TL;DR

- Global Digital Health funding declined 23% quarter-on-quarter, yet Europe showed only a 17% drop, signalling relative resilience.

- $1.0 billion was invested across Europe in Q3 2025, spanning 55 deals with an average size of $20.5 million.

- U.K. ventures led with $409 million, driven by AI-enabled drug discovery and preventive health.

- Partnerships shifted toward Patient Solutions and Research Solutions, with healthcare providers accounting for 38% of collaborations.

- The market is pivoting from hype to proof of outcomes — investors now demand validated endpoints, not just technological novelty.

Digital Health Funding Summary: A Calm in the Global Storm

Europe’s Digital Health sector continues to weather global headwinds. While global investment in Digital Health declined 23% quarter-on-quarter, European funding fell by only 17%, highlighting its resilience in a cautious market.

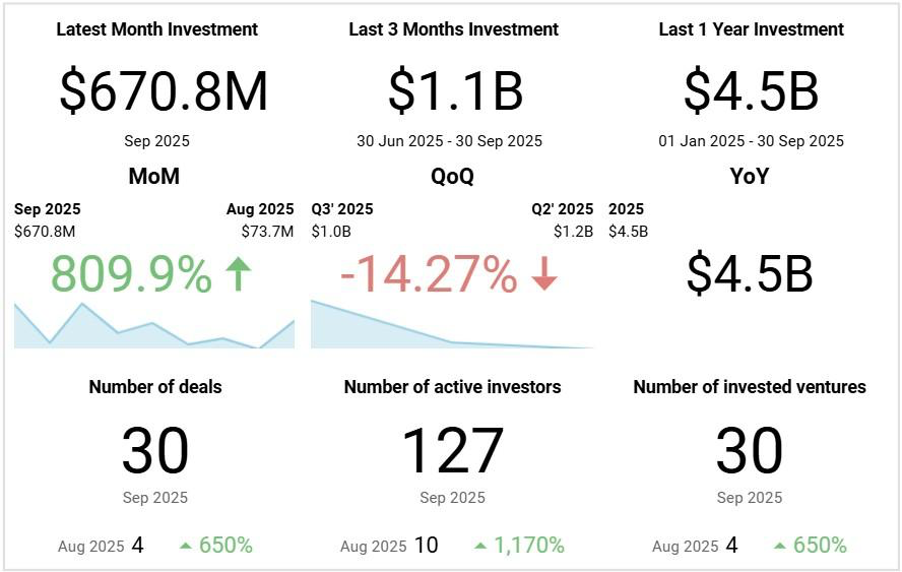

According to Galen Growth’s HealthTech Alpha data, Europe recorded $1.0 billion in venture investment across 55 deals, averaging $20.5 million per transaction. The pattern mirrored seasonal trends — a predictable August slowdown followed by a sharp rebound in September, when monthly investment surged 809% to $670.8 million.

Though the era of mega-rounds may be fading, Europe Digital Health Funding Q3 2025 reflects a maturing market driven by smaller, evidence-backed deals. This rational recalibration — fewer speculative bets and greater focus on validation — underscores investor discipline, not retreat.

Europe Shows Resilience Amid Global Funding Decline

Across the continent, Digital Health investors are becoming more selective yet confident in ventures demonstrating measurable clinical impact. Europe’s stability rests on validation, regulatory readiness, and strategic partnerships that reassure investors wary of overvaluation.

In Q3 2025, Growth Stage investments (Series B & C) represented 67% of total funding, showing investors’ preference for scaling proven solutions. Early-stage funding remains active, particularly in AI-driven diagnostics and digital therapeutics.

The U.K. led with $409 million, followed by Germany, France, and the Nordics — driven by strong performance in AI-enhanced preventive health, oncology, and drug discovery.

| Venture | Country | Cluster | Funding | Series |

|---|---|---|---|---|

| Ōura | Finland | Wellness | $250 M | Debt Financing |

| Charm Therapeutics | U.K. | Research Solutions | $80 M | Series B1 |

| MRM Health | Belgium | Research Solutions | $64.5 M | Series B |

| Numan | U.K. | Telemedicine | $60.3 M | Series B1 |

| Ultromics | U.K. | Medical Diagnostics | $55.0 M | Series C |

AI Is Now Infrastructure, Not Just Innovation

Artificial intelligence has moved beyond hype — it is now core infrastructure in European Digital Health. From diagnostics to decision support and patient engagement, AI is embedded across regulated, evidence-based platforms.

In Q3 2025, AI-enabled ventures dominated funding flows, especially in oncology and Preventive Health. Examples include CHARM Therapeutics ($80M) and MRM Health ($64.5M), which leverage AI to accelerate clinical discovery.

Wearables have evolved from consumer devices to clinical-grade data tools. Notably, Ōura’s $250M debt round (24% of total funding) illustrates how continuous patient monitoring underpins future care models. Drug Discovery ventures attracted $203M (19%), solidifying AI’s pivotal role in pharma R&D.

Strategic Partnerships Over Pure Capital

Europe’s 2025 playbook emphasizes capital efficiency and collaboration. Unlike North America’s scale-through-capital model, European startups are leveraging strategic partnerships to access markets and validate use cases.

Galen Growth partnership data shows a pivot from from Medical Diagnostics in Q2 to Patient Solutions and Research Solutions in Q3.

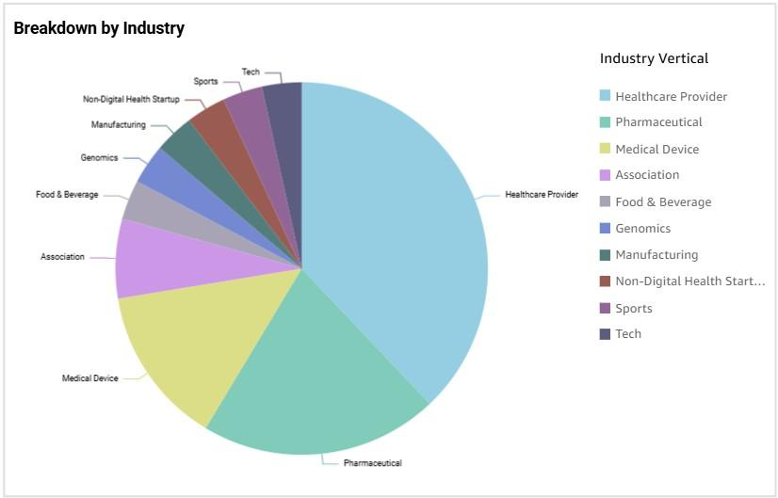

Notably, 38% of all partnerships involved healthcare providers — proof that clinical workflow integration is now essential.

This trend signals a more collaborative ecosystem, prioritising interoperability, data sharing, and evidence generation — hallmarks of Europe Digital Health Funding Q3 2025 success.

Focus Areas: From Preventive Care to Drug Discovery

Funding distribution highlights Europe’s strategic focus:

- Preventive Health: $278M

- Oncology: $219M

Together, they accounted for half of total investment, underscoring a shift toward evidence-driven, proactive healthcare.

Interestingly, Gastroenterology drew $348M — a reminder of the diversity across Europe’s healthtech innovation. Integration of genomics, AI, and wearables is blurring traditional preventive–therapeutic lines.

The U.K.’s $409M total exemplifies this convergence — startups bridging preventive interventions and pharmaceutical R&D to embed themselves in the complete care continuum.

Investors Want Proof, Not Promises

The absence of mega-deals in Q3 underscores a new investor mindset: proof over promises.

Investors now seek validated endpoints, clinical ROI, and scalable outcomes — not untested algorithms.

Two-thirds of total funding went to Growth Stage ventures, confirming preference for companies with demonstrable clinical impact. Startups must now provide real-world evidence to attract durable capital — a shift marking the new discipline of Digital Health.

Why It Matters: The New Discipline of Digital Healt

Europe’s Q3 performance signals a turning point. The region’s resilience amid contraction illustrates how regulatory compliance and scientific validation sustain investor trust.

For:

- Industry leaders: Europe remains a strong testbed for scalable digital solutions.

- Investors: Confidence grows in markets where value equals validated outcomes.

- Startups: Sustainability now depends on proving impact, not just innovation.

Europe Digital Health Funding Q3 2025 thus marks the transition from hype to health impact, setting the stage for rational, validated growth.

Galen Growth Point of View

From Galen Growth’s perspective, 2025 represents a return to rational growth.

The HealthTech Alpha platform tracks ~1,000 active funding rounds and 1,900+ partnerships as of Q3 2025.

Though funding sits below historic peaks, global Digital Health investment is expected to close 2025 at USD 25–26B — a sustainable baseline for future expansion. The winners of 2026 will bridge data, evidence, and commercial scalability, backed by strategic partnerships.

Conclusion: Europe’s Moment of Clarity

Europe’s Q3 funding landscape reflects recalibration, not retreat.

Investors prioritise evidence over excitement, and startups are meeting that standard.

As the region heads into 2026, Europe’s disciplined, data-driven approach may become the blueprint for global Digital Health growth — rational, validated, and ready for scale.

About Galen Growth and HealthTech Alpha

Galen Growth is the global leader in Digital Health intelligence, trusted by pharma, med-tech, investors, and health systems to benchmark innovation.

Its flagship platform, HealthTech Alpha, covers 50,000+ ventures and over 1 billion data points, empowering clients with evidence-based insights for faster, smarter decisions.

As Digital Health shifts from hype to health impact, Galen Growth continues to deliver actionable intelligence — bringing clarity where others deliver noise.