The global artificial intelligence community has been buzzing lately, and AI in Digital Health stands to benefit from the latest breakthrough. DeepSeek, a Chinese AI startup, has upended long-standing assumptions about the high costs and massive infrastructure required to train cutting-edge models. According to its reports, DeepSeek-V3 was trained using less than $5.6 million worth of computing power—far below the $100 million or more that many US tech giants have poured into similar AI programs.

Although the exact figures have not been independently verified, the announcement alone has already had tangible effects on the market. Nvidia’s stock plunged by more than 15 per cent, and other companies riding the AI hype train also suffered sizeable share-price declines. Is this a sign that AI innovation is about to be democratized? And how might it affect European AI developers who historically have lacked access to the same scale of investor capital as their American or Chinese counterparts?

In this blog, we explore how DeepSeek’s claims about AI in Digital Health could reshape global technology, challenge existing regulatory frameworks, and bring fresh opportunities—particularly in healthcare. By the end, you’ll see why this latest development in the AI race is cause for optimism, not pessimism.

1. DeepSeek Is Challenging Traditional Assumptions About AI Training Costs

Most AI professionals and investors have long believed that training a state-of-the-art generative AI model requires vast sums of money and enormous computational resources—at least tens of millions, if not hundreds of millions, in investment. DeepSeek’s claim to have trained DeepSeek-V3 for only $5.6 million—using a relatively modest collection of Nvidia H800 chips—throws this assumption into question.

Could AI Development Become More Accessible?

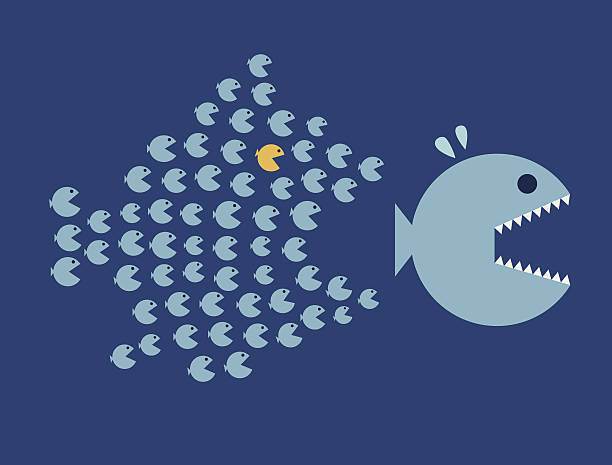

If DeepSeek’s figures are even partially accurate, it suggests that smaller AI startups could soon enjoy the same computational prowess once reserved for tech behemoths. This is where the beauty of innovation truly shines: it disrupts entrenched beliefs and opens the field to new players. For those lamenting an AI divide—where only the wealthiest countries and corporations can afford to compete—lowering the cost of AI research could be a game-changer.

2. Ripples Across the Stock Market

Unsurprisingly, DeepSeek’s announcement sent shock waves through the global technology ecosystem. Nvidia’s shares dropped by over 15 per cent, erasing billions of dollars in market value. Other companies heavily invested in AI infrastructure, like Oracle and those involved in energy production, also saw their valuations take a hit. Why? Because if it is really possible to build competitive AI models at a fraction of the cost, then the rationale behind massive spending—and the lofty valuations it supports—suddenly looks suspect.

Hard Questions for Investors

DeepSeek’s claims also raise hard due diligence questions for investors. If one startup can purportedly develop top-tier models with minimal computing, why would you back a competitor pledging to spend $100 million or more? We may soon see new valuation strategies for AI companies, with an increasing focus on efficiency, unique data advantages, or specialized use cases rather than pure raw computing power.

3. What It Means for Government Initiatives

DeepSeek’s cost-efficiency could alter not only the private sector but also government-led AI initiatives. For instance, Stargate, an American program aiming to secure national leadership in AI, might need to reassess its strategy. The same goes for European programs: they could leapfrog ahead with less capital if efficient AI research proves feasible.

A Parallel to the TikTok Debate

Questions about data privacy and censorship naturally arise when a Chinese company threatens to dominate a product millions of Americans use—much like the concerns raised during the TikTok drama. If a Chinese startup’s AI models become integral to US infrastructure—commercial or governmental—will that pose significant security and privacy risks? These questions highlight the complexities of a globally networked AI market.

4. Potential Impacts on European AI Developers

Europe often tries to compete with two juggernauts: the United States and China. While American and Chinese tech companies benefit from enormous investment pools, European developers typically do not enjoy the same level of funding. This disparity has made it challenging for promising AI startups like Mistral, a rising star on the European scene, to scale as quickly or extensively as their American or Chinese counterparts.

DeepSeek impact on HealthTech and Europe

If DeepSeek can genuinely cut down AI training costs, that might spur a surge of smaller European AI ventures. Suddenly, the cost barrier to entry might be less intimidating, enabling European innovators to focus on unique data sources or niche applications rather than struggling to assemble substantial war chests for GPU clusters. Such a development could reinvigorate the European tech ecosystem and encourage more entrepreneurs to venture into AI.

5. A Boon for Healthcare Innovation

One sector that stands to gain significantly from cheaper AI is healthcare. In 2024, about 60 per cent of all digital health funding worldwide went to AI-driven solutions. However, Generative AI (GenAI) companies still make up just 5 per cent of private digital health ventures globally. Of these, nearly a quarter focus on medical diagnostics.

Accelerating Drug Discovery and Diagnostics

DeepSeek-like models could further democratize AI-driven healthcare by lowering the entry cost for upstarts in drug discovery, diagnostics, and broader health system productivity. This is particularly true for TechBio companies: 11 per cent of TechBio (Drug Development) ventures already use GenAI, and more could follow if the price tag for AI training continues to fall. The result might be faster and cheaper drug development, more personalized treatment options, and improved patient outcomes.

6. Why This Doesn’t Signal a Bearish AI Future

If anything, DeepSeek’s breakthrough suggests a much brighter future for AI. Rather than expecting a chilling effect on the industry, the evolution of more cost-effective AI can increase competition and innovation. Large companies will not only have to refine their value propositions but also streamline their R&D processes, while smaller firms will gain new opportunities to challenge the status quo.

Competition is almost always beneficial for consumers and enterprises alike. More players in the AI space can mean more user-centric solutions, broader application scopes, and, ultimately, a richer ecosystem. If DeepSeek’s claims hold up, it could herald a new era where resources become less of a limiting factor and creative problem-solving becomes the real differentiator.

7. Looking Ahead: Winners, Losers, and New Opportunities

In any disruption, there are winners and losers. The winners here might include European AI developers, who could finally compete on a more even footing if they embrace more affordable AI models. The losers could be heavily capitalized AI programs that depend on massive budgets to maintain a technological edge. Yet, even for these players, a new environment of healthy competition could serve as a catalyst for greater efficiency and breakthrough innovations.

Conclusion: A Challenge Worth Embracing

DeepSeek’s announcement should be viewed not as a threat to the global tech industry but as a wake-up call that innovation does not always hinge on who can spend the most money. If AI can be trained and deployed cost-effectively, then entire sectors, such as healthcare, stand to benefit enormously.

This news represents a positive disruption in an ever-evolving field rather than a sign of a bearish future. It challenges global investors, government bodies, and technology leaders to reevaluate their assumptions, streamline their processes, and focus on AI’s actual value. For those aspiring to enter the AI field but lacking access to billion-dollar budgets, DeepSeek’s announcement might be exactly the spark of hope they need.