The landscape of venture funding in the United Kingdom experienced notable shifts and trends throughout 2023, reflecting both challenges and opportunities within the market. Despite facing a decrease in both total investment value and deal volume compared to the previous year, the UK remained a vibrant hub for innovation and entrepreneurial activity. This overview encapsulates key highlights from the dynamic ecosystem, including insights into funding trends, top therapeutic areas, notable exits, and emerging clusters. Understanding these dynamics is crucial for stakeholders seeking to navigate and leverage opportunities within the UK’s ever-evolving venture landscape.

In 2023, notable funding rounds underscored the resilience and potential of select ventures within the UK’s startup ecosystem. Causaly secured £48M in Series B funding, further bolstering its position as a leading player in the realm of causal relationship discovery within healthcare. Similarly, Peppy, a digital health platform focused on supporting employees’ health and wellbeing, raised £37M in Series B funding, signaling strong investor confidence in its innovative approach. Additionally, GetHarley, a telemedicine platform connecting patients with aesthetic practitioners, secured £42M in Series B funding, highlighting the growing demand for accessible and convenient healthcare solutions. These significant investments reflect the continued interest and support for ventures driving innovation and transformation across various sectors within the UK.

HealthTech Alpha, a Galen Growth proprietary solution, and the world’s leading Digital Health private market data, intel and insights platform powers this report!

Highlights from the UK Digital Health Investment Insights 2024

UK Venture Funding

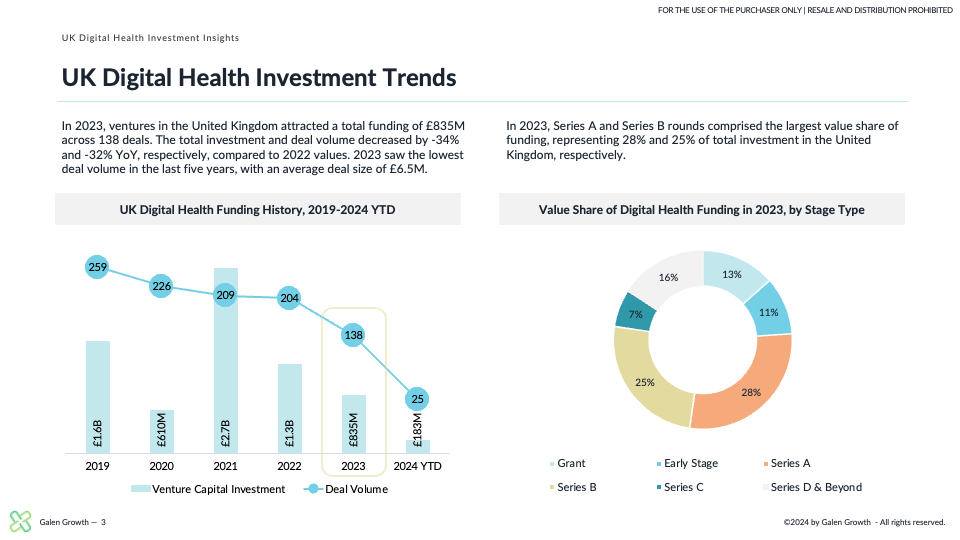

- £835M across 138 deals, down 34% and 32% YoY respectively.

- Series A and B rounds made up 28% and 25% of funding.

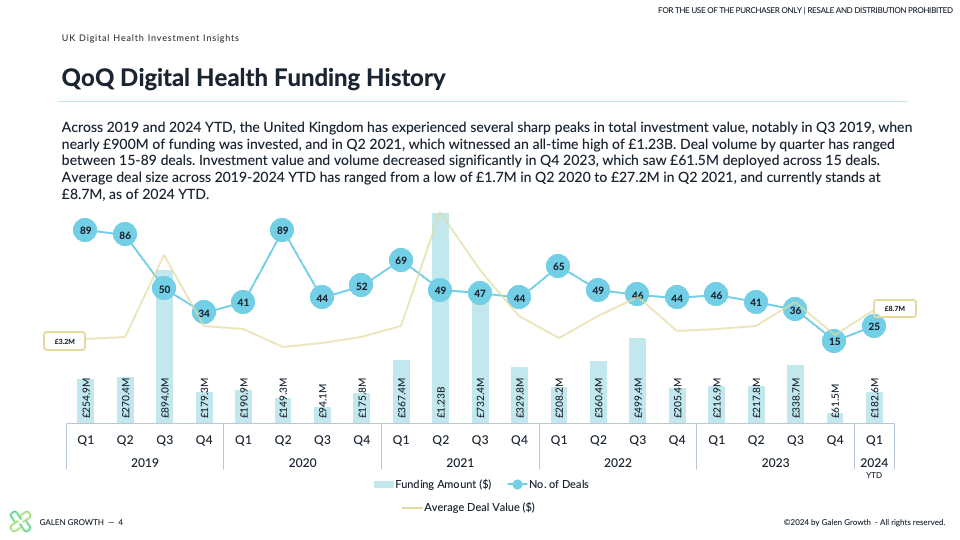

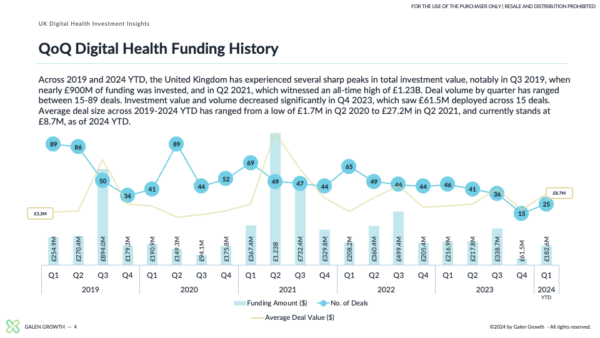

- Peak investments in Q3 2019 (£900M) and Q2 2021 (£1.23B).

- Investment value and volume decreased significantly in Q4 2023, with £61.5M deployed across 15 deals.

Top Therapeutic Areas in 2023

- Oncology (£153.1M), Mental Health (£87.5M), Women’s Health (£66.2M), Hepatology, and Dermatology.

- Disease Agnostic solutions raised 25% of funds.

Exits

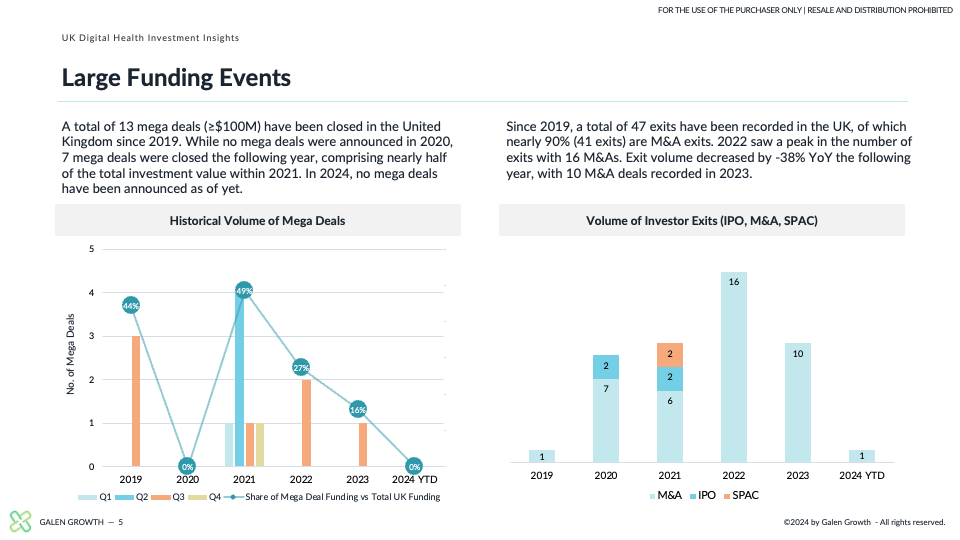

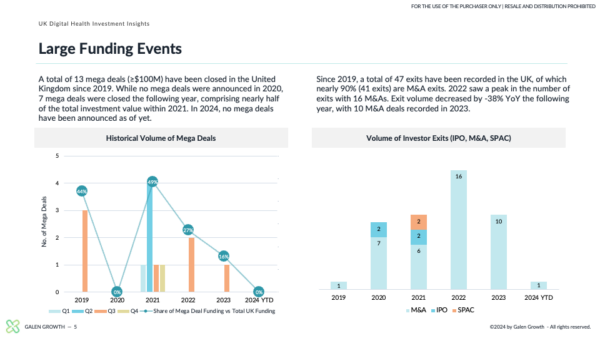

- 47 exits since 2019, 90% M&A. 10 M&A deals in 2023.

- Exit volume decreased by -38% YoY in 2023.

Explore our latest Digital Health reports

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Snapshot: 6 pages, 10 charts, 2 tables |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level