A Deep Dive into ROIC in Digital Health: Navigating the Funding Drought and High Cost of Capital Over the Last Two Years

TL;DR

- The past two years in digital health have seen a funding drought and higher capital costs, slowing down investment and exits.

- Despite this, mergers and acquisitions (M&A) remain strong, with 64% of deals achieving a return on invested capital in Digital Health above 1.

- Large exits in areas like AI-driven healthcare and precision medicine are delivering notable returns.

- Ventures that excel in leadership, partnerships, and innovation will likely succeed.

- Investors are still making money, but only by backing ventures with operational excellence and strategic positioning.

The digital health landscape has experienced a remarkable evolution in recent years, driven by groundbreaking innovations and substantial venture capital investment. As of 2024, the global digital health ecosystem boasts over 11,000 active, private ventures, with cumulative venture capital funding reaching an impressive $268 billion across 20,305 deals. The growing interest in digital health reflects the sector’s potential to revolutionise healthcare delivery, patient outcomes, and operational efficiencies. This article explores the latest trends in digital health investment, exit activity, and return on invested capital (ROIC), shedding light on the forces shaping the industry’s future. Access Galen Growth’s mini-report on Unlocking $ Value in Digital Health.

A Surge in Digital Health Investment

Between 2019 and 2024, the global digital health ecosystem witnessed a 5-year compound annual growth rate (CAGR) of approximately 8%, with venture capital flowing into various subsectors of healthcare technology. Despite a cooling-off period following the pandemic-fueled boom of 2021, when annual digital health funding reached a record $61.16 billion, the market remains robust. Investors continue to back ventures that promise to transform healthcare through innovative technologies such as artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT).

Digital health investment is increasingly concentrated in areas like telemedicine, remote monitoring, and AI-driven diagnostic tools. Telemedicine, in particular, saw a meteoric rise during the COVID-19 pandemic as healthcare providers sought solutions that allowed patients to receive care without leaving their homes. While the telemedicine boom has stabilised, it remains a critical component of healthcare delivery, particularly for chronic disease management and mental health services. AI and machine learning are enabling faster, more accurate diagnostics, while IoT is driving innovation in connected medical devices that monitor patients’ health in real time.

The rise in digital health funding over 2024 underscores the sector’s critical role in addressing modern healthcare challenges. From telemedicine platforms and mobile health apps to sophisticated AI-driven diagnostic tools, digital health solutions are not only enhancing patient care but also streamlining clinical workflows and optimising hospital operations. The integration of these technologies helps hospitals manage increasing patient loads and reduce the strain on healthcare professionals by automating routine tasks and improving operational efficiencies.

Exits in Digital Health: M&A Activity and IPOs

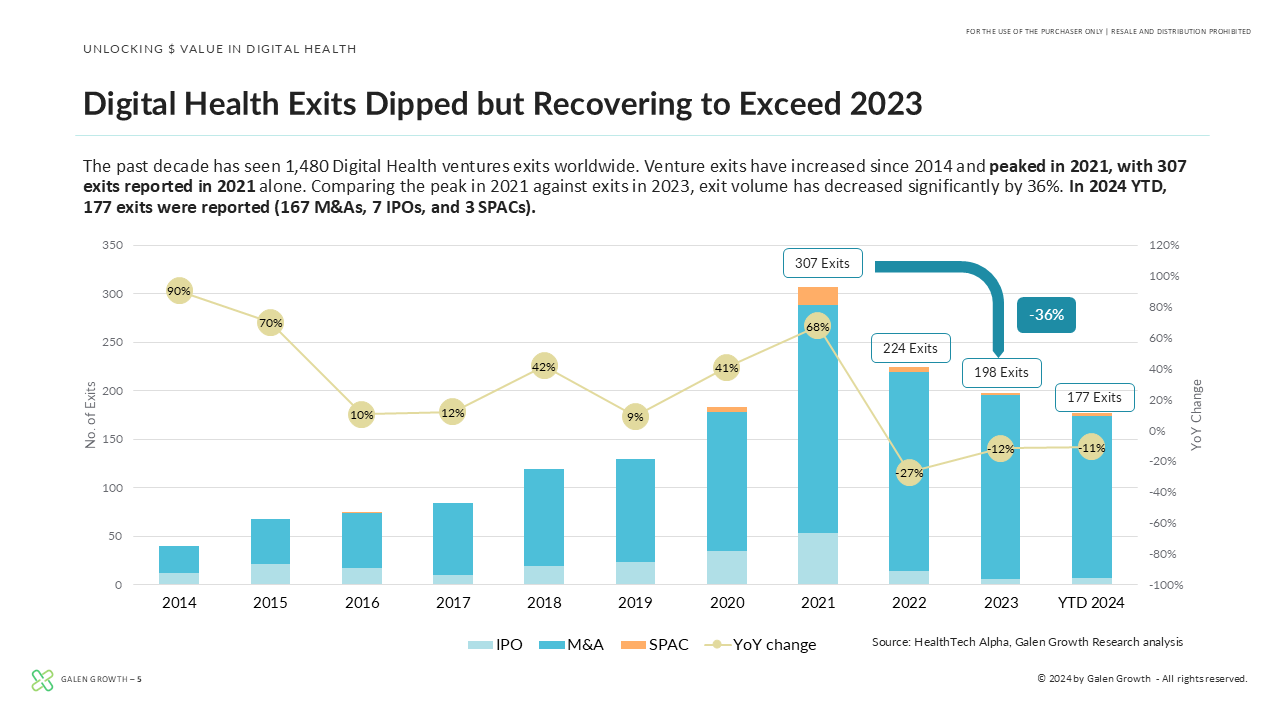

Exit activity in the digital health sector has been a focal point for investors seeking liquidity and strong returns. Since 2014, the industry has recorded over 1,480 exits, including mergers and acquisitions (M&A), initial public offerings (IPOs), and special purpose acquisition companies (SPACs). While the exit volume peaked in 2021 with 307 exits, the landscape saw a 36% decline in 2023 as the market recalibrated. However, 2024 is on track to exceed last year’s exit figures, with 177 exits reported as of the third quarter.

Notably, M&A activity has dominated the exit landscape, with 167 M&A deals reported in 2024 alone. Of these, 64% achieved a return on invested capital (ROIC) greater than 1, with a median ROIC of 7.2. These figures highlight the growing attractiveness of digital health ventures as acquisition targets for larger healthcare and technology companies looking to bolster their digital capabilities. The rise in M&A exits demonstrates the increasing consolidation within the digital health sector, as established players seek to acquire innovative startups that offer new technologies or access to new markets.

IPOs, although fewer in number, have also played a significant role in the exit landscape. Companies that successfully go public can often access larger capital reserves, enabling them to scale faster and expand into new regions. However, the IPO route can be riskier, with companies needing to demonstrate sustained growth and profitability to maintain investor confidence. SPACs, which gained popularity as a quicker alternative to traditional IPOs, have seen fluctuating success rates, as some companies have struggled to meet their projected growth targets post-merger.

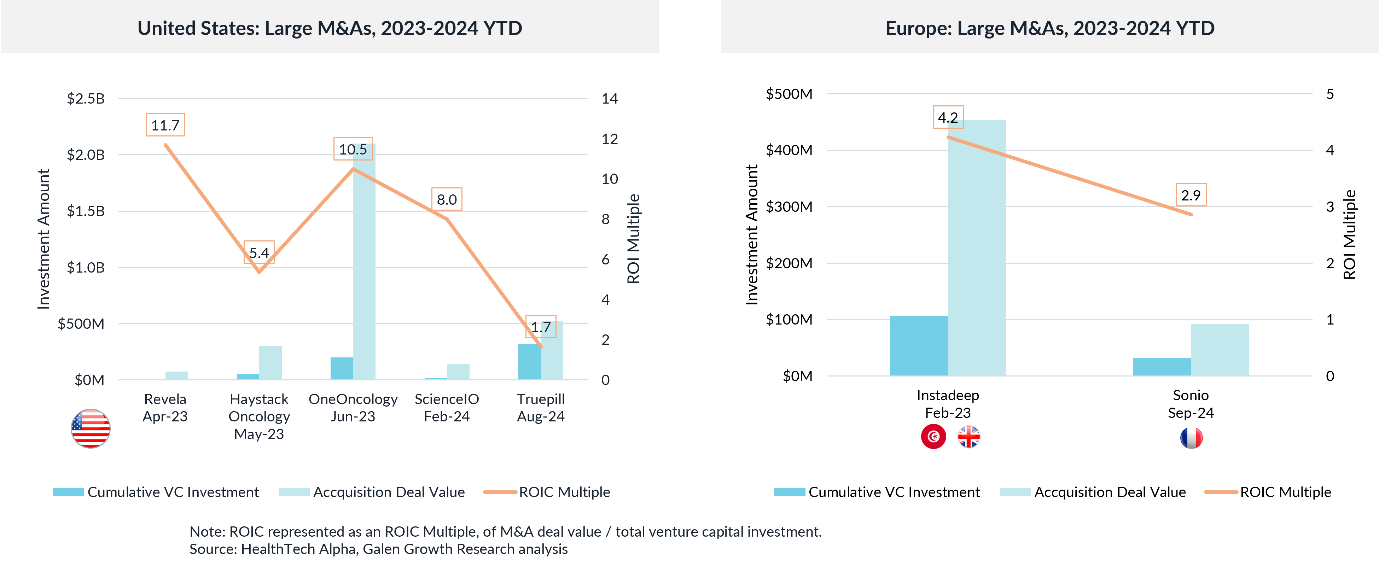

ROIC Trends: Large M&A Deals Outperform

In the realm of large M&A deals, defined as those with acquisition values exceeding $50 million, several ventures have set the benchmark for superior returns. For instance, Revela, a US-based omics-related research company, achieved a remarkable ROIC multiple of 11.7x following its acquisition in 2023 . Similarly, OneOncology, a physician network venture, delivered a 10.5x return. These outsized returns are indicative of the value digital health ventures can deliver when they are operationally strong and strategically aligned with the broader healthcare ecosystem. Read more about Digital Health in US Health Systems.

The ability of these ventures to secure high ROIC multiples can be attributed to several factors. First, they tend to operate in high-growth areas of healthcare, such as precision medicine and AI-driven diagnostics, where demand for innovative solutions is high. Second, they are often able to leverage strong partnerships with larger healthcare providers, insurance companies, and technology firms, which can accelerate their growth and enhance their market position. Finally, ventures with a proven track record of clinical efficacy, supported by robust regulatory approvals and clinical trial data, are more attractive to acquirers and investors alike. Read more about clinical strength in digital health.

What Drives Success in Digital Health Ventures?

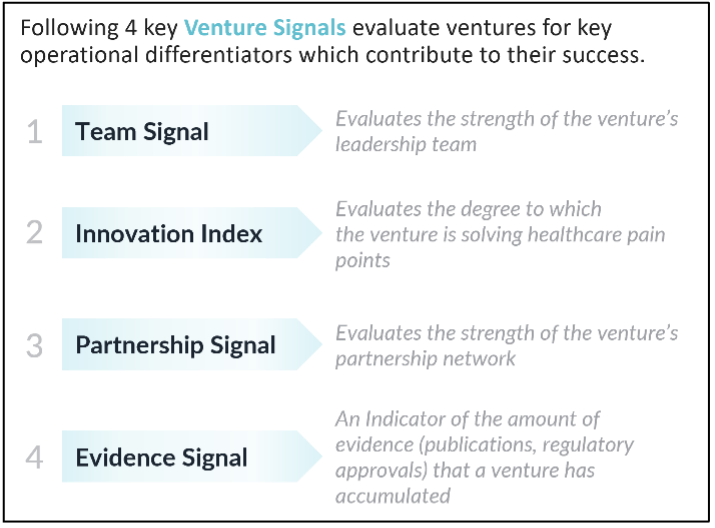

One of the key differentiators between ventures that exit with a ROIC greater than 1 and those that do not is their operational performance. According to data from HealthTech Alpha, ventures that exited via M&A in 2023-2024 outperformed private ventures in several key areas. These include leadership strength (Team Signal), partnership networks (Partnership Signal), and innovation capabilities (Innovation Index). Additionally, ventures with a strong evidence base—such as clinical trial data and regulatory approvals—tend to attract higher acquisition values and deliver better returns.

Leadership teams with a clear vision and the ability to execute on that vision are critical to a venture’s success. Strong leadership not only drives innovation but also helps build the partnerships necessary to scale operations and enter new markets. Additionally, ventures that have established a solid network of partners—whether they be healthcare providers, insurers, or technology firms—are better positioned to succeed. These partnerships provide critical support, from accessing new customer bases to integrating with existing healthcare infrastructures.

The importance of innovation cannot be overstated. Ventures that are truly innovating, rather than iterating on existing solutions, tend to capture more investor interest and command higher valuations. In particular, ventures that are solving pressing healthcare challenges—such as improving diagnostic accuracy, reducing healthcare costs, or personalising treatment—are more likely to succeed.

The Future of Digital Health Exits

Looking ahead, the digital health ecosystem shows no signs of slowing down. With 177 exits already reported in 2024 and more expected before year-end, the sector is well-positioned for continued growth. Investors are increasingly drawn to ventures that demonstrate operational excellence and the potential to integrate seamlessly into the broader healthcare system. As digital health technologies continue to evolve, the opportunities for lucrative exits will likely increase, particularly for ventures focused on AI-driven healthcare solutions, precision medicine, and value-based care models.

The ongoing shift toward value-based care, where healthcare providers are reimbursed based on patient outcomes rather than the volume of services provided, is creating new opportunities for digital health ventures. Technologies that can help providers deliver better outcomes—whether by enabling earlier diagnosis, improving treatment adherence, or reducing hospital readmissions—are in high demand. Ventures that can demonstrate their ability to improve outcomes will likely attract significant interest from both acquirers and investors. Access Galen Growth’s mini-report on Unlocking $ Value in Digital Health to read more.

Conclusion

The digital health sector has become a powerhouse of innovation, attracting billions in venture capital and delivering strong returns for investors. With over 11,000 active ventures globally and a growing number of exits, the industry is proving its resilience and ability to deliver value. As healthcare systems worldwide embrace digital transformation, ventures that prioritise operational excellence, innovation, and strategic partnerships will be best positioned to capitalise on the ongoing wave of digital health investment and exit activity.

For investors, the digital health sector offers a unique opportunity to participate in the future of healthcare. As more ventures exit through M&A or IPOs, those that have built strong operational foundations, established key partnerships, and driven innovation will continue to deliver superior returns. The future of healthcare is digital, and the ventures at the forefront of this transformation are poised to unlock tremendous value in the years to come. Access Galen Growth’s mini-report on Unlocking $ Value in Digital Health to read more.