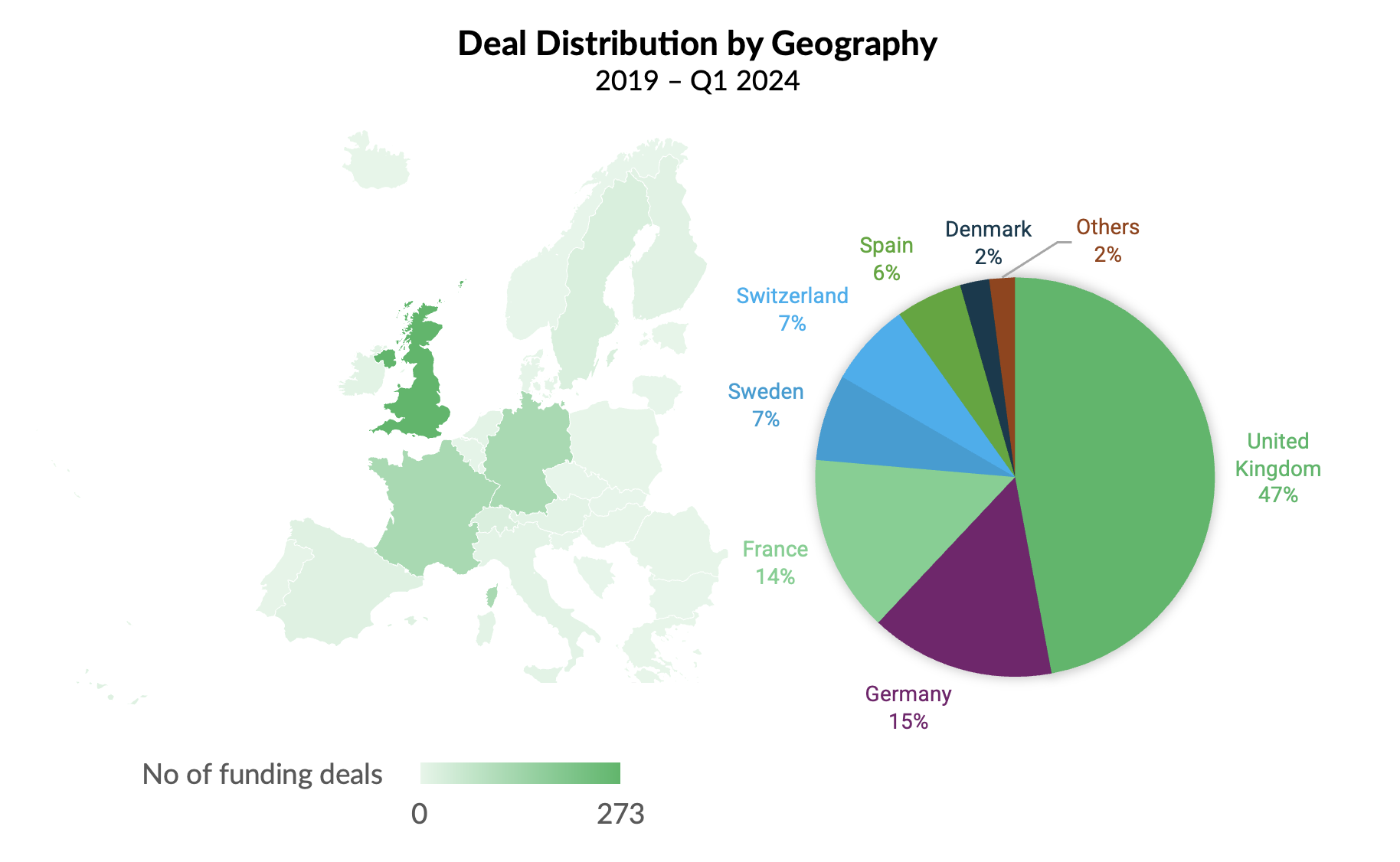

Between 2019 and Q1 2024, the global digital health sector experienced significant investor activity, with approximately 7,300 investors deploying capital into early-stage ventures. During this period, 33% of total venture capital funding value and 85% of investment deals for European-founded ventures have been deployed in Early Stage rounds. In Europe, around 1,900 unique investors have participated in 1,472 early-stage deals, supporting 1,029 Digital Health ventures with a combined capital injection of $7.1 billion. Over the same period, this averages out at $5.5 million per deal. While the funding activity in Europe is approximately 50% lower compared to the United States, the investment landscape outperformed the Asia Pacific region in terms of both total early-stage funding and the number of deals.

Identifying the Most Impactful Digital Health Investors

Some are committed to Digital Health, while others see It as a portfolio diversification strategy. At Galen Growth, we have developed a comprehensive methodology to identify the most impactful digital health investors worldwide. In other words, investors who have invested at least once each year from 2019 to 2023 inclusive. These investors have been committed to Digital Health innovation, whatever the funding and valuation climate.

Using our proprietary HealthTech Alpha platform, which tracks over 40,000 digital health companies and organisations globally, we analyse key metrics to pinpoint noteworthy investors. Our methodology is explained fully in our blog published last month, “Unveiling the Most Impactful Investors in Digital Health,” where we highlight investors who have and are making significant contributions to the digital health ecosystem.

It is important to note that our analysis excludes all forms of public funding e.g. grants.

Why Focus on Early-Stage Private Capital Funding in Europe?

Early-stage venture capital funding is essential for startups and emerging companies in their initial development phases, typically during angel, seed, pre-Series A (Pre-A), or Series A rounds. At the pre-seed stage, entrepreneurs focus on building their business model and conducting research to attract early-stage VC investors. In the seed stage, the emphasis shifts to refining the business model and establishing credibility. By the Series A funding stage, startups usually demonstrate positive business growth, making them attractive to investors. These investments are crucial for startups to grow, develop their products or services, and establish themselves in the market.

In recent years, the stages have become more fluid as many seed-stage investors now expect early-stage companies to demonstrate proof-of-concept through pilots or with customers and achieve a pathway to profitability. In Europe, sources of early-stage public funding are abundant and contribute significantly to the overall pool of early-stage funding in the region. Since public funds’ motivation to invest differs from that of private capital, in our analysis of early-stage investors in Europe, we have explicitly focused solely on private capital investors and their investment activities in Digital Health since 2019.

In Europe, sources of early-stage public funding are abundant and contribute significantly to the overall pool of early-stage funding in the region. Since public funds’ motivation to invest differs from that of private capital, in our analysis of early-stage investors in Europe, we have explicitly focused solely on private capital investors and their investment activities in Digital Health since 2019.

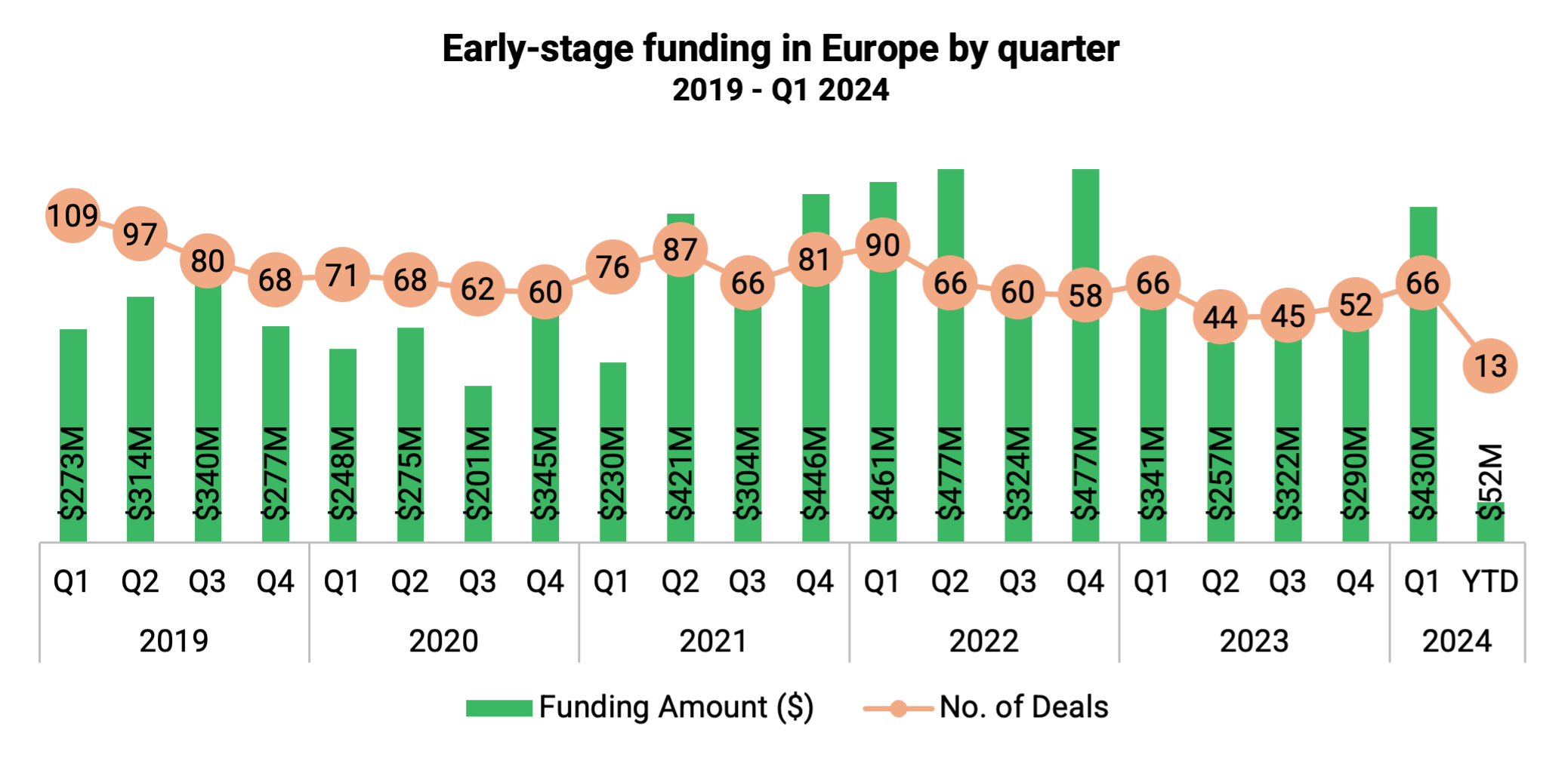

Early-Stage Private Capital Trends in Europe

Private capital Early-stage funding includes Seed, Pre-A, or Series A in Digital Health, but it excludes all forms of public funding, e.g. grants, has been substantial in Europe, with over $7.1 billion deployed between 2019 and 2024 across 1,472 deals. Unlike in the US and Asia Pacific, early-stage funding in Europe has been robust over the past five years. Q1 2024 started strong with $430 million invested, outperforming every quarter of 2023.

Deal volume and investor participation in the European early-stage investment landscape has remained robust. A total of 408 investors participated in eat least one deal every year since 2019. Over the past 20 quarters, the average quarterly deal volume was 70, with the first quarter of 2024 just slightly below this average. This trend fuels confidence for local and international investors to continue investing in the region.

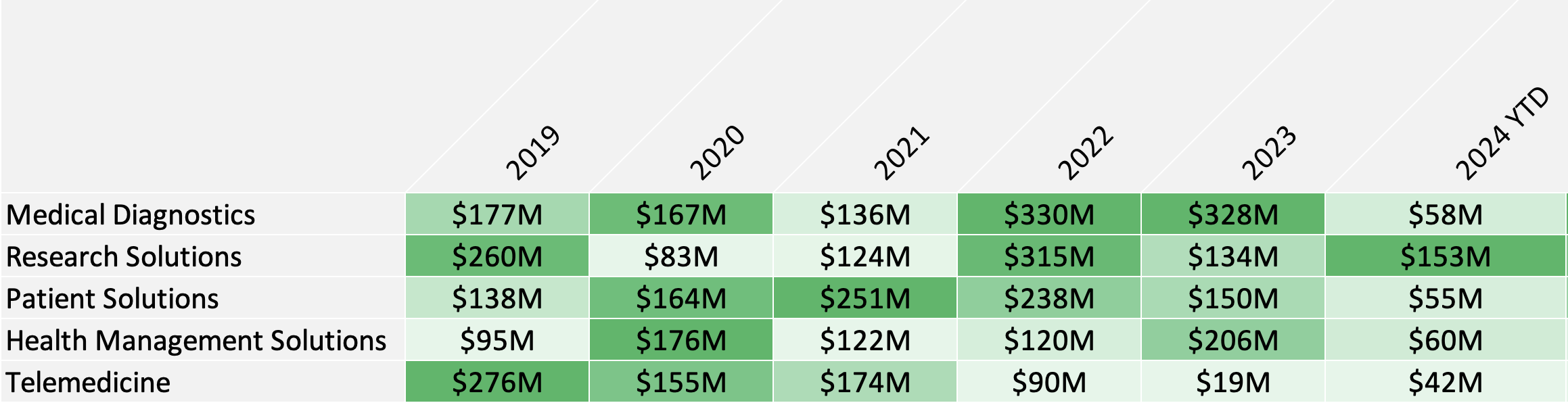

Digital Health Sectoral Deployment of Capital in Europe

A closer look at the Digital Health clusters targeted by private capital reveals exciting trends in Europe. Most venture capital funding in early-stage ventures is directed towards Medical Diagnostics ($1.2 billion), followed by Research Solutions (also known as TechBio) with $1.1 billion invested, and Patient Solutions with $995 million. Over the past two years, investment in Medical Diagnostics has more than doubled, peaking at $330 million in 2022. In 2024, TechBio has already outperformed its total investment in 2023 and is on track to become the largest digital health sector by year-end.

The strong performance of the TechBio sector in the first quarter of 2024 can be attributed to several large Seed funding rounds. In February, Bioptimus, a French startup focused on developing the first universal AI foundation model specifically for biology, raised $37.9 million in Seed funding. This round was led by Sofinnova Partners, with participation from Bpifrance, Owkin, and others. In March, Relation Therapeutics, a London-based pioneer in using machine learning and computational approaches for drug discovery, secured $35 million in a Seed round led by DCVC and NVentures, with additional investment from Magnetic Ventures, Khosla Ventures, and others.

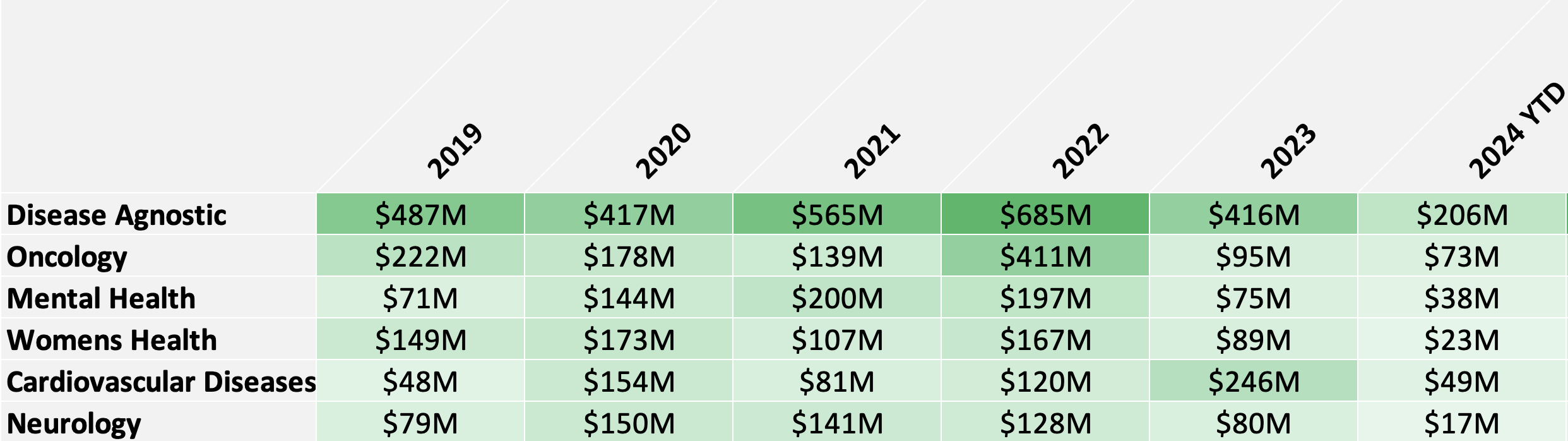

Top Therapeutic Areas by Deployment of Capital

In Europe, 74% of all early-stage venture capital funding is deployed across ventures with a specific disease focus, while 26% is directed towards disease-agnostic ventures. Since 2019, more than $1.1 billion in early-stage venture capital has been raised by ventures focusing on oncology. Mental Health has received the second-highest investment with $724 million, followed by women’s health, which has attracted $706 million. Listed below are the top five therapeutic areas by investment value, across 2019-2024 YTD.

Most Impactful Investors in Europe

Among the numerous investors engaged in Digital Health across Europe, 408 have showcased significant impact within the ecosystem by consistently investing in key sectors of Digital Health. Their contributions are vital in nurturing the ecosystem’s growth and maturity.

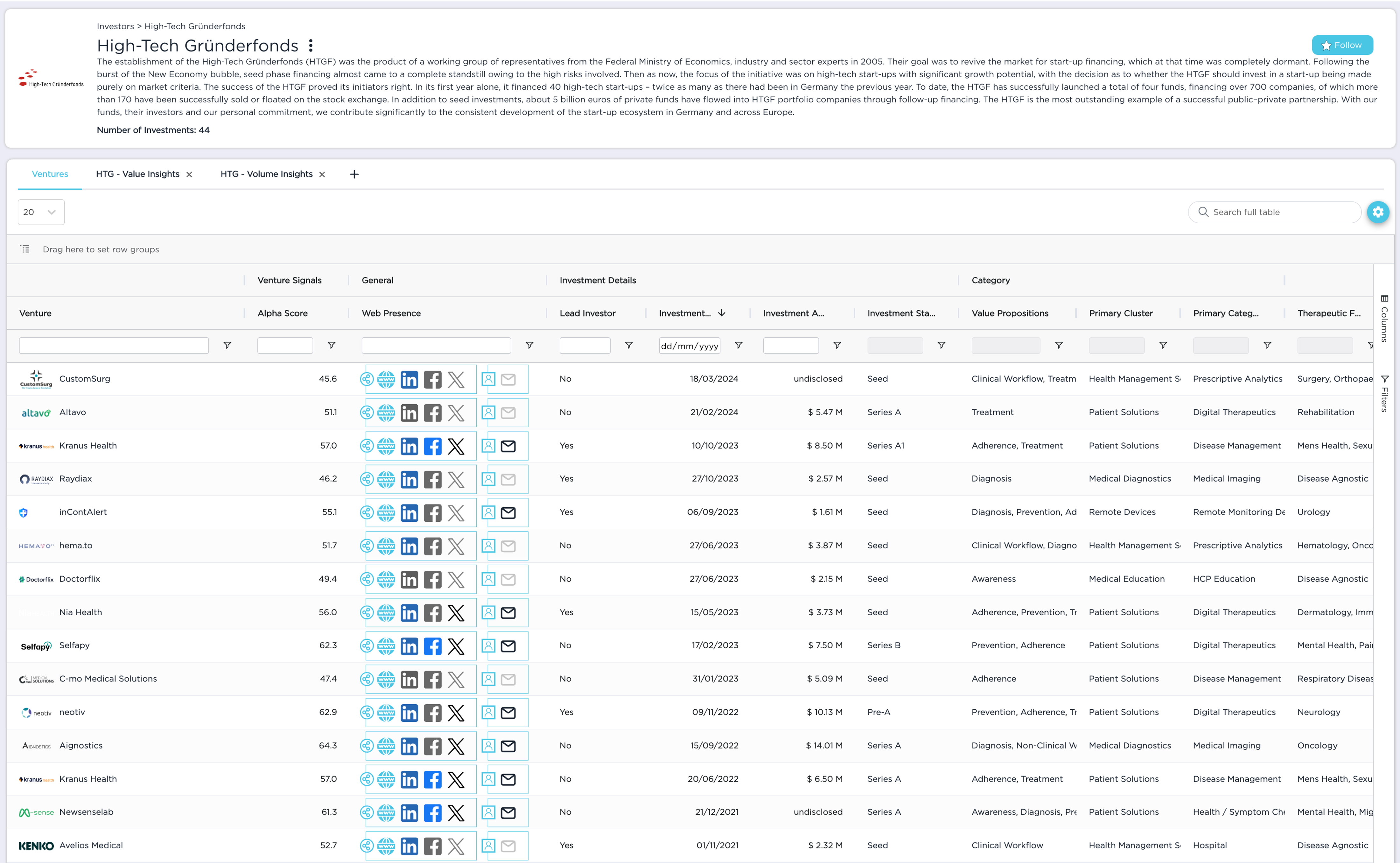

The most early-stage investor in Europe by volume is High-Tech Gründerfonds. The High-Tech Gründerfonds is a public-private partnership model for financing technology-oriented startups in Germany by the German federal government, the KfW banking group, and 32 private companies.

It invests venture capital in young, innovative technology companies with high growth potential.

The goal is to strengthen the high-tech sector and promote growth and employment in Germany.

Since 2019, High-Tech Gründerfonds participated in 24 early-stage funding rounds of Digital Health ventures totalling $245.5 million in venture capital.

The Most Impactful Investors ranked by total raise of their investees

| Investor | Amount participated (2019 – 2024 YTD) | Latest Investees (Early-stage) |

| Khosla Ventures | $178.3M | Relation Therapeutics (Mar 2024), Limbic (Mar 2024), TORTUS (Feb 2024). |

| Elaia Partners | $159.0M | Pixacare (Apr 2024), Aqemia (Jan 2024), I-Virtual (Dec 2023). |

| Speedinvest | $151.3M | Hi.Health (Jan 2024), Orakl Oncology (Oct 2023), Doctorly (Mar 2023). |

| Octopus Ventures | $127.1M | Awell (Sep 2023), Alba Health (Jun 2023), Little Journey (Apr 2023). |

| Hoxton Ventures | $110.7M | BaseImmune (Feb 2024), MultiOmic Health (May 2023), Inflow (Jan 2023). |

Explore all impactful early-stage investors in Europe

Most notable early-stage investors in Europe by deal volume

| Investor | Number of Early-stage Deals (2019 – 2024 YTD) | Latest Investees (Early-stage |

| High-Tech Gründerfonds | 24 deals | CustomSurg (Mar 2024), Altavo (Feb 2024), Raydiax (Oct 2023). |

| Speedinvest | 23 deals | Hi.Health (Jan 2024), Orakl Oncology (Oct 2023), Doctorly (Mar 2023). |

| Octopus Ventures | 22 deals | Awell (Sep 2023), Alba Health (Jun 2023), Little Journey (Apr 2023). |

| Crista Galli Ventures | 22 deals | Vitrue Health (Feb 2024), Collective Minds Radiology (Aug 2023), Surgery Hero (Nov 2022). |

| Seedcamp | 22 deals | Sable (Feb 2024), Lindus Health (Aug 2023), Doctorly (Mar 2023). |

Explore all impactful early-stage investors in Europe

These investors have played a pivotal role in supporting early-stage ventures and driving innovation in Digital Health across the region.

Will it be enough to scale European early-stage Digital Health Innovation?

In summary, the European Digital Health ecosystem is advancing rapidly, positioning itself as a global leader alongside the United States. This growth is propelled by robust government grants such as Horizon Europe, which foster innovation and attract venture capital investments. Over 900 active funds drive substantial early-stage funding, totalling over $7.1 billion across 1,472 deals from 2019 to Q1 2024.

Notable investments in sectors like Medical Diagnostics and Research Solutions highlight the diverse landscape of digital health innovation. Specific therapeutic areas like oncology and mental health also attract significant venture capital attention. The impact of over 478 influential investors in key sectors is pivotal, nurturing growth and innovation in the European digital health landscape. Their ongoing involvement is set to accelerate progress further, shaping the future of digital health in Europe and beyond.

Explore all data in on-demand with HealthTech Alpha Edge

Alpha Edge is a tool that delivers real-time business intelligence insights created through filtered lists in HealthTech Alpha. With its ability to provide real-time data updates, users can make informed decisions swiftly and confidently, ensuring they stay ahead of the curve in today’s dynamic Digital Health market landscape. By empowering users to visualize key metrics, track performance trends, and perform ad-hoc analysis, Alpha Edge streamlines the data analysis process, saving time and driving efficiency.