Unpacking the Surge in M&A and the Cautious Re-emergence of IPOs in a Transforming Landscape

The global digital health sector has witnessed a dynamic and, at times, turbulent journey in recent years. After a period marked by economic uncertainty and a broader pullback in investment, 2025 is proving to be a pivotal year, moving beyond mere hype towards a phase of “selective scale”. This shift has profound implications for exit activities, with a distinct emphasis on companies demonstrating robust clinical validation and clear paths to profitability. For investors and innovators alike, understanding the nuances of digital health exits in the first half of 2025 is crucial for charting a successful course in this evolving landscape.

TLDR

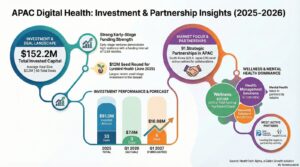

- Overall digital health funding in H1 2025 reached $12.1 billion across 616 deals globally, marking a 13% year-on-year decline in funding.

- Digital Health Exit activity cooled in H1 2025, with a total of 113 global digital health exits comprising 6 Initial Public Offerings (IPOs) and 107 Mergers & Acquisitions (M&As). This represents one more IPO than in H1 2024.

- The anticipated return to a robust IPO market in 2025 appears unlikely for digital health, with projections indicating continued sluggishness until year-end.

- Hinge Health’s IPO in May 2025 and Omada Health’s NASDAQ debut in June 2025 were significant bellwethers, signalling a cautious reopening of the public exit window for mature, high-growth digital health firms with proven business models.

- M&A activity accounted for the vast majority of exits by volume, with 107 deals in H1 2025, and 70% of these were venture-to-venture transactions, highlighting a trend towards consolidation.

- The secondary market is gaining prominence as a vital mechanism for generating liquidity, especially for high-valued unicorns seeking to provide liquidity to early investors and employees without traditional exits.

- Investors are prioritising “productivity premium” solutions that shorten care pathways or reduce operational costs, particularly those leveraging Artificial Intelligence (AI).

The Evolving Exit Landscape in H1 2025

The first half of 2025 has seen the digital health market shift from exuberance to a more grounded reality, where outcomes and profitability are paramount. Total global digital health funding (excluding exits) amounted to $12.1 billion across 616 deals in H1 2025. This figure indicates a 13% decline in funding year-on-year (YoY) compared to H1 2024, demonstrating a more discerning investment climate.

The broader private equity (PE) market, from which digital health exits draw parallels, has been contending with an historic exit backlog, with over 18,000 companies held under PE ownership for more than four years in 2024, a sixfold increase since 2005. This protracted holding period means that general partners (GPs) are under considerable pressure to deliver returns to their limited partners (LPs). This pressure often means LPs are willing to accept valuations below recent marks if it means achieving conventional exits.

In this challenging environment, digital health exit activity in digital health cooled in H1 2025. Globally, there were 113 exits recorded, comprising 6 IPOs and 107 M&A transactions. Notably, this was only one more IPO than in H1 2024, indicating that the anticipated robust return to a buoyant IPO market in 2025 is unlikely to materialise as previously hoped. Instead, the market is navigating persistent macroeconomic uncertainties, including concerns over tariffs and ongoing trade tensions, which have dampened public listing appetites.

The Public Market’s Cautious Return: The IPO Story

Despite the overall sluggishness in IPOs, the first half of 2025 saw two significant digital health companies bravely enter the public market, acting as crucial “test cases” and “bellwethers” for the industry.

Hinge Health, a digital musculoskeletal (MSK) care company, made its NASDAQ debut on 22nd May 2025 under the ticker symbol HNGE. The San Francisco-based firm, founded in 2014, successfully raised approximately $437 million by selling 9+ million shares. The stock opened at $39.25, a significant 23% increase from its IPO price of $32 and closed its first day of trading at $37.56 per share, up 17%.

Hinge Health’s IPO, while a success in terms of debut performance, also reflected a “sobering” valuation reset from its private market highs. The company’s approximate market capitalisation post-IPO was around $3 billion, representing a nearly 60% decline from its $6.2 billion valuation achieved in October 2021. However, this recalibration was largely expected, given that late 2021 was near the peak of the market cycle. Analysts view Hinge’s valuation as reasonable, given its strong growth trajectory and healthy margin profile.

Hinge Health’s financial performance leading up to its IPO was robust. It generated $123.8 million in revenue in Q1 2025, a 50% increase compared to Q1 2024. The company also achieved net income of $17.1 million in Q1 2025, a significant improvement from a net loss of $26.5 million in Q1 2024 and was free cash flow positive for the last four quarters. Its gross margin stood at an impressive 81% in Q1 2025. Hinge Health’s model is built on automating care delivery itself for musculoskeletal conditions through AI-powered motion tracking technology and an FDA-cleared wearable device called Enso, reducing human clinician hours by an estimated 95%. The company primarily targets self-insured employers and health plans, with client agreements including nearly half of Fortune 100 companies. Its success underscores the viability of condition-specific virtual care companies targeting the employer market.

Following closely, Omada Health, a virtual-first provider for chronic conditions, also made its public debut on the NASDAQ on 6th June 2025. Trading under “OMDA,” the company opened at $23 per share, a 21% jump from its IPO price of $19, and raised $150 million. Omada’s successful launch, coming on the heels of Hinge Health, further validated the market’s appetite for digital health companies that can demonstrate significant scale, strong revenue growth, and a clear strategy.

Omada Health tackles the enormous costs associated with chronic conditions. The company supports over one million lifetime members and serves more than 2,000 enterprise customers, providing virtual care for obesity, diabetes, and cardiovascular disease. Omada has integrated AI, launching “OmadaSpark” for food tracking to offer real-time nutritional guidance. Financially, Omada reported Q1 2025 revenue of $55 million, a 57% increase from Q1 2024, and significantly narrowed its net loss to $9.4 million in Q1 2025. Its 90% three-year average customer retention rate further reinforces its sustainable growth model.

Despite these landmark IPOs, the overall IPO market for digital health is still expected to remain sluggish through the end of 2025. Public listings remain a challenging exit option for larger private equity-backed companies, often viewed as a channel of last resort for assets too big to sell otherwise. The broader tech IPO market has been in a prolonged drought since late 2021, and this caution continues to influence digital health.

The Shifting Tides of Mergers and Acquisitions

While IPOs have shown nascent signs of revival, M&A activity has been the primary driver of digital health exits by volume in H1 2025. A total of 107 M&A deals were recorded globally in the first half of the year. A significant proportion of this activity, 70%, comprised venture-to-venture deals, underscoring a prevailing trend towards consolidation and strategic expansion within the industry.

This wave of M&A is not new; it rose by 5% year-on-year in 2024, totalling 101 transactions, and continued to increase into 2025, with H1 alone seeing 107 deals, a 5% increase over the same period last year. The primary drivers for this surge include the availability of distressed assets at attractive valuations, alongside favourable regulatory shifts in regions like the US that are designed to streamline healthcare mergers.

Key areas of acquisition focus have been healthcare providers and tech-enabled diagnostics, driven by the imperative to enhance integrated care solutions and diagnostic precision. Noteworthy acquirers such as Oura, Innovaccer, and Fabric made multiple acquisitions in 2024, strategically expanding their digital health footprints. From a geographical perspective, while specific deal volumes weren’t detailed for all regions, the US led M&A activity, followed by Europe. Medical Diagnostics, Health Management Solutions, and Research Solutions emerged as the high-growth clusters attracting the most M&A attention.

The private equity playbook, particularly the “roll-up” strategy, is also gaining traction among venture capital firms. This involves investing in tech start-ups to acquire smaller rivals and build dominant conglomerates. Firms like Thrive Capital, General Catalyst, Khosla Ventures, Bessemer Venture Partners are actively pursuing this approach. The motivation behind these roll-ups is to generate liquidity from portfolios when traditional IPOs and dealmaking are slow. Crucially, unlike traditional PE, VCs aim to drive efficiency and margins by infusing technology, especially AI, into these acquired businesses. This method transforms pre-AI businesses into AI-driven entities, leveraging AI for tasks like back-office operations to achieve a “productivity premium”.

Navigating a Landscape of Selective Growth: Overall Market Dynamics

The digital health ecosystem in H1 2025 is characterised by a “selective scale” funding model, moving firmly out of “triage mode”. Investors are demanding clinically proven datasets, clear reimbursement pathways, and defensible AI pipelines. This is reflected in the trend towards “bigger cheques, fewer bets,” with the median deal size for AI-driven digital health reaching $27.5 million by May 2025. Across all funding stages, the average ticket size for late-stage financings in H1 2025 saw a 1.6x increase compared to the same period in 2024, signalling a global reallocation of capital towards more substantial investments.

Regulatory tailwinds, such as new FDA AI/ML guidance in Q2 2025, have also helped trim perceived risks for patient-facing algorithms, further encouraging investment. A notable trend is the strategic capital rotation, where corporate venture capital arms from pharmaceutical, payor, and med-tech companies have filled the void left by more cautious generalist investors, representing roughly 40% of active investors in May.

Furthermore, AI-powered ventures are capturing a significantly larger share of funding, accounting for 65% of total funding in H1 2025, despite only 40% of global healthcare ventures currently deploying AI technology. This highlights strong investor conviction in AI’s transformative potential across operational and scientific domains in healthcare.

However, the industry faces ongoing challenges. The number of venture capital deals in digital health continued its quarter-over-quarter decline in H1 2025, reflecting more selective investor behaviour and lengthier due diligence cycles. Partnership activity also saw a steady decline since Q2 2024, with a 27% quarter-on-quarter drop in Q2 2025, as corporations and investors demand concrete outcomes over experimental ventures. Liquidity remains a pressing issue for LPs in the broader private capital markets, impacting fundraising for venture capital funds. The average time for funds to close has also nearly doubled since before the pandemic, reaching approximately 20 months in 2024.

The Road Ahead: Digital Health Exits H2 2025 Outlook

The second half of 2025 is expected to be a period of sustained discipline and renewed momentum for the digital health ecosystem. Capital will continue to flow selectively, primarily favouring AI ventures that can demonstrably convert clinical validation into tangible revenue. The “productivity premium” for solutions that shorten care pathways or reduce operational costs will remain a paramount investment criterion. Given that many growth- and late-stage companies have an average “funding strength” or runway of only around 12 months, a considerable number of scale-ups are expected to return to the market before the year’s end.

Galen Growth forecasts for global digital health project total funding for 2025 to reach $24.8 billion under neutral conditions, suggesting that 2025’s run rates could establish a new floor for investment activity. However, the sector’s resilience will continue to be tested by lingering macroeconomic uncertainties, potentially leading to tighter access to capital and partnerships if corporate operating costs rise and investor sentiment becomes more defensive.

The IPO market for digital health is projected to remain sluggish through the end of the year, with a “large flood” of listings not anticipated. A full-scale IPO recovery is unlikely until key policy uncertainties are resolved, and more companies demonstrate consistent market readiness. The trend of flat or declining valuations upon exit is also expected to persist for many IPO candidates who may have exhausted private capital options. However, there is some optimism, with banker pipelines indicating that at least three AI-native ventures are preparing Q4 filings, and successful pricings could potentially push overall funding into an upside band.

M&A activity is likely to continue being driven by smaller acquisitions, as large-scale deals remain scarce due to ongoing macroeconomic uncertainty and increased regulatory scrutiny. The growing secondary market will play an increasingly vital role in generating liquidity, particularly for high-valued unicorns seeking to provide exits for early investors and employees without resorting to a traditional IPO. The digital health sector’s ability to adapt supply chains, strategically consolidate, and adeptly navigate shifting investor priorities will be crucial for its sustained growth in the coming months.

Find out More: Read the Full Report!

For a comprehensive deep dive into these transformative trends and detailed analytics across the digital health ecosystem, we strongly encourage you to read the full Q2 Digital Health 2025 Funding and Key Trends report from Galen Growth. It offers unparalleled data-driven insights to help navigate this evolving market and make informed strategic decisions.

About Galen Growth

Galen Growth is the leading intelligence platform for digital health, purpose-built to help organisations navigate and win in an increasingly complex, data-saturated landscape. Our proprietary solution, HealthTech Alpha, combines GenAI-powered analytics with the industry’s most structured dataset to deliver targeted, clinically relevant insights instantly.

Trusted by global pharma, investors, and health systems, we empower teams to accelerate decision-making, reduce risk, and focus their resources where they add the most strategic value.

As GenAI redefines expectations for speed, efficiency, and precision, market intelligence is no exception. Galen Growth is at the forefront of this shift, enabling partners to modernise how they source, assess, and act on innovation opportunities.