Digital Health Funding Q1 2023:

Digital Health’s worst quarter since 2019

Here’s what transpired in global Digital Health Funding in Q1 2023 and how the sector performed this quarter.

As we drew the curtain on 2022, the hope was that Digital Health funding had bottomed out. The wishful outlook for the new year was that trends would now begin to steadily move upwards. However, the bad news has only become worse.

Leaving to one side the continued strain caused by the uncertain geopolitical and inflationary environment, the demise of Silicon Valley Bank sent shockwaves throughout tech. These were felt by Digital Health too, causing a dislocation of venture capital (VC) promised IRR and reality hitting home. Many VCs entered the space with limited healthcare venture-building experience, driving runaway valuations based on often flaky business models. VCs are also now under pressure to demonstrate actual cash returns, holding up a return to capital market activity.

Against this scenario, here’s what transpired in Digital Health in Q1 2023 and how the sector performed this quarter.

HealthTech Alpha Premium subscribers get full access to a wealth of data on investments, exits, partnerships, and regulatory approvals in the industry.

If you’re new to HealthTech Alpha, you can sign up for a complimentary account and enjoy 7 days of full access to the platform. This is a great opportunity to explore the platform and see if it’s a good fit for your needs. After the trial period ends, you can choose to upgrade to continue accessing all the features and benefits of the platform.

Digital Health Funding Q1 2023:

Digital Health’s worst quarter since 2019

Here’s what transpired in global Digital Health Funding in Q1 2023 and how the sector performed this quarter.

As we drew the curtain on 2022, the hope was that Digital Health funding had bottomed out. The wishful outlook for the new year was that trends would now begin to steadily move upwards. However, the bad news has only become worse.

Leaving to one side the continued strain caused by the uncertain geopolitical and inflationary environment, the demise of Silicon Valley Bank sent shockwaves throughout tech. These were felt by Digital Health too, causing a dislocation of venture capital (VC) promised IRR and reality hitting home. Many VCs entered the space with limited healthcare venture-building experience, driving runaway valuations based on often flaky business models. VCs are also now under pressure to demonstrate actual cash returns, holding up a return to capital market activity.

Against this scenario, here’s what transpired in Digital Health in Q1 2023 and how the sector performed this quarter.

HealthTech Alpha Premium subscribers get full access to a wealth of data on investments, exits, partnerships, and regulatory approvals in the industry.

If you’re new to HealthTech Alpha, you can sign up for a complimentary account and enjoy 7 days of full access to the platform. This is a great opportunity to explore the platform and see if it’s a good fit for your needs. After the trial period ends, you can choose to upgrade to continue accessing all the features and benefits of the platform.

Q1 2023 closes at $5.2B globally

From a high of $15.71B in Q4 2021, funding steadily declined throughout 2022 to close the year at $6.92B in Q4. Now, the venture capital deployed in Digital Health globally has further dropped to $5.20B in Q1 2023.

This is Digital Health’s lowest funded quarter since Q3 2019. But, this doesn’t indicate a lack of interest in Digital Health solutions. Rather, it’s a reflection of the adjustment in venture valuations combined with the troubled waters that venture capital firms are currently navigating.

All venture deals are exclusively sourced from HealthTech Alpha. Get the full picture of global Digital Health in our 2022 Year-End Report

North America stabilises, Middle East feels the heat

Zooming into the quarterly trends of key regional ecosystems — venture funding in North America has stabilised since Q3 2022 at $3.37B, seeing no significant ups or downs. However, given recent headlines related to major venture capital firms in the United States, funding is likely to continue trending downwards in the region.

It seems Digital Health’s funding slowdown has reached the Middle East. 2022 trends made it appear like the region may have dodged the bullet but Q1 2023 results suggest a delayed impact. From $193.2M in Q4 2022, venture capital funding for Digital Health in the Middle East dropped to $56.0M in Q1 2023 — a stark contrast from the more optimistic $214.0M in Q1 2022.

All venture deals are exclusively sourced from HealthTech Alpha.

At $2.00B, Q4 was Asia Pacific’s best quarter in 2022. But, the tide turned rather dramatically for the region with Q1 2023 closing at $323.0M — its lowest quarter in five years. While funding in Europe may have surpassed the Asia Pacific, its $679.7M in Q1 2023 is no match to the funds it raised throughout 2021 and 2022.

Check out our Regional Reports for a detailed analysis of Digital Health in each ecosystem — North America, Asia Pacific, Europe, Middle East, South America

Half the market has a tough year ahead

Examining the funding strength of growth-stage ventures globally paints a grim picture for the year ahead. In North America, six months ago, 69% of the ventures had raised funds in the past 18 months. That share has shrunk to 54% after Q1 2023.

The situation is bleaker still in Europe and the Asia Pacific, where only 46% and 36% of the ventures respectively have raised funds in the past 18 months. Almost half the market in North America, and more than half in Europe and the Asia Pacific, will be looking to raise funds facing 2023’s tough conditions.

The Funding Strength is a proprietary metric calculated by Galen Growth to determine the funding health of Digital Health ventures.

Market consolidation continues

Amid Digital Health’s precarious venture funding situation, the global appetite for mergers and acquisitions remains strong. The M&A transactions in Q1 2023 pushed slightly ahead of the quarterly numbers for 2022 Q2 to Q4.

While the medical devices and pharmaceutical companies did step up their M&A activities this quarter, the dominant acquirer of Digital Health ventures continues to be ventures themselves. This industry consolidation is likely a direct result of the faltering funding strength and declining venture valuations.

Digital Health is swiftly moving towards its next phase — this report covers everything there is to know about Digital Health Platforms

All acquisitions are exclusively sourced from HealthTech Alpha.

Advancing interoperability for healthcare is in focus

The importance of the Health Management Solutions cluster has been growing steadily over the past few years. It includes ventures that develop software and apps used by healthcare providers, pharmacies, and patients — such as information and inventory systems, medical and patient records, and prescriptive analytics.

It ranked at #5 among the top-funded clusters in 2021, moving to #4 in 2022 and is now at #3 in Q1 2023. Ventures in North America took 70% of the funding — no surprise since interoperability is the current hot topic in the US with a significant focus on increasing the operational efficiency of hospitals.

The Patient Solutions cluster took second place, despite a deeply troubled quarter, with the digital therapeutics company Pear Therapeutics declaring bankruptcy and mental health company Mindstrong Health terminating operations after selling its technology to SonderMind

All venture deals are exclusively sourced from HealthTech Alpha.

Oncology loses lead after five years

Neurology emerged as the front-runner among therapeutic areas, raising $814M this quarter. Oncology’s firm grip on the top spot globally — which it held for five years — loosened in Q1 2023, as it scraped together only $181M. Our upcoming report, Digital Health in Oncology, takes an in-depth look at this development.

If the first quarter’s low investment levels seem harsh, we haven’t seen the end to these conditions yet. Experts predict this is just the beginning of a more complex environment. As a result, VC liquidity is expected to face significant challenges.

Venture founders and CxOs must be prepared to make tough decisions — cut costs and pivot business models, if necessary. They should prioritise sustainability and profitability over growth. Investors should focus on venture proof points, such as Clinical Evidence, which demonstrate a proven track record and are well-positioned to weather the storm. Ultimately, venture founders, CxOs and investors alike need to brace for a rough year ahead.

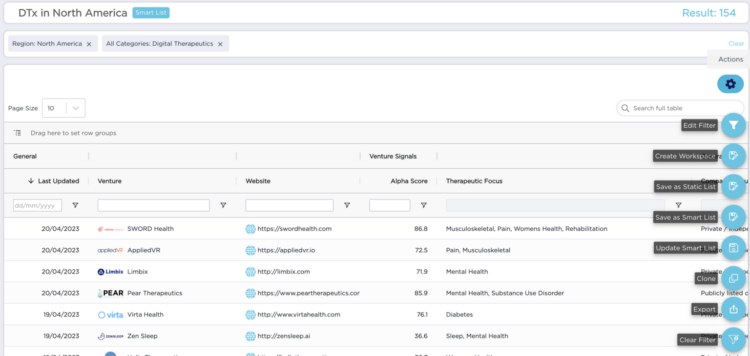

Smart Lists

We recently launched Smart Lists on HealthTech Alpha

Smart Lists are a powerful tool that allow users to create dynamic lists of Digital Health ventures, investors, or corporations based on our advanced filters. These filters can be customized to specific criteria such as funding rounds, location, industry focus, and more.