Unveiling Digital Health’s Investors

In the dynamic landscape of Digital Health, where digital innovation converges with healthcare, investors play a pivotal role in driving progress and transforming ideas into impactful solutions.

Total funding in Digital Health broke records in 2021 when it reached $58.9B, driven by an abundance of investors of all sizes and shapes. Since then, we have witnessed a cooling-off period where funding is scarce. Globally, $21.7B was deployed in 2023, down 63% since 2021, and the ecosystem is consolidating.

By the end of 2023, only 34% of growth stage ventures worldwide had secured funding in the past 18 months, the typical runway period for a raise, signalling a significant drop in investor largesse.

With so many investors fleeing to safety, the fair-weather friends, who are these investors who have persistently and repeatedly bucked the trend and invested come rain or shine?

Understanding the core investors in this dynamic sector is crucial for entrepreneurs, ecosystem stakeholders, and enthusiasts alike. In this comprehensive analysis, we delve into the core investors in Digital Health, unveiling key insights into their strategies, performance, and contributions to the evolving ecosystem. Discover the strategies and impact of leading Digital Health investors on healthcare innovation and transformation.

What is a Core Leading Investor: Methodology

Pre-requisite to be a Core Leading Digital Health Investor

We developed a robust methodology to identify and assess core investors in the Digital Health sector, ensuring thorough coverage. These investors were shortlisted based on clearly defined criteria, which included:

- A consistent track record of investments over the past five years (the investor has invested in a Digital Health venture at least once each year)

- The investor is not a governmental institution or an accelerator/incubator

This pre-requisite led to a narrowed pool of 385 investors in Digital Health, representing approximately 4% of the sector’s total number of investors, which we labelled core investors.

We then constructed a scoring system comprising Macro and Micro indices to evaluate investor performance. We applied this system to the pool of 385 investors to arrive at a list of the 50 most active early-stage and growth-stage investors.

Additionally, we identified 29 late-stage investors, some of whom may also be included in the early-stage or growth-stage lists.

Scoring Methodology for the Core Digital Health Investors

Macro Index (50% weighting): This index provides a macro-level perspective based on the overall development of the Digital Health landscape, encompassing clinical evidence, ecosystem analysis, and partnerships.

Micro Index (50% weighting): The Micro Index evaluates an investor’s performance relative to their investment stage, considering factors such as average Alpha Score within their portfolio, funding volume and value, investee mobile application releases, follow-on rounds, exits, partnerships, and clinical evidence.

Our Key Findings

Our analysis revealed several fascinating insights into the core investors spearheading the shaping the future of Digital Health.

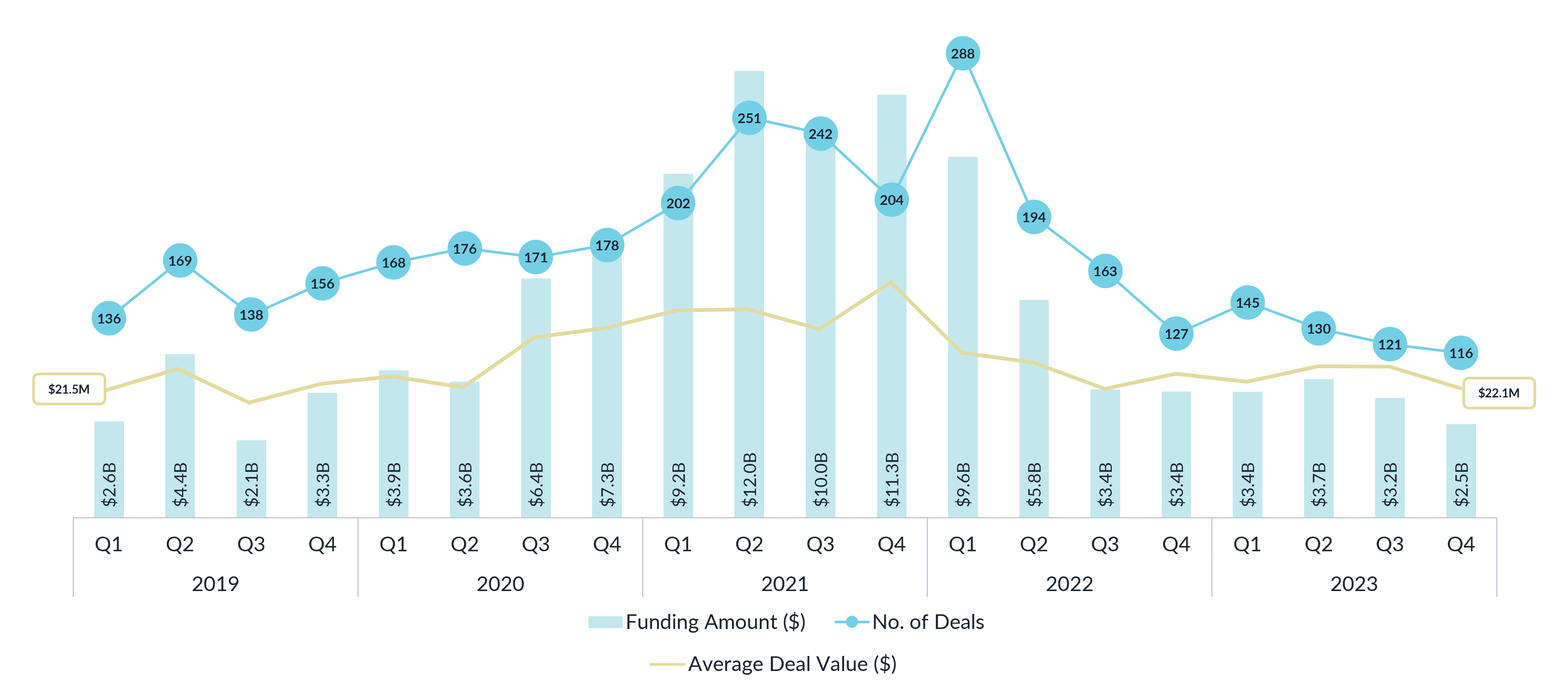

Across 2019-2023, Digital Health core investors have cumulatively invested a total of $111.0B across 3475 deals, which represents nearly two-thirds (65%) of total global investment over the five-year period. Looking at QoQ funding history, peak investment value was observed in Q2 2021, which fetched $12.0B across 251 deals. Deal volume spiked in Q1 2022 with 288 deals; since then, deal activity of core investors has decreased, reaching a low of 116 deals in Q4 2023. The largest average deal size of core investors was recorded in Q4 2021 at $59.3M. Average deal size has since dropped to levels similar to 2019 and early 2020. In 2023, average deal size of core investors ranged between $22.0M-$29.8M across quarters.

Core Investors: QoQ Funding History, 2019-2023

Geographical Distribution

Geographical distribution plays a crucial role in understanding the landscape of Digital Health investments.

As expected, the majority of core Digital Health investors are located in the United States, representing 59.2% of the cohort of global core Digital Health investors – across early-stage, growth-stage and late-stage investments. This dominance highlights the robust ecosystem and investment opportunities for Digital Health ventures in the U.S. market.

Following the U.S., the United Kingdom and China emerged as significant players, home to 7% and 5% of core investors, respectively. Notably, investor activity in China has decreased drastically in the past few years. Despite being home to more than 1,300 investors with at least one Digital Health investment, only 19 made it onto the Digital Health Core Investor list. However, 5 of the ten countries with the greatest number of Core Investors are in Asia Pacific, with China, Japan, South Korea, Singapore and India having an active investor network.

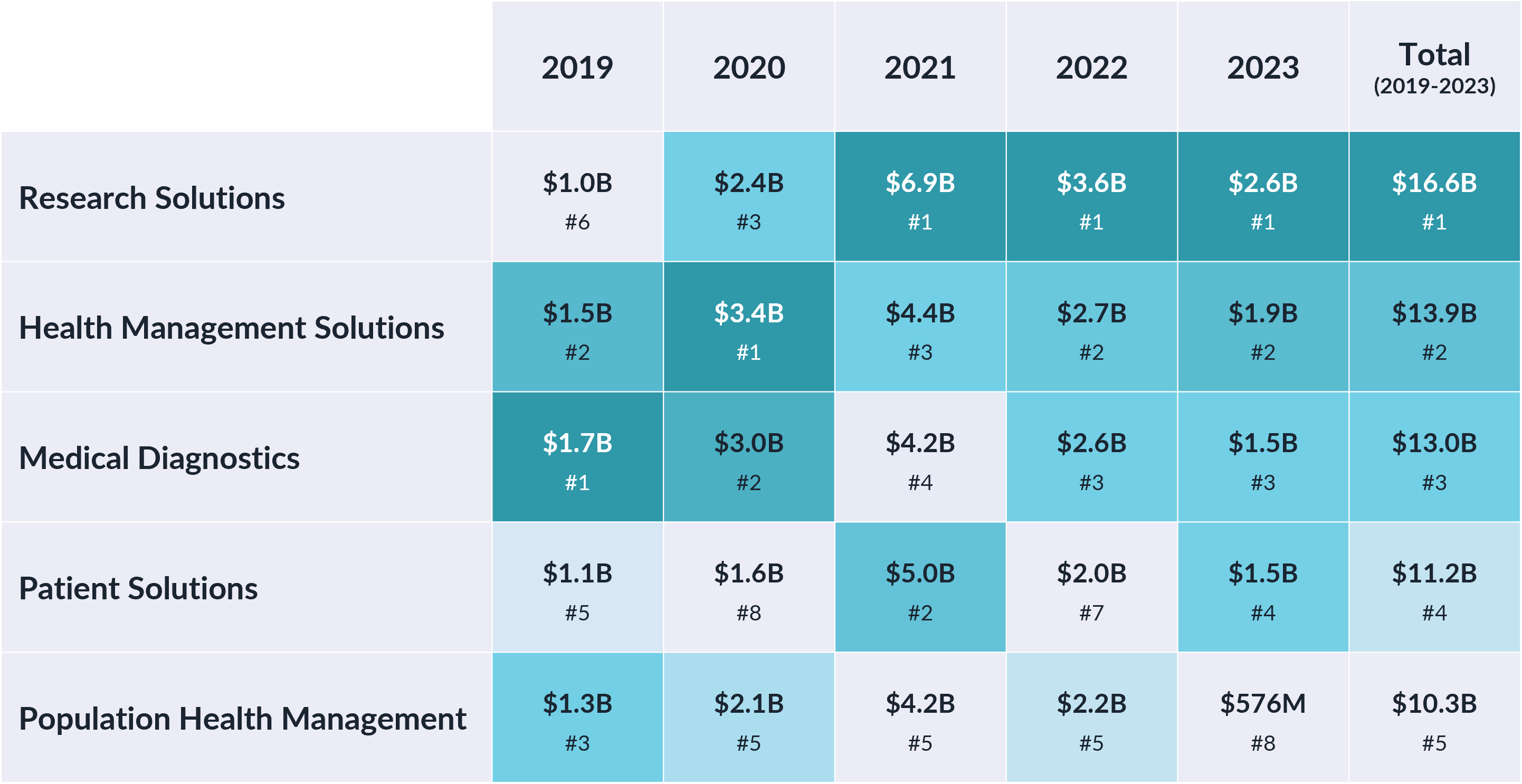

Digital Health Cluster Distribution

Over the past five years, the Digital Health landscape has witnessed significant investment activity, with more than $75 billion deployed by the most active investors across five key clusters: Research Solutions, Health Management Solutions, Medical Diagnostics, Patient Solutions and Population Health Management. In 2021, the pandemic catalysed a surge in investment for these sought-after clusters, exceeding $28 billion – nearly double the amount invested in 2020 alone.

By 2023, however, the momentum had waned, with these clusters experiencing a decline to their lowest levels since the pandemic’s onset. Notably, only Research Solutions managed to surpass the funding achieved in 2020. Against the backdrop of challenges such as a lack of evidence creation and high-profile bankruptcies – including Pear Therapeutics and Babylon Health – clusters such as Patient Solutions and Population Health Management reached their lowest total value since 2020 and 2019, respectively.

Core Investors: Top 5 Digital Health Clusters by Total Funding, 2019-2023

Therapeutic Area Distribution

Our exploration of core investor activity over five years unearthed intriguing insights into healthcare investment, where trends can often defy expectations. Despite the prevailing spotlight on Obesity and Diabetes within public health discourse, neither claimed a spot in the top five therapeutic areas attracting investment.

Instead, Oncology stood tall as the perennial favourite, maintaining its stronghold as the most sought-after sector for capital infusion. However, amidst this landscape of consistency, Mental Health emerged as a beacon of resilience, surpassing 2019 funding levels while other therapeutic areas dwindled below their previous marks. This remarkable resilience underscores a growing recognition of the importance of mental health interventions, potentially signalling a profound shift in investor sentiment towards this critical arena.

Nevertheless, our analysis revealed a broader narrative of cautious optimism within the investor community. While core investors remained steadfast in their therapeutic area priorities, there was a discernible reduction in the overall appetite for investment. This tempered enthusiasm reflects a nuanced understanding of the evolving market dynamics and the need for prudent navigation amidst uncertainty.

Core Investors: Top 5 Therapeutic Areas by Total Funding, 2019-2023

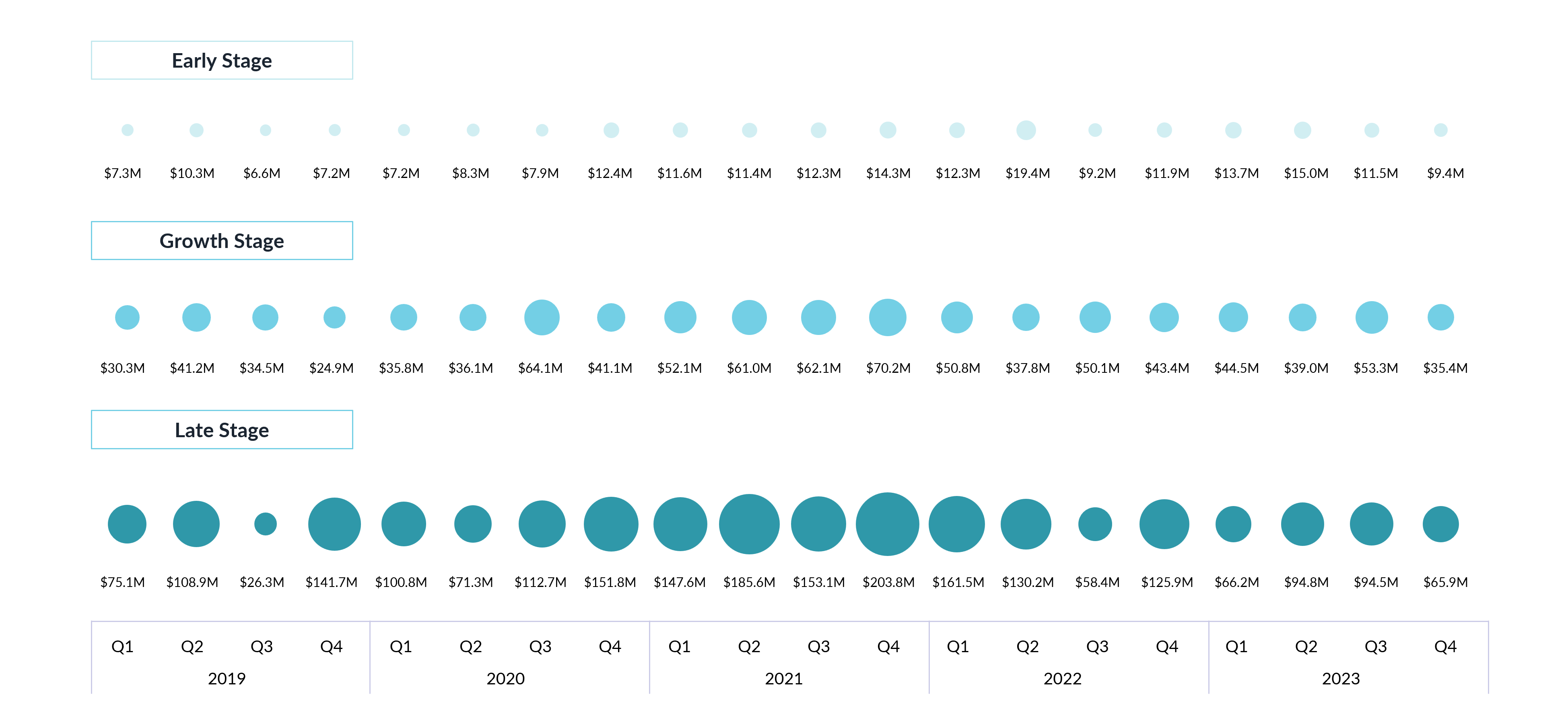

Average Funding Distribution

A closer look into core investor deals by stage type reveals insights into how average deal size has fluctuated in the past five years. Average deal size for Early Stage deals ranged from $6.6M in Q2 2019 to $19.4M in Q2 2022. Growth Stage deals saw average deal sizes ranging from $24.9M in Q4 2019 to $70.2M in Q4 2021. Late Stage deals have ranged from a low of $26.3M in Q3 2019 to $203.8M in Q4 2021. As of end 2023, the average deal sizes of Early, Growth and Late Stage deals which core investors participated in stood at $9.4M, $35.4M and $65.9M, respectively.

Core Investors: QoQ Average Deal Size by Stage Type, 2019-2023

Diving Deep: Navigating the Future of Digital Health

Over the coming weeks, we are excited to share a series of subset analyses focusing on the Core Leading Digital Health Investors across different stages and geographies of the Digital Health investment ecosystem. Our upcoming publications will delve into the characteristics and performance of core leading early-stage, growth-stage, and late-stage investors across the Digital Health landscape.

Additionally, we will provide insightful summaries highlighting the top investors in Europe, North America, and the Asia Pacific region.

Stay tuned as we showcase the nuances of Digital Health investment across diverse stages and geographical regions, empowering ecosystem stakeholders with actionable insights to navigate this dynamic ecosystem and shape healthcare delivery’s future.

As we enter April, anticipation mounts for the unveiling of Galen Growth Research’s latest insights into the Digital Health landscape. With their customary analysis set to illuminate the trends shaping the industry in the first quarter of the year, all eyes turn to the burning questions lingering in the minds of stakeholders worldwide. Is the 2023 correction still exerting influence, or have we begun to witness signs of recovery? Has the funding strength/stress index reached its nadir, signalling a potential shift in investor sentiment? Moreover, where is funding being channelled within the vast Digital Health ecosystem?

Deep-dive into the core investors

Galen Growth Research’s forthcoming report promises to clarify these pressing issues, offering invaluable insights into the industry’s trajectory and the opportunities it presents.

We recommend subscribing to Galen Growth to be notified of the publication of our ongoing analyses into Digital Health Core investors and our other sought-after thematic research.

To get access to the portfolio of more than 13,000 Digital Health investors, sign up for HealthTech Alpha.