Global Digital Health Ecosystem 2022 Year End Report

This Global Digital Health Report reviews 2022 year-end venture funding in the context of ecosystem developments throughout the year and highlights trends to expect in 2023. Experts from Galen Growth’s data & research professionals collaborated with the FINN Global Digital Health Group to:

- Chart the complex & fragmented digital health landscape

- Uncover emerging market trends

- Identify areas of growth & innovation

- Look beyond funding to explore what’s next in this fast-paced sector

HealthTech Alpha, a Galen Growth proprietary solution, powers this report!

Contents

- Digital Health Headlines

- Ecosystem Insights

- Investment Insights

- Cluster Focus

- Therapeutic Focus

- Noteworthy

- What’s Next?

Key Insights

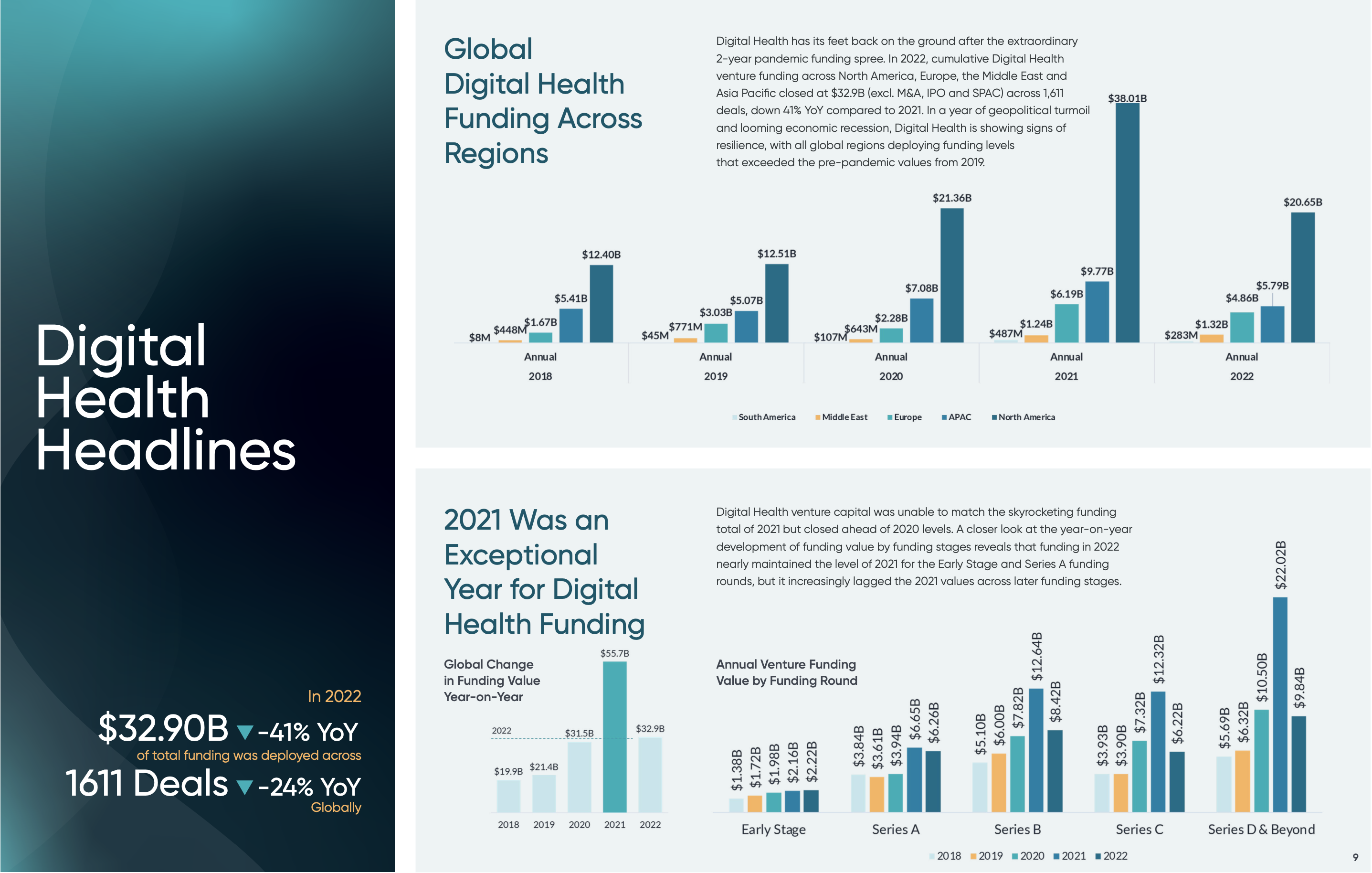

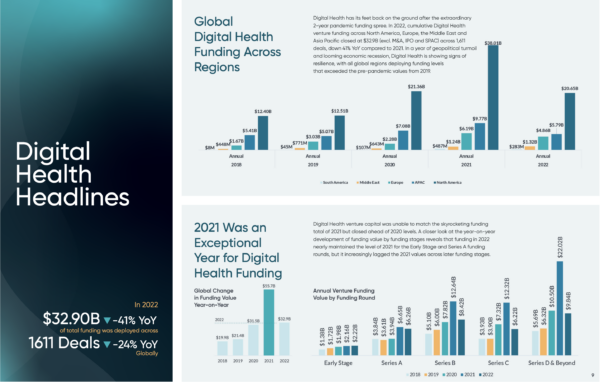

- Digital Health has its feet back on the ground after the extraordinary 2-year pandemic period funding spree. In this year of geopolitical turmoil and looming economics recession, Digital Health is showing signs of resilience, with all global regions deploying funding that far exceeds the pre-pandemic levels of 2019, ventures submitting more than double the number of regulatory filings as 2021, and with an increase of 1.5x in partnering activity over 2021.

- Cumulative global venture funding across the globe experienced a steady declined across the first 3 quarters of 2022 and stabilized in Q4, with a final YoY deficit of 41% below 2021, ushering in a new phase of Digital Health, with less extravagance and higher expectations for proof points and ROI.

- While late and growth-stage funding stumbled, early-stage venture funding nearly kept pace with 2021 funding and promises a healthy pipeline of innovation.

- M&A activity has lost momentum, with a dip of 16% YOY, however, industry consolidation is becoming stronger, with Digital Health ventures accountable for 60% of acquisition activity. Acquisitions are being fueled by the slowdown in venture funding, with a global average of only 25% of ventures having raised capital in the last 18 months.

- The surge in funding during the height of the pandemic (2020 – 2021) was fueled by more than 5,100 investors, of whom 3,200 had not participated in funding Digital Health ventures in the previous 3 years. Across the pre-pandemic years (2018 – 2019), the height of the pandemic and 2022, there were only 870 investors active in all 3 of these periods,

- Ventures in the Medical Diagnostics cluster had an exceptional year by representing 12% of all regulatory filings of Digital Health ventures across the globe, taking the top spot for ventures with significant Clinical Evidence (Evidence Signal >40), and capturing the highest investment volume share (17%), with the total cluster funding value falling short of 2021 by 16%.

- The path forward into 2023 will certainly be more challenging, but this new landscape will strengthen the pipeline of ventures, driving innovation and business model viability further to bring the Digital Health promise nearer.

Source of Data

HealthTech Alpha, Galen Growth’s proprietary on-demand platform, is the data source for this report. With more than 200 million data points HealthTech Alpha is the leading Digital Health intelligence and analytics platform. Moreover, its coverage exceeds 12,000 Digital Health ventures globally. To find out more about our data, visit https://www.healthtechalpha.com/, or visit https://www.galengrowth.com/research for our reports.

Our Mission

Founded by HealthTech innovators, Galen Growth solves global healthcare system pain points and to create significant financial and social values. To find out more, visit https://www.galengrowth.com/