TL;DR

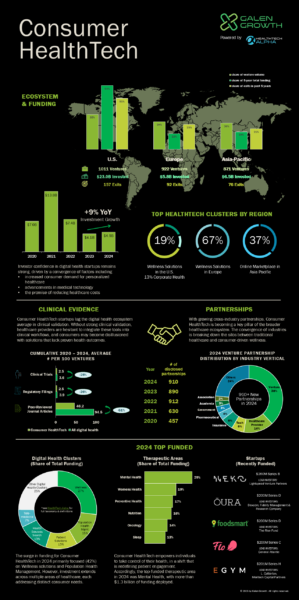

- Consumer HealthTech Investment Surging: 9% year-on-year growth in 2024, outpacing the broader digital health sector.

- AI, Remote Monitoring & Preventive Care Lead Innovation: High investor interest in AI-driven diagnostics, wearables, and proactive health solutions.

- Startups Driving Healthcare Integration: Emerging leaders are those aligning with traditional healthcare systems for cost-effective, scalable solutions.

- Strong Clinical Validation Gaining Priority: 20% of Consumer HealthTech ventures in the U.S. now have proven efficacy through trials and peer-reviewed research.

- Future of Healthcare is Consumer-Driven: Consumer HealthTech is reshaping the industry with smarter, more sustainable, and patient-centered solutions.

- Read the full report to gain deeper insights into how these trends impact industry stakeholders.

A New Dawn for Consumer HealthTech: What the Analysis Reveals

The Consumer HealthTech sector is undergoing a fundamental transformation. A surge in investment, coupled with rapidly evolving technologies and changing patient behaviours, is reshaping the industry’s landscape. As investors recalibrate their strategies in response to economic pressures, regulatory shifts, and technological breakthroughs, the trajectory of consumer healthtech innovation is entering a crucial phase.

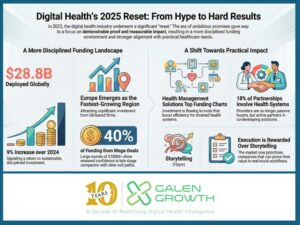

According to Galen Growth’s latest analysis, total investment in Consumer HealthTech has continued to rise, with 9% year-on-year investment growth, compared to 6% growth seen across the entire digital health ecosystem, according to Galen Growth’s 2024 Funding and Key Trends report. While valuations are stabilising, interest in AI-driven diagnostics, remote patient monitoring, and preventative care solutions remains robust.

This recalibration presents both opportunities and challenges. The next wave of growth will be driven by startups that can integrate seamlessly with traditional healthcare infrastructures, offering both cost-efficiency and improved patient outcomes.

Investment Trends: Capital Flows Backed by Structural Shifts

Investor confidence in digital health — and particularly Consumer HealthTech — remained notably resilient in 2024, with a 9% year-on-year increase in Consumer HealthTech investment from 2023 to 2024. At the heart of this capital momentum is an empowered consumer base. Individuals are demanding care that is personalised, proactive, and digitally accessible — a trend accelerated by post-pandemic behavioural shifts. From chronic disease management to mental wellbeing, consumers are seeking tools that meet them where they are — on their phones, in their homes, and on their own terms.

In parallel, technological maturity across AI, biosensors, remote monitoring, and data integration is lowering the barrier to innovation while raising expectations around precision, personalisation and scalability.

These forces have translated into sustained investment velocity. While macroeconomic headwinds have tempered exuberance in some sectors, digital health remains a capital priority for funds with long-term theses around value-based care, platform ecosystems and healthcare decentralisation.

Here are recent large investments in Consumer HealthTech:

- Neko Health, $260 million Series B led by Lightspeed Venture Partners

- EGym, $201 million Series H led by L. Catterton and Meritech Capital Partners

- Flo Health, $200 million Series C led by General Atlantic

- Ōura, $200 million Series D led by Dexcom and Fidelity Management & Research Company

- Foodsmart, $200 million Series D led by The Rise Fund

Cross-Industry Convergence: Healthcare Without Walls

The consumerisation of health is dissolving legacy silos. Increasingly, we are seeing a confluence of players — from retail and fitness to pharma and tech — co-creating solutions that straddle both wellness and care. Over 900 new partnerships were disclosed by Consumer HealthTech ventures in 2024. This convergence not only accelerates innovation but redefines who delivers health, and how.

Regulatory Tailwinds and Market Maturity

The regulatory environment is also evolving, with new guidelines shaping how Consumer HealthTech companies operate. Investors are increasingly factoring in compliance frameworks, favouring startups that proactively align with evolving standards.

Consumer HealthTech startups are building evidence of solution efficacy to ensure that consumers do not become disillusioned with solutions that lack proven health outcomes. In the U.S., 20% of the ventures in this sector have proven solutions through either clinical trials, regulatory filings, or peer-reviewed publications. Without strong clinical validation, healthcare providers are hesitant to integrate these tools into clinical workflows.

Conclusion: The Consumer Health Revolution is Just Beginning

Galen Growth’s analysis reveals that Consumer HealthTech isn’t just a trend—it’s a game-changer for the future of healthcare. By shifting the focus from reactive treatment to proactive care, it eases the burden on overstretched hospitals and healthcare providers, helping create a more sustainable system. It improves health outcomes by enabling early detection and real-time monitoring, catching issues before they become critical. Cutting-edge technologies like AI-driven diagnostics and digital biomarkers are making precision medicine a reality—delivering treatments tailored to each person’s unique genetic makeup and lifestyle.

This isn’t just innovation—it’s the foundation of smarter, more efficient, and more human-centered healthcare.

To explore these insights in greater depth, read the full report and understand what’s next for consumer health.

Why This Matters: Implications for the Industry

For Startups:

The consumer health sector remains a high-potential market, but the recent bankruptcy announcements in the sector have investors scrutinising financial sustainability more than ever. Startups must build robust business models that align with industry shifts towards personalised, AI-enhanced, and preventative care solutions.

For Investors:

Market recalibration presents both risk and opportunity. Investors who identify the next wave of consumer health innovation early—particularly in AI, wearables, and hybrid care—stand to benefit from long-term industry transformations.

For Industry Leaders:

The integration of big tech, pharma, and insurance players into the consumer health space suggests that traditional healthcare silos are breaking down. Companies that embrace technology-driven partnerships will be best positioned to capture emerging market value.

Frequently Asked Questions About Consumer HealthTech

Q: What is Consumer HealthTech?

Consumer HealthTech refers to digital health solutions and technologies that empower individuals to manage their health and wellness. This encompasses various tools and services, including mobile health apps, wearable devices, telehealth platforms, and personalised wellness solutions. The core aim is to shift healthcare from reactive treatment to proactive care, putting individuals in control of their health journey.

Q: Is Consumer HealthTech a growing industry?

Yes, the Consumer HealthTech sector is experiencing significant growth and transformation. According to Galen Growth’s analysis, total investment in Consumer HealthTech saw a 9% year-on-year increase in 2024, outpacing the 6% growth observed across the entire digital health ecosystem. This surge in investment is driven by increased consumer demand for personalised healthcare, advancements in medical technology, and the potential for reducing healthcare costs.

Q: How much funding has the Consumer HealthTech industry received?

The sources indicate substantial investment in Consumer HealthTech. While specific cumulative figures vary across different reports within the sources, it’s clear that billions of dollars have been invested. For example, figures show investment in “All digital health” reaching $7.0B in 2020, $13.8B in 2021, $7.4B in 2022, $4.1B in 2023, and an estimated $4.5B in 2024. Another source highlights that in 2024, venture funding primarily focused (42%) on Wellness solutions and Population Health. There were over 900 new partnerships in the Consumer HealthTech space in 2024.

Q: What are the key areas of innovation in Consumer HealthTech?

Several areas are driving innovation within Consumer HealthTech. These include:

- AI-driven diagnostics: There is a high investor interest in solutions that leverage artificial intelligence for health analysis and diagnosis.

- Remote patient monitoring: Wearable devices and remote monitoring technologies are gaining traction for their ability to provide continuous health data.

- Preventive care solutions: Solutions focused on proactive health management and disease prevention are attracting significant investment.

- Personalised healthcare: The demand for tailored health solutions is a major driving force behind innovation.

- Digital biomarkers: Cutting-edge technologies are making precision medicine a reality by delivering treatments tailored to individual genetic makeup and lifestyle.

Q: Why is clinical validation important for Consumer HealthTech?

Strong clinical validation is crucial for the widespread adoption of Consumer HealthTech solutions. Without proven efficacy through clinical trials, regulatory filings, or peer-reviewed research, healthcare providers are hesitant to integrate these tools into clinical workflows. Furthermore, consumers may become disillusioned with solutions that lack evidence of positive health outcomes. Notably, in the U.S., 20% of Consumer HealthTech ventures have demonstrated proven solutions through such validation.

Q: What role do partnerships play in the Consumer HealthTech ecosystem?

Cross-industry partnerships are becoming increasingly vital in Consumer HealthTech. The convergence of players from retail, fitness, pharma, and tech is leading to the co-creation of solutions that bridge wellness and care. In 2024, over 900 new partnerships were disclosed by Consumer HealthTech ventures, highlighting this growing trend. These collaborations accelerate innovation and redefine how healthcare is delivered.

Q: What are some of the top-funded therapeutic areas within digital health?

While the primary focus is Consumer HealthTech, broader digital health funding trends offer context. In 2024, the top funded therapeutic areas included Mental Health (29%), Women’s Health (19%), Preventive Health (17%), Nutrition (16%), Oncology (14%), and Sleep (13%). Wellness solutions also accounted for a significant share of venture volume.

Q: What are the key implications of Consumer HealthTech for the healthcare industry?

Consumer HealthTech is driving a paradigm shift in healthcare by:

- Empowering individuals: It enables individuals to take greater control of their health and well-being.

- Improving patient engagement: It redefines how patients interact with their health and healthcare providers.

- Easing the burden on healthcare systems: By focusing on proactive care, it can reduce the strain on overstretched hospitals and providers.

- Improving health outcomes: Early detection and real-time monitoring facilitated by these technologies can lead to better patient outcomes.

- Driving efficiency and sustainability: It contributes to a more efficient and sustainable healthcare system.

Q: What should startups in the Consumer HealthTech space focus on?

Given recent market dynamics, startups must prioritise building robust business models and demonstrating financial sustainability. They should align their solutions with industry shifts towards personalised, AI-enhanced, and preventative care. Strong clinical validation is also crucial for gaining the trust of both consumers and healthcare providers.

Q: What opportunities exist for investors in Consumer HealthTech?

Market recalibration presents both risks and opportunities for investors. Those who can identify the next wave of innovation, particularly in areas like AI, wearables, and hybrid care models, benefit from long-term industry transformations.

Q: How is the regulatory environment impacting Consumer HealthTech?

The regulatory environment is evolving, with new guidelines shaping how Consumer HealthTech companies operate. Investors increasingly consider compliance frameworks, favouring startups that proactively align with these changing standards.