Overview

Global Digital Health venture capital investment has experienced a decline, and the complex economic conditions continue to challenge both larger organizations’ capacity to invest in Digital Health and ventures’ ability to raise funding. Our analysis of investment trends in Q3 2023 underscores the current difficulties in the global investment climate, with a year-over-year decrease in Digital Health venture capital investment compared to Q3 2022. We delve into the key trends observed in Q3 2023 to better understand the global and regional funding landscapes, shed light on the Digital Health solution clusters and therapeutic areas that have attracted significant funding throughout 2023, and spotlight noteworthy deals that successfully closed during this quarter.

Create a free account on HealthTech Alpha to access all data.

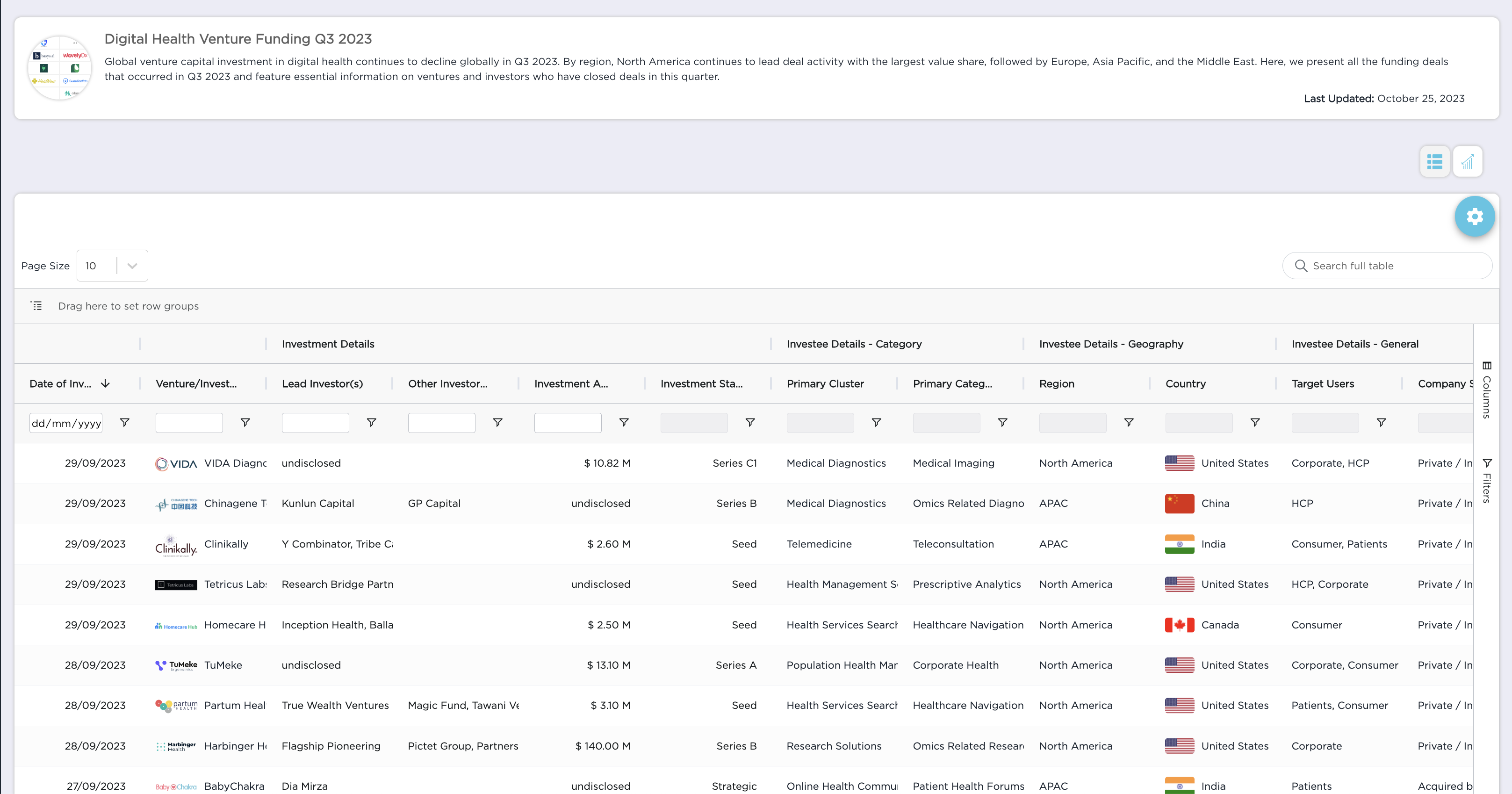

Explore all Q3 Deals with HealthTech Alpha

We made a Hubpage available in HealthTech Alpha, where users can find a detailed overview of all Digital Health venture deals recorded during the third quarter of 2023. Delve into the latest trends and notable deals that are shaping the future of healthcare technology.

Create a free account on HealthTech Alpha to access all data.

A Deep Dive into Q3 2023 Digital Health Funding Metrics

Digital Health funding has declined in Q3 2023, with global venture capital investment in Digital Health amounting to $15.6 billion across 926 deals. Cumulative venture capital investment in Q3 2023 experienced a significant 44% year-over-year decrease compared to Q3 2022, which had closed at $27.8 billion. When comparing quarter-to-quarter investments, Q3 2023 saw a decrease of 22%, closing at $4.49 billion, compared to $5.75 billion in Q2 2023.

Q3 2023 marks the lowest funding quarter since Q3 2019, indicating that Digital Health funding may be approaching a new low. Deal volume decreased by 38% in Q3 2023 compared to Q3 2022. Despite the decline in deal volume, the average deal size in Q3 2023, at $20 million, remains comparable to the average deal sizes seen in fiscal quarters in 2022 and is similar to the average deal size in the previous quarter, Q2 2023, which was $21 million. Out of the 921 deals observed, Early Stage deals (Series A and earlier) account for the majority of the deal volume at 68%, followed by Growth Stage deals (Series B and Series C) with a volume share of 24%, and Late Stage deals (Series D and beyond) with a deal volume share of 9%.

Create a free account on HealthTech Alpha to access all data.

Regional Perspectives on Q3 2023 Digital Health Funding Trends

In regional ecosystems, North America takes the lead with cumulative venture capital investment in Q3 2023, amounting to $11.3 billion. This marks a 36% year-over-year decrease when compared to Q3 2022, which had closed at $17.7 billion. Following North America is Europe, where total investment in Q3 2023 reached $2.36 billion, experiencing a 46% year-over-year decrease from the $4.4 billion seen in Q3 2022. Despite the year-over-year decrease, Europe saw an increase in venture capital funding quarter-over-quarter (QoQ), with Q3 2023 alone bringing in $894.8 million, a 13% increase from the $794.3 million in Q2 2023.

Venture capital investment continues to decline in the APAC region, with Q3 2023 investment closing at $1.44 billion, marking a significant 66% year-over-year decrease compared to Q3 2022, when it was at $4.29 billion. Q3 2023 funding in the APAC region saw a sharp 53% decrease from the previous quarter, closing at $349.6 million compared to $739.1 million in Q2 2023. Notably, within Q3 2023, Indonesia stood out with the highest venture capital funding in the APAC region, driven by Halodoc’s $100 million Series D raise announced in July 2023.

In the Middle East, venture capital investment in Q3 2023 amounted to $425.8 million, representing a 61% year-over-year decrease when compared to the $1.09 billion seen in Q3 2022. In terms of quarter-over-quarter comparisons, the Middle East witnessed a modest 8% increase in Q3 2023, amassing $195.6 million compared to $180.3 million in Q2 2022.

Challenges and Pressures on Growth Stage Ventures Worldwide

Growth stage ventures (Series B and C) in North America, Europe, and Asia Pacific continue to grapple with funding challenges. This is evident in the analysis of the volume share of Growth Stage ventures that have secured funding in the 18 months leading up to the fiscal quarters tracked in the chart below. The situation is most acute in APAC, where only 32% of Growth Stage ventures have successfully raised funding since H1 2022.

Create a free account on HealthTech Alpha to access all data.

Q3 2023 Digital Health Venture Exits: M&A Dominance and Emerging Trends

As of Q3 2023, a total of 119 venture exits were reported, comprising 114 M&As, 4 IPOs, and 1 SPAC. This marked a 25% year-over-year decrease compared to Q3 2022 when there were a total of 158 exits. M&A remains the prevailing exit strategy for Digital Health ventures, with venture-to-venture acquisitions representing the most common acquisition activity, accounting for 29% of the global acquisition value share as of Q3 2023.

Create a free account on HealthTech Alpha to access all data.

Unpacking the Digital Health Solution Clusters: Key Funding Insights in Q3 2023

When analyzing Digital Health solution clusters that have attracted the most funding globally as of Q3 2023, the Research Solutions cluster takes the lead with a total of $2.8 billion across 69 deals, representing 18% of the value share of venture capital investment. It is followed by the Health Management Solutions sector, which secured $2.3 billion across 144 deals, representing 15% of the value share of venture capital funding. Both sectors experienced a year-over-year decrease in funding compared to Q3 2022, with Research Solutions funding declining by 31% and Health Management Solutions funding declining by 21%.

Within Q3 2023, several significant deals were closed by ventures offering Research Solutions. The largest deal in the Research Solutions cluster was secured by the biotherapeutics company Generate Biomedicines, raising $273 million in a Series C deal, with notable investors including MAPS Capital, ARCH Venture Partners, NVentures, Amgen, T. Rowe Price Associates, and more. Nimbus Therapeutics, whose TYK2 program subsidiary was acquired by Takeda earlier in February 2023, obtained $210 million in private financing, co-led by GV, SR One, and Atlas Venture. Harbinger Health, focused on early cancer detection, raised $140 million in a Series B round led by Flagship Pioneering.

In the Health Management Solutions cluster, the largest deal in Q3 2023 was secured by the UK-based surgical robotics company CMR Surgical, raising $165 million in a Series E round, with prominent investors such as Softbank, AllyBridge Group, Tencent Holdings, and more.

Mega deals were also observed in other clusters and countries, including Germany-based wellness company eGym, which raised $225 million in a Series G round led by Affinity Partners, and digital therapeutics company Beta Bionics, which raised $100 million in a Series D round led by Omega Funds, Marshall Wace, and Sands Capital.

Create a free account on HealthTech Alpha to access all data.

Funding Focus on Oncology and Neurology Therapeutic Areas in Q3 2023

Taking a closer look into venture capital investment by therapeutic areas, Oncology and Neurology-focused ventures are in the lead, with both therapeutic areas representing 8% of value share each, as of Q3 2023. Ventures providing oncology solutions raised a cumulative total of $1.54B, and ventures providing Neurology solutions raised a total of $1.43B. In addition to the large deals by Nimbus Therapeutics and Harbinger Health which pertain to Oncology, precision therapeutics company Viome Life Sciences raised a $86.5M Series C round in August 2023, with investors including Khosla Ventures, WRG Ventures, and Bold Capital.

Within Q3 2023, several growth stage deals were closed by Neurology-focused ventures. RapidAI, which focuses on clinical decision-making and patient workflow solutions, raised $75M in a Series C round led by Vista Credit Partners. Verge Genomics, which focuses on drug discovery for neurology diseases, raised $42M in Strategic financing from AstraZeneca. Octave Bioscience, which develops precision care solutions for multiple sclerosis and other neurodegenerative solutions, raised a $30M Series B1 round in July 2023 from investors including dRx Capital, Hikma Ventures, Intermountain Ventures, and participation from other existing investors.

Challenges and Prospects for Digital Health Funding in the Near Future

With the ongoing decline in overall deal value and volume in Digital Health venture capital investment on a global scale, the funding trends in Q3 2023 reflect the challenges faced by Digital Health ventures in securing funding for their continued development.

Throughout 2023, investor attention has been directed towards ventures providing technological solutions aimed at enhancing research and clinical workflow efficiencies. Ventures within the Research Solutions and Health Management Solutions clusters, offering solutions within these domains, continue to attract the majority of global funding.

Looking ahead, as global funding in Digital Health retraces the levels seen nearly half a decade ago, specifically in 2018 and 2019, it’s apparent that the landscape is evolving. Stay tuned with us to observe how these key trends develop in our 2023 end-of-year analysis, powered by HealthTech Alpha, the world’s leading private market platform for Digital Health.

Missed the Global Digital Health Funding H1 Update?

Read our blog: Global Digital Health Funding H1 2023