China’s digital health sector remains a key player in global healthcare innovation, boasting the third-largest ecosystem globally. With a mix of domestic and international ventures, the landscape in China is marked by notable achievements in digital diagnostics, health management, and patient solutions. This short report, powered by HealthTech Alpha provides an analysis of the key trends driving the digital health ecosystem in China from 2014 to 2024, including funding patterns, investor activity, and therapeutic focus areas. It highlights how China is adapting to the challenges of digital health, supported by significant venture capital investment and clinical advancements.

Key Messages from the China Digital Health Key Trends 2024

- Ecosystem Size and Survival Rate: China has 663 domestically founded digital health ventures and 83 international ventures operating in the country. The survival rate of digital health ventures in China is 85%, lower than the global average of 93%.

- Venture Capital Funding: Over the last decade, China has raised $32.4 billion in venture capital for digital health ventures, ranking second globally. Despite a peak in 2017, with $6.6 billion raised, investments have seen a decline, with $998.9 million raised in 2024 YTD.

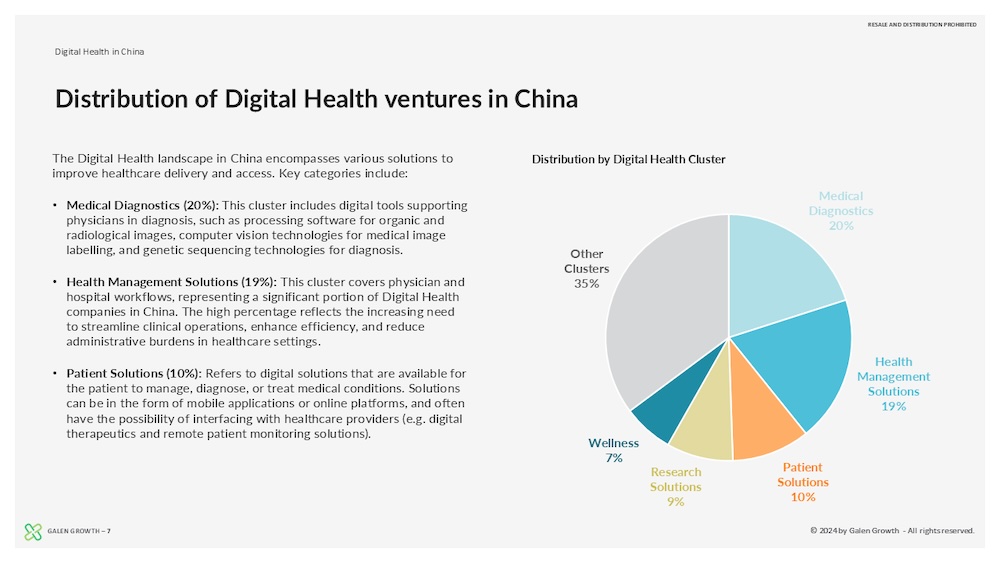

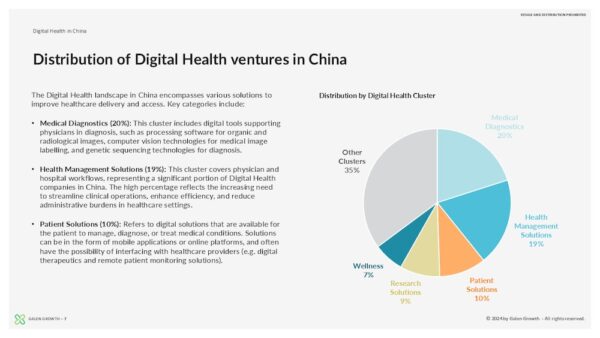

- Key Digital Health Categories: The top categories in China’s digital health landscape are medical diagnostics (20%), health management solutions (19%), and patient solutions (10%), reflecting the country’s focus on improving healthcare workflows and patient care.

- Investor Activity: More than 1,400 investors have participated in China’s digital health funding rounds, with key players including HongShan, Matrix Partners China, and Tencent Holdings.

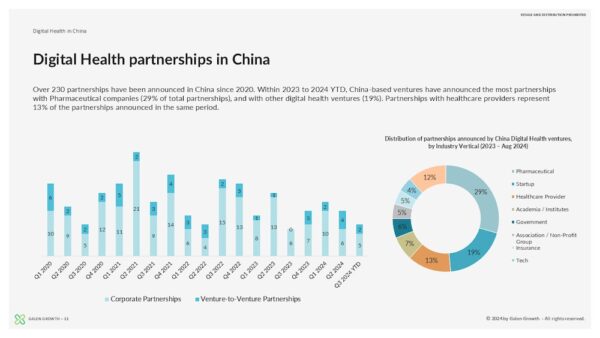

- Partnership Activity: Partnership growth has slowed, with over 230 partnerships announced from 2020 to 2024. The pharmaceutical sector dominates partnerships, accounting for 29% of total collaborations.

These highlights emphasize China’s growing influence in digital health, despite recent funding challenges. The sector’s focus on disease-specific solutions, supported by partnerships and clinical validation, points to a resilient and evolving ecosystem.

Also read our United States Digital Health Key Trends 2024.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Key Findings | |

| Digital Health ventures in China | |

| Digital Health funding in China | |

| Medical specialties of Digital Health ventures in China | |

| Notable ventures | |

| Notable investors |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level