TL;DR

- European digital health funding in 2024 has surged 19% year-on-year to reach $3.5 billion, signalling renewed investor confidence.

- AI-driven healthcare ventures dominate the funding landscape, capturing 61% of total investments.

- Strategic partnerships in Europe rose by 13%, with pharmaceutical companies leading the charge.

- Despite the growth in AI funding, early-stage startups face funding challenges, with less than 25% raising capital in the past 18 months.

- Mental Health and women’s health sectors saw significant funding increases of 188% and 149%, respectively, driving investor interest.

The European digital technology innovation in the healthcare landscape in 2024 is undergoing a significant transformation. After weathering a turbulent period marked by cautious investor sentiment and constrained capital flows, the sector has emerged more resilient than ever. Fuelled by innovative technologies, rising investor confidence, and strategic partnerships, Europe is again at the forefront of global digital health innovation. This resurgence reflects the growing importance of digital health and its potential to revolutionise healthcare as we know it.

In this blog, we explore the key trends shaping the future of digital health in Europe, from a rebound in venture capital investment to the critical role of artificial intelligence (AI) and the increasing number of mega-deals. We also discuss the sectors attracting the most attention, including mental health and women’s health, and the evolving dynamics of strategic partnerships.

A Resurgence in Global Digital Health Funding

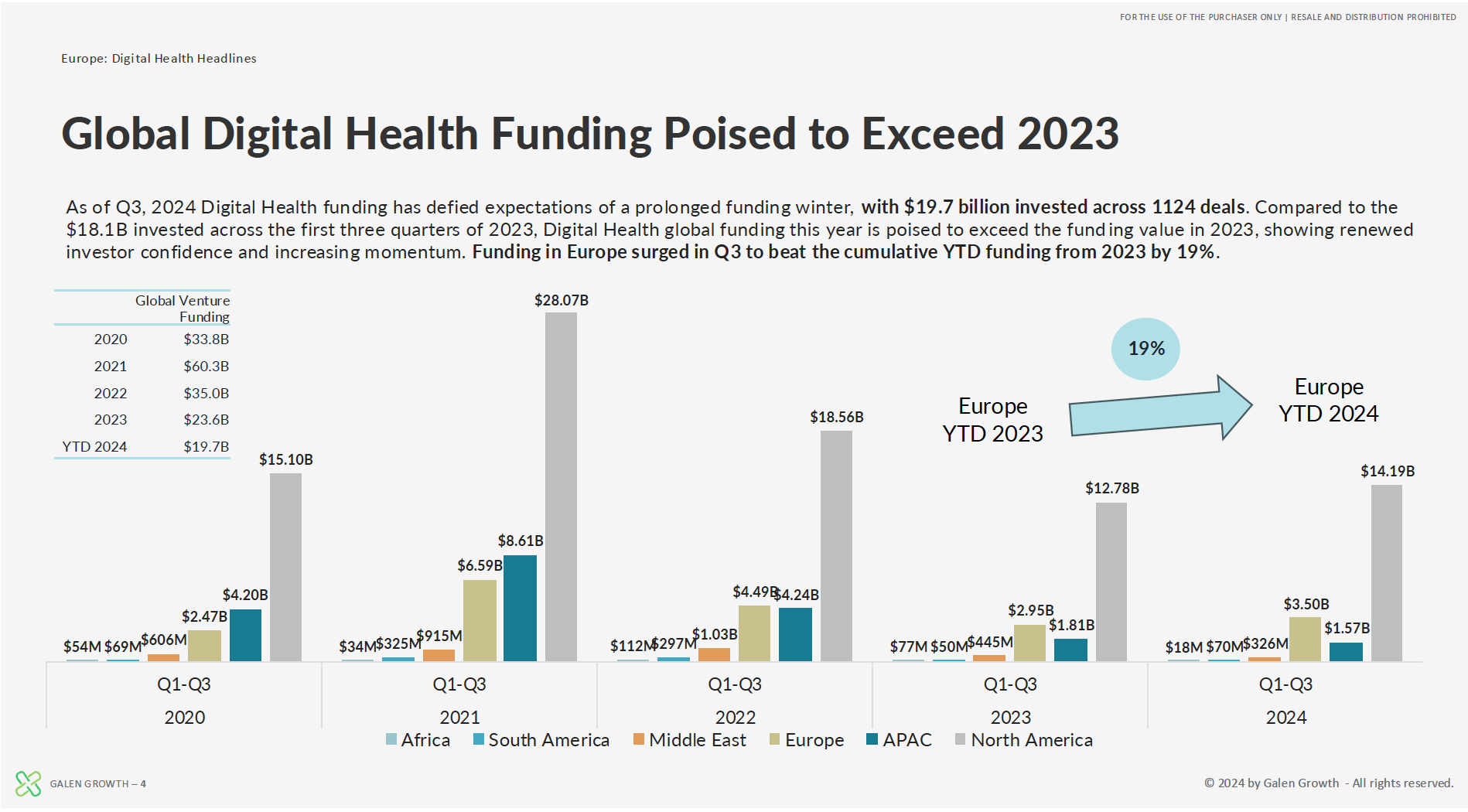

One of the most striking developments in 2024 has been the significant rebound in global digital health funding. By Q3 2024, the sector had secured $19.7 billion across 1,124 deals, marking a substantial recovery from the “funding winter” many predicted would persist. This is particularly noteworthy as it outpaces the $18.1 billion invested during the same period in 2023, demonstrating that investor confidence in the digital health sector has returned in force.

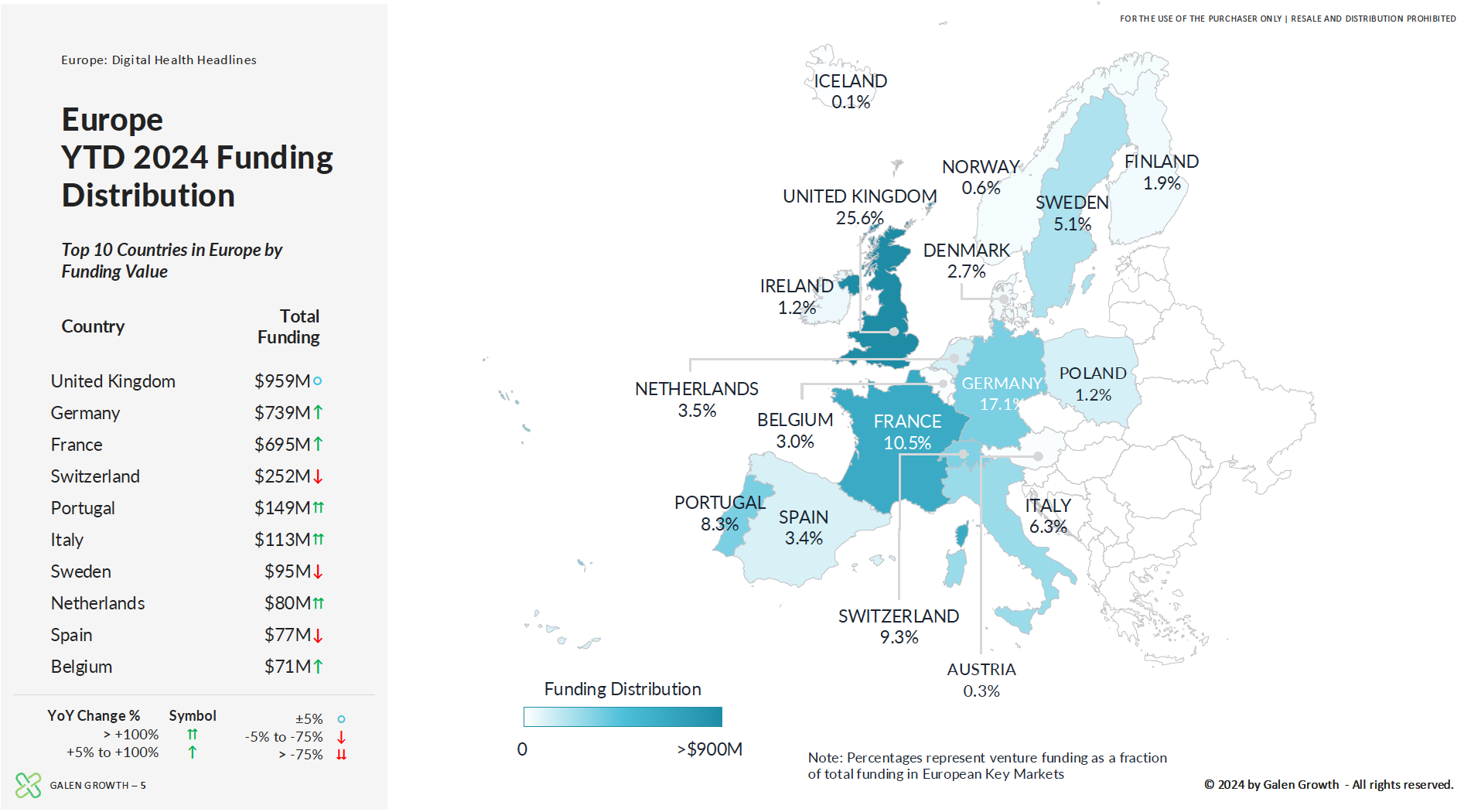

In Europe, this renewed momentum is palpable. Venture funding surged by 19% year-on-year to reach $3.5 billion, signalling a robust recovery in key markets such as the United Kingdom, Germany, and France. The UK led the charge, securing nearly $1 billion in venture funding, followed by Germany with $739 million and France with $695 million. These numbers highlight the growing investor appetite for digital health solutions and the strength of Europe’s innovation ecosystem.

AI: The New Powerhouse of European Digital Health Ventures

Artificial intelligence is no longer a futuristic concept in healthcare—it’s here, and it’s reshaping the entire industry. In 2024, AI-driven ventures captured 61% of the total venture capital deployed to European digital health startups, a disproportionately large share given that only 43% of these ventures leverage AI technology. This underscores the importance investors place on AI’s ability to drive innovation across various healthcare domains.

AI is being utilised in various applications, from improving diagnostic accuracy and personalising treatment plans to optimising clinical trial processes and enhancing operational efficiencies. The Patient Solutions cluster has been a focal point for AI investment, accounting for 22% of all capital deployed to AI-driven ventures in the first half of 2024. This cluster includess AI-powered platforms that assist healthcare providers in delivering more personalised and efficient patient care.

However, while the growth in AI investment is undoubtedly welcome, it has created funding imbalances within the ecosystem. Early-stage digital health startups, particularly those not leveraging AI, continue to face significant funding stress. Less than a quarter of early-stage ventures have raised funding in the past 18 months, highlighting a critical gap in capital availability. While AI ventures enjoy an outsized share of investment, a more balanced approach to funding distribution will be necessary to ensure the broader digital health ecosystem thrives.

This funding disparity poses risks to the innovation pipeline, as many promising early-stage startups struggle to secure the resources they need to scale. Addressing this imbalance will be vital to ensuring that diverse, non-AI-driven solutions also have the opportunity to contribute to healthcare’s digital transformation.

The Strategic Role of Partnerships in European Digital Health

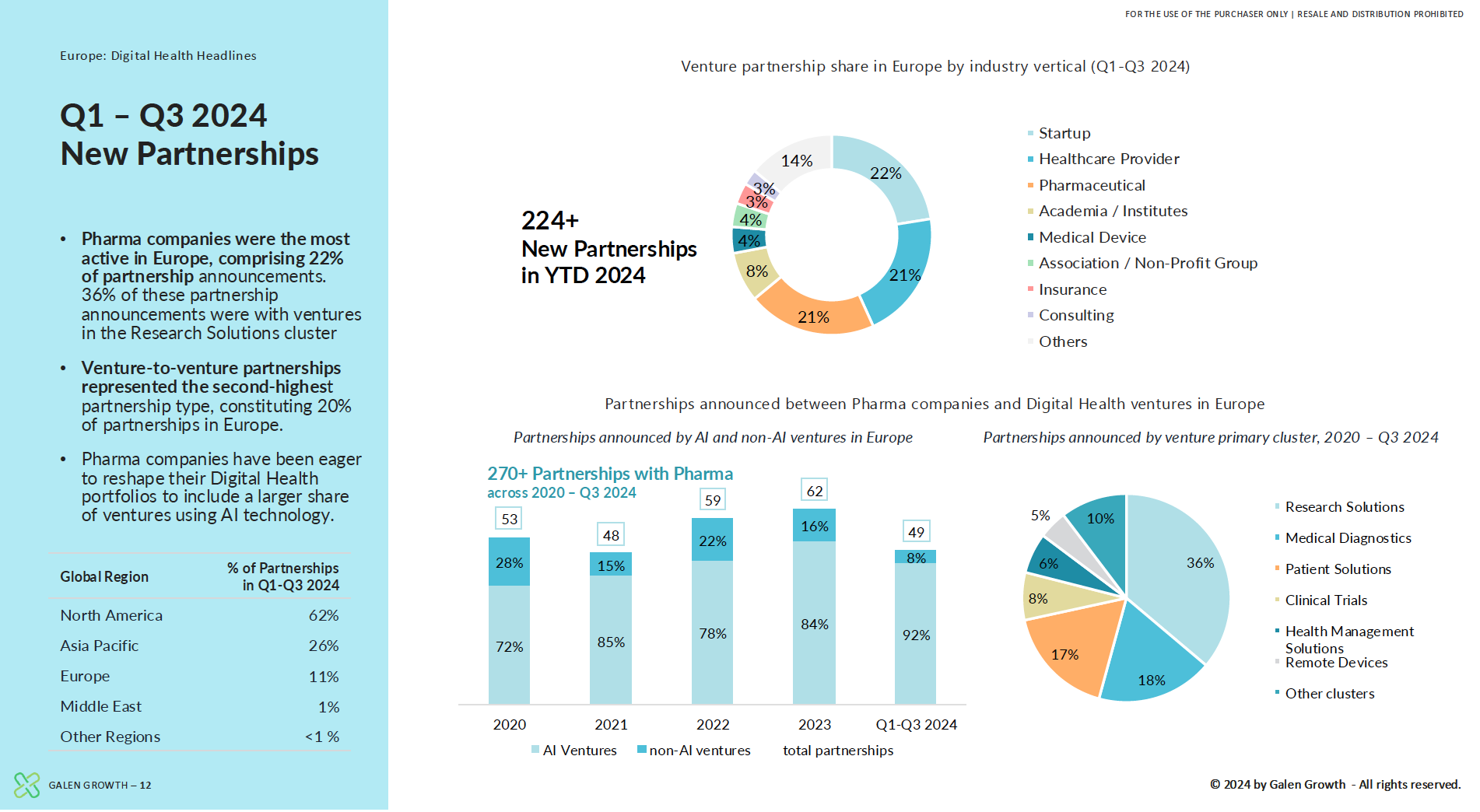

Strategic partnerships have become crucial for digital health ventures seeking to scale their operations and navigate funding challenges. As of Q3 2024, 253 partnerships were announced in Europe, representing a 13% increase from the previous year. This growth reflects the importance of collaboration in fostering innovation and creating synergies between different healthcare stakeholders.

Pharmaceutical companies, in particular, have been active participants in this trend. In 2024, they accounted for 22% of all partnership announcements in Europe, with many of these collaborations focused on ventures in the Research Solutions cluster. AstraZeneca, for instance, emerged as the most active corporate partner, forging five new digital health partnerships in 2024. These partnerships are vital for pharmaceutical companies looking to expand their digital health portfolios, especially in AI-driven ventures.

In addition to pharma, venture-to-venture partnerships have grown in prominence, representing 20% of all partnership activity. These collaborations are often driven by the need to pool resources, access new markets, or enhance technological capabilities. Partnerships provide an alternative pathway to growth and patient access for digital health ventures facing capital constraints.

Mega Deals: A Strategic Focus on High-Value Ventures

While the total number of deals in Europe reached a five-year low in Q3 2024, the region witnessed a surge in high-value mega deals (≥$100M). Five such deals were closed in Q3, bringing the year-to-date total to seven. These mega deals now account for 34% of the total venture capital investment in Europe.

This trend towards fewer but larger deals suggests a strategic focus on scaling ventures with proven potential. Investors increasingly prioritise quality over quantity, directing capital towards ventures with solid growth prospects and clear market differentiation. The appetite for high-value deals indicates that the European digital health ecosystem is maturing, with many ventures reaching the scale necessary to attract significant investment.

Moreover, investor exits have gained momentum in 2024, with 45 exits recorded as of Q3, surpassing the total number in 2023. This reflects the growing maturity of the sector and highlights the increasing interest from acquirers, particularly in the pharmaceutical and healthcare technology spaces.

Therapeutic Areas on the Rise: Mental Health and Women’s Health

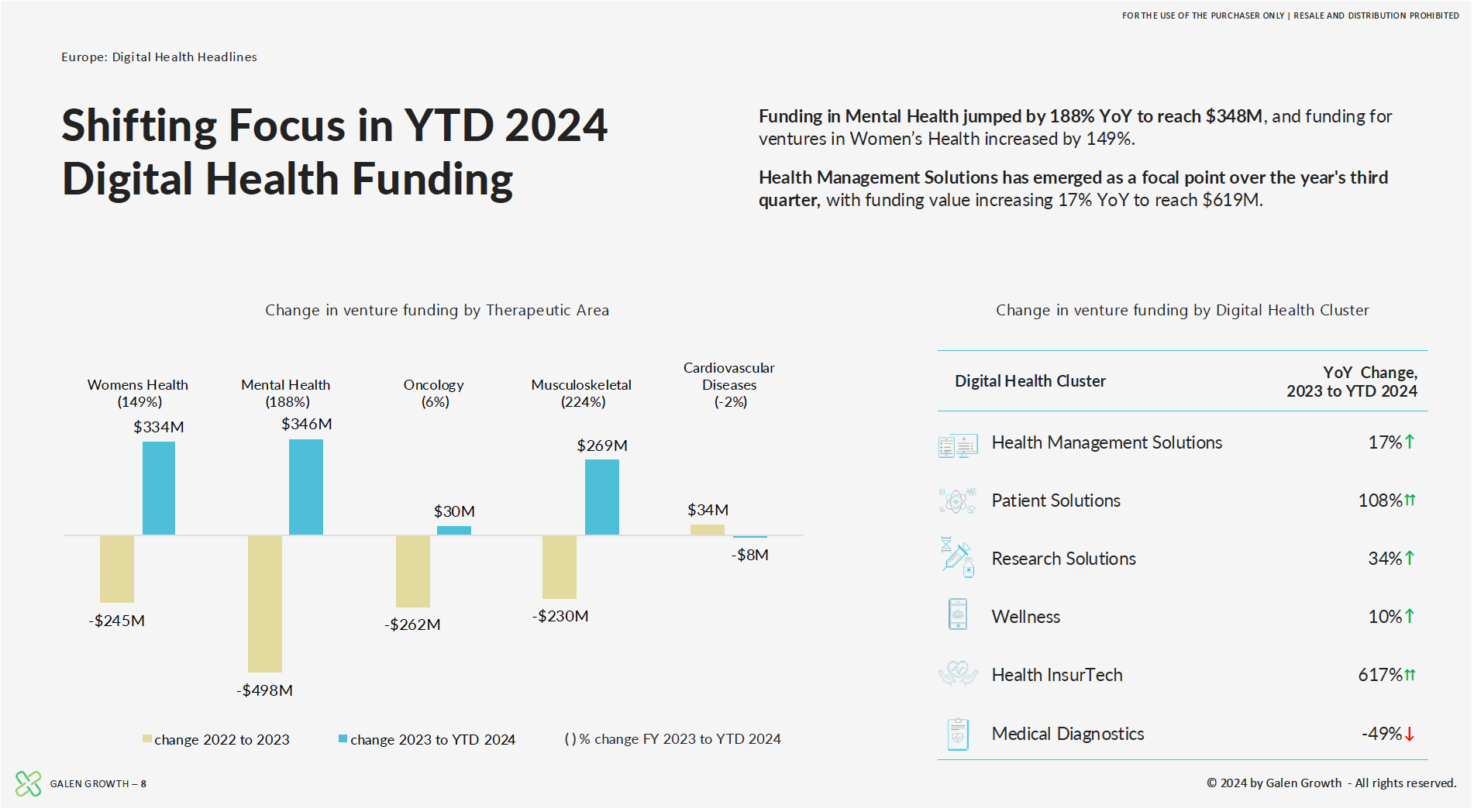

One of the most exciting developments in 2024 has been the surge in funding for specific therapeutic areas, particularly mental health and women’s health. These two sectors have seen explosive growth, attracting significant capital as they address long-standing gaps in healthcare delivery.

Mental health ventures secured 188% more funding in 2024 than the previous year, reaching $348 million. This increase reflects a growing recognition of the need for innovative digital solutions to address mental health challenges, particularly in the wake of the COVID-19 pandemic. From AI-powered therapy platforms to mental health management apps, digital health ventures are providing scalable solutions to improve mental health outcomes.

Similarly, women’s health ventures experienced a 149% increase in funding year-on-year. This sector has historically been underfunded, but in recent years, there has been a growing awareness of the unique healthcare needs of women. Digital health solutions focused on women’s health are gaining momentum, with ventures introducing innovative products addressing fertility, pregnancy, menopause, and conditions that involve female-specific symptoms and disease progression.

The Road Ahead for European Digital Health Innovation

As we look towards the future, it is clear that the digital health ecosystem in Europe is at a critical juncture. The convergence of AI, rising investor confidence, and strategic partnerships is driving unprecedented innovation across the healthcare value chain. From diagnostics and treatment to healthcare management and clinical research, digital health solutions are transforming the way healthcare is delivered and managed.

However, challenges remain. Early-stage ventures, particularly those in Series A, continue to face funding pressures, and the pathway to securing capital is becoming increasingly competitive. For these ventures, building strong partnerships and demonstrating clear value propositions will be key to attracting investment.

As the digital health landscape continues to evolve, investors, corporates, and startups must stay ahead of the curve. With the help of platforms like HealthTech Alpha, stakeholders can access the data and insights they need to make informed decisions, benchmark portfolios, and uncover new opportunities in the digital health ecosystem.

Explore more on HealthTech Alpha: www.healthtechalpha.com