Venture capital funding in H1 2025 favoured fewer, larger bets, rewarding clinical proof and late-stage maturity over early-stage hype.

TL;DR

- What is the total Digital Health funding in H1 2025? → $12.1B across 616 deals, down 13% year-over-year

- Which region showed the strongest growth in Digital Health funding? → Europe, with a 1.65x increase led by the UK

- Where did mega deals concentrate? → In AI-enabled Health Management and Research Solutions ventures

- Which therapeutic areas led Digital Health investment? → Oncology ($1.8B), Mental Health ($1.0B), and Cardiovascular Diseases ($1.0B)

- What happened with Digital Health exits? → Only 6 IPOs and 107 M&As, with slow exit activity

- What’s the key takeaway in Digital Health funding trends? → Proof and outcomes now outweigh hype—late-stage, validated ventures dominate

Global Snapshot: Precision Replaces Hype

The first half of 2025 marked a turning point in Digital Health funding. While global venture funding declined 13% year-over-year, this contraction masks a broader recalibration. Investors are moving away from high-volume, early-stage bets to focus on fewer, larger, later-stage investments with proven value.

$12.1B was invested across 616 deals globally, with average late-stage deal size rising 1.6x compared to H1 2024. Mega deals now account for 40% of all deployed capital, with 65% of that funding targeting AI-driven ventures, particularly those offering clinically validated productivity gains.

In short, digital health funding isn’t declining—it’s maturing.

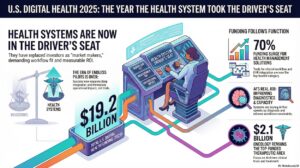

US+: Leadership Under Pressure

Despite remaining the largest regional market, Digital Health funding in North America saw a significant 29% drop in funding YoY to $7.5B. U.S. deal volume continued to decline, influenced by macroeconomic uncertainty, capital constraints, and investor caution.

Still, North American ventures led the mega-deal tally and attracted the majority of late-stage capital. Oncology dominated therapeutic funding, but key areas like Mental Health and Women’s Health suffered steep declines. U.S. IPO activity was modest at best, with only a handful of exits bucking the trend.

Europe: The Rising Force in Digital Health funding

Europe stood out in H1 2025 with a remarkable 1.65x increase in digital health venture funding over the same period in 2024, reaching $3.3B. The UK led the charge with $1.29B, followed by France and Germany.

Seven European ventures secured mega-deals in H1 2025—evidence of the continent’s increasing capacity to scale. Research Solutions captured the largest share of funds, while Cardiovascular ventures enjoyed a boost from a landmark $260M deal for Neko Health.

Europe also outpaced all other regions in clinical validation, with 42% of ventures exhibiting a strong Evidence Signal, in a funding environment demanding outcomes that matter.

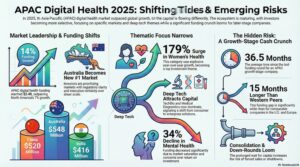

Asia Pacific: Resilient but Recalibrating

Digital health funding in Asia Pacific held steady at $1.0B, a modest 10% YoY decline. Series C and later-stage investments outpaced early-stage rounds, a sign of pipeline maturation.

Medical Diagnostics led regional funding, capturing 26% of deployed capital, while Women’s Health saw a dramatic upswing—up 611%—driven by a few standout deals.

The region is also making strides in strategic partnerships. APAC ventures accounted for 30% of global partnerships in Q2, up from 25% in Q1, as local ecosystems pursue alliances to weather funding volatility.

Clusters: Health Management and Research Solutions Dominate

Digital Health clusters saw clear winners in the first half of 2025. Topping the list:

- Health Management Solutions – $2.7B across 101 deals

- Research Solutions (TechBio) – $2.4B

- Medical Diagnostics – $1.6B

These three clusters alone accounted for over half of global Digital Health funding. They reflect growing investor focus on AI-enabled tools that reduce care costs, streamline workflows, and power scientific discovery.

Interestingly, clusters such as Population Health Management and Wellness also saw moderate upticks, indicating demand for broader, system-level, and consumer-centric solutions.

Therapeutic Areas: AI Meets Clinical Need

From an investment perspective, three therapeutic areas captured more than $3B in H1 2025:

- Oncology – $1.8B

- Mental Health – $1.0B

- Cardiovascular Diseases – $1.0B (up 76%)

Notably, ventures in Cardiovascular and Women’s Health posted the most substantial funding momentum, particularly outside the U.S. This trend suggests a shift toward areas where digital solutions can address clear clinical pain points—and where outcomes are measurable.

Exits: A Mixed Bag

The exit environment remained difficult. H1 2025 saw:

- 113 total exits, including

- 6 IPOs

- 107 M&As

- 70% of M&A activity was venture-to-venture

IPO volume ticked up slightly, but pricing challenges persisted. Only one company closed above its listing price by June 30. The market continues to favour private secondary transactions and small-to-mid M&A as the primary exit routes.

This signals a longer wait for liquidity, especially for unicorns that burned through late-stage capital in recent years.

Notable Digital Health Deals

The first half of 2025 witnessed significant capital movement in both funding and exit transactions within the digital health sector.

Top 3 Digital Health Funding Deals (H1 2025, by value):

- Isomorphic Labs received a $600.0M strategic investment in March 2025, highlighting continued large-scale investment in AI-driven drug discovery and health research solutions.

- Pathos secured $365.0M in Series D funding in May 2025, indicative of strong investor confidence in advanced patient solutions.

- Truveta raised $320.0M in Series C funding in January 2025, demonstrating investment in data-driven health insights and platforms.

Why This Matters

For Industry

Hospitals, pharma companies, and payors are under pressure to innovate—but they’re done experimenting. They’re backing ventures that can integrate into existing workflows, demonstrate ROI, and reduce complexity. The end of “spray and pray” innovation is here.

For Investors

The productivity premium is real. Growth and late-stage ventures with validated clinical outcomes and economic value are getting funded. Early-stage funding remains subdued—unless you’re AI-powered and evidence-rich.

For Startups

Expectations have shifted. It’s not enough to be promising—you need to be proven. Funding is available, but the bar is higher: proof points, strong leadership, commercial traction, and strategic fit are now prerequisites.

Call to Action: Navigate with Precision

At Galen Growth, we don’t just track the ecosystem—we structure it.

Whether you’re an investor seeking validated targets, a corporation scanning for strategic partnerships, or a startup raising your next round, HealthTech Alpha can help you cut through the noise.

👉 Explore HealthTech Alpha—the leading GenAI-powered platform for Digital Health intelligence

👉 Download our complete Q2 2025 Report for all insights, data, and forecasts

👉 Talk to our team to see how we can help inform your next strategic move

Let’s move beyond the buzz. The future of Digital Health will be built by those who deliver—and those who know where to look.

About Galen Growth

Galen Growth helps healthcare leaders, investors, and innovators turn digital health data into a strategic advantage. As GenAI reshapes business expectations around efficiency and speed, organisations must rethink how they access and apply market intelligence. Galen Growth’s proprietary platform, HealthTech Alpha, combines healthcare expertise with GenAI to deliver targeted, clinically relevant insights, enabling clients to focus their resources on strategic decision-making rather than manual data gathering.

Key Information

This article was written using analysis powered by HealthTech Alpha Copilot, the leading GenAI-powered search copilot for Digital Health.

Disclaimer: This article is provided for informational purposes only and does not constitute investment, legal, or medical advice. While every effort has been made to ensure the accuracy of the information presented, Galen Growth makes no guarantees regarding completeness or reliability. Readers should conduct their research and consult appropriate professionals before making any decisions based on this content