Description

With a significant influx of $232B in venture capital across more than 17,500 funding deals and approximately 1,200 exits encompassing mergers and acquisitions (M&A), initial public offerings (IPOs), and Special Purpose Acquisition Company (SPAC) activities, the Digital Health sector showcases both enthusiasm and pragmatism. This mini report titled ‘Exits and Operational Performance in Digital Health’ delves into the thriving landscape of Digital Health exits, where ventures navigate a substantial funding inflow and myriad exit avenues, reflecting the sector’s dynamic evolution.

As Digital Health matures, ventures are reconsidering strategies. Some are repositioning for potential exits, seeking avenues for growth and evolution within this dynamic landscape.

A pivotal focus of this analysis is investors’ returns within the Digital Health sphere. This mini report examines the concept of MOIC (Multiple on Invested Capital) to gauge if higher MOIC figures align with superior operational execution.

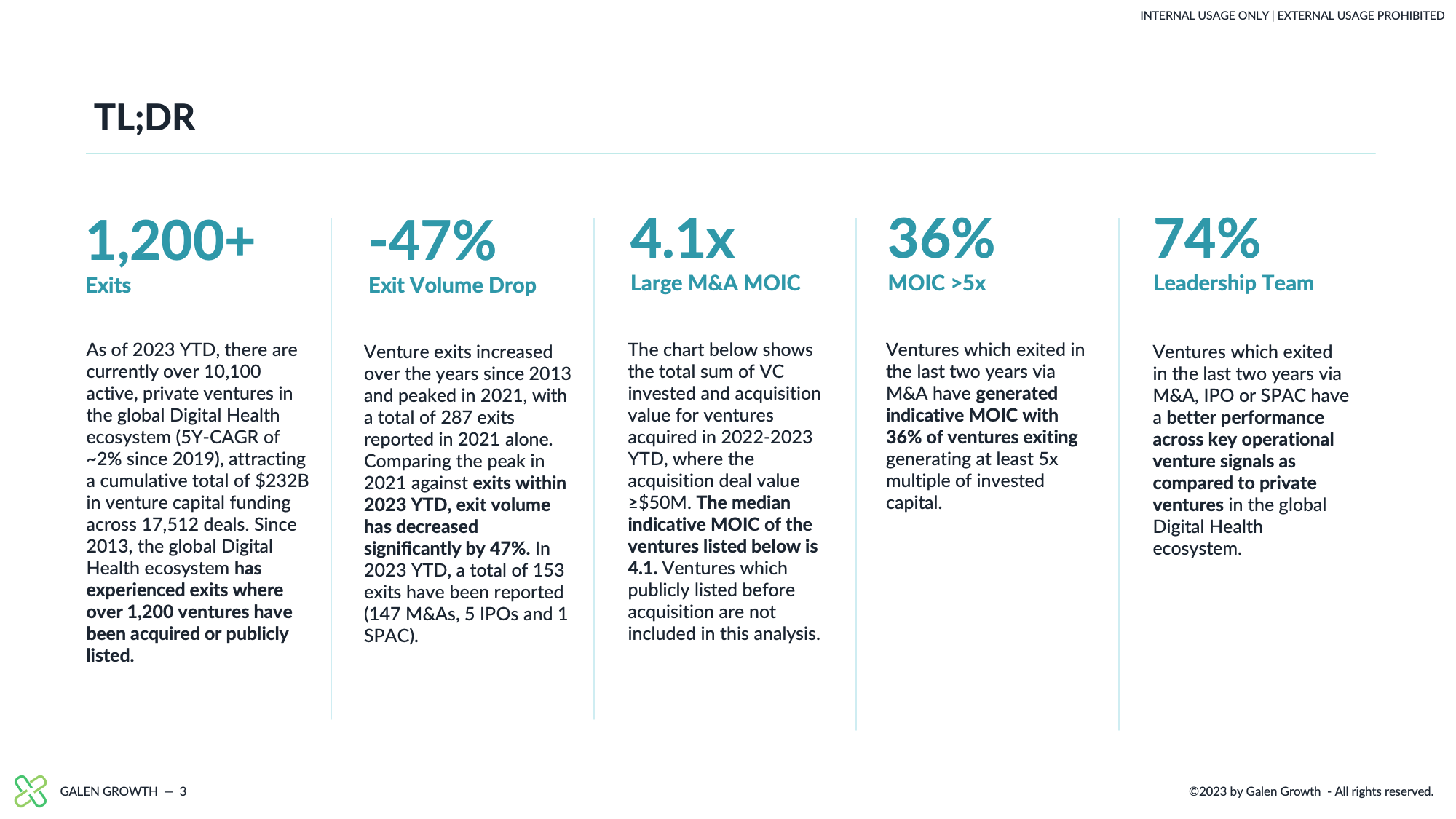

Key Insights

- As of 2023 YTD, the global Digital Health ecosystem boasts over 10,100 active, private ventures, experiencing a 5-year compound annual growth rate (CAGR) of approximately 2% since 2019. These ventures have attracted a cumulative total of $232B in venture capital funding across more than 17,500 deals, showcasing the sector’s sustained growth and financial traction.

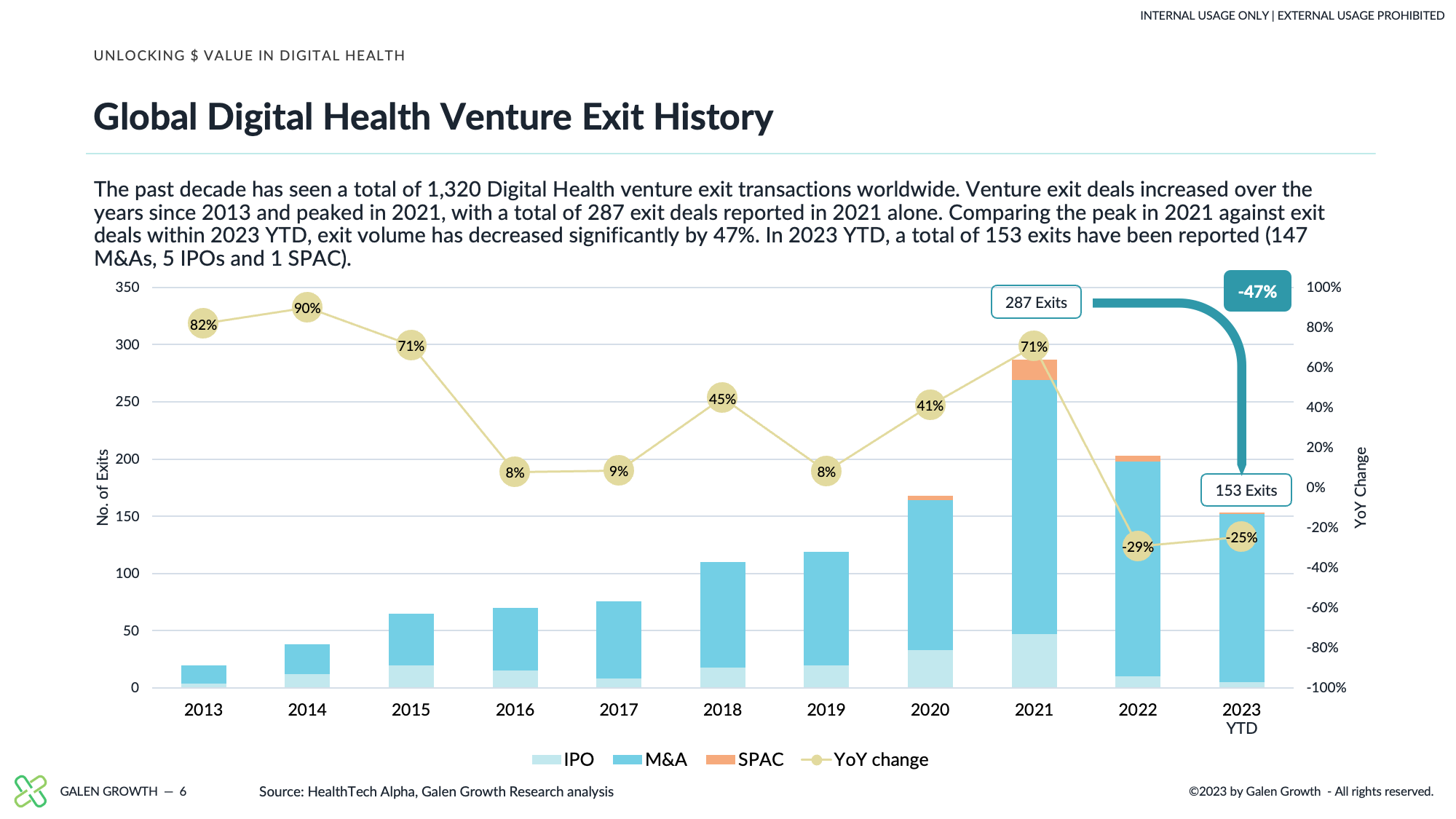

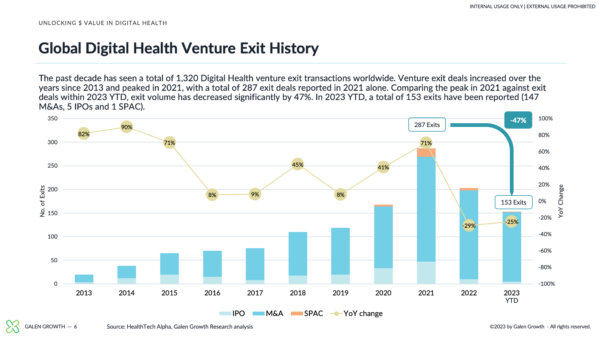

- Venture exits in the Digital Health realm witnessed a surge, peaking in 2021 with a total of 287 exits reported. However, in 2023 YTD, the exit volume has notably decreased by 47%, with 153 exits reported (comprising 147 M&As, 5 IPOs, and 1 SPAC). This decline in exit volume prompts a closer examination of the sector’s current dynamics and exit trends.

- Analyzing ventures with acquisition deal values ≥$50M from 2022-2023 YTD reveals intriguing insights. The median indicative MOIC of these ventures stands at 4.1, shedding light on the financial performance of ventures within this specific acquisition value threshold. Notably, 36% of ventures exiting via M&A in the last two years have achieved at least a 5x multiple of invested capital, emphasizing strong returns within this subset of ventures.

This Global Digital Health Innovation Thematic Report on Generative AI in Digital Health includes data on the following companies:

Signify Health, One Medical, Castlight Health, Dialogue, MiroBio, Haystack Oncology, BreezoMeter (בריזומיטר), Artemis Health, PlusDental

HealthTech Alpha, a Galen Growth proprietary solution, and the global leading Digital Health private market data, intel and insights platform powers this report!

Missed our last report?

Get access to HealthTech Alpha and read our Generative AI in Digital Health – Hype or Reality?

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Foreword: 1 page |

| TL;DR: 1 page |

| MOIC Analysis: 11 pages, 11 tables, 4 tables |

| Key Information |

| About Galen Growth |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level