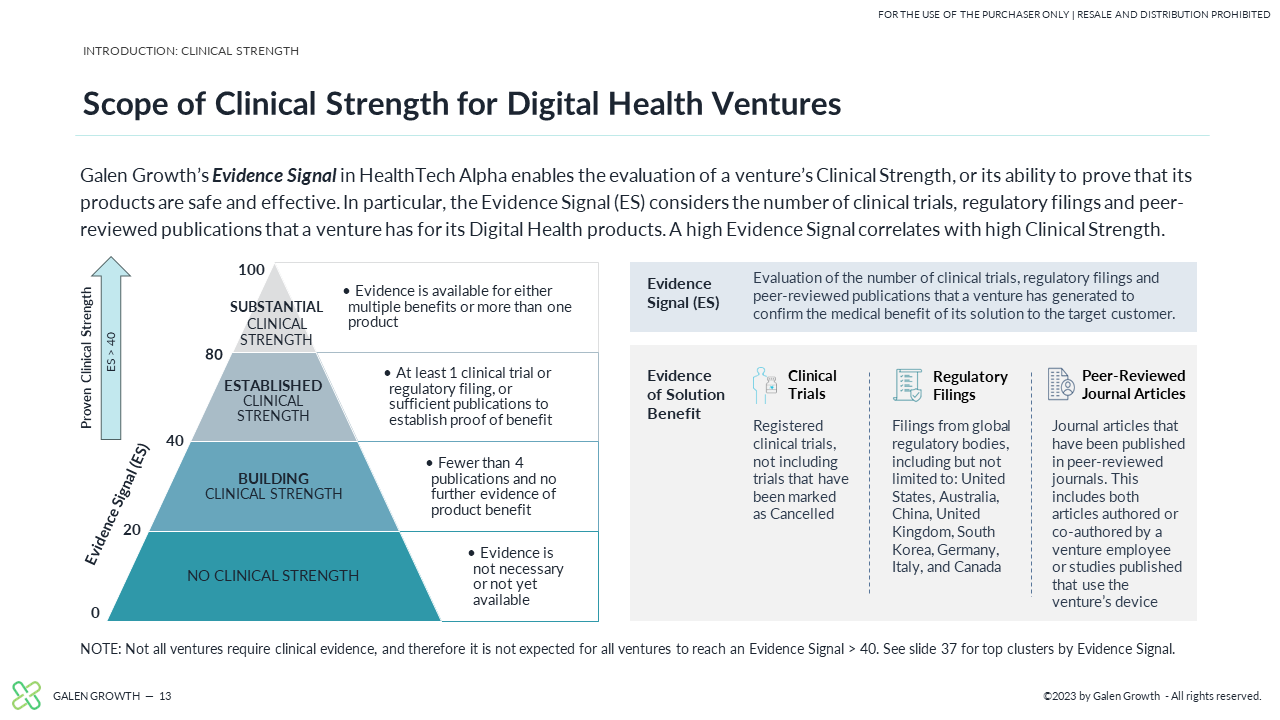

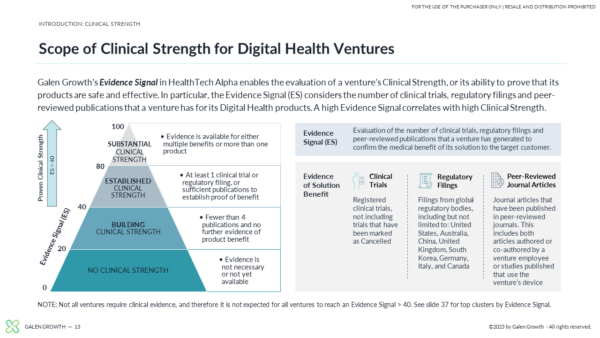

While a great idea and good business acumen have scaled strong Digital Health companies over the past decade, there is a shift in focus to proof points, with Clinical Strength being a priority data point. Galen Growth first published its industry-leading research report in 2022 looking at the Clinical Strength of a Digital Health venture by evaluating a venture’s clinical trials, regulatory filings, and peer-reviewed publications.

This report dives deep into the Global Digital Health ecosystem to demonstrate the importance of proof points for ventures to attract funding, types of products that have proven Clinical Strength, as well as the growth of proof points and its impact on venture success.

Key Insights

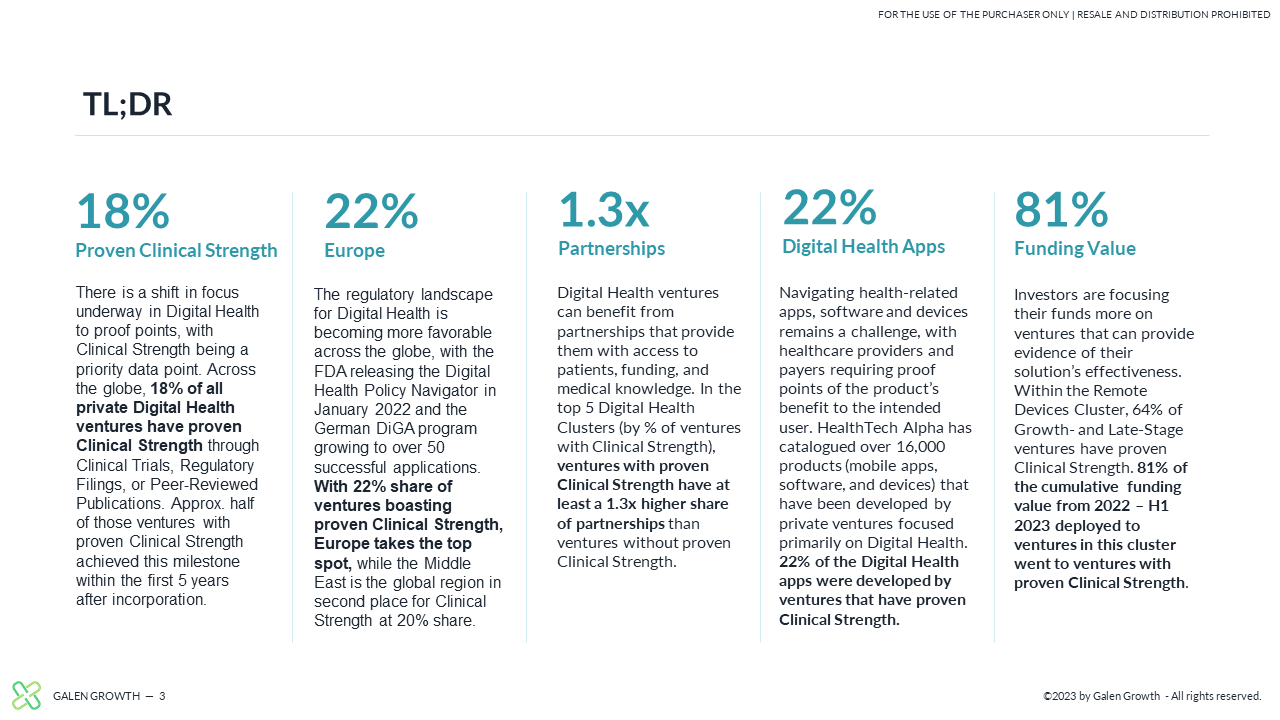

- There is a shift in focus underway in Digital Health to proof points, with Clinical Strength being a priority data point. Across the globe, 18% of all private Digital Health ventures have proven Clinical Strength through Clinical Trials, Regulatory Filings, or Peer-Reviewed Publications.

- The regulatory landscape for Digital Health is becoming more favorable across the globe, with the FDA releasing the Digital Health Policy Navigator in January 2022 and the German DiGA program growing to over 50 successful applications. With 22% share of ventures boasting proven Clinical Strength, Europe takes the top spot

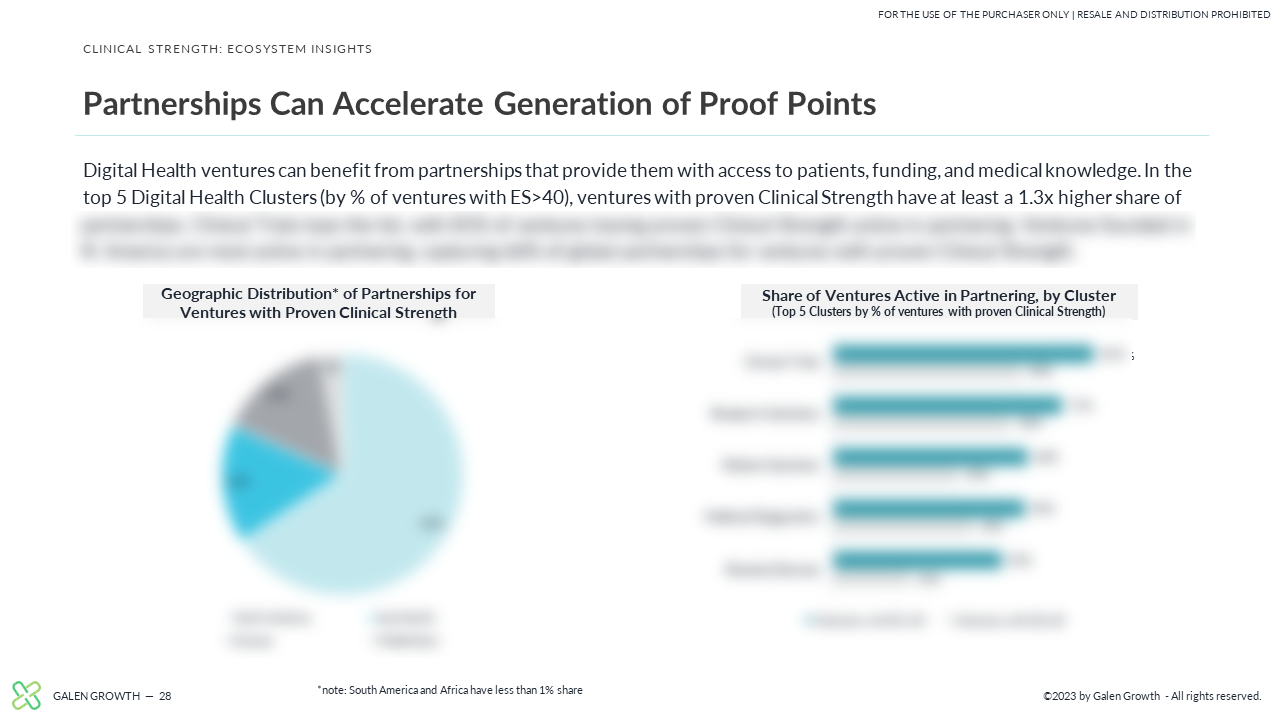

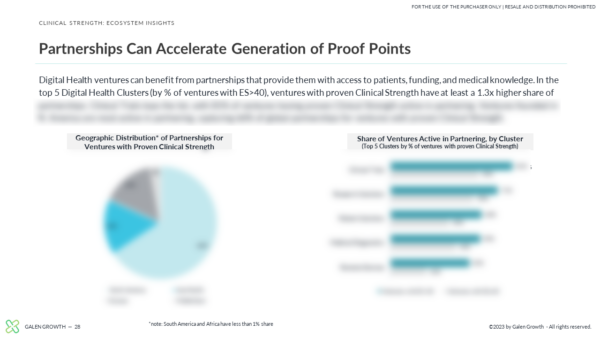

- Digital Health ventures can benefit from partnerships that provide them with access to patients, funding, and medical knowledge. In the top 5 Digital Health Clusters (by % of ventures with Clinical Strength), ventures with proven Clinical Strength have at least a 1.3x higher share of partnerships than ventures without proven Clinical Strength.

- Navigating health-related apps, software and devices remains a challenge, with healthcare providers and payers requiring proof points of the product’s benefit to the intended user. HealthTech Alpha has catalogued over 16,000 products (mobile apps, software, and devices) that have been developed by private ventures focused primarily on Digital Health. 22% of the Digital Health apps were developed by ventures that have proven Clinical Strength.

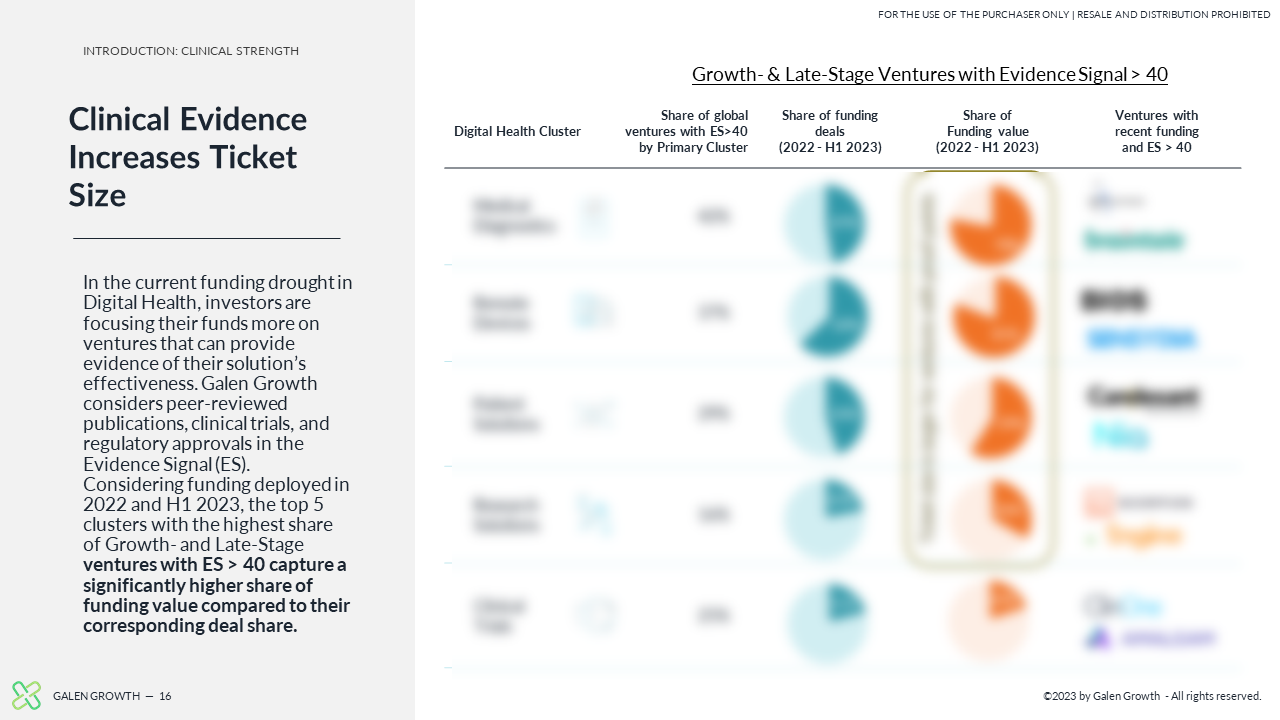

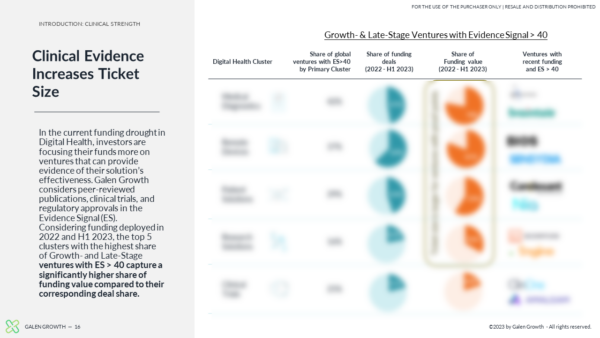

- Investors are focusing their funds more on ventures that can provide evidence of their solution’s effectiveness. Within the Remote Devices Cluster, 64% of Growth- and Late-Stage ventures have proven Clinical Strength. 81% of the cumulative funding value from 2022 – H1 2023 deployed to ventures in this cluster went to ventures with proven Clinical Strength.

The “Global Digital Health Innovation Thematic Report on Clinical Strength in Digital Health” report includes data on the following companies: CyMedica, Neurophet, AstraZeneca, Roche, Novartis, NHS, Mayo Clinic, Tempus, Lunit, 23andME, SOPHiA Genetics, Helix, HeartFlow, Idoven, Health.io, Saluda Medical, Synaptive Medical, Augmedics, Spect, Owlstone Medical, Mojo Vision, Eargo, Finni Health, Densitas, Hygieia, Selfapy, Perspectum, Castor, Eyetelligence, SigTuple Technologies, The Intellect Company, Droobi Health, Neteera Technologies, Distalmotion, Aledade, Cognito Therapeutics, EOFlow, Lucira, Winterlight Labs, Limbix, XRHealth, Medtronic, Pfizer, Cambridge Cognition, Big Health, Geisinger, Chugai Pharmaceutical, MD Anderson Cancer Center, Novo Nordisk, Point32Health, Freenome, Biofourmis, Generate Biomedicines, Diabeloop, Valera Health

Galen Growth is pleased to share with you our latest insights on the Clinical Strength of Digital Health ventures. We define the boundaries of this important topic and connect the importance of proof points for funding, product development, and partnerships. Our analysis focuses on private ventures and includes ecosystem growth, most active partners, regulatory approvals and venture funding.

HealthTech Alpha, a Galen Growth proprietary solution, and the global leading Digital Health private market data, intel and insights platform powers this report!

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| ABOUT GALEN GROWTH | |

| INTRODUCTION: 10 pages, 5 charts, 2 tables | |

| ECOSYSTEM INSIGHTS: 11 pages, 11 charts, 2 tables | |

| CLUSTER FOCUS: 4 pages, 3 charts, 1 table | |

| THERAPEUTIC FOCUS: 4 pages, 4 charts, 1 table | |

| INVESTMENT INSIGHTS: 3 pages, 3 charts, 2 tables | |

| DEEP DIVES: 15 pages, 16 charts, 4 tables | |

| NOTEWORTHY: 3 pages, 3 tables | |

| KEY INFORMATION |

BASIC

-

Purchase and download this report

-

Access to limited data in HealthTech Alpha

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level