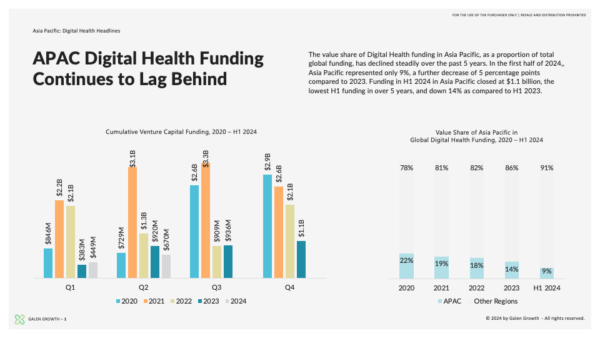

Digital health funding in Asia Pacific H1 2024 has experienced a downturn despite a global increase of investment in the health tech sector. While the overall digital health landscape in H1 2024 continues to exhibit immense potential, funding has contracted, reflecting a more cautious investor sentiment. The Asia Pacific (APAC) region, once a hotbed of digital health innovation, has not been immune to this trend. Despite facing unique challenges, the region still harbors significant growth opportunities.

Overview of Digital Health Funding in APAC

APAC’s digital health funding witnessed a 14% decline in H1 2024 compared to the previous year, totaling $1.1 billion. While Q1 exhibited relative strength, the subsequent quarter experienced a downturn, underscoring the volatile nature of the market. For more detailed insights, you can refer to Galen Growth’s 2024 Mid-Year Digital Health in Asia Pacific Key Trends Report.

Key Drivers of the Downturn

The underperformance of major markets like China and India has significantly impacted the overall APAC funding landscape. Extended funding cycles have posed challenges for established health tech startups, hindering their growth trajectories. Compared to the robust ecosystems in Europe and the United States, APAC’s digital health sector is still in its nascent stages, facing hurdles in terms of regulatory frameworks, infrastructure, and talent pool. For a comprehensive analysis on the global ecosystem, check out the H1 2024 Digital Health Funding: Global Key Trends Report.

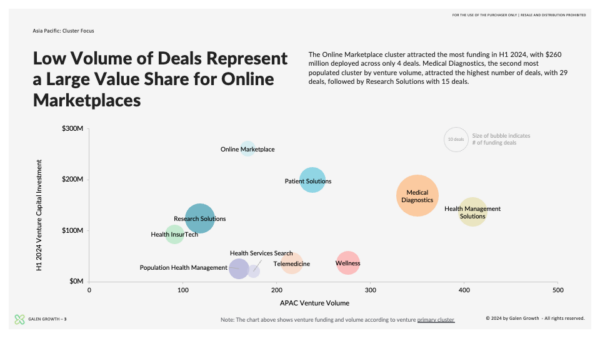

Notable Digital Health Clusters

Despite the funding slowdown, certain sub-sectors within APAC’s digital health ecosystem have shown resilience. Online Marketplaces have again emerged as a prominent cluster, attracting $261 million in investment. India’s PharmEasy has been instrumental in driving the top spot for this cluster. Additionally, Patient Solutions have gained traction, with increased focus on chronic disease management and mental health. Strategic partnerships with healthcare providers are becoming increasingly common, facilitating the integration of digital tools into patient care pathways. More details can be found in the H1 2024 Digital Health Funding: Reaching the Turning Point blog.

Noteworthy Ventures

PharmEasy, India’s leading online pharmacy, has secured substantial venture capital funding of $216 million by MEMG in H1 2024, solidifying its position as a dominant player in the online marketplace cluster. For more information on PharmEasy, visit HealthTech Alpha and their website. TaiDoc Health, a China-based digital healthcare platform, has also made significant strides, focusing on chronic disease management and teleconsultation. You can learn more about TaiDoc Health on HealthTech Alpha and their official site.

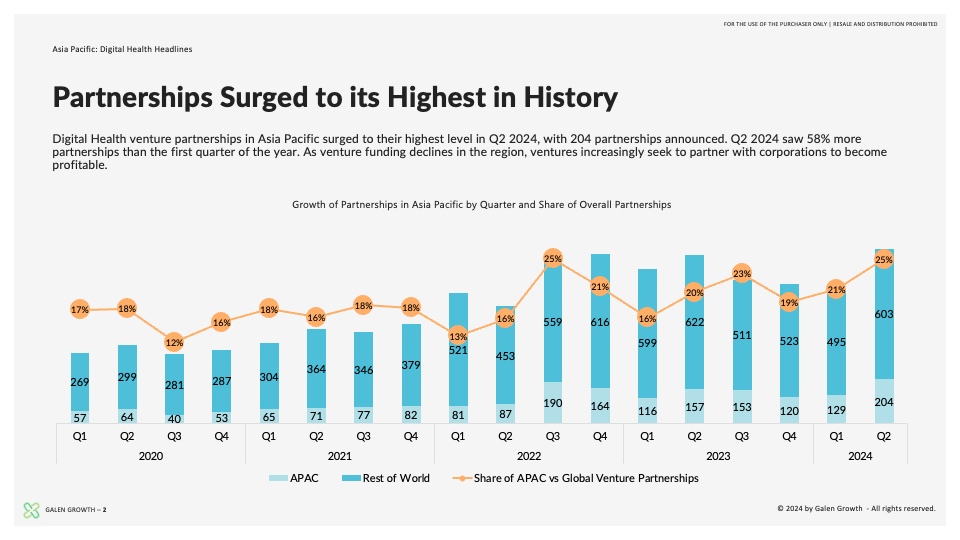

Strategic Partnerships and Ecosystem Growth

The surge in collaborations between digital health startups and healthcare providers is a positive indicator of the sector’s maturity. These partnerships are essential for validating digital solutions and accelerating their adoption. Regulatory advancements in several APAC countries as well as the launch of a clinical trial registry for Southeast Asia in Singapore are creating a conducive environment for digital health innovation, fostering ecosystem growth.

Adoption of Emerging Technologies

While generative AI has garnered significant attention globally, its adoption in APAC’s digital health sector has been cautious. Only 1% of ventures are currently leveraging this technology, primarily in TechBio (Research Solutions) and Medical Diagnostics. As the technology matures and its applications become clearer, we can expect a gradual increase in AI adoption within the region. For more insights on the adoption of AI in digital health, refer to the report on digital health investment rebounding in 2024 .

Conclusion

H1 2024 has been a continuation of the period of decreased funding activity for the APAC digital health sector. While challenges persist, the underlying potential remains immense. The focus on patient-centric solutions, strategic partnerships, and emerging technologies offers promising avenues for growth. As the industry navigates this dynamic landscape, data-driven insights will be crucial for making informed decisions.

Call to Action

For a deeper dive into the APAC digital health landscape, explore the Galen Growth 2024 Mid-Year Analysis. HealthTech Alpha provides comprehensive data on the global digital health sector, enabling stakeholders to identify emerging trends and opportunities. By staying informed and collaborating with key stakeholders, the APAC digital health ecosystem can overcome challenges and emerge stronger than ever.

Disclaimer: This blog post is based on available data and insights up to H1 2024. The digital health landscape is rapidly evolving, and trends may have shifted since then.