Digital Health Trends Unveiled in 2023

In our H1 2023 Digital Health funding review, Galen Growth anticipated a continued upheaval and challenges in Digital Health, foreseeing a continued contraction in venture capital funding that would reshape the industry landscape. This ongoing transformation of the Digital Health ecosystem is characterized by consolidation, heightened scrutiny, and a notable shift in investment dynamics.

In our anticipated year-end briefing, Galen Growth offers an exclusive preview of the highly awaited 2023 Year End Digital Health Global Key Trends report—a fundamental resource eagerly anticipated by industry leaders, investors, and innovators. This comprehensive annual edition, scheduled for release on January 16, 2024, stands as the definitive guide to the evolving Digital Health landscape. Renowned for its in-depth analysis, this report leverages the unparalleled capabilities of HealthTech Alpha, the world’s leading Digital Health data, intelligence, and insights platform, ensuring comprehensive coverage curated by Galen Growth’s specialized Digital Health team.

Evolution of Digital Health Investment

As the landscape of Digital Health rapidly evolves, a significant shift is evident, moving the sector from an era of inflated expectations to a more realistic perspective post the exuberance of 2021. Having over a decade to mature, the Digital Health sector has expanded, housing more than 10,000 private entities, each showcasing varying degrees of innovation and potential.

Healthcare value chain challenges play a pivotal role in reshaping Digital Health priorities. This transformation fuels increased commitments from pharmaceutical companies, directing greater investment towards Digital Health innovation in their research efforts. Concurrently, health systems intensify their focus on harnessing Digital Health innovation to enhance healthcare delivery, effectively tackling mounting capacity and productivity challenges.

Challenges in Securing Funding for Digital Health Ventures

Despite the thriving ecosystem, the Digital Health sector grapples with formidable funding challenges. Recent data paints a stark picture: less than 35% of Digital Health ventures secured funding in the past 18 months, indicating a substantial decline in investor largesse.

The pace of mergers and acquisitions (M&A) has notably decelerated, while initial public offerings (IPOs) and Special Purpose Acquisition Companies (SPACs) activities remain scarce. Particularly in Europe, the absence of recorded IPOs underscores the subdued state of the industry.

The sector’s narrative is punctuated by high-profile closures, exemplified by Pear Therapeutics (United States), Olive.ai (United States), and Babylon (United Kingdom). Despite substantial funding and lofty valuations, these entities faltered due to unrealistic growth assumptions, signalling the potential for similar shutdowns during 2024.

GenAI or Generative AI, has emerged as a central focus for Digital Health innovators in 2023. Its prominence in biopharma and health systems partnerships with Digital Health ventures underlines its status as the most captivating topic in Digital Health innovation, garnering attention from industry stakeholders, investors, innovators, and media.

Adapting to Funding Decreases in Digital Health

The Digital Health sector has undergone a substantial shift in funding dynamics, departing from previous years’ inflated expectations towards a phase emphasizing practical solutions. This transition from hype to reality over the past two years has resulted in a significant plunge in venture funding, dropping to over $22 billion – a staggering 37% decline year-on-year from 2022. This decline reflects a global trend reduced investor interest across all regions.

Navigating the current landscape proves increasingly challenging for Digital Health ventures with a significant portion facing critical funding shortages. Alarmingly, only 31% of Early-Stage ventures, 34% of Growth-Stage ventures, and 53% of Late-Stage ventures secured funding within the past 18-month or standard runway period. This funding gap has led many ecosystem players to grapple with implementing cost-cutting measures or reassessing their business models.

Investor Engagement and Regulatory Trends in Digital Health

Exit Transactions in 2023

Compared to the peak year of 2021, exit transactions in the Digital Health sector—encompassing Mergers and Acquisitions (M&A), Initial Public Offerings (IPOs), and Special Purpose Acquisition Company (SPAC) activities— experienced a 14% decrease in volume throughout 2023. Notably, venture-to-venture acquisitions dominated M&A activities in the sector during this period.

Decline in Investor Engagement

Investor engagement within the Digital Health domain also declined, witnessing a 28% reduction in unique investor participation in 2023 compared to the previous year. Despite the cumulative count of over 9,000 unique investors between 2019 and 2023, a mere 4% consistently participated in funding rounds across all periods surveyed.

Global Regulatory Filings

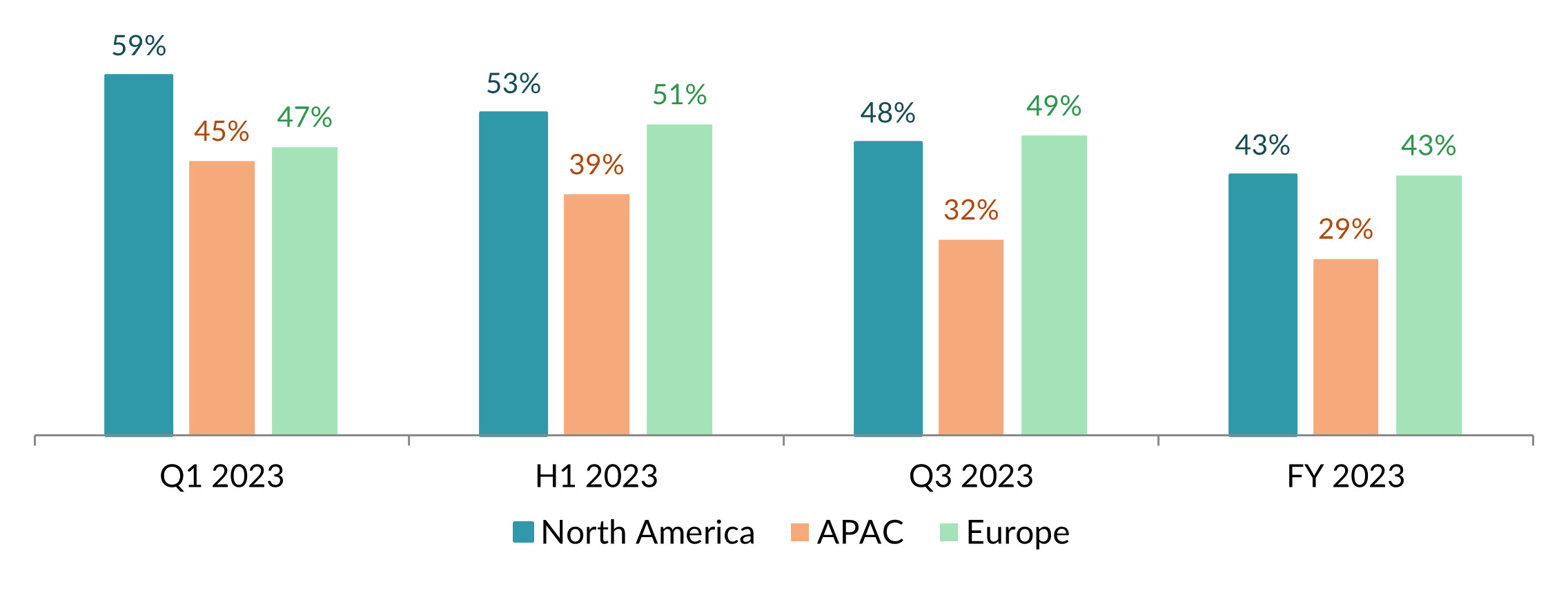

Global regulatory filings for Digital Health ventures sustained a downward trajectory for the second consecutive year, plummeting by 48% year-on-year. While North American ventures accounted for the largest share of these filings at 43%, this decline indicates a global trend in regulatory engagement within the sector.

Rising Partnerships with Health Systems

Despite these challenges, health systems, including private clinics and hospitals, emerged as pivotal partners for Digital Health ventures. Announcements of new partnerships in 2023 surged by 1.2 times compared to the previous year. Globally, the total number of partnerships disclosed by Digital Health ventures globally witnessed a 3% year-on-year increase, signalling incumbants’ confidence despite challenges stemming from the geopolitical and economic environment.

Technology Integration Driving Digital Health Partnerships

Technological integration remains a cornerstone, with 39% of private Digital Health ventures leveraging Artificial Intelligence (AI) or Generative AI technologies. Among these ventures, 43% focus primarily on Medical Diagnostics or Patient Solutions. Remarkably, within the Medical Diagnostics Cluster, only 3% currently incorporate GenAI technology.

Regarding funding distribution, the Research Solutions cluster claimed 20% of the total funding by value deployed in 2023, despite a 28% year-on-year decline. Mega Deals (>$100M) propelled this cluster’s prominence, with the top 5 funded clusters representing 62% of the total investment in 2023.

Moreover, the announcement of Galen Growth’s annual HealthTech 250 highlighted the most promising Early-Stage Digital Health Ventures in 2023, spanning across various regions globally, including North and South America, Asia Pacific, Europe, the Middle East, and Africa. These ventures represent a diverse spectrum driving innovation in Digital Health on a global scale.

As the Digital Health sector confronts these challenges, its resilience and adaptability will be tested in fostering sustainable growth amidst fluctuating funding trends and evolving regulatory landscapes.

Outlook for 2024: Challenges and Opportunities

The forecast for the Digital Health landscape in the initial half of 2024 echoes the trends observed in the previous year, navigating geopolitical uncertainties. The imminent US presidential election adds another layer of complexity to the industry’s narrative, indicating a year of continued volatility. Nevertheless, optimism emerges for the latter half of 2024, potentially marking a pivotal turning point for the sector.

Amidst persistent unpredictability, the industry is steadfastly moving towards heightened resilience and innovation. Gradually, regulatory frameworks and reimbursement structures are evolving due to a health system crisis exacerbated by the slow adoption of Digital Health innovations among Healthcare Providers. The resulting pressure from payors to establish Digital Health reimbursement frameworks, exemplified by initiatives like DiGA in Germany and PECAN in France, signifies the industry’s evolving landscape.

Digital Health Venture Sustainability

Digital Health ventures face imminent funding challenges, leading to lower valuations. Emphasis shifts toward profitability pathways, highlighting the need for robust proof points like clinical evidence. This setting sets the stage for continued consolidation, marked by M&A activities and business closures.

The focus must now also turn towards constructing Digital Health platforms offering comprehensive solutions, seamless interoperability, and enhanced value compared to fragmented solutions. Biopharma is anticipated to intensify its Digital Health innovation efforts in drug Research and Development, driven by significant patent cliff and pipeline shortages.

Global Healthcare Challenges and Innovation

The challenging scenario in the United Kingdom, where the NHS waitlist surpasses 8 million people, representing over 12% of the population, forcing more than 40% of UK citizens to self-diagnosis driven by their limited healthcare access. This situation mirrors challenges seen in health systems globally, emphasizing the pressing need for transformative healthcare solutions. Health systems must prioritize Digital Health innovation to enhance capacity, productivity, and address rising demand, labour shortages, and escalating costs.

Investors grapple with a constrained investment value chain, experiencing reduced exits and scare IPO opportunities and navigating these stormy seas for improved returns in an extended higher cost of capital environment. Current valuations, not yet at their lowest, significantly influence follow-on rounds and multiples on invested capital (MOIC). The venture capital landscape, which was flooded with new entrants due to easy access to capital, now foresees an inevitable consolidation. However, this reshaping presents an opportunity to transition from short-term, exit-oriented strategies toward sustainable venture-building approaches.

Conclusion: Navigating Digital Health Challenges

Despite multifaceted challenges, 2024 offers promise for perceptive investor organizations and forward-thinking entities within the Digital Health sector.

In essence, the Digital Health ecosystem faces a critical phase entering 2024. It will need to recalibrate amidst funding obstacles and significant setbacks while focusing on addressing fundamental healthcare challenges. The industry’s resilience and adaptability will undergo scrutiny as it transitions from hype-driven trends to practical innovation, laying the groundwork for a dynamic and potentially transformative future.

_____________________

This article provides a quick preview of our comprehensive analysis, timely for the many busy professionals gearing up for JPM 2024. Our complete report, a staple of our unbiased approach, spanning over 70 pages, meticulously curated with data, tables, charts, and expert narratives.

Subscribe to Galen Growth for access to the ultimate analysis covering Digital Health activities and advancements over the past 12 months.

Explore our broad collection of unrivalled thematic reports, all powered by HealthTech Alpha, the foremost global platform for Digital Health data, intelligence, and insights. Anticipate our upcoming comprehensive report, delving deeper into the trends shaping the Digital Health landscape and offering invaluable insights into the industry’s evolution.