TL;DR

- Cardiovascular diseases (CVDs) remain the leading cause of death globally, responsible for over 17.9 million deaths annually, with 32% of all deaths attributed to CVDs. Many of these deaths could be prevented through education and lifestyle changes.

- Digital health innovations, including AI (used by 56% of cardiovascular ventures), mobile apps (46% of digital products), and remote monitoring, are revolutionising CVD management and enhancing patient outcomes.

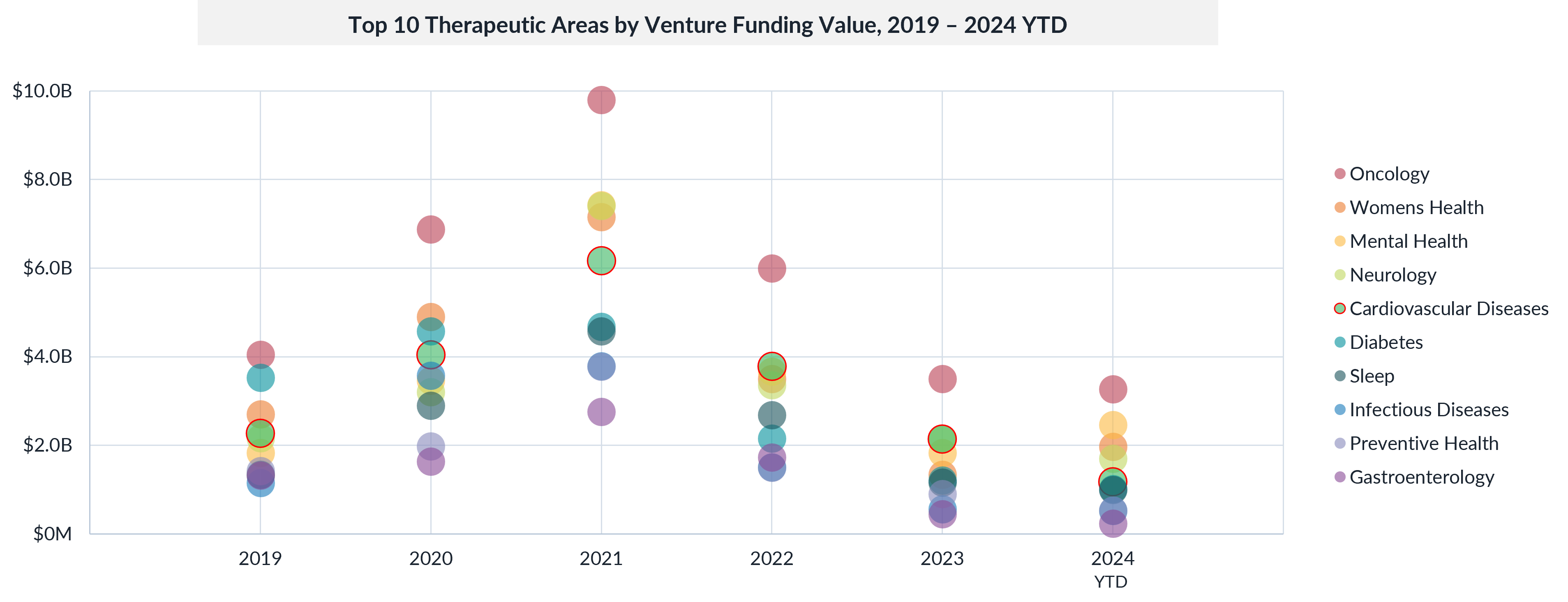

- Despite funding challenges, venture capital for cardiovascular digital health dropped 45% YoY to $2.1 billion in 2023, yet the sector remains a top 5 therapeutic area by funding, showcasing resilience and strong clinical backing (47% of ventures have significant clinical evidence).

- Clinical evidence is a critical success factor in digital health for cardiovascular care, with 47% of ventures demonstrating significant clinical validation (Evidence Signal > 40). Notably, 79% of ventures with digital solutions for clinical trials show robust clinical evidence, emphasising the importance of proven solutions in improving patient outcomes.

- Galen Growth’s latest analysis offers a comprehensive overview of the global digital health ecosystem in cardiovascular care, covering 706 active ventures and investment insights across key regions: US, Europe, Asia Pacific, and the Middle East.

As we mark the centenary of the American Heart Association (AHA), the focus on cardiovascular health has never been more crucial. In tandem with these celebrations, the release of the latest analysis by the Peterson Health Technology Institute (PHTI) on digital technology innovation in hypertension management has drawn attention to this important area. However, it is worth noting that digital innovation in cardiovascular disease often competes for the spotlight, overshadowed by more high-profile issues such as obesity. The Peterson report evaluates the clinical effectiveness and economic impact of digital interventions, summarising its findings with a traffic light rating system. Yet, it is limited in scope, being based on the evaluation of only 12 digital health ventures and the insights of 12 patients.

Galen Growth’s latest in-depth analysis: Advancing Cardiovascular Health: The Impact of Digital Health Innovation, powered by the proprietary HealthTech Alpha platform, broadens this perspective. It offers a comprehensive look at the entire ecosystem of digital technology innovation in the cardiovascular disease therapeutic area, providing a richer and more complete understanding of its landscape. This analysis goes beyond limited case studies to cover the global ecosystem, investment trends, and clinical advancements. It is a crucial resource for stakeholders aiming to make data-driven decisions in the fight against cardiovascular disease.

Cardiovascular diseases (CVDs) are responsible for over 17.9 million deaths globally each year, making them the leading cause of mortality worldwide. Despite advancements in medicine, CVDs have remained the biggest killer of humans for the past century, accounting for 32% of all global deaths. This year marks the 100th anniversary of the American Heart Association (AHA), a pivotal organisation in the fight against heart disease. The centenary celebration is a reminder of the progress made and highlights the need for continued innovation.

The focus on innovation has never been more critical, and digital health is at the forefront of these efforts. Digital health solutions, from artificial intelligence (AI) to remote monitoring devices and mobile apps, transform how CVDs are diagnosed, managed, and treated. By enhancing early detection, personalising care, and empowering patients to take control of their health, these innovations are crucial in reducing the burden of cardiovascular disease.

Galen Growth’s analysis of Digital Health Innovation in Cardiovascular Diseases explores how these cutting-edge technologies and investment trends are shaping the future of cardiovascular care.

A Global Overview of Cardiovascular Health and Digital Health Innovation

Cardiovascular diseases, including hypertension, heart failure, and stroke, continue to demand significant attention from the global health community. As of 2024, 706 active digital health ventures are providing solutions to improve cardiovascular care. The analysis highlights that cardiovascular disease remains a high priority in digital health, ranking third for venture maturity and fourth in the number of active ventures globally.

Key regions leading digital health innovation in cardiovascular care include North America, Europe, and the Asia Pacific, with substantial investments being made across these areas. For instance, North America leads with 278 ventures and $12.4 billion in investments since 2019, while Europe and Asia Pacific follow with 205 and 173 ventures, respectively. These regions are innovation hubs, driving new solutions that help clinicians, hospitals, and patients manage cardiovascular conditions more effectively.

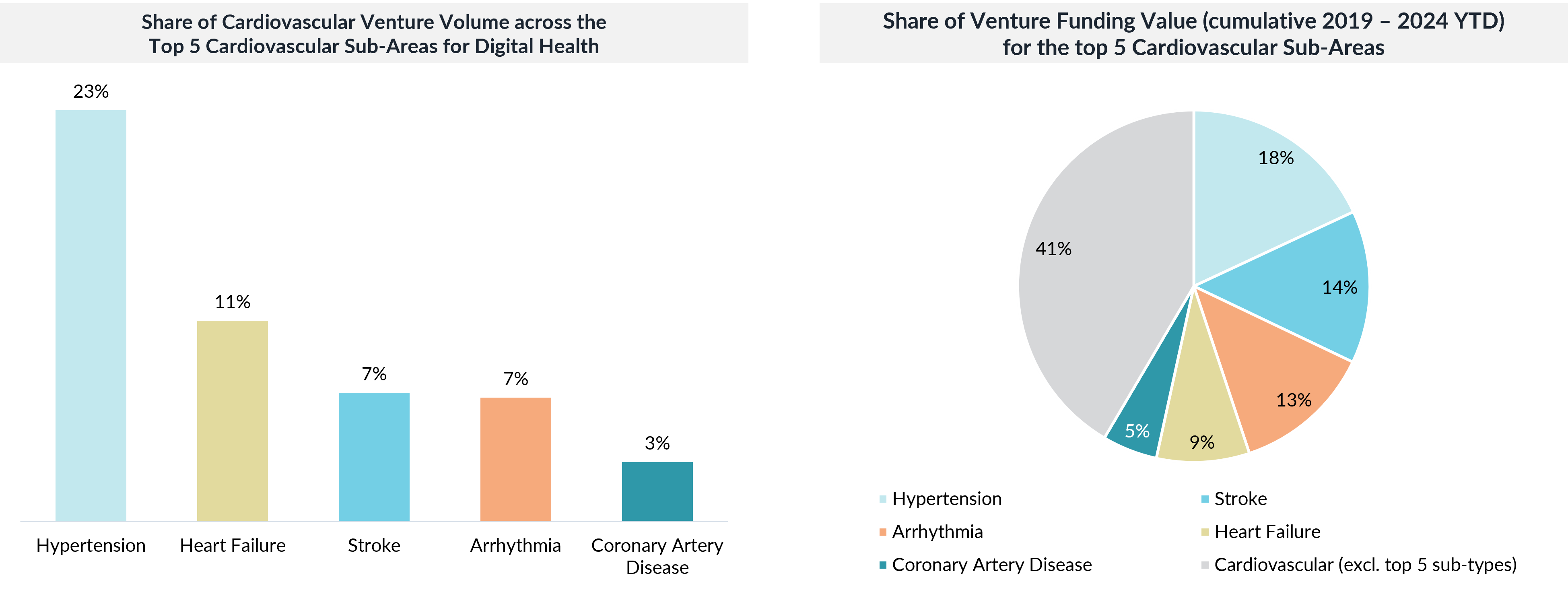

Hypertension is a Focal-Point within Cardiovascular Diseases

Hypertension leads the digital health landscape in terms of both venture volume and capital investment within the cardiovascular disease therapeutic area. Since 2019, over 160 startups worldwide have emerged, securing a combined $4.2 billion in venture funding. These digital health solutions span the entire value chain—from biopharma research and diagnostic tools to patient adherence support in treatment regimens. Notably, the Peterson Health Technology Institute (PHTI) has highlighted digital innovation in hypertension management in its recent publication, underscoring the critical need for scalable solutions in this area. HealthTech Alpha is an indispensable tool for gaining deeper insights into the breadth of available solutions as well as the clinical evidence generated by these solutions.

The Decline in Venture Funding: Challenges and Resilience

One of the key insights from the analysis is the notable decline in venture funding for cardiovascular digital health ventures, dropping 45% year-on-year (YoY) to $2.1 billion in 2023 from $3.8 billion in 2022. Despite this significant reduction, cardiovascular health remains one of the top five funded therapeutic areas within digital health. The global digital health ecosystem saw cardiovascular ventures capturing 6% of the total venture capital funding so far in 2024, a testament to the ongoing interest in this field despite broader economic challenges.

This funding drop reflects a broader trend in the digital health ecosystem, where overall investment in digital health ventures declined due to economic instability and shifting investment priorities. However, the resilience of the cardiovascular sector is notable. Although funding volumes have decreased, cardiovascular health remains a focus for digital health solutions, particularly those leveraging mobile apps, artificial intelligence (AI), and remote monitoring devices.

The Rise of AI and Mobile Apps in Cardiovascular Digital Health

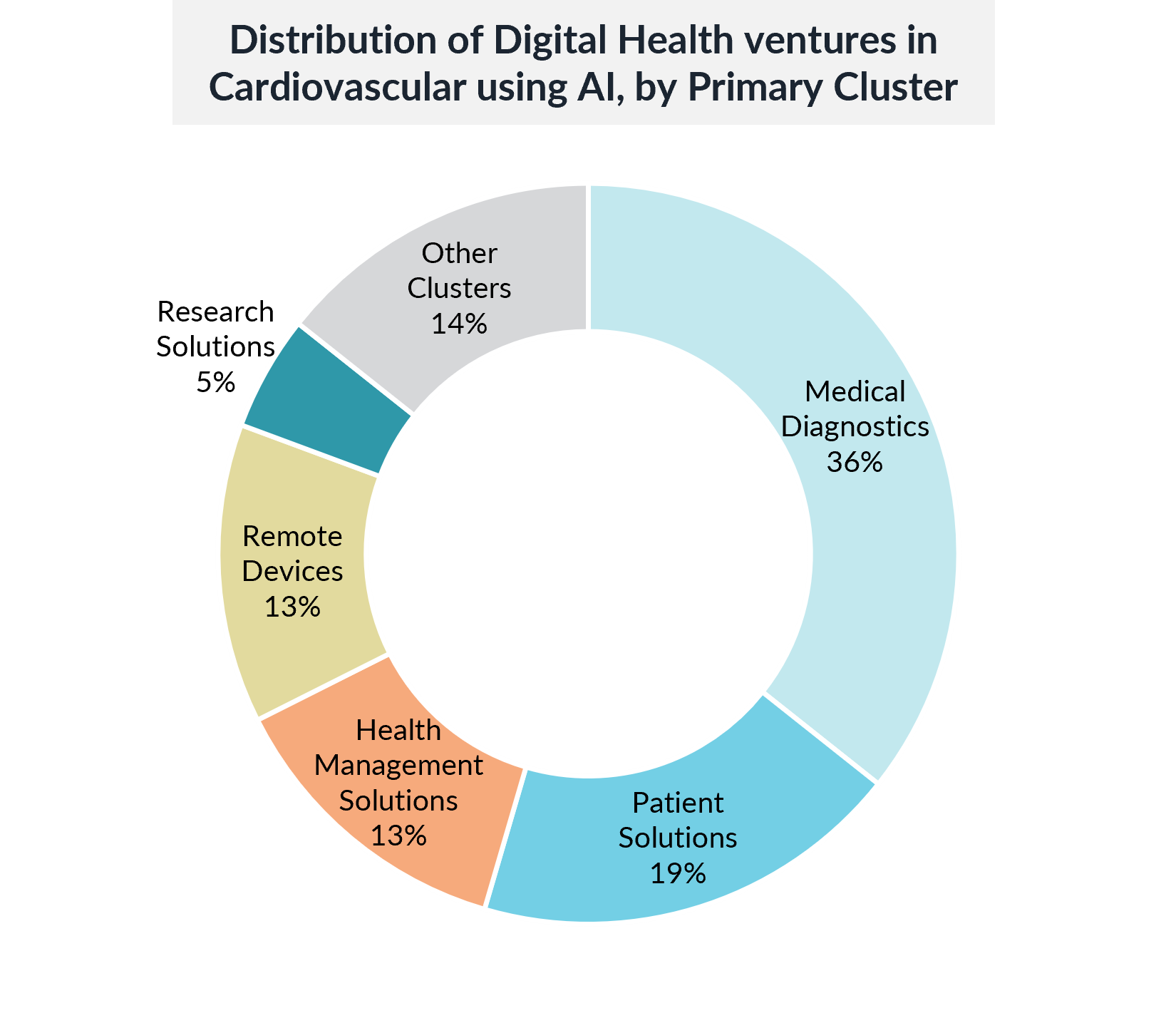

AI is playing a pivotal role in the development of digital health solutions for cardiovascular diseases. According to the analysis, 56% of digital health ventures in cardiovascular care use AI, with 4% employing Generative AI. The application of AI ranges from medical diagnostics to predictive analytics, enabling healthcare professionals to make more informed decisions and improve patient outcomes.

Across the digital health clusters, Medical Diagnostics ventures most frequently use AI technology, with 36% of cardiovascular ventures in this cluster integrating AI into their products. These AI-driven tools assist in diagnosing complex conditions such as atrial fibrillation, heart failure, and coronary artery disease, providing clinicians with more accurate and timely information.

Mobile applications form a significant portion of the digital health products developed for cardiovascular care. The analysis reveals that 46% of cardiovascular digital health products are mobile apps, highlighting the trend towards patient empowerment and self-management. These apps allow patients to track their health metrics, monitor symptoms, and share data with their healthcare providers, improving engagement and outcomes.

Evidence-Based Solutions: Clinical Trials and Regulatory Approvals

A key feature of successful digital health ventures is the ability to provide evidence-based solutions. Clinical trials and regulatory approvals are critical in demonstrating the efficacy of digital health products in improving patient outcomes. The 2024 analysis reveals that 47% of cardiovascular digital health ventures have an Evidence Signal score greater than 40, meaning they have substantial clinical backing through peer-reviewed studies, regulatory filings, and clinical trial results.

Notably, ventures based in Europe lead the way in terms of clinical evidence, with 52% of European cardiovascular digital health companies having an Evidence Signal score greater than 40. Moreover, ventures involved in clinical trials show robust clinical evidence, with 79% scoring above 40. This data underscores the importance of clinical evidence in the success and adoption of digital health products as healthcare providers and patients increasingly seek proven solutions. Read Galen Growth’s report on Clinical Strength in Digital Health for further details on this topic.

The Evolution of Cardiovascular Ventures: From Remote Monitoring to Digital Therapeutics

The focus of digital health ventures in cardiovascular care has evolved significantly over the past decade. In the early 2010s, most ventures were concentrated on remote monitoring devices and diagnostic tools. However, since 2019, there has been a marked shift towards patient-centric solutions, including digital therapeutics and disease management tools.

Digital therapeutics are software-driven treatments that provide patients with evidence-based interventions to manage or treat diseases. In cardiovascular care, these solutions are designed to help patients manage chronic conditions such as hypertension and heart failure. Digital therapeutics also offer the potential to complement or even replace traditional drug-based treatments in some cases, providing patients with more accessible and personalised care.

Digital medical diagnostics tools play a critical role in advancing cardiovascular disease management, enabling earlier and more accurate detection of conditions such as hypertension, arrhythmias, and heart failure. These tools harness technologies like AI, image analysis, and remote monitoring to deliver insights that empower both patients and clinicians to make data-driven decisions. Reflecting the value of these innovations, the Medical Diagnostics cluster captured 33% of the total funding value deployed cumulatively in 2024 YTD to take the top spot among the Cardiovascular-focused ventures, with 30% of cardiovascular-focused ventures dedicating themselves to this area. This investment highlights the potential of digital diagnostics to transform cardiovascular care, reduce the burden on healthcare systems, and improve patient outcomes through timely intervention and personalized care.

The Importance of Strategic Partnerships in Driving Innovation

Strategic partnerships are essential to the growth and success of digital health ventures. The 2024 analysis highlights partnerships in cardiovascular digital health solutions accounted for 13% of all global digital health partnerships in 2023. This steady level of collaboration, despite a 6% decline in overall global partnerships, indicates the continued importance of cardiovascular solutions to corporate and academic partners.

Healthcare providers, including hospitals and health systems, are increasingly partnering with digital health ventures to integrate new diagnostic and treatment tools into their clinical workflows. Notably, medical diagnostics ventures accounted for 29% of all cardiovascular partnerships, reflecting these solutions’ critical role in improving clinical outcomes.

Additionally, AI-driven partnerships have become more common, with 56% of cardiovascular digital health ventures using AI in some capacity. Generative AI, although still in its early stages, is expected to play a growing role in transforming healthcare delivery in the coming years. As AI evolves, its potential to enhance diagnostics, personalise treatments, and streamline clinical workflows will likely drive further innovation and investment in cardiovascular care.

Regional Insights: North America, Europe, and Asia Pacific

The digital health ecosystem for cardiovascular solutions is highly regionalised, with North America, Europe, and Asia Pacific dominating the landscape. North America remains the largest market, with 262 ventures and $10.6 billion in investments. The United States, in particular, leads the charge in developing cutting-edge solutions for cardiovascular care, with a strong focus on AI, remote monitoring devices, and clinical trial validation.

Europe, meanwhile, boasts 184 cardiovascular ventures, with significant investment in clinical trials and regulatory approvals. European companies prioritise evidence-based solutions, with 52% of ventures scoring highly on clinical evidence metrics. The region’s emphasis on clinical validation positions it as a leader in developing rigorously tested and effective digital health tools for cardiovascular care.

In the Asia Pacific region, China and Singapore are key players in the cardiovascular digital health ecosystem. The analysis indicates that between 2019 and YTD 2024, 45% of venture funding in the Asia Pacific region was allocated to ventures in China, with 30% of these ventures being founded in the country. These ventures are increasingly focusing on AI and mobile health solutions to address the growing burden of cardiovascular diseases in the region.

Conclusion: The Future of Digital Health in Cardiovascular Care

Despite the challenges posed by declining venture funding and economic uncertainty, the digital health sector remains committed to improving cardiovascular care. Advancing Cardiovascular Health: The Impact of Digital Health Innovation highlights the ongoing innovation across the value chain, including mobile apps, remote monitoring devices, and digital therapeutics, all of which have the potential to transform how cardiovascular diseases are managed and treated.

As healthcare providers, investors, and policymakers continue to recognise the value of digital health solutions, we can expect further advancements in the coming years. Strategic partnerships, clinical validation, and patient-centric solutions will remain key drivers of success, ensuring that digital health ventures play a central role in reducing the global burden of cardiovascular diseases. The future of cardiovascular care lies in integrating these cutting-edge technologies into mainstream healthcare, empowering patients and clinicians alike to achieve better outcomes.