Key Takeaways

- Digital Health Exits through M&As have consistently been the most prevalent form of exit in the digital health sector.

- The decline in IPOs and SPACs is attributed to the underperformance of digital health stocks.

- Patient Solutions have taken the lead in 2024, driven by a significant decline in funding.

- The U.S. dominates the geographical distribution of exits, with Europe and Asia Pacific also playing significant roles.

- High-profile exits in 2024 include Labcorp’s acquisition of Invitae’s assets and UpHealth’s sale of Cloudbreak Health business to GTCR.

Digital Health Exits: A Comprehensive Overview

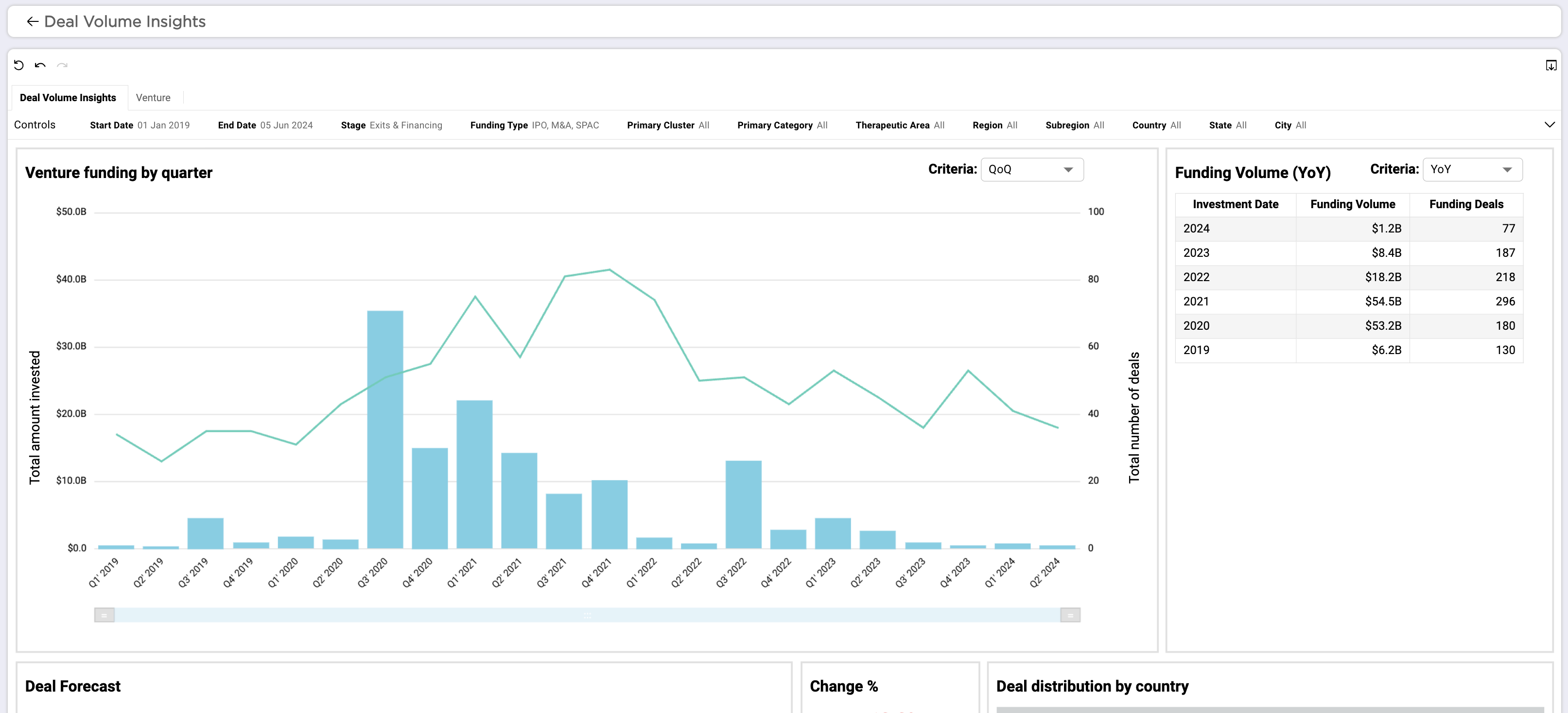

The Digital Health sector has witnessed significant exit activity over the past few years, with a total of 945 ventures exiting through initial public offerings (IPOs), special purpose acquisition companies (SPACs), or mergers and acquisitions (M&As) since 2020. This blog delves into the trends, key sectors, and geographical distribution of these exits, providing a detailed analysis of the current landscape and its evolution.

The Landscape of Digital Health Exits

Since 2020, the digital health sector has experienced a total of 945 exits, which can be broken down into three primary categories:

- Initial Public Offerings (IPOs): 97 ventures have gone public through IPOs, representing approximately 10% of the total exits.

- Special Purpose Acquisition Companies (SPACs): 32 ventures have gone public through SPACs, accounting for around 3.4% of the total exits.

- Mergers and Acquisitions (M&As): 816 ventures have been acquired through M&As, making up approximately 86% of the total exits.

While IPOs and SPACs initially gained traction, mergers and acquisitions (M&As) have consistently been the most prevalent form of exit. This trend has been particularly pronounced in recent years, driven by the underperformance of digital health ventures on the public market.

IPOs: A Declining Trend

In 2020 and 2021, IPOs represented 19% and 17% of all digital health exit transactions, respectively. However, this percentage sharply declined to just 5.5% in 2023 and a mere 3% in 2024 year-to-date (YTD). The volatility and underperformance of digital health stocks have steered companies towards more stable M&A exits.

Annual Exit Analysis

The peak year for digital health exits was 2021, with 296 companies going public or being acquired. This surge coincided with a period of significant funding in the sector, offering ample opportunities for market and product expansion through acquisitions.

In contrast, 2024 has recorded 76 exits as of May, tracking closely with the 187 exits recorded in 2023. Historically, the majority of exits occur in the latter half of the year, suggesting that 2024 could see a substantial uptick in activity as the year progresses.

Key Sectors in Digital Health Exits

The sectors with the most exits since 2020 are:

- Health Management Solutions (17%)

- Medical Diagnostics (12%)

- Patient Solutions (11%)

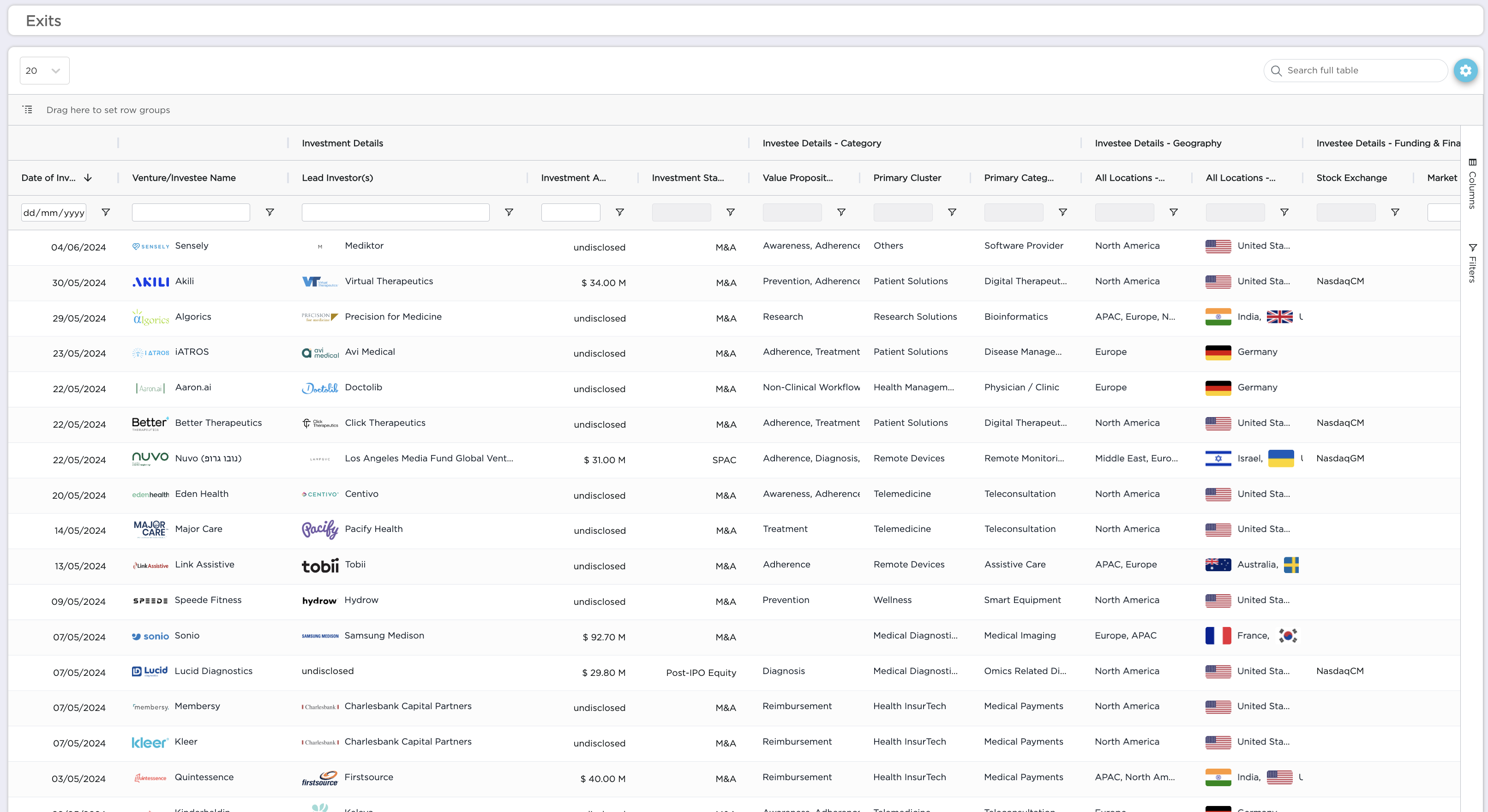

In 2024, Patient Solutions took the lead with 14 exits (18%), followed by Medical Diagnostics with 13 exits, and Health Management Solutions with 10 exits. The rise in Patient Solutions exits is attributed to a significant decline in funding, which dropped to $2.4 billion in 2023—a 64% year-on-year decrease. High-profile bankruptcies and unmet investor expectations have further influenced this trend.

Notable Patient Solutions Cases:

- Akili Therapeutics, acquired by Virtual Therapeutics for $34 million in May 2024, had previously raised over $270 million in venture capital and went public via SPAC in January 2022 at a valuation of $420 million.

- Pear Therapeutics (2023) and Proteus Digital Health (2020) faced similar fates, with both companies going bankrupt and selling their assets for a fraction of their raised capital.

Geographical Distribution of Exits

United States: 44 Exits

The United States continues to be the dominant player in the digital health exit landscape, with 44 exits in 2024 till the end of May. This is not surprising, given the country’s strong healthcare system, high levels of investment in healthcare technology, and the presence of many major healthcare companies. The U.S. exits were spread across various sectors, including Telemedicine, Health Management Solutions, and Remote Devices.

Europe: 18 Exits (All M&A Transactions)

Europe saw 18 exits in 2024, with all of them being M&A transactions. This is a significant increase from previous years, indicating that European companies are becoming more active in the digital health space. The European exits were concentrated in the Health Management Solutions and Medical Diagnostics sectors, with companies like Samsung Medison and Omron Healthcare being involved in transactions.

Asia Pacific: 14 Exits

The Asia Pacific region saw 14 exits in 2024, with a mix of IPOs, SPACs, and M&As. This is a significant increase from previous years, indicating that the region is becoming more active in the digital health space. The Asia Pacific exits were concentrated in the Patient Solutions and Health Management Solutions sectors, with companies like Aptar Digital Health and M3, Inc. being involved in transactions.

Prominent Exits of 2024

Several high-profile exits have been recorded in 2024, showcasing the sector’s dynamism:

- Labcorp: Labcorp acquired Invitae’s assets for $239 million, expanding its capabilities in genetic testing and diagnostics.

- GTCR: UpHealth sold Cloudbreak Health Business to GTCR for $180 million, expanding its capabilities in healthcare technology and services.

- Veradigm: Veradigm bought AI company ScienceIO for $140 million, expanding its capabilities in artificial intelligence and machine learning.

- Alto Neuroscience: Alto Neuroscience announced an upsized $147.9 million IPO at a market cap of about $407 million, which has since declined by 25% to $304 million as of June 5th.

Future Outlook

The digital health sector continues to evolve, with M&As dominating exit strategies amid a challenging public market environment. As funding landscapes shift and companies navigate the complexities of market expectations, acquisitions remain a preferred route for many ventures. The sector’s resilience and adaptability will be crucial as it faces ongoing financial and operational challenges, and the remainder of 2024 promises to bring further developments and insights into this dynamic field.

As the sector navigates the challenges of funding and market expectations, it is crucial for companies to adapt and innovate to stay competitive. The future outlook for digital health exits will depend on the sector’s ability to evolve and respond to these challenges.