TL;DR

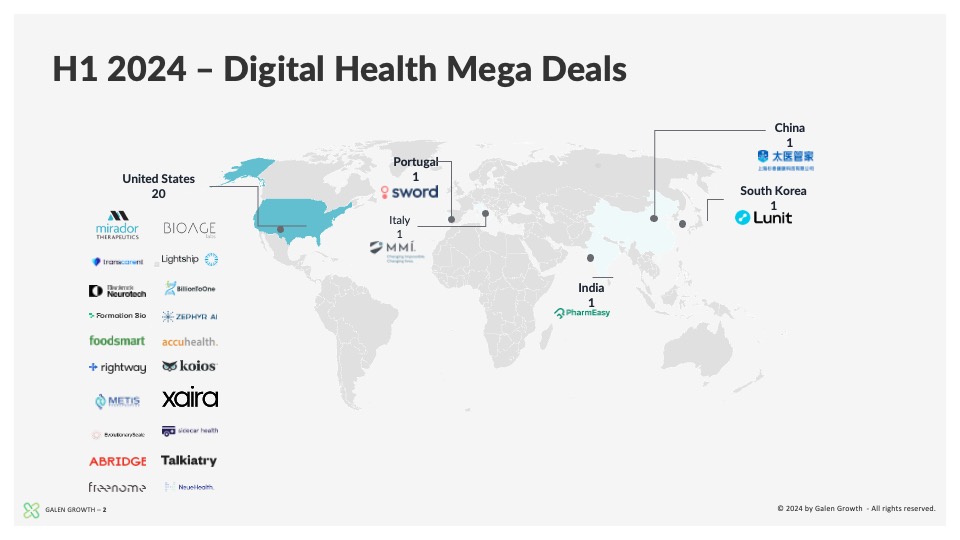

- In H1 2024, the digital health sector saw a surge in mega deals, with 26 investments totalling $4.9 billion, a 9% increase from H1 2023.

- The US dominated the landscape, hosting 21 of these deals.

- Investments spanned various stages, reflecting strong investor confidence despite startups pushing cash reserves to their limits and longer intervals between funding rounds.

- Key sectors attracting significant investments included:

- Therapeutics

- Diagnostics

- Health management solutions

- Notable deals:

- Xaira Therapeutics: $1 billion in Series A funding

- Freenome: $254 million in Series E funding

- Prominent investors included ARCH Venture Partners, Andreessen Horowitz, and Roche.

- The sector is poised for continued growth, driven by advancements in artificial intelligence, telemedicine, and personalized medicine.

The digital health sector witnessed unprecedented mega deals in the first half of 2024. Mega deals, defined as investments exceeding $100 million, have reshaped the funding landscape and underscored growing investor confidence in large-scale digital health ventures. This blog delves into the digital health sector’s significant trends, notable deals, and outlook, providing a comprehensive overview of the dynamic market.

Mega Deals Take Centre Stage

In the first half of 2024, digital health saw 25 mega deals, collectively worth $5.3 billion, which accounted for 39% of the overall funding in the sector. This mega deal volume represents a 9% increase from H1 2023, reflecting the burgeoning investor confidence in digital health innovations. The substantial rise in investment highlights the sector’s resilience and potential, even amidst broader economic uncertainties.

United States: The Epicentre of Innovation

The United States continues to be the leading market for digital health mega deals, hosting 21 out of the 26 deals. This dominance highlights the robust digital health ecosystem in the US, supported by a conducive environment for innovation, significant investor interest, and a robust healthcare infrastructure. The concentration of mega deals in the US indicates a favourable landscape for digital health startups and established companies.

Investor Confidence Across All Stages

Mega deals in H1 2024 spanned various funding stages, from Series A to Series E, and included strategic investments. This diversity underscores a healthy pipeline of digital health startups at different maturity levels, attracting substantial investments. The broad range of funding stages demonstrates investors’ willingness to support early-stage innovations and more mature companies scaling their operations. Such diversity in funding stages is crucial for sustaining innovation and growth within the sector.

However, suppose you normalize the current AI dealmaking frenzy. In that case, a harsh reality of today’s fundraising landscape comes into full view: more startups are pushing the limits of how long they can go before replenishing their cash reserves. The time that companies are waiting between funding rounds has been widening, which will likely result in more shutdowns. Despite the impressive figures for H1 2024, these underlying challenges present significant risks, even as they highlight companies’ resilience and strategic planning in navigating the complex funding environment.

Breakthrough Sectors Leading the Charge

Several sectors attracted significant investments, including therapeutics, diagnostics, and health management solutions. These areas have been at the forefront of digital health innovation, driven by technological advancements and an increasing focus on personalized and preventive healthcare. The emphasis on these sectors reflects the evolving priorities within the healthcare industry as stakeholders seek more efficient and effective solutions.

High-Profile Deals Making Headlines

- Xaira Therapeutics: Secured $1 billion in Series A funding co-led by ARCH Venture Partners and Foresite Labs, highlighting the immense potential seen in innovative therapeutic solutions.

- Freenome: Raised $254 million in Series E funding led by Roche, underscoring the growing importance of diagnostics and the role of major pharmaceutical companies in supporting digital health startups.

- PharmEasy: Acquired $216 million in Series G1 funding led by MEMG, reflecting ongoing interest in health management solutions and the strategic importance of digital pharmacies.

- Blackrock Neurotech: Received $214.3 million in strategic funding from Tether, pointing to the increasing focus on neurotechnology and its potential to revolutionize health management.

- Formation Bio: Raised $375 million in Series D funding led by Andreessen Horowitz, emphasizing continuous support for companies at the intersection of biotechnology and digital health.

Top Investors Driving the Revolution

Top investors in these mega deals included ARCH Venture Partners, Andreessen Horowitz, and Roche. Their active participation underscores their strategic focus on digital health innovations and their belief in the sector’s long-term growth potential. The involvement of such prominent investors signals a robust future for digital health, as they bring not only capital but also strategic guidance and industry expertise.

Strategic Alliances Shaping the Future

Several mega deals in H1 2024 involved strategic collaborations between pharmaceutical companies and digital health startups, including Bristol-Myers Squibb participating in Outpace Bio’s $144 million Series B round led by RA Capital Management, Roche leading Freenome’s $256 million Series E round, and Sanofi joining Formation Bio’s $372 million Series D funding round.

These partnerships are crucial for driving innovation and bringing new solutions to market more efficiently. The digital health sector has witnessed a notable increase in collaborative efforts, highlighting the importance of partnerships in advancing healthcare solutions. Such collaborations enable startups to leverage the expertise and resources of established companies, accelerating their growth and market penetration.

The Road Ahead: Trends and Predictions

The digital health sector is poised for continued growth in mega deal activity throughout 2024. The increasing number of high-value investments indicates sustained confidence and interest from investors across the board. Emerging trends likely to drive future investments include advancements in artificial intelligence, telemedicine, and personalized medicine. These areas are expected to play a critical role in shaping the future of healthcare, offering more efficient, effective, and personalized solutions.

The rise in total funding has also increased the average check size to its highest since 2019, at $191 million. Notably, the $1 billion deal for Xaira Therapeutics significantly impacted this average, which would otherwise have been $156 million. Despite this, the volatility in the average funding amount for mega-rounds decreases as the ecosystem matures. In H1 2024, the five-year volatility shrank to $29 million, suggesting greater stability and predictability for mega deals.

A Promising Future for Digital Health: Key Takeaways from H1 2024

The first half of 2024 has been a remarkable period for digital health mega deals, marked by substantial investments, strategic partnerships, and a focus on innovative sectors. As the digital health landscape continues to evolve, the trends and insights from H1 2024 provide a glimpse into the promising future of this dynamic industry. Investors, startups, and stakeholders can look forward to continued growth driven by technological advancements and a persistent focus on improving healthcare outcomes.

Source

For a deeper understanding of the digital health landscape trends, explore our latest report, the H1 2024 Digital Health Global Key Trends Report. This comprehensive analysis provides valuable insights into the current startup ecosystem, key players, and the driving forces behind digital health funding. Powered by HealthTech Alpha, our report is an invaluable resource for anyone navigating the evolving digital health market. Access the full report to stay informed on the critical developments in digital health innovation.

About Galen Growth

Galen Growth (https://www.galengrowth.com/) is a pioneering global think tank advancing Digital Health innovation. With approximately a decade of unparalleled expertise, we have consistently delivered cutting-edge research, analytics, and insights to industry leaders and investors, solidifying our reputation as the premier authority in this dynamic field.