Digital Health in US Health Systems

In another first-of-a-kind study of Digital Health, the Galen Growth Research team takes the bold step in understanding the Digital Health ecosystem of Health Systems and hospitals in the U.S. and have built the baseline necessary to evaluating the effectiveness of their activities in Digital Health. The 2023 Thematic Report on Digital Health in U.S. Health Systems analyses the private Digital Health ventures and ecosystem key trends, through the lens of:

- Top Health System portfolio maps

- Partnership insights & trends

- Clinical evidence

- Key categories

- Disease areas

- Venture funding

HealthTech Alpha, a Galen Growth proprietary solution, powers this report!

Contents

- Health Systems and Digital Health

- Top Health System Portfolio Maps

- Partnership Insights & Trends

- Cluster Focus

- Therapeutic Focus

Key Insights

- In 2022, 31% of all global partnerships with Digital Health ventures founded in the United States were built with U.S. Health Systems and hospitals – more partnerships than any other industry vertical engaged with Digital Health.

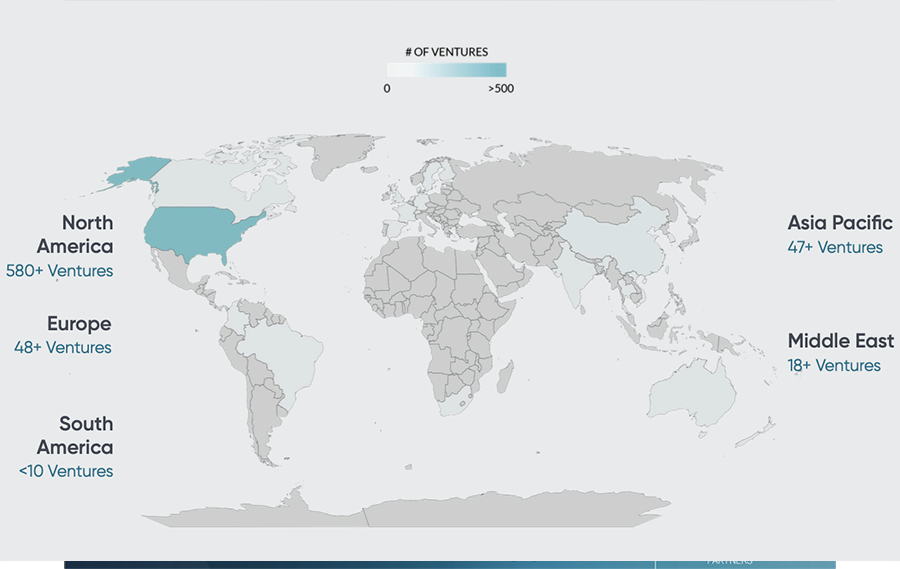

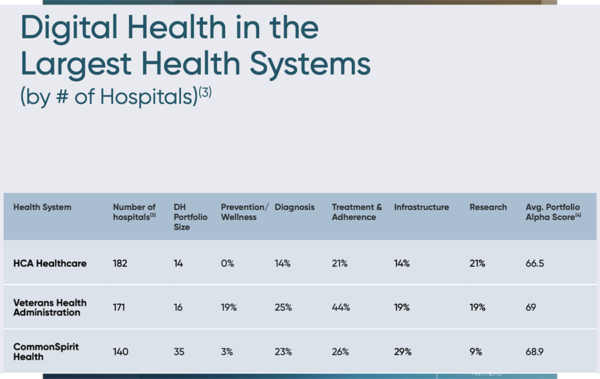

- Galen Growth has recorded more than 1,400 partnerships globally between ventures and Health systems in the United States since 2012, with only 10 Healthcare Systems recording a Digital Health portfolio larger than 15 ventures. More than 560 hospitals and Health Systems are active, but only the top 65 most active Health Systems are accountable for 50% of all recorded partnerships.

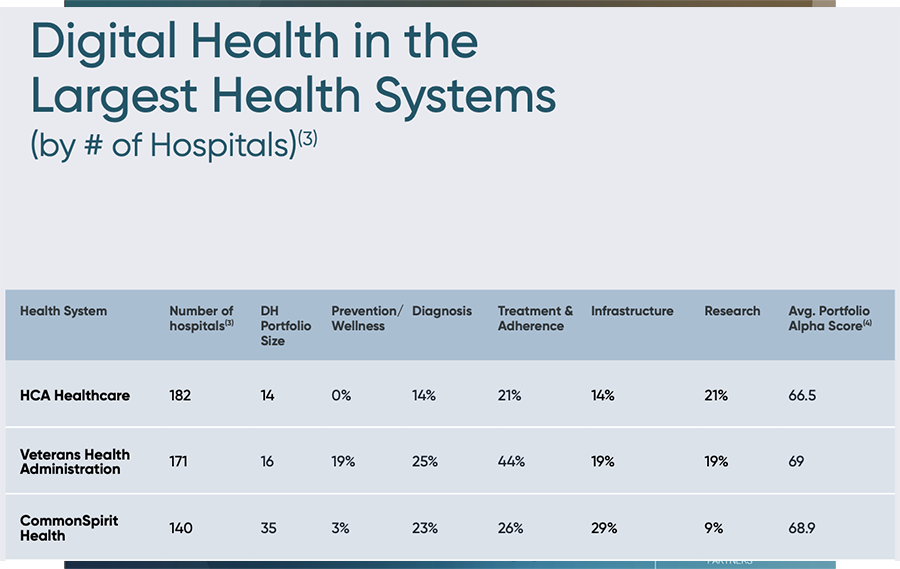

- Across the U.S., there is a 2.1x difference in the portfolio size between the most active Health Systems and the largest Health Systems. While the largest Health Systems focus on partnerships in infrastructure improvement and treatment, the most active systems are partnering more in diagnosis and have a higher share of digital tools for research (incl. clinical trials). Neither group has significant activity in Digital Health tools for Prevention and Wellness.

- Among the ventures that are partnering with U.S. Health Systems, ventures focused on Research & Clinical Trials take the top strategic area spot, with 69% of the ventures having Evidence Signal > 40, indicating significant Clinical Evidence. Ventures in the strategic areas of Diagnosis and Treatment captured 40% and 36% shared, respectively.

- Oncology takes the top position across the therapeutic areas, with more than 30% of U.S. Health System partnering with ventures in this area. Cardiovascular Diseases was in second place, with 20%. Looking across the top 25 most active Health Systems, the top 13 therapeutic areas were represented in more than half of the Digital Health portfolios.