- Biopharma R&D faces challenges of low productivity, high failure rates, and lengthy timelines, necessitating a focus on efficiency and effectiveness.

- Digital Health tools, including AI and machine learning, offer opportunities to accelerate drug development, reduce costs, and personalize care.

- Integration of Digital Health tools, including Generative AI, promises to transform the R&D landscape and address longstanding productivity challenges in biopharma.

Biopharma R&D has long grappled with low productivity, high failure rates, and lengthy development timelines. As biopharma companies confront patent cliffs and the urgency to replenish drug pipelines, they prioritize enhancing R&D efficiency. The emergence of Digital Health tools in biopharma research marks a significant shift, propelling traditional firms to the forefront of technological advancements.

Digital Health technologies like Artificial Intelligence (AI) and machine learning empower biopharma to identify novel drug targets, optimize drug properties, and predict efficacy more accurately. They accelerate drug development, trim costs, and hasten therapeutics to market. Beyond the lab, these innovations improve clinical trial design, cut patient recruitment time, and enhance patient stratification. Digital biomarkers and remote patient monitoring enable personalized care and better disease management.

Leveraging the power of big data and various AI forms, including Generative AI (GenAI), biopharma are beginning to see progress. Integrating Digital Health tools is poised to transform the R&D landscape, addressing longstanding productivity challenges.

Our blog post delves into key insights from the “Algorithms to Cure: How Biopharma is Redefining Innovation with AI” report, previewing Digital Health’s pivotal role. We detail the ecosystem, emphasizing the significance of funding, AI, and partnerships. Our analysis centers on private ventures, covering ecosystem growth, top partners, regulatory approvals, and venture funding.

Partnerships Driving the Digital Health Revolution

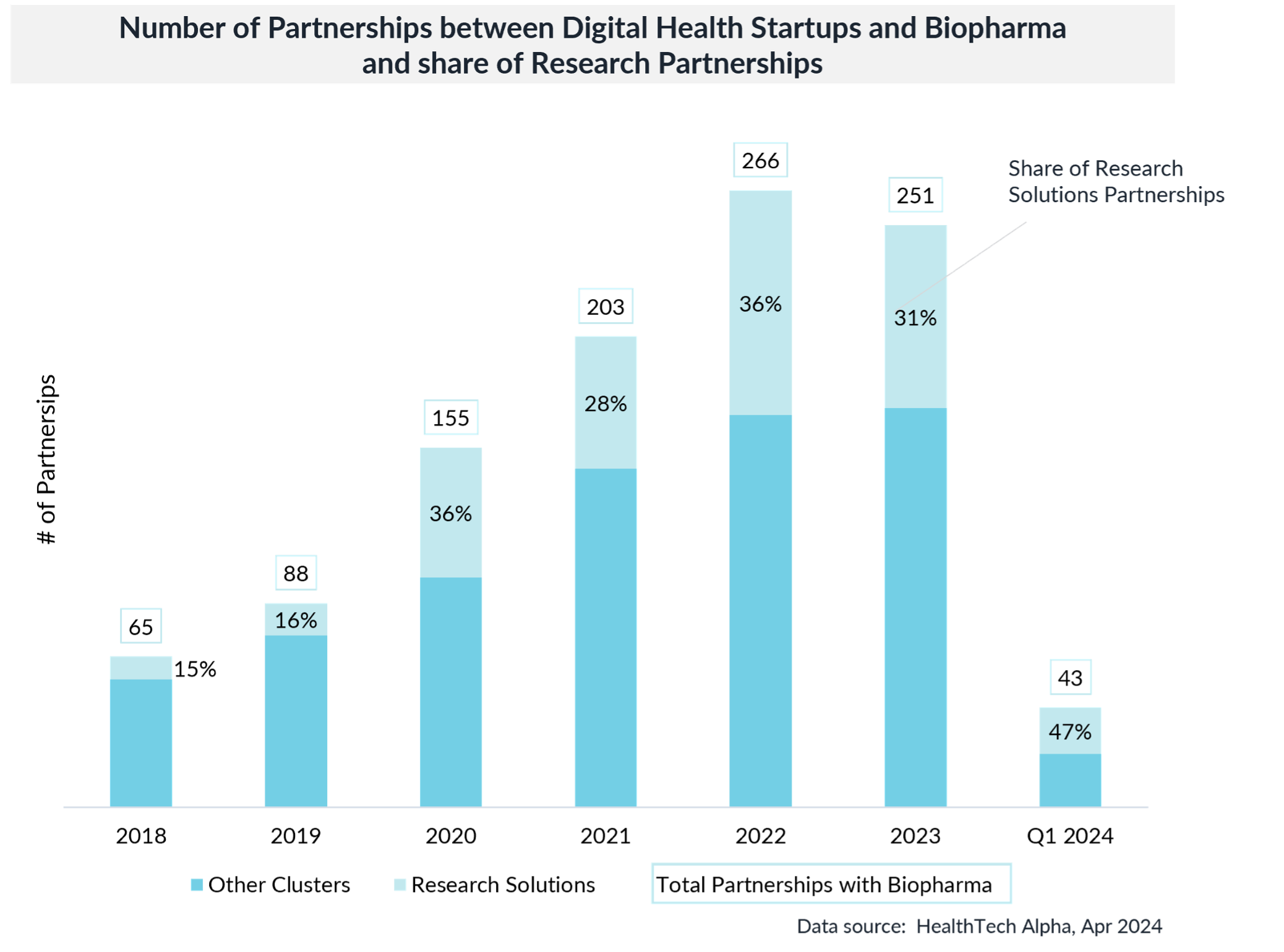

The data reveals a significant shift in the focus of partnerships between biopharma and Digital Health ventures. From 2018 to 2023, the number of such partnerships has grown by an impressive 3.9x. The emphasis has shifted from Patient Solutions and Medical Diagnostics (combined 45% in 2018) to Research Solutions (32% in 2023). This shift has resulted in an increasing trend for clinical development productivity as biopharma companies leverage the power of Digital Health tools to streamline their research and development processes.

Concentration of Partnerships in the Biopharma Sector

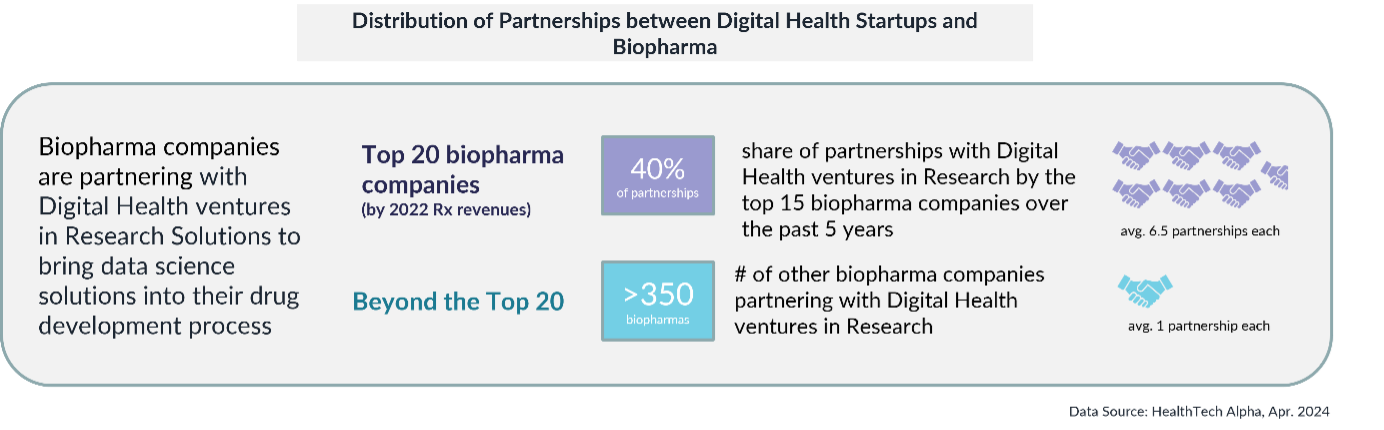

Despite the benefits of Digital Solutions, the growing number of partnerships are still concentrated within only a few companies. The top 20 biopharma companies, based on 2022 sales, were accountable for over 40% of the Digital Health partnerships. The remaining 60% of partnerships are distributed among more than 350 other biopharma companies, with an average of only one partnership disclosed per company. This concentration of partnerships among the industry’s leading players highlights their strategic focus on leveraging Digital Health solutions to maintain their competitive edge while the remaining 60% are putting their future at risk.

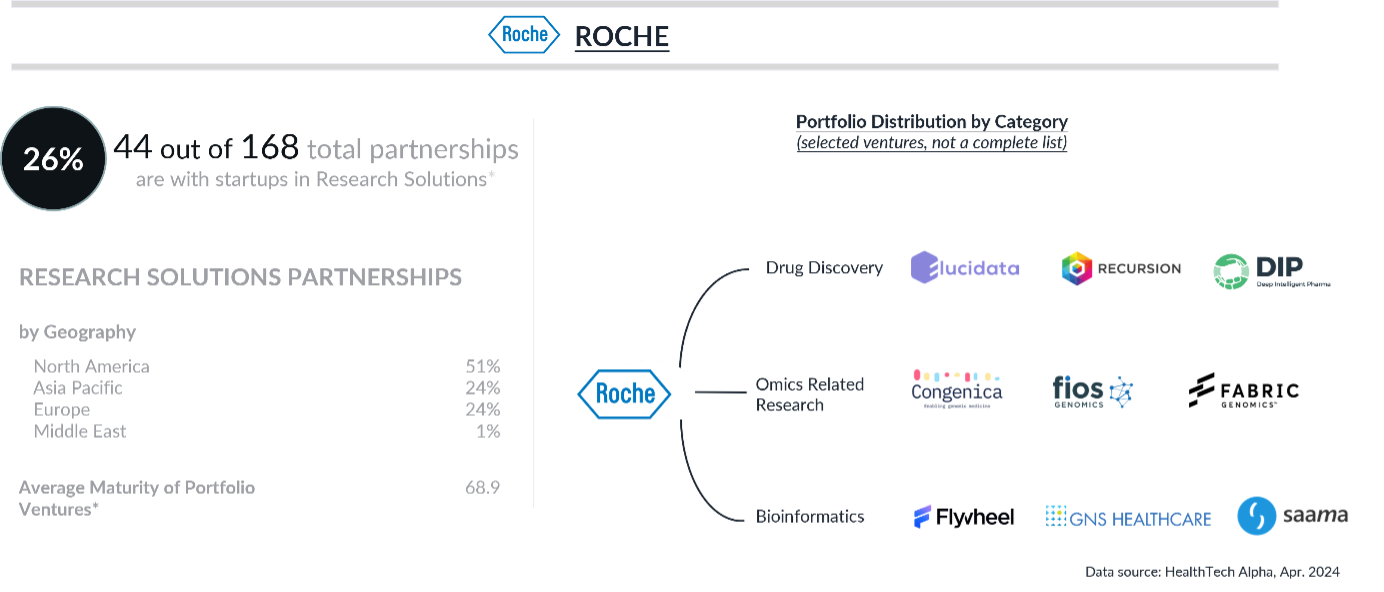

The top 5 most active corporate partners for Digital Health ventures in the Research Solutions Cluster are all major biopharmaceutical companies. Leading the pack is Roche, with a staggering 44 announced partnerships comprising 26% of its Digital Health partner portfolio (find Roche on HealthTech Alpha). These Roche-backed Research Solutions ventures were founded primarily in North America, Asia Pacific, and Europe, reflecting the company’s global reach.

The Rise of AI and Generative AI in Research Solutions

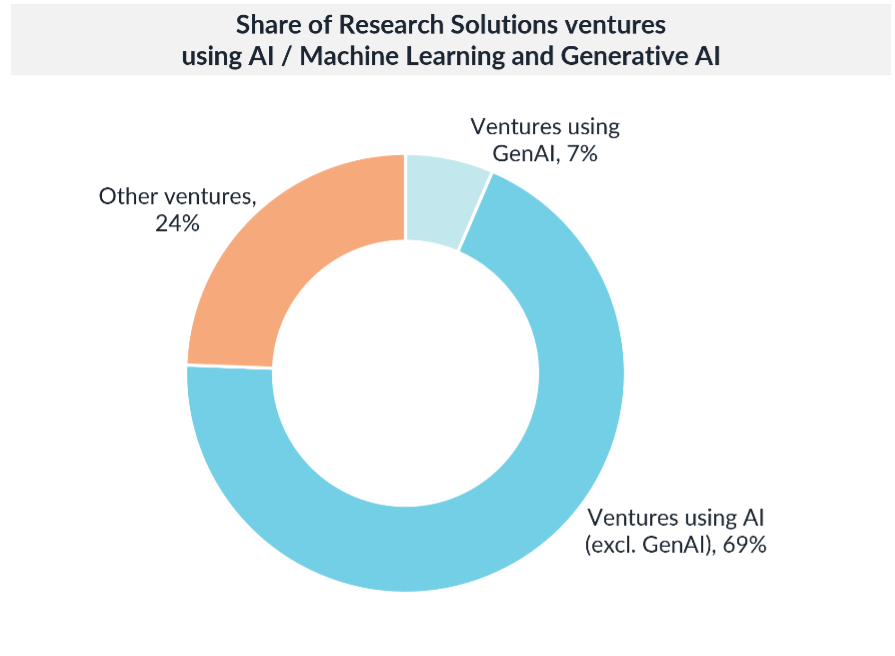

Across the Research Solutions domain, 76% of ventures are utilising AI (including GenAI) technology. This technological integration has demonstrated the ability to reduce drug discovery timelines from 3-6 years to an average of 17 months (LEK webinar; Oct. 2023, “AI in R&D: Artificial Intelligence for Authentic Innovation”). The power of AI and GenAI is transforming the biopharma industry, enabling faster and more efficient drug discovery and development.

For more information and insights into Generative AI for Digital Health, download Galen Growth’s “GenAI: Hype or Reality” report at galengrowth.com/research.

Clinical Strength and Impact of Digital Health Solutions

The Digital Health ecosystem has matured beyond prototypes and proof-of-concept stages.

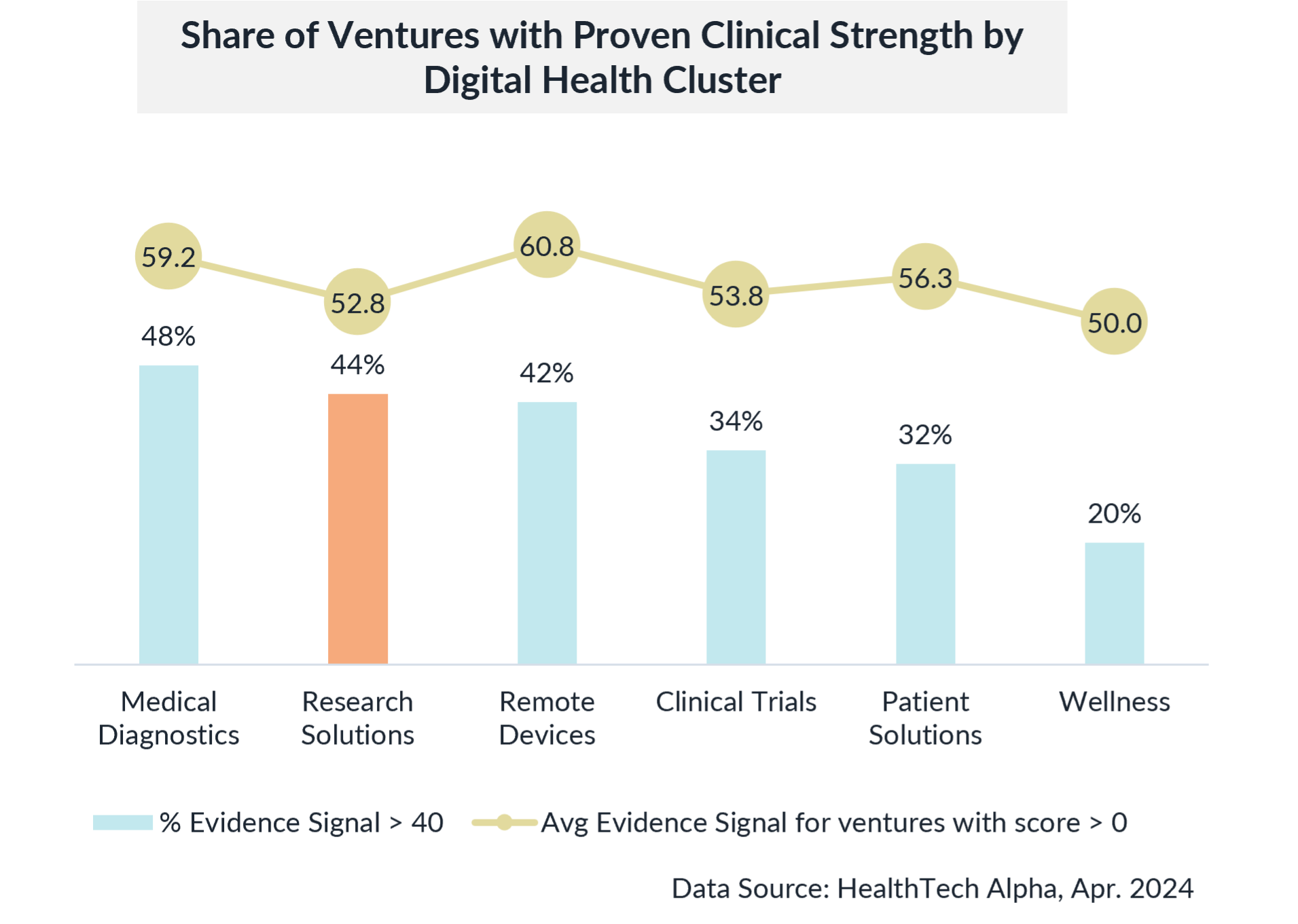

In the Research Solutions segment, 44% of ventures have proven Clinical Strength, with an Evidence Signal greater than 40. Galen Growth’s Evidence Signal is based on clinical trials, regulatory filings, and peer-reviewed publications. This metric underscores the tangible impact of these Digital Health solutions on patient outcomes, further validating their value proposition to biopharma companies.

For more information on the Evidence Signal methodology and insights into Clinical Strength in Digital Health, download Galen Growth’s Clinical Strength in Digital Health report at galengrowth.com/research.

Rising Stars in Research Solutions

Galen Growth’s HealthTech Alpha platform harnesses unparalleled data, intelligence, and insights, enabling analysis of critical data points to spotlight high-potential young ventures in Digital Health. With access to over 650 million data points and our exclusive venture signals analytics, we have considered ventures with significant momentum that are developing clinical evidence and have begun seeking partnerships within the Digital Health ecosystem. In a competitive landscape, some of the rising stars are listed below:

| Founding | Country | Inc. Year | Alpha Score |

| myNEO Therapeutics | Belgium | 2018 | 52.0 |

| Concr | United Kingdom | 2018 | 53.5 |

| VantAI | United States | 2020 | 44.8 |

| Known Medicine | United States | 2020 | 51.9 |

| Epigene Labs | France | 2019 | 54.6 |

| Kaiko | Netherlands | 2021 | 39.8 |

| OneThree Biotech | United States | 2018 | 54.6 |

| ADLIN Science | France | 2020 | 44.6 |

| Geneyx (ג’ניקס ג’נומיקס בעמ)” | Israel | 2018 | 52.1 |

| Epistra (エピストラ) | Japan | 2018 | 44.1 |

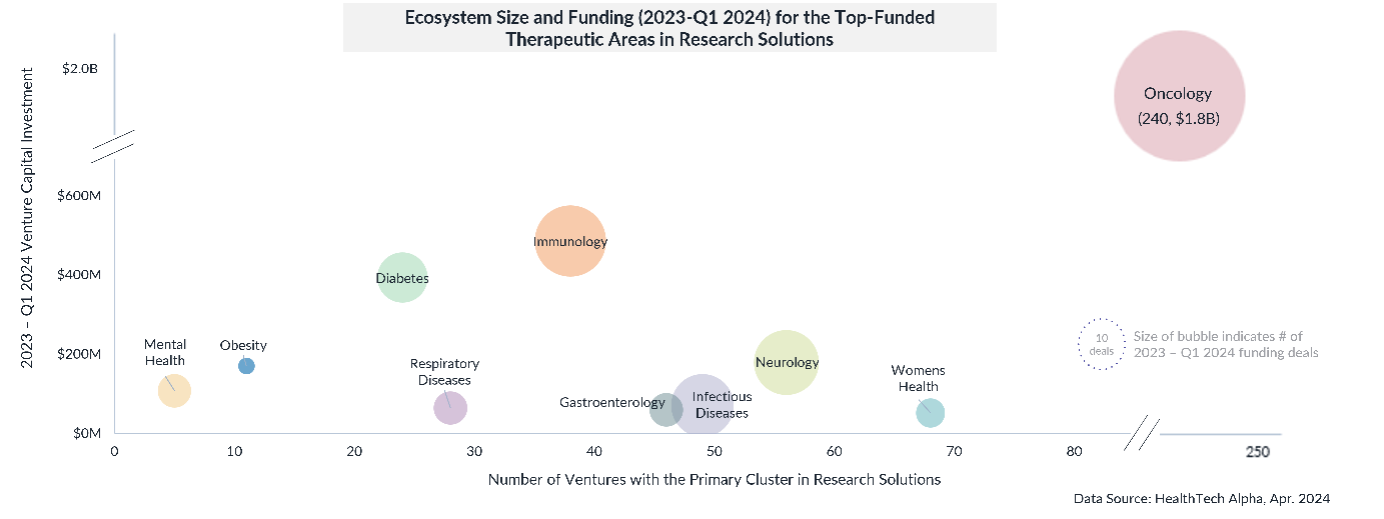

Oncology: The Dominant Therapeutic Area in Research Solutions

Within the Research Solutions domain, 36% of the ventures have solutions that focus on Oncology, making it the most significant therapeutic area by venture volume. It is the most extensive area by the number of ventures and secures a dominant share (46%) of the total partnerships and venture funding (39%) within the cluster.

Funding Challenges in the Digital Health Ecosystem

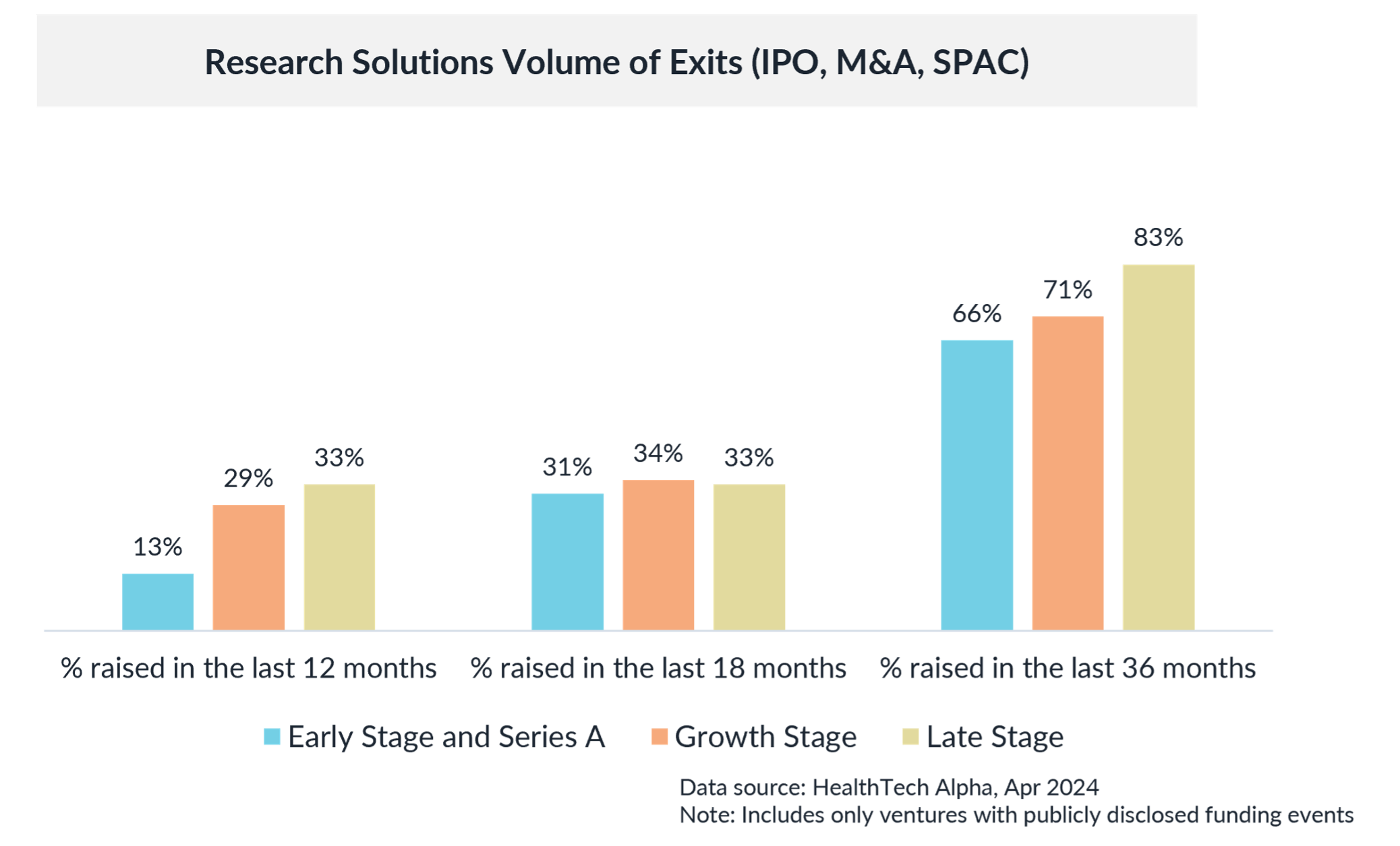

Despite the advancements in the Digital Health sector, financial pressure remains high across the ecosystem. Cumulative Digital Health venture funding worldwide closed at $22.0B in 2023, down 37% compared to 2022. Venture funding in Research Solutions also tumbled 35% over 2023 to close the year at $3.9B, with 76% of the capital in 2023 deployed to ventures founded in North America.

A concerning trend emerges when examining the funding landscape for Research Solutions ventures. In North America and Asia Pacific, only a third or fewer of Growth-Stage ventures have successfully raised funding in the past 18 months, indicating a weak funding strength. In contrast, 75% of European-founded ventures have secured funding during the same period. This disparity highlights the need for biopharma companies to exercise due diligence when selecting their venture partners to ensure long-term sustainability and success.

Conclusion to Biopharma R&D

As highlighted in our research publication, “Algorithms to Cure: How Biopharma is Redefining Innovation with AI,” the integration of Biopharma R&D Digital Health tools marks a transformative shift. This evolution empowers biopharma firms to harness big data, AI, and GenAI, catalyzed by partnerships with Digital Health ventures. This collaboration enhances research productivity and elevates patient outcomes. As the Digital Health ecosystem advances, biopharma entities must navigate funding and strategic partnerships to drive industry evolution.