Introduction

The Asia Pacific Digital Health market is characterised by a multifaceted and diverse geographical region, encompassing varying cultures and attitudes towards the application of Digital Health. In recent years, some investors, recognising the Digital Health sector’s potential, have increasingly shown interest in supporting early-stage ventures in Asia Pacific. However, the region presents unique challenges, especially in Southeast Asia, where investors have traditionally been cautious in deploying capital. Each region and market within Asia Pacific has its own challenges and regulatory frameworks, adding complexity to investment decisions. However, out-of-pocket expenses for healthcare remain high, particularly in developing markets, further influencing investment dynamics.

Despite these hurdles, some investors stand out, committed to tapping into its innovation potential and addressing pressing healthcare needs.

Understanding the Digital Health Landscape in Asia Pacific

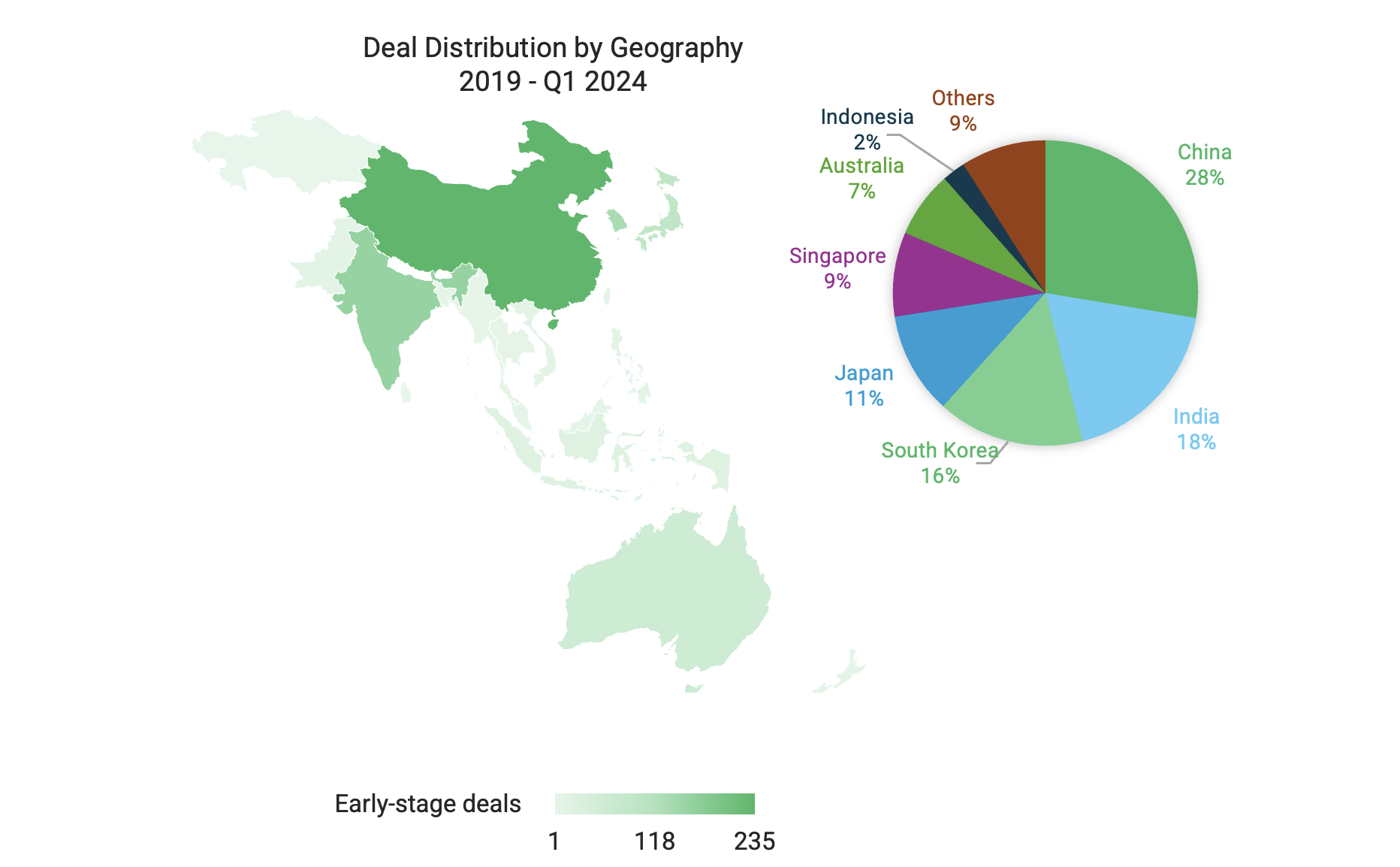

From 2019 to Q1 2024, the global Digital Health sector has seen significant investor activity, with over 7,300 investors deploying capital into early-stage ventures. In Asia Pacific alone, approximately 1,700 unique investors have participated in 1,327 early-stage deals, supporting 851 Digital Health ventures with a combined capital infusion of $4.7 billion, averaging $3.5 million per deal over the same period. These numbers underscore the growing interest and investment in Digital Health across the region.

Methodology and Data Source

We have developed a comprehensive methodology at Galen Growth to identify the most impactful Digital Health investors globally. Leveraging our proprietary data, intel and insights platform, HealthTech Alpha, which covers over 40,000 companies and organisations active in Digital Health globally, we analyse key metrics to identify notable investors. Our methodology, previously described in the blog titled Unveiling the most impactful investors in Digital Health, allows us to identify investors who have significantly contributed to the Digital Health ecosystem.

What is Early-Stage Funding?

Early-stage (venture capital) funding is essential for startups and emerging companies in their initial development phases, typically occurring during the angel, seed, pre-Series A (often referred as Pre-A), or Series A rounds. At the pre-seed stage, entrepreneurs focus on building their business model and gathering research to attract early-stage VC investors. In the seed or startup stage, the emphasis is on refining the business model and bolstering credibility. By the Series A funding stage, startups are already showing positive business growth, making them attractive to investors. These investments are crucial for startups to grow, develop their products or services, and establish themselves in the market.

In recent years, the stages have become blurred as many seed-stage investors now expect early-stage companies to demonstrate proof-of-concept through pilots or clients, as well as achieve a minimum annual recurring revenue (ARR).

Early-Stage Funding Trends in Asia Pacific

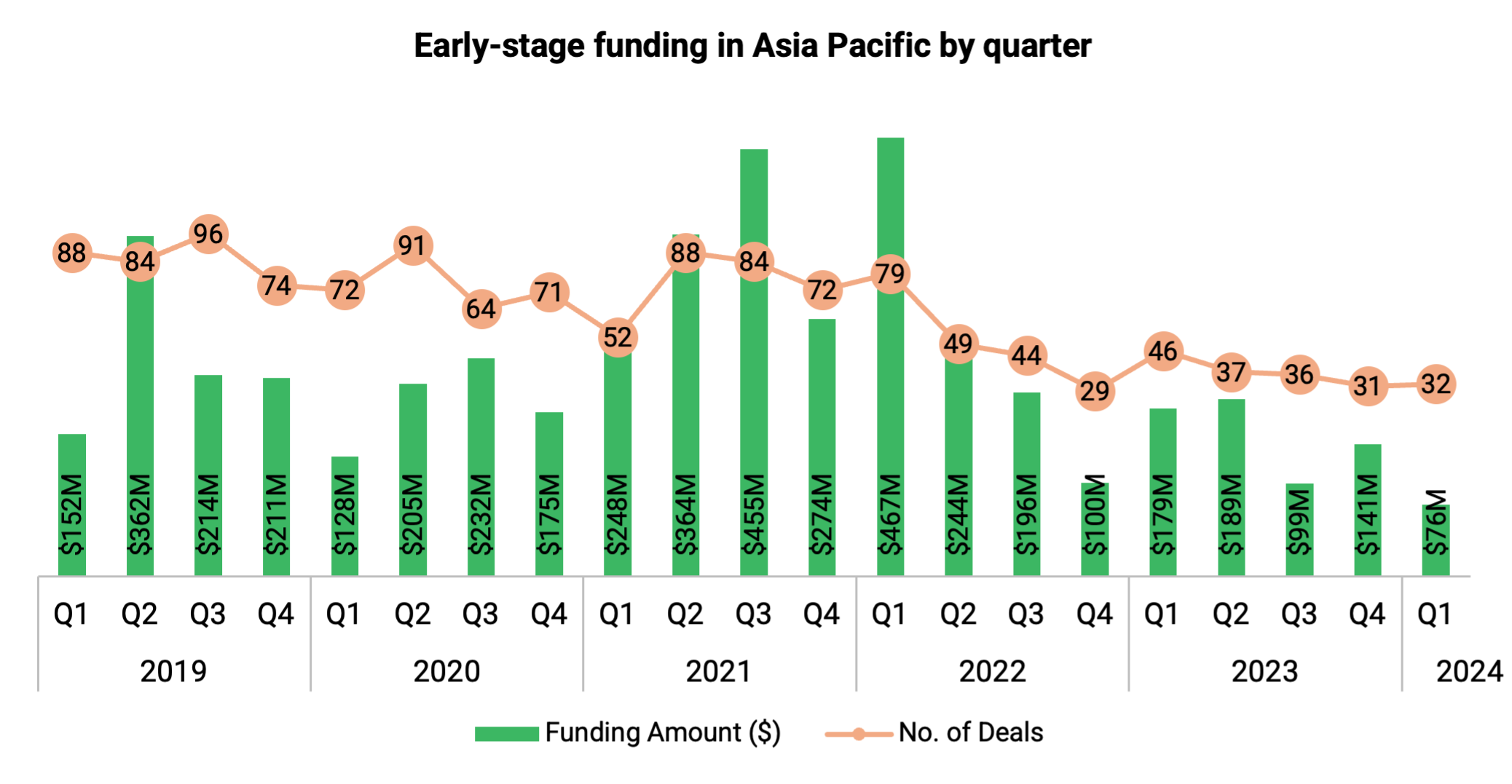

Early-stage funding is referred as Seed, Pre-A or Series A in Digital Health has been substantial in Asia Pacific, with over $4.7 billion deployed between 2019 and 2024 across 1,327 deals. However, there has been a gradual decrease in the total funding raised and the number of deals since the second half of 2022, with only $76.5 million deployed across 32 deals in Q1 2024. Despite this trend, the region continues to attract local and international investor interest, albeit at a slightly slower pace.

Sectoral Deployment of Capital

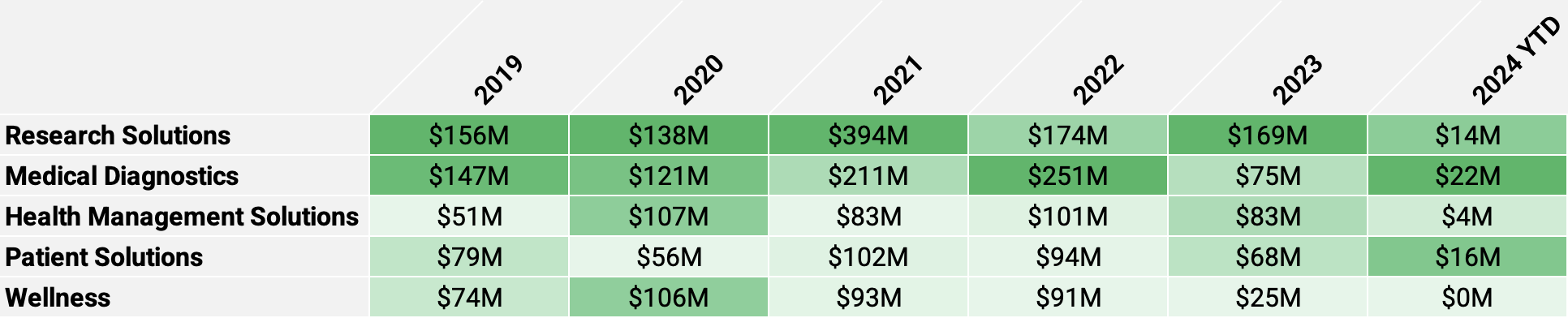

A closer look at the sectoral deployment of capital by Asia Pacific’s notable investors reveals exciting insights. Most venture capital funding in early-stage ventures is directed towards Research Solutions, aka TechBio, with $1.05 billion invested, followed by Medical Diagnostics ($827 million) and Health Management Solutions ($430 million). Investment in Research Solutions peaked in 2021, reaching $394 million, underscoring the importance of advancing medical research and innovation in the region.

In February, Algorithmic Biologics (Research Solutions; Bioinformatics), a Bengaluru-based business raised $2.5 million in a Pre-A funding round from Bharat Innovation Fund and Axilor Ventures

Therapeutic Area Deployment of Capital

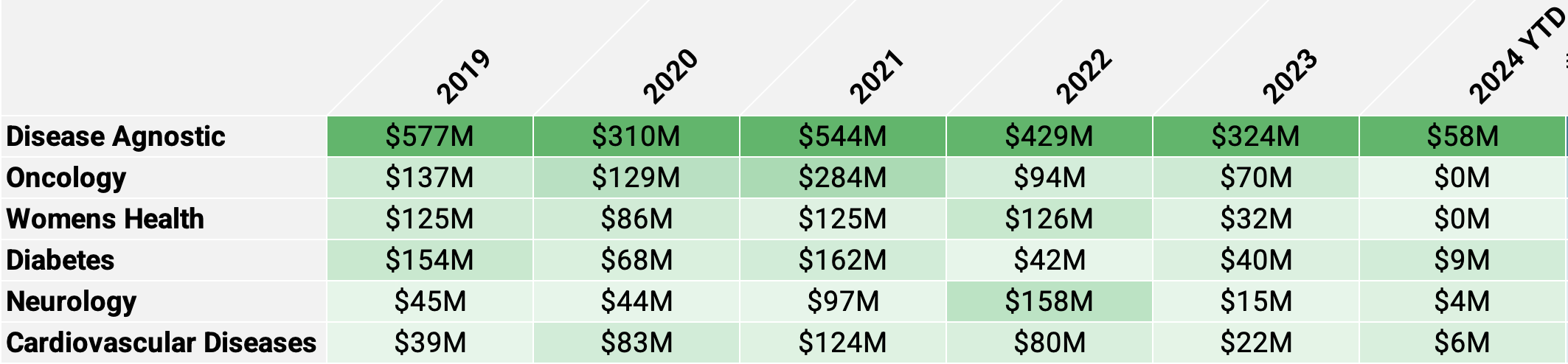

Furthermore, the deployment of capital across therapeutic areas highlights key focus areas for investors. Since 2019, significant venture capital has been raised by early-stage ventures focusing on Oncology ($713 million), Women’s Health ($494 million), Diabetes ($474 million), Neurology ($361 million), and Cardiovascular Diseases ($353 million), reflecting the diverse healthcare needs and priorities in the region.

Most Impactful Investors in Asia Pacific

Among the many investors active in Digital Health in Asia Pacific, 488 (29%) have demonstrated a repetitive pattern of investing in the sector.

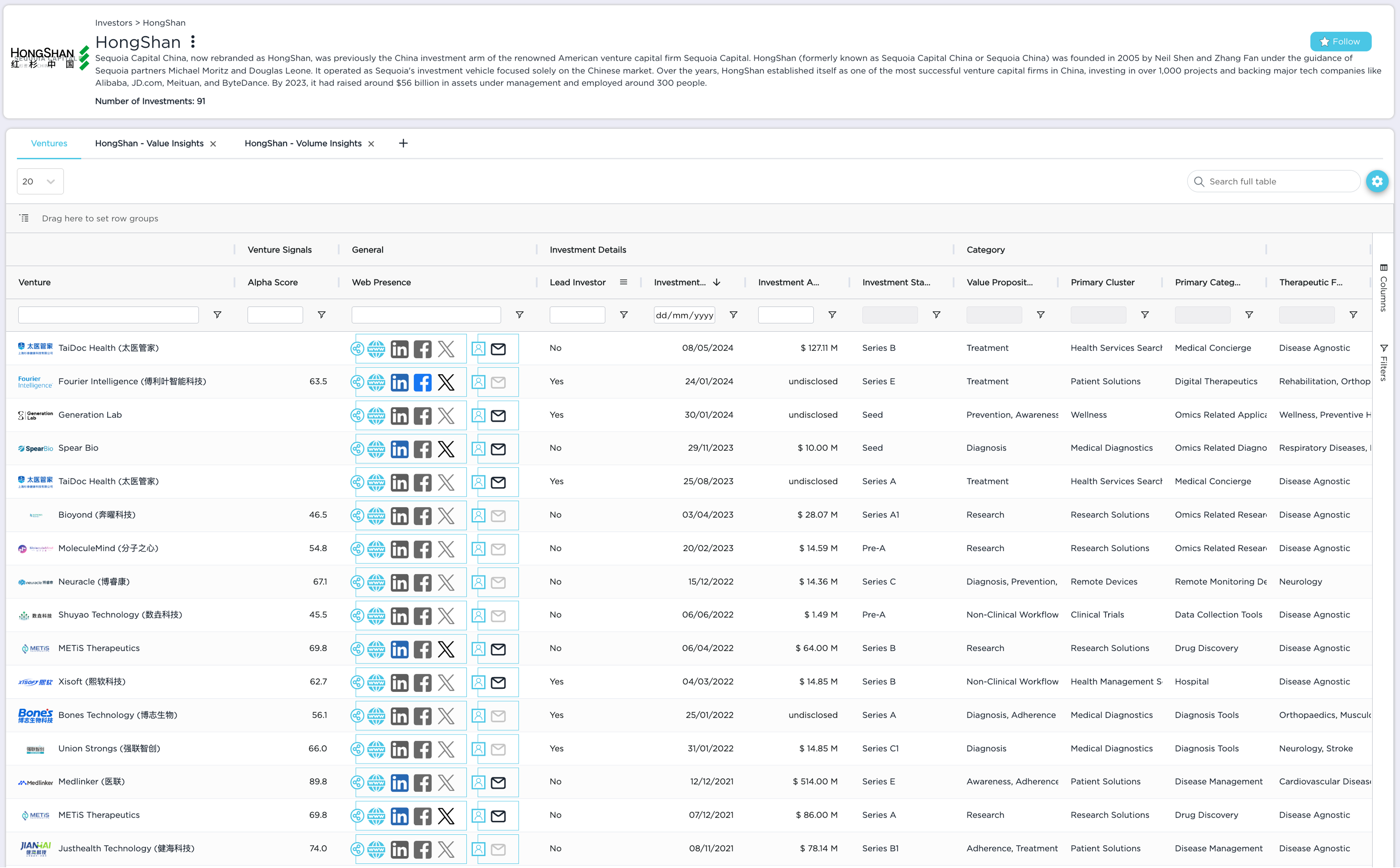

Over the past five years, HongShan, previously known as Sequoia Capital China, emerged as the most notable investor in Asia Pacific. HongShan was previously the China investment arm of the renowned American venture capital firm Sequoia Capital. In June 2023, Sequoia Capital announced plans to split into three independent entities HongShan, Peak VX Partners and Sequoia Capital. The split allowed HongShan to operate independently as a Chinese venture capital firm, raising capital from domestic sources rather than being tied to its American parent company.

Since 2019, HongShan participated in 22 early-stage funding rounds of Digital Health ventures totalling $245.5 million in venture capital.

Most notable early-stage investors in Asia Pacific by deal value

| Investor | Amount participated (2019 – Q1 2024) | Latest Investees (Early-stage) |

| HongShan (fka Sequoia Capital China) | $245.5 million | Generation Lab (Jan 2024), Spear Bio (Nov 2023), Bioyond (Apr 2023). |

| GL Ventures | $119.5 million | BayOmics (Jun 2023), Helixon (Jun 2022), Infinite Wellness (Mar 2022). |

| Qiming Venture Partners | $107.0 million | Yanyin Technology (Mar 2024), Prime Life Science (Jan 2024), Thorough Future (Jun 2023). |

| Tencent Holdings | 102.0 million | Fiture (Sep 2020), Singleron (Sep 2020), ZhongBao Insurtech (Sep 2019). |

| 5Y Capital | $79.8 million | Hourstech (Oct 2021), neoX (Jul 2021), neoX (Jan 2021). |

Explore all impactful early-stage investors in Asia Pacific

Most notable early-stage investors in Asia Pacific by deal volume

| Investor | Number of Early-stage Deals (2019 – Q1 2024) | Latest Investees |

| HongShan (fka Sequoia Capital China) | 22 deals | Generation Lab (Jan 2024), Spear Bio (Nov 2023), Bioyond (Apr 2023). |

| SMBC Venture Capital | 20 deals | Hedgehog MedTech (Dec 2023), Metagen Therapeutics (Jun 2023), Cardio Intelligence (Aug 2022). |

| Korea Investment Partners | 19 deals | Promedius (Mar 2024), Blue Signum (May 2023), Mei Miao Miao (Oct 2021). |

| East Ventures | 17 deals | Mesh Bio (Jan 2024), Mesh Bio (Oct 2023), Aevice Health (Jul 2023). |

| Blackbird Ventures | 17 deals | Carepatron (Nov 2023), Heidi Health (Oct 2023), Carepatron (Nov 2022). |

Explore all impactful early-stage investors in Asia Pacific

These investors have played a pivotal role in supporting early-stage ventures and driving innovation in Digital Health across the region.

Conclusion

As Asia Pacific continues to scale as a hub for Digital Health innovation, early-stage investors play a crucial role in fuelling growth and driving change. By identifying and highlighting the most impactful investors in the region, we aim to celebrate their contributions and provide valuable insights for entrepreneurs, healthcare professionals, and stakeholders navigating the dynamic Digital Health landscape.

Stay tuned as we also explore the Most Impactful Investors and their investment activities in Digital Health across other key regions.

Explore all data in on-demand with HealthTech Alpha Edge

Alpha Edge is a tool that delivers real-time business intelligence insights created through filtered lists in HealthTech Alpha. With its ability to provide real-time data updates, users can make informed decisions swiftly and confidently, ensuring they stay ahead of the curve in today’s dynamic Digital Health market landscape. By empowering users to visualize key metrics, track performance trends, and perform ad-hoc analysis, Alpha Edge streamlines the data analysis process, saving time and driving efficiency.