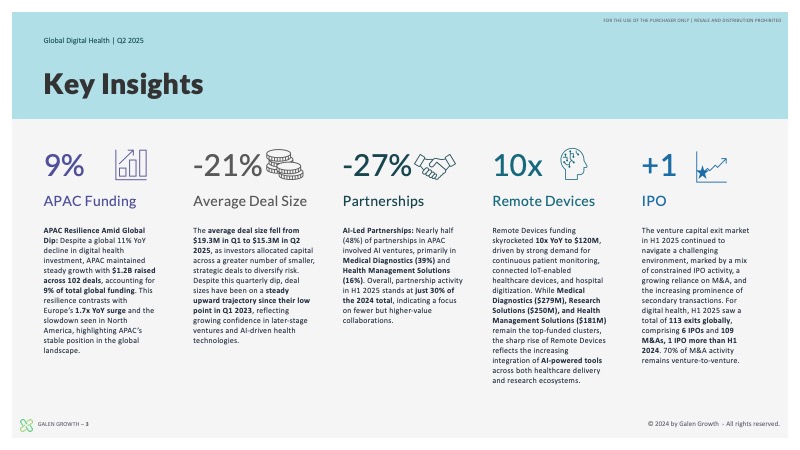

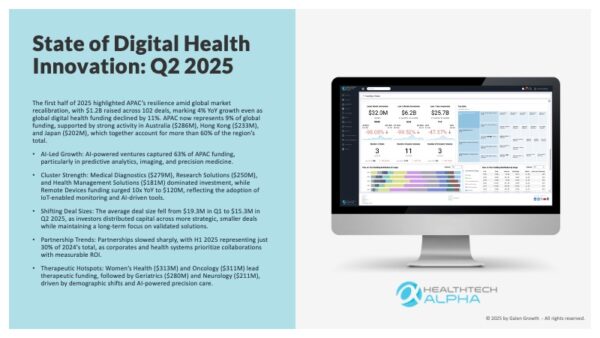

The first half of 2025 has been a defining moment for Asia-Pacific’s digital health ecosystem, as the region pivots from hype to evidence-backed, AI-driven innovation. While global digital health funding declined by 11%, APAC defied the trend with $1.2B raised across 102 deals, reflecting 4% YoY growth. This performance cements APAC’s role as a resilient and fast-maturing hub for health technology, with standout contributions from Australia ($286M), Hong Kong ($233M), and Japan ($202M).

Artificial intelligence continues to dominate APAC’s innovation landscape, accounting for 63% of all funding, particularly in predictive analytics, AI-powered imaging, and precision medicine. Clusters such as Medical Diagnostics ($279M), Research Solutions ($250M), and Health Management Solutions ($181M) remain strong, while Remote Devices saw a 10x YoY surge to $120M, underscoring the demand for connected care and real-time patient monitoring. With partnerships shifting toward ROI-driven collaborations and therapeutic focus areas like Women’s Health ($313M) and Oncology ($311M) leading the way, APAC is shaping the future of digital health in 2025.

Key Findings – APAC H1 2025

-

AI Dominates APAC Funding: AI ventures captured 63% of APAC funding, with predictive analytics, AI-powered imaging, and research solutions driving adoption.

-

Deal Size Adjustments: The average deal size decreased from $19.3M in Q1 to $15.3M in Q2, as investors opted for more, smaller strategic deals, though the trend remains upward since Q1 2023.

-

Partnership Recalibration: APAC partnerships in H1 2025 account for just 30% of 2024’s total, with Medical Diagnostics (39%) and Health Management Solutions (16%) leading ROI-driven collaborations.

-

Cluster Leaders: Medical Diagnostics ($279M), Research Solutions ($250M), and Health Management Solutions ($181M) dominate funding, while Remote Devices surged 10x YoY to $120M.

-

Therapeutic Focus: Women’s Health ($313M) and Oncology ($311M) lead therapeutic investments, followed by Geriatrics ($280M) and Neurology ($211M).

Why it Matters

APAC’s digital health ecosystem is maturing rapidly, driven by AI integration, clinical validation, and cross-border partnerships. The rise of AI-enabled health solutions across diagnostics, hospital infrastructure, and therapeutic care demonstrates APAC’s strategic importance in shaping global health technology trends.

Explore the Full Report

Gain a deep dive into the global H1 2025 digital health funding trends, cluster performance, and therapeutic priorities, with actionable insights for investors, corporates, and healthcare leaders.

Powered by HealthTech Alpha

The Q2 digital health Funding report is powered by HealthTech Alpha, the premier digital health intelligence platform delivering unparalleled data and insights into the evolving healthcare technology landscape. Leveraging an extensive database of over 15,000 ventures and cutting-edge analytics, HealthTech Alpha provides a data-driven foundation to analyse the critical trends shaping the future of digital health.

Designed to empower stakeholders—including investors, pharmaceutical leaders, and medical device manufacturers—HealthTech Alpha offers actionable intelligence to navigate digital transformation complexities. This collaboration ensures readers gain a comprehensive, evidence-based view of the intersection between digital health and healthcare, equipping them to identify strategic opportunities, assess market dynamics, and stay ahead in this fast-evolving industry.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

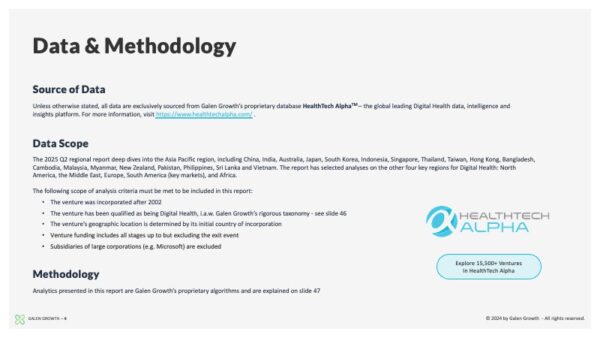

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Pages | Section | Content |

|---|---|---|

| 2–6 | Introduction | – |

| 7–8 | About Galen Growth | |

| 9–18 | Digital Health Headlines | 12 charts, 3 tables |

| 19–24 | Ecosystem Insights | 7 charts, 1 tables |

| 25–30 | Investment Insights | 7 charts, 1 tables |

| 31–36 | Cluster Focus | 3 charts, 2 tables |

| 37–43 | Therapeutic Focus | 4 charts, 2 tables |

| 44-50 | Key Information | – |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level