Global Digital Health Funding H1 2023:

Digital Health funding is down 49%

The first half of 2023 has been a challenging period for the Digital Health industry and Digital Health funding globally. The global funding in Q1 represented the worst since Q4 2019, totalling $5.3B. Although the second quarter saw a marginal increase, totalling $, the first 6 months fell short by close to 50% as compared to the previous year. Of note, funding in Digital Health in China is almost non-existent and in the US may have bottomed out.

While funding seems to have hit bottom, we witnessed an increased number of prominent bankruptcies of four notable companies, including Pear Therapeutics, in the first six months of the year, further highlighting the difficulties faced by Digital Health ventures to sustain in the current market.

The announcement of quarterly new partnerships has dropped to below 500, their lowest in four quarters, indicating a slowdown in innovation and collaboration within the sector. In the current political environment larger organizations are demonstrating an increased reluctance to invest in Digital Health in an effort to increase short term revenue and an increased effort in company restructuring to lower their burn.

Given this backdrop, let’s take a closer look at what happened in Digital Health during H1 2023 and how the sector fared this quarter.

HealthTech Alpha Premium subscribers get full access to an unrivalled wealth of data on investments, exits, partnerships, and regulatory approvals, market signals and Digital Health products in the industry.

If you’re new to HealthTech Alpha, you can sign up for a complimentary account and enjoy 7 days of full access to the platform. This is a great opportunity to explore the platform and see for yourself why our platform is the global leader. After the trial period ends, you can choose to upgrade to continue accessing all the features and benefits of the platform.

Digital Health in H1 2023 closes at $10.7B globally

In H1, funding for Digital Health reached $10.7B which is lower than the amount raised in Q4 2021, where a total of 15.7B was invested. Funding deployment has remained nearly stable for the third consecutive quarter, indicating that we may have reached a bottom.

All venture deals data are exclusively sourced from HealthTech Alpha.

North America slides lower, Europe bounces back

Taking a closer look at the quarterly trends of significant regional ecosystems, we can observe that venture funding in North America has experienced a 5% decline, amounting to $4.0B. This trend can be mainly attributed to the persistent absence of mega deals, which are venture deals that exceed $100M. In the first half of 2023, only 20 mega deals were recorded, which is a relatively low number compared to previous years. This decline in mega deals has had a significant impact on the overall venture funding landscape in North America.

All venture deals data are exclusively sourced from HealthTech Alpha.

The funding landscape in the Asia-Pacific (APAC) region has been relatively slow in recent times. In the first half of 2023, only $816M was raised, which is significantly lower than previous years where more than $6.0B of funding were raised. The lack of funding in Digital Health in China and India has been identified as a key driver of the slow funding in the region. This is a particularly concerning trend as APAC remains one of the most significant regions for Digital Health innovation.

Shrinking runway for ventures

The Funding Strength is a proprietary metric calculated by Galen Growth to determine the funding health of Digital Health ventures.

Market consolidation continues

Despite the series of high-profile bankruptcies that occurred in the first half of 2023, the global appetite for mergers and acquisitions (M&A) in Digital Health remains strong, albeit slightly lower than the previous two half-years. In the first half of 2023, a total of 84 M&A activities were disclosed, which is an 18% decrease compared to the same period last year. This current dip in M&A activity could potentially be attributed to the uncertainty and volatility in the global economic landscape.

However, it’s worth noting that venture-to-venture acquisitions still remain the most prominent exit activity, accounting for approximately 27% of all M&A activities. This highlights the continued interest of established startups in acquiring promising young companies or struggling competitors to expand their portfolio and market reach. Despite the dip in M&A activity, the overall trend suggests that investors and established companies still view M&A as a viable strategy for growth and expansion in the startup ecosystem.

All acquisitions data are exclusively sourced from HealthTech Alpha.

Health Management Solutions Emerges as Top-Funded Cluster in H1 2023

In the first half of 2023, Health Management Solutions has emerged as the leading cluster in terms of venture funding, thanks to a recent $260.0M Series F investment in Aledade. This impressive funding has propelled Health Management Solutions from the fourth spot in 2022 to the top position, with a total of $1.8B in funding. Following closely behind is Research Solutions, which secured the second-place spot with a substantial amount of funding. Meanwhile, Neumora Therapeutics was able to raise $474.0M in a Series C funding round, putting them in third place.

It’s worth noting that the top three funded clusters represented nearly half of the total value invested in H1 2023. This was largely due to the significant Mega Deals that took place during this period, which helped to boost the overall investment in these clusters. Overall, it’s been an exciting and fruitful first half of the year for the top-funded clusters in the venture funding landscape.

All venture deals are exclusively sourced from HealthTech Alpha.

Neurology leads the pack

Neurology emerged as the front-runner among therapeutic areas, raising $1.2B in the first 6 months, driven by a strong Q1 where $814.0M were disclosed. After a weak first quarter with only $181.0M for Oncology ventures, the second quarter saw a pickup in funding activity, closing the half year at $646.0M on the fourth position behind Mental Health and Nephrology.

About 60% of the total funding in the first half was deployed in ventures with clear defined therapeutic focus. This value share continues to increase with investors targeting more specialized ventures.

Looking forward

As investors look for more clinically validated ventures Venture founders and CxOs must be prepared to make tough decisions — cut costs and pivot business models, if necessary. They should prioritise sustainability and profitability over growth. Investors should focus on venture proof points, such as Clinical Evidence, which demonstrate a proven track record and are well-positioned to weather the storm. Ultimately, venture founders, CxOs and investors alike need to brace for a rough year ahead.

Did you know?

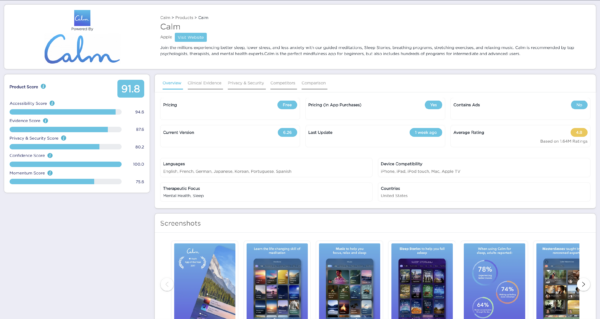

Did you know you can search for Digital Health Product as well as Digital Health Ventures on HealthTech Alpha?

Our smart search allows you to search for both Products and Ventures in HealthTech Alpha. You can use our filters to search products and ventures by therapeutic focus, category, geographical reach or clinical efficacy and compare similar offerings to one another.