TL;DR

- The US leads the global Digital Health ecosystem with $117.6 billion invested over the past five years.

- The Most Impactful Early-Stage Investors (by deal volume): General Catalyst, Andreessen Horowitz, Gaingels, Lux Capital, and Alumni Ventures

- Digital Health Ventures that received early-stage funding from one of the top 5 Most Impactful Early-Stage Investors in the US and have reached late-stage funding have (on average) raised 3.6 months earlier than the ecosystem average.

- The US raised $6.4 billion across 252 deals in early 2024, outpacing Europe ($1.0 billion) and Asia ($830 million).

- From 2019 to Q1 2024, 3,207 US investors participated in 3,218 early-stage deals, raising $25.14 billion.

- Investment themes in focus: TechBio ($4.4 billion), Health Management Solutions ($3.0 billion), Medical Diagnostics ($2.9 billion).

The US dominates in Digital Health funding

The United States boasts the world’s largest and most mature Digital Health ecosystem. Over the past five years, North America has seen more than $120 billion in venture capital funding deployed in Digital Health, representing 65% of the total amount invested globally. The US alone accounted for $117.6 billion (98%) of the $120 billion invested in North America. This influx of capital has established the US as the leading hub for Digital Health innovation, with many prominent venture capital firms and corporate venture capital arms focusing on the market.

While Digital Health funding has declined from its peak levels in 2021 ($38 billion), the US still leads with $6.4 billion raised across 252 deals from January through April 2024, significantly higher than other regions like Europe ($1.0 billion) and Asia-Pacific ($830 million).

Identifying the most impactful Digital Health investors across the globe

Some investors are committed to Digital Health, while others see it as a portfolio diversification strategy. We have developed a comprehensive methodology at Galen Growth to identify the most impactful Digital Health investors worldwide. Using our proprietary HealthTech Alpha platform, which tracks over 40,000 Digital Health companies, partners, and investors globally, we analyse key metrics to pinpoint the most impactful investors. Our methodology is explained fully in our April blog, “Unveiling the Most Impactful Investors in Digital Health.” This analysis highlights notable investors across key regions and funding stages. The selected investors have been committed to Digital Health innovation, whatever the funding and valuation climate and have invested at least once each year from 2019 to 2023 inclusive.

It is important to note that our analysis excludes all forms of public funding, e.g. grants.

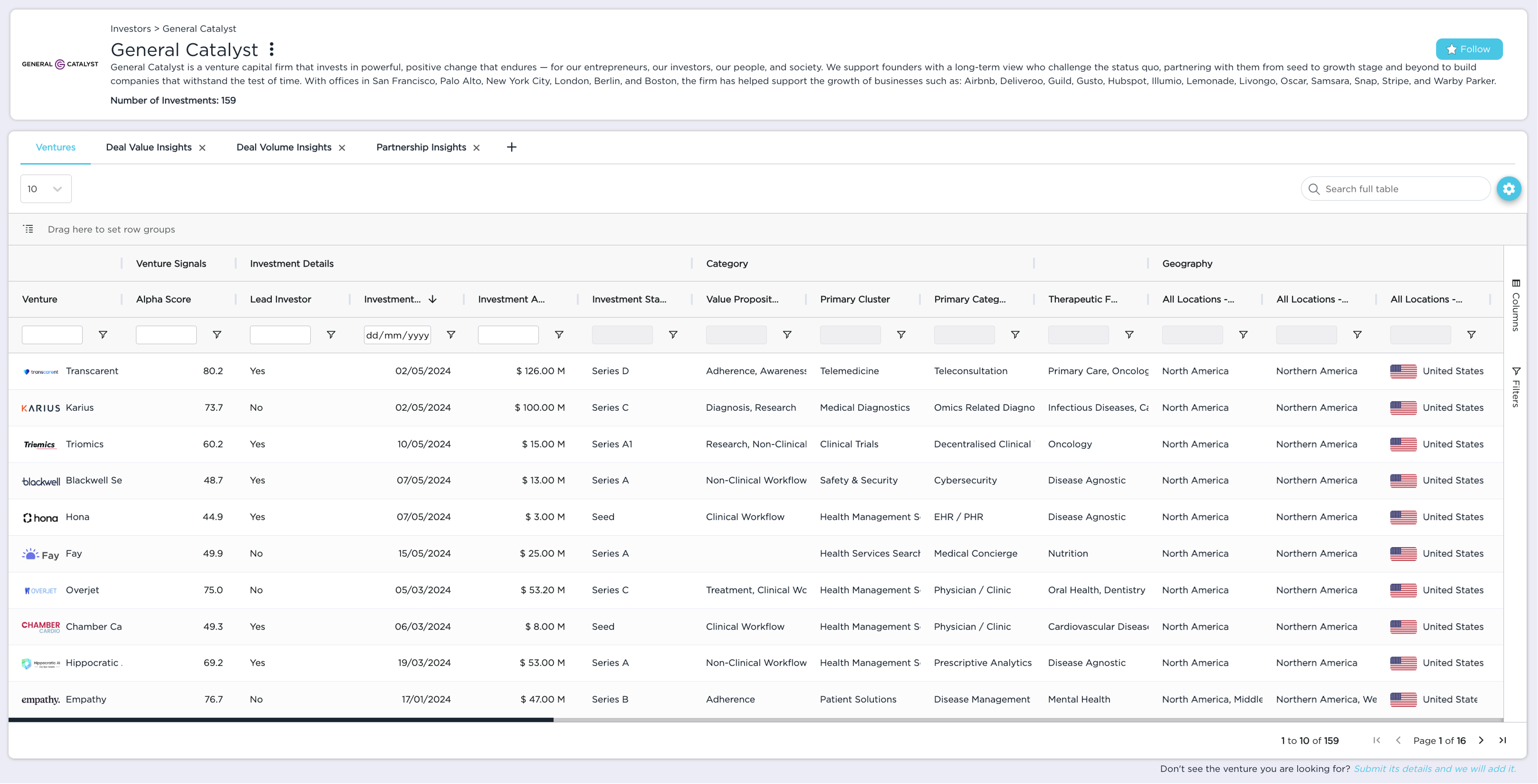

Top 5 Most Impactful Early-Stage Investors in the US

Of the 3,207 early-stage investors active in Digital Health in the US, 914 (28.5%) have shown a repetitive pattern in investing in Digital Health. Leading venture capital firms and corporate venture arms have been instrumental in shaping the sector.

Most Impactful Early-Stage Investors in the US (by deal volume)

| Investor | Number of early-stage deals (2019 – 2024 YTD) | Latest Investees (early-stage) |

| General Catalyst | 53 deals | Chamber Cardio (Mar 2024), Hippocratic AI (Mar 2024), Fabric (Feb 2024). |

| Andreessen Horowitz | 50 deals | Hippocratic AI (Mar 2024), Tennr (Mar 2024), Milu Health (Mar 2024). |

| Gaingels | 42 deals | Forta (Jan 2024), Shimmer (Jan 2024), Allara (Oct 2023). |

| Lux Capital | 31 deals | Summer Health (Apr 2024), Mendaera (Aug 2023), Thatch (Feb 2023). |

| Alumni Ventures | 31 deals | Nest Health (Mar 2024), Century Health (Mar 2024), Forta (Jan 2024). |

Explore all impactful early-stage investors in the US and North America

Impactful early-stage investors can set startups up for success

Although raising funding from investors may not be in the core business model of a new venture, it is typically a critical step toward growth, and an impactful investor contributes more than just funds. From introduction to new business partners to board members and beyond, choosing the right investor can open doors to further success.

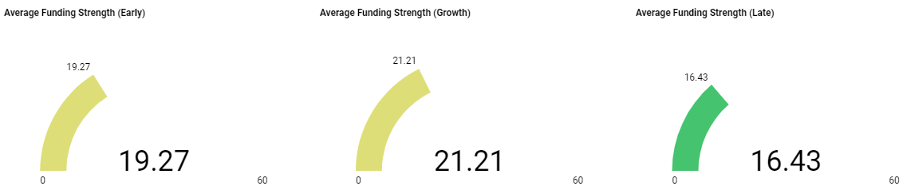

Evaluation of the portfolio ventures from the top 5 Most Impactful Early-Stage Investors in the US shows that across the lifetime of the venture, it has more success raising funding at a shorter interval than other Digital Health ventures that were supported by other investors. The below analysis is from the Alpha Edge business intelligence dashboard in HealthTech Alpha.

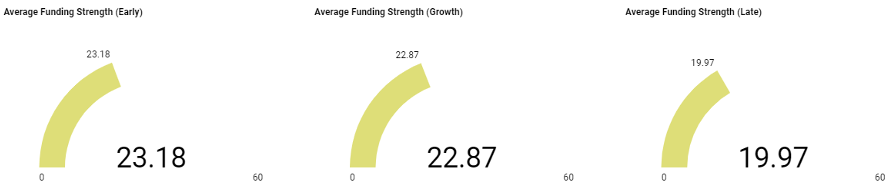

Funding Strength for All Ventures Founded in the US That Are Early-Stage or Beyond

Funding Strength for US-Founded Ventures That Received Early-Stage Funding from the Top 5 Most Impactful Early-Stage Investors in the US

Funding Strength calculates the average number of months that have elapsed since the last funding round for the ventures in the selected dataset. Only ventures that have raised funding after January 1, 2019 are considered in the analysis. A green bar (in green color) indicates high funding strength, with the average funding interval less that 18 months. A yellow bar (yellow color) indicates moderate funding strength, with an average funding interval between 18 and 30 months.A red bar (in red color) indicates weak funding strength, with an average funding interval greater than 30 months.

Why raise Early-Stage funding in the United States?

Early-stage venture capital funding (including Seed, Pre-A, or Series A rounds) is crucial for startups during their initial development phases. At the pre-seed stage, entrepreneurs focus on building their business model and conducting research to attract early-stage VC investors. In the seed stage, the emphasis shifts to refining the business model and establishing credibility. By the series A funding stage, startups typically demonstrate positive business growth, making them attractive to investors. These investments are essential for startups to grow, develop their products or services, and establish themselves in the market.

In recent years, the stages have become more fluid, with many seed-stage investors now expecting early-stage companies to demonstrate proof-of-concept through pilots or with customers and achieve a pathway to profitability. Additionally, grant providers like NIH SBIR actively support the building, scaling, and the adoption of innovative Digital Health solutions.

Digital Health investment in the US is driven by adoption and partnering

The stronger adoption of Digital Health solutions by providers and patients in the US, coupled with substantial interest in partnering from large corporations, has fuelled investment in the sector. Of the 11,885 partnerships publicly announced since 2019, the US represented 7,714 (65%). Healthcare providers, such as Mayo Clinic, Northwell Health, and Cleveland Clinic, led 27% of these partnerships, while insurance companies like Humana, Cigna, and Aetna were the second most active partners, accounting for 12%.

Early-stage funding in the US – Key Metrics

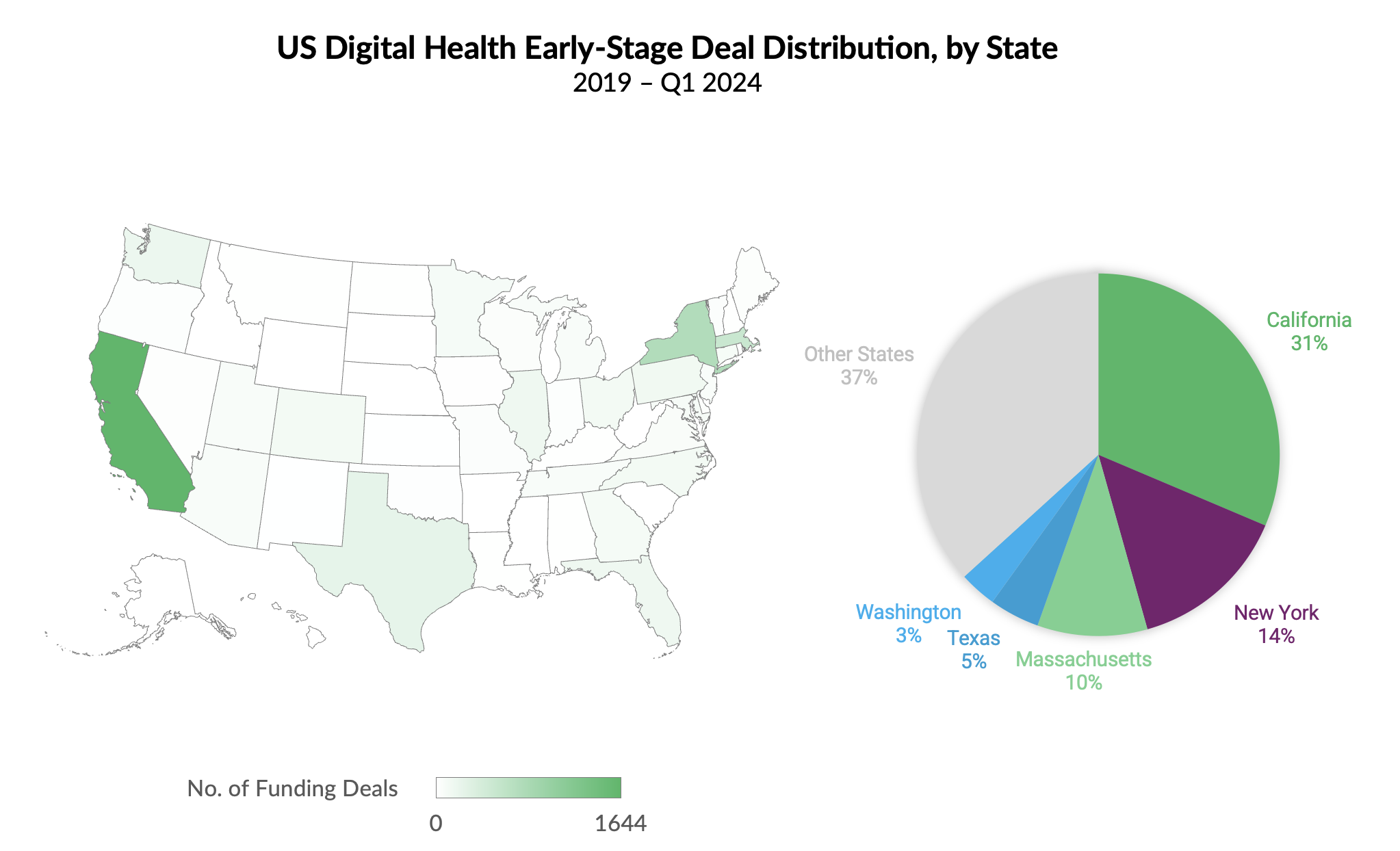

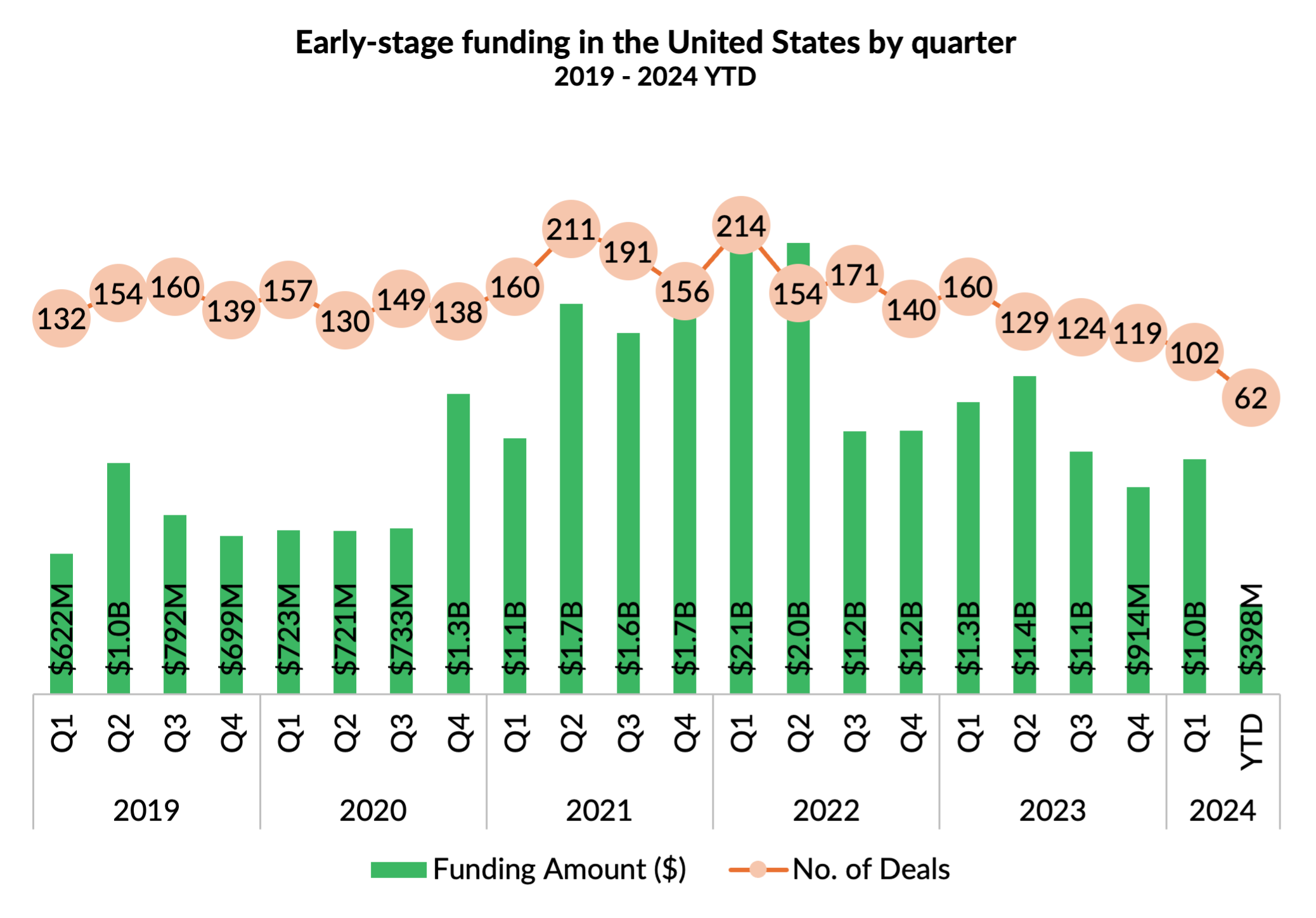

From 2019 to Q1 2024, over 7,300 investors globally deployed capital in early-stage Digital Health ventures. In the US, approximately 3,207 investors participated in 3,218 early-stage deals across 2,093 Digital Health ventures, raising a combined $25.14 billion, with an average deal size of $7.8 million. This level of investment significantly outpaces regions like Asia ($4.73 billion across 1,327 deals) and Europe ($7.11 billion across 1,485 deals).

Despite a decrease in deal volume over the last four quarters, averaging 119 deals per quarter compared to a historical average of 152, the US remains a powerhouse in early-stage Digital Health funding.

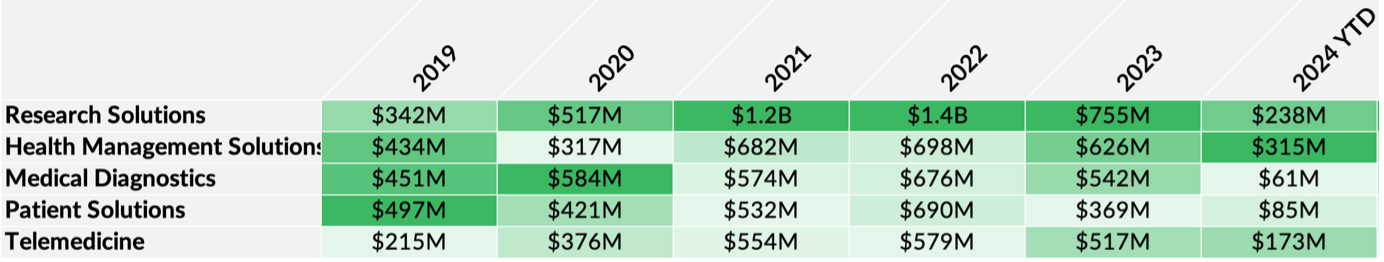

Early-Stage investors deploy the most capital to Health Management Solutions and Research Solutions ventures.

Over the past five years, early-stage investments in Digital Health in the US have focused on Research Solutions (aka TechBio), Health Management Solutions, and Medical Diagnostics. Research Solutions, encompassing genomics, bioinformatics, and personalised medicine, have attracted $4.4 billion. Health Management Solutions has secured $3.0 billion, followed by Medical Diagnostics with $2.9 billion.

Recent Funding Deals in Health Management Solutions:

January. Fabric secured the largest early-stage deal of the year with a $60 million Series A funding round led by General Catalyst, along with participation from Thrive Capital, GV, Salesforce Ventures, and others. Fabric leverages conversational AI and intelligent adaptive interviews to unify virtual and in-person care through its three main products: In-Person Care Suite, Virtual Care Suite, and Engagement Suite.

March. Hippocratic AI raised $53 million in a Series A round, bringing its total funding to $118 million. Hippocratic AI specialises in training large language models (LLMs) on healthcare data and benchmarking them against medical exams and certifications for doctors, nurses, and other professionals. Investors in Hippocratic AI include Andreessen Horowitz and General Catalyst.

April. PreciseDx announced a $20.7 million Series A1 extension to its $10.75 million Series A funding round from 2022 in April. PreciseDx focuses on developing AI-powered predictive platforms and disease-specific assays that provide patient-specific risk information and insights to improve outcomes across the healthcare continuum. Their flagship product, predicts the risk of recurrence for early-stage invasive breast cancer within six years. Merck’s Global Health Innovation Fund is among their investors.

These substantial investments reflect the increasing confidence and interest in Health Management Solutions, driving innovation and enhancing patient care in the Digital Health ecosystem.

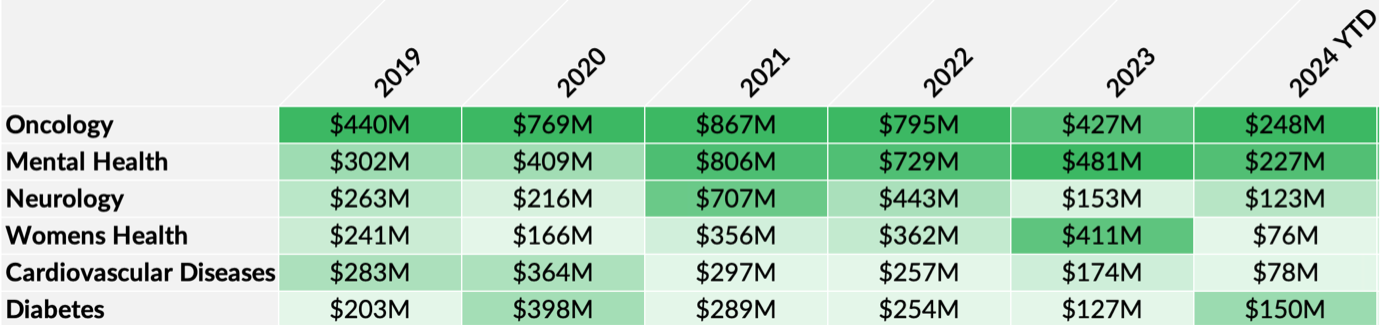

Oncology, the largest therapeutic area in Digital Health, tops the funding list for the US.

Sixty-eight per cent of early-stage funding has been deployed across ventures with a specific disease focus, while 32% are disease-agnostic. Since 2019, over $3.5 billion has been invested in early-stage deals focusing on oncology, mental health ($3.0 billion) and neurology ($1.9 billion). Notably, in the first four months of 2024, funding for early-stage ventures focusing on diabetes has already surpassed the total for 2023, driven by the recent focus on GLP-1 agonists and the strategic shift of pharmaceuticals going straight to consumers, exemplified by Eli Lilly’s LillyDirect platform.

Paving the Way for a Thriving Digital Health Future: The Crucial Role of Early-Stage Investors in the US

In conclusion, the US continues to lead the global Digital Health landscape, driven by substantial early-stage funding, stronger adoption by providers and patients, and the partnering appetite of large corporations. The most impactful early-stage investors, which include venture capital firms and corporate venture arms, play a critical role in fostering innovation and growth within this dynamic sector. These investors are instrumental in reducing funding stress for their portfolio ventures and ensuring startups are set up for success. With a strategic focus on health management solutions and research ventures, they significantly impact the industry’s trajectory. Oncology remains the most heavily funded therapeutic area, highlighting its importance in Digital Health advancements. As the Digital Health ecosystem evolves, these investors will continue to shape the future of healthcare, driving advancements and improving outcomes across the ecosystem.