TL;DR

The wait is over! Galen Growth’s annual HealthTech 250 has arrived, spotlighting the most promising early-stage HealthTech startups of 2025. This prestigious, data-driven ranking includes Europe’s disrupting digital health ventures, recognizing the high-potential startups poised to revolutionize healthcare.

- Galen Growth’s annual HealthTech 250 is a data-driven, no hype nor bias evaluation that identifies Europe’s top early-stage HealthTech startups to watch in 2025.

- Oncology and Women’s Health shine as the most represented therapeutic areas.

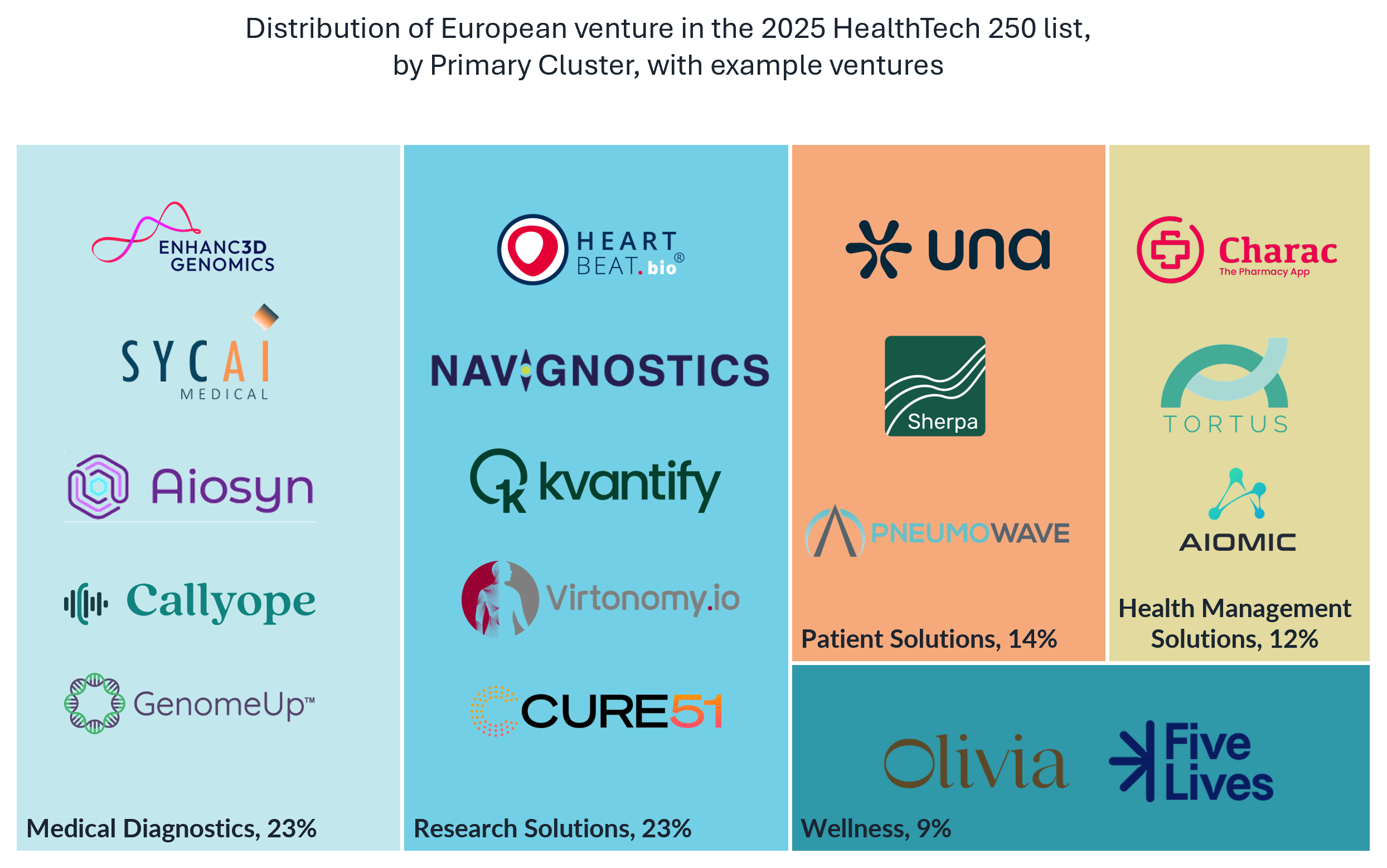

- Research Solutions and Medical Diagnostics dominate as top HealthTech Clusters, each claiming 23% of Europe’s representation.

- A growing number of venture capital firms are investing in early-stage ventures and reshaping the European digital health landscape.

- Explore the full HealthTech 250 list on Galen Growth’s website: HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2025.

- Galen Growth’s HealthTech 250 isn’t just a list—it’s a barometer for the future of healthcare innovation in Europe.

Europe’s Quiet Revolution: HealthTech Startups Are Breaking Through

Europe’s digital health technology innovation scene has long been overshadowed by the more buoyant ecosystems of Silicon Valley and Asia Pacific. Yet, the 2025 edition of Galen Growth’s HealthTech 250 – The Most Promising Early Stage Ventures list paints a very compelling picture. Seventeen percent of the HealthTech 250 ventures were founded in Europe—a significant figure given the region’s tendency towards slower startup growth due to limited private funding. Historically reliant on public funding and slower capital cycles, the continent is now nurturing a generation of startups poised to redefine healthcare.

The question, however, remains: can these ventures break through global competition, or will Europe’s fragmented ecosystem continue to stifle its ability to scale?

Oncology and Women’s Health Lead the Charge

This year’s HealthTech 250 identifies 43 standout European ventures, all founded within the past five years and funded up to Series A. Of these ventures, 25% offer disease agnostic solutions, while the remaining ventures target over 22 distinct therapeutic areas.

- Oncology tops the list, with nine outstanding European startups pushing boundaries in cancer treatment. Cure51, a bioinformatics venture that uses computational modelling to identify target therapies in oncology, has closed the highest-value funding round, with a $16.4 million round in March 2024.

- Women’s Health is thriving in Europe, reflecting a broader industry pivot toward precision medicine and inclusive care. With a $1.8 million seed round last September, Hello Inside closed the highest-value funding round in the past year for European-founded Women’s Health ventures on the HealthTech250 list.

- Eleven ventures offer disease-agnostic solutions, revolutionizing diagnostics and patient care with AI-driven platforms, and setting new standards for disease prevention and treatment.

From Research Labs to Real-World Impact

Europe’s academic strength is fueling its HealthTech boom, with 23% share of ventures specializing in Research Solutions (aka TechBio). These startups bridge the gap between lab discoveries and clinical application. Another 23% focus on Medical Diagnostics, a critical area as healthcare systems worldwide push for earlier disease detection and cost-efficient care. These clusters reflect the global industry trends, where AI-driven research, precision diagnostics, and patient-centric health management are reshaping healthcare delivery.

Notable funding rounds in the past year for European ventures on the HealthTech 250 list within top clusters:

- Bioptimus, a French Bioinformatics company building the reference AI foundation model in biology to drive advancements in scientific research and biotechnological innovation, closed a $41.1M Series A round in January 2025, led by Cathay Innovation. This followed its launch in February 2024 with $35M of seed funding.

- Spanish venture Sycai Medical took the top funding spot for European Medical Diagnostics ventures over the past year, with a 3 million Euro seed round led by LUMO Labs and Ship2B Ventures in January 2025 and a 5 million Euro Horizon Europe grand in September 2024.

Europe’s HealthTech Hubs: Where Innovation Thrives

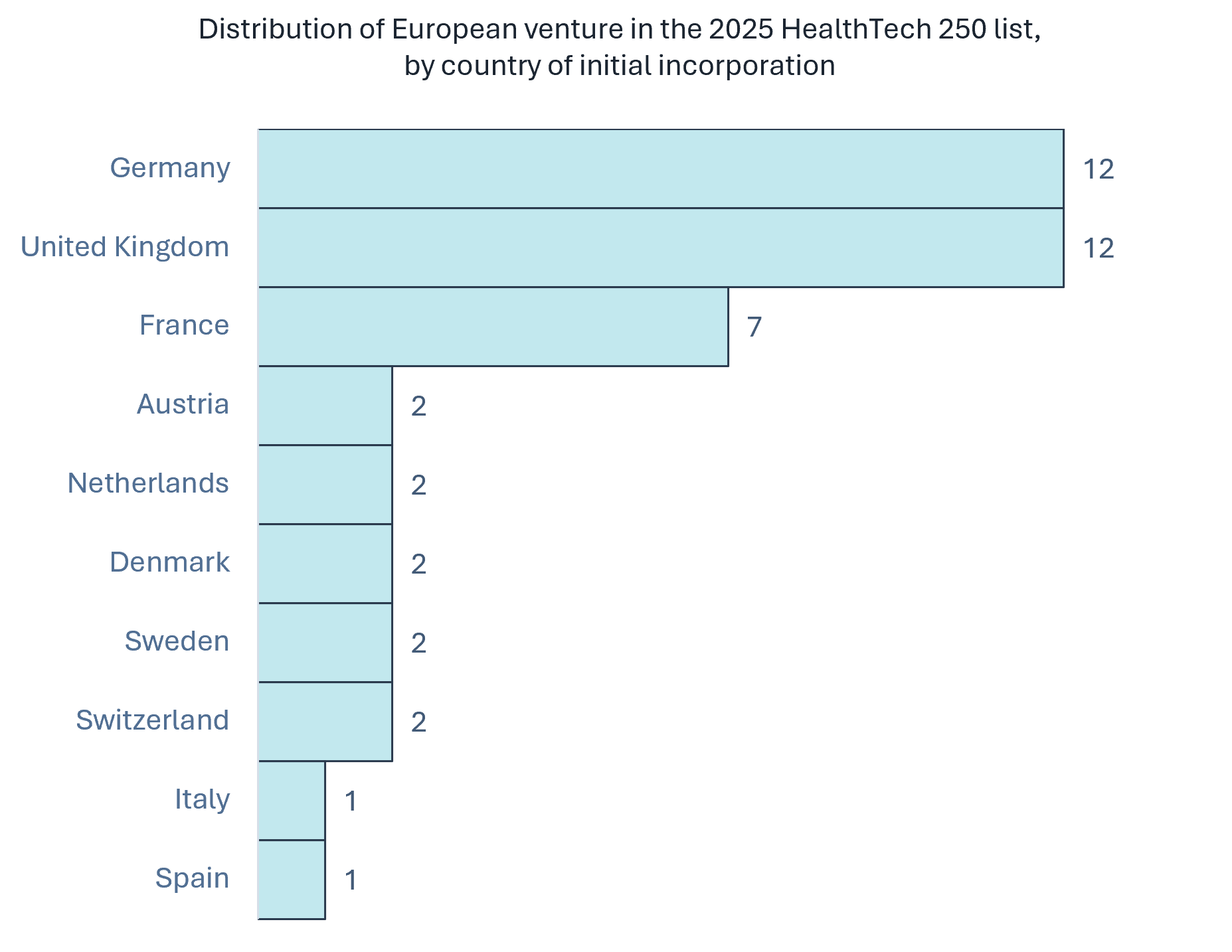

Germany and the UK lead the charge, each boasting 28% of Europe’s HealthTech 250 ventures, closely followed by France (16%).

This distribution reflects broader trends in European digital health funding. Germany’s robust public funding frameworks and innovation hubs in cities like Berlin and Munich have fostered startup growth. With its NHS-backed innovation programmes and strong angel investment network, the UK continues to punch above its weight. Meanwhile, France’s government-driven initiatives, such as the “French Tech” programme, have accelerated early-stage innovation despite more conservative private capital.

See Galen Growth’s 2024 Digital Health Funding in Europe blog for a deeper dive into country-specific funding patterns.

Three of the most mature German ventures in the HealthTech 250:

- Formel Skin, a teleconsultation and Consumer Marketplace for Dermatology, last raised funding in a $33.9M Series A funding round in January 2022. The lead investors for this round included Singular and Heal Capital.

- Virtonomy is a digital twin venture that enables medical device developers to design, develop and gain approval for their products more efficiently in a virtual environment. In its most recent funding round, Bayern Kapital led a pre-A investment of $3.8 million.

- Floy is a German startup that leverages artificial intelligence to provide advanced radiology diagnostics and holistic health insights; in February 2025, HV Capital and Acurio Ventures invested an additional 3.6 million Euro of seed capital for international expansion and regulatory approvals.

Partnerships: A Slow but Promising Evolution

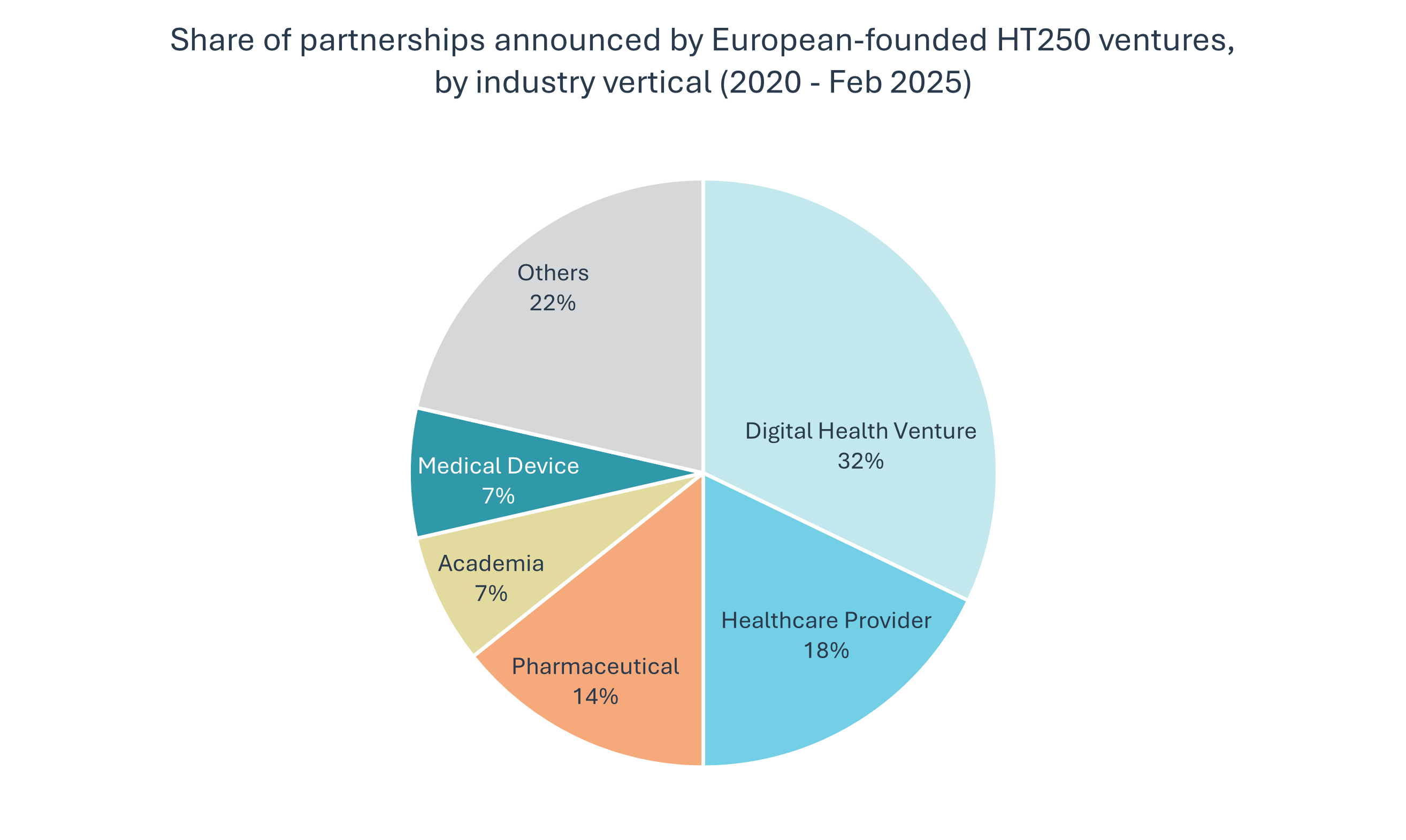

While funding remains conservative, partnerships in digital health trends reveal an ecosystem slowly finding its rhythm. From 2023 to 2024, the number of announced partnerships rose from seven to ten—modest growth, but notable for the types of collaborations emerging.

- Over the past five years, 18% of partnerships involved healthcare providers, including hospitals and physicians.

- 14% of collaborations were with pharmaceutical and biotech companies, fueling innovation in drug discovery and personalized medicine.

- The most remarkable shift? Venture-to-venture collaborations have surged to 40% in 2024, demonstrating a growing trend of startups joining forces to maximize impact!

Partnership spotlight: the venture-to-venture partnership announced in October 2024 between the French venture Bioptimus and Philadelphia-founded Proscia enhances the precision and efficacy of Proscia’s pathology diagnostics by tapping into the AI foundation models in biology developed by Bioptimus.

These strategic alliances are paving the way for faster product development, stronger market penetration, and more efficient regulatory pathways. The era of competition is giving way to an era of collaboration!

Funding Realities: Public Support, Private Hesitation

Europe’s HealthTech startups have historically leaned on public funding, and the HealthTech 250 confirms this trend. Only 11 ventures (26%) have raised Series A rounds—a stark contrast to the more aggressive funding seen in the United States or Asia.

This capital restraint reflects not just investor caution but also a preference for milestone-driven progress. European founders often secure significant non-dilutive grants before turning to venture capital, creating leaner, more resilient companies.

However, as ventures mature, the absence of private capital could stifle scale. Without Series A funding, expanding beyond domestic markets remains challenging—particularly in an industry where regulatory approval and clinical validation are costly and time-consuming.

Top Venture Deals in 2024: Bioptimus closed a $41.1 million Series A round in January 2025, in November 2024 Yazen closed a $12.2 million Series A round, and Cure51 announced the closing of a $16.4 million Seed round in March 2024.

Who’s Investing? A Select Few Lead the Charge

Early-stage investment remains elusive in Europe, but several players are shaping the landscape. Calm/Storm Ventures and angel investor Tom Blomfield stand out, having made the most investments among the top European ventures.

Their involvement signals a shift in investor sentiment. While traditional VCs remain cautious, sector-specific funds and prominent angels are stepping in, recognising the potential for startups that can navigate Europe’s complex regulatory and reimbursement landscape.

| VC Investors | Number of investments in European-founded HT250 ventures | Recent investee | Value of investment round | Country of Venture Incorporation |

| Calm/Storm Ventures | 4 | Biloba | $1.5M (Seed) | France |

| Hummingbird Ventures | 3 | Anima Health | $12.0M (Series A) | United Kingdom |

| Sofinnova Partners | 3 | Bioptimus | $41.1M (Series A) | France |

| Entrepreneur First | 3 | thymia | $2.7M (Seed) | United Kingdom |

| HV Capital | 3 | Virtonomy | $3.8M (Pre-A) | Germany |

Why This Matters: A Point of View

Galen Growth’s HealthTech 250 isn’t just a list—it’s a barometer for the future of healthcare innovation in Europe. For industry stakeholders, investors, and startups alike, the findings offer crucial insights:

- For Industry: European digital health ventures are increasingly aligned with global healthcare priorities—early detection, precision treatment, and patient-centric care. Collaborating with these startups could fast-track innovation pipelines.

- For Investors: The scarcity of Series A rounds presents an opportunity. Investors who engage early could secure stakes in ventures with de-risked technology and strong public backing.

- For Startups, the rise of venture-to-venture partnerships highlights the importance of ecosystem engagement. Startups that collaborate—rather than compete—may find faster paths to scale.

Methodology: How the HealthTech 250 Was Built

Galen Growth’s HealthTech 250 leverages its proprietary HealthTech Alpha platform, analysing over 15,000 startups globally. The 2025 edition focuses on ventures:

- Founded within the past five years

- Backed by at least one funding round (equity or grant)

- Demonstrating clear technological differentiation and commercial potential

Startups were scored across multiple dimensions: product maturity, partnership activity, and investor confidence.

For the full methodology, refer to the full HealthTech 250 list on Galen Growth’s website: HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2025.

Explore the Full HealthTech 250

Discover the complete list of the top 250 early-stage HealthTech ventures shaping healthcare in 2025. Visit Galen Growth’s HealthTech 250 here.