Galen Growth is pleased to share with you our 2025 Q2 Analysis on Digital Health Innovation in the United States. We look across the startup ecosystem for Digital Health and explain the current trends that are driving demand. Our analysis focuses on private ventures and includes ecosystem growth, most active partners, regulatory approvals and venture funding.

This report, powered by HealthTech Alpha- a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform- offers unmatched, non-biased, non-hyped, and data-driven coverage of the global Digital Health ecosystems.

H1 2025 Digital Health Funding Highlights from the U.S.:

-

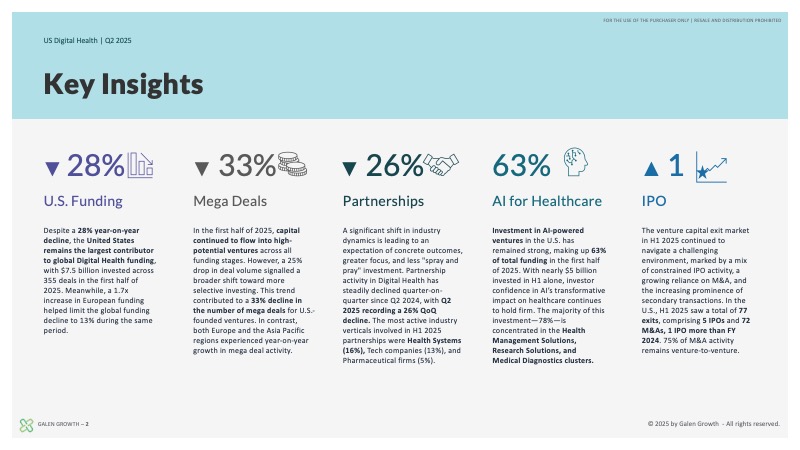

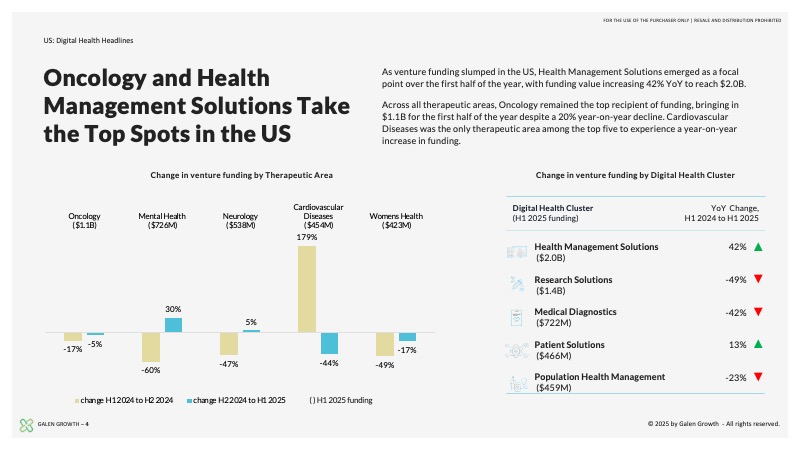

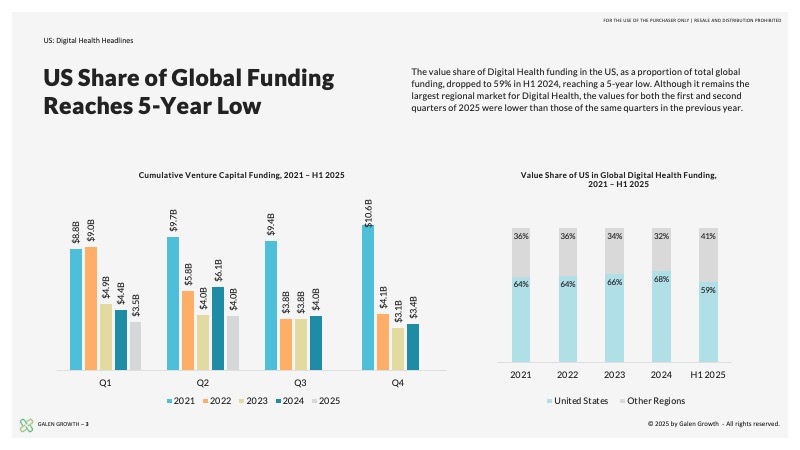

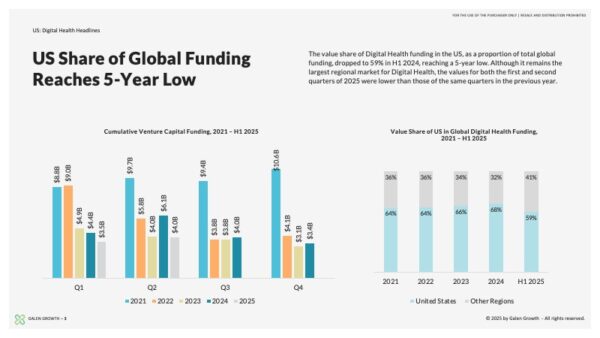

- S. Maintains Leadership: Despite a 28% year-over-year decline, the United States remained the leading source of global Digital Health funding, contributing $7.5 billion across 355 deals in the first half of 2025.

- Mega Deals Decline: A more selective investment climate led to a 25% reduction in overall deal volume and a 33% decrease in mega deals among U.S.-based companies.

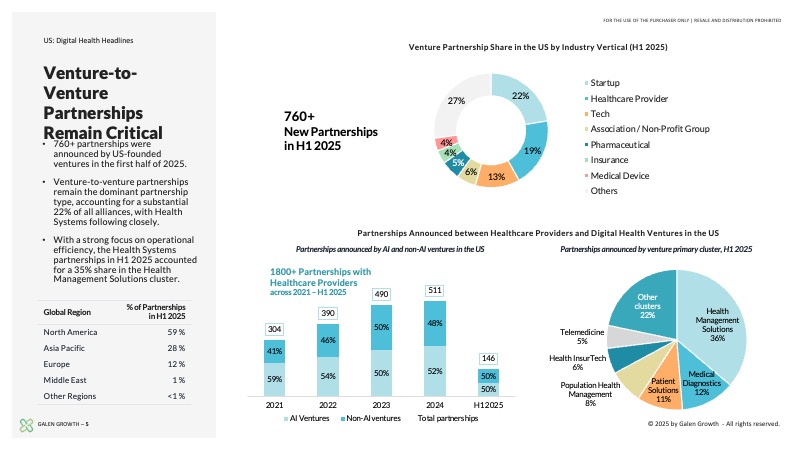

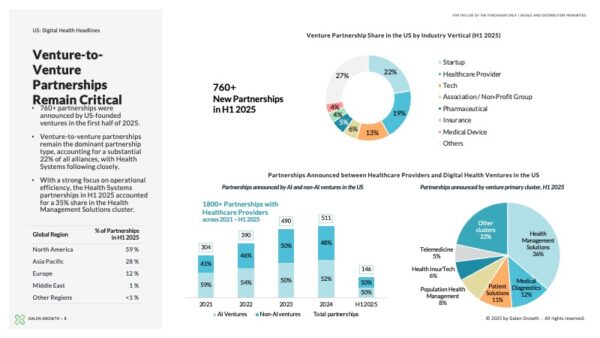

- Partnership Activity Slows: Digital Health partnerships continued to decline, with Q2 2025 registering a 26% quarter-over-quarter drop. Health Systems (16%), Technology firms (13%), and Pharmaceutical companies (5%) were the most active sectors.

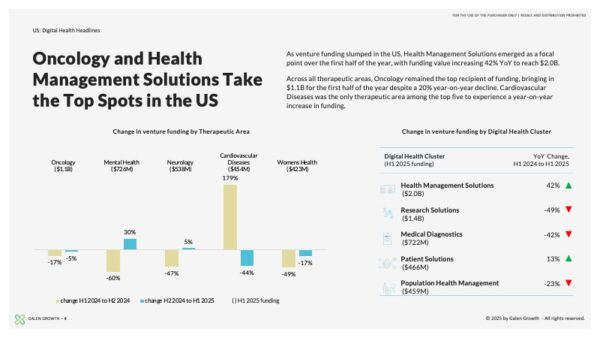

- Strong Momentum in AI: AI-focused ventures accounted for 63% of U.S. Digital Health funding, attracting nearly $5 billion in H1 2025—a clear indication of sustained investor confidence in AI’s healthcare potential.

- Exit Market Challenges: The venture capital exit environment remained difficult, with 77 U.S. exits in H1 2025—comprising 5 IPOs and 72 M&A transactions—highlighting the continued reliance on acquisitions and secondary sales over public offerings.

Ventures and Companies Covered in the Report

The “2025 Mid-Year Digital Health U.S. Key Trends Report” report includes data on the following companies:

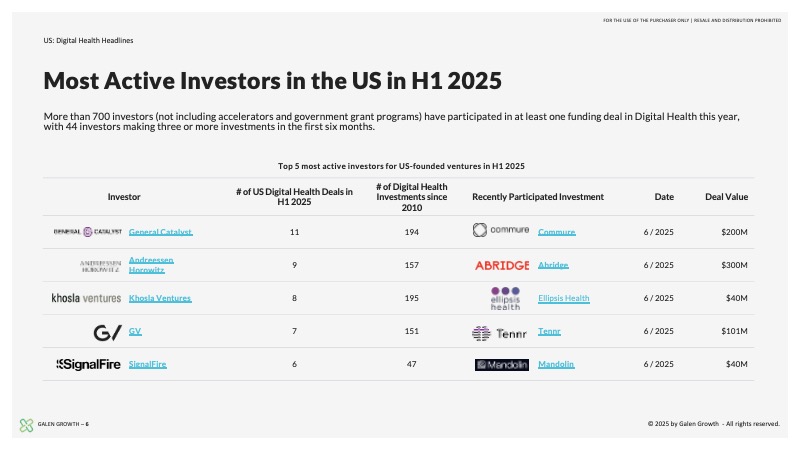

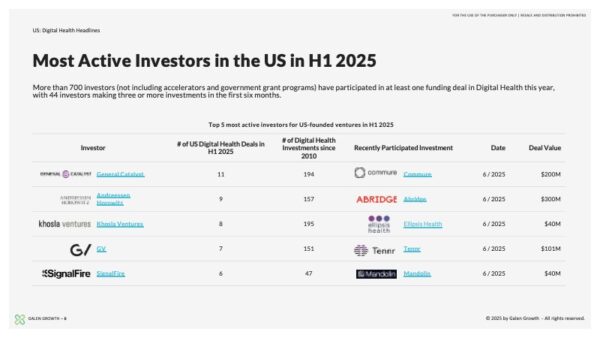

Commure, Abridge, Ellipsis Health, Tennr, Mandolin, Pathos, Prenuvo, Science Corporation, Cohere Health, Empathy, SandboxAQ, Proscia, General Catalyst, Andreessen Horowitz, Khosla Ventures, GV, SignalFire

Explore the Full Report

Gain a deep dive into the global H1 2025 digital health funding trends, cluster performance, and therapeutic priorities, with actionable insights for investors, corporates, and healthcare leaders.

Powered by HealthTech Alpha

The Q2 digital health Funding report is powered by HealthTech Alpha, the premier digital health intelligence platform delivering unparalleled data and insights into the evolving healthcare technology landscape. Leveraging an extensive database of over 15,000 ventures and cutting-edge analytics, HealthTech Alpha provides a data-driven foundation to analyse the critical trends shaping the future of digital health.

Designed to empower stakeholders—including investors, pharmaceutical leaders, and medical device manufacturers—HealthTech Alpha offers actionable intelligence to navigate digital transformation complexities. This collaboration ensures readers gain a comprehensive, evidence-based view of the intersection between digital health and healthcare, equipping them to identify strategic opportunities, assess market dynamics, and stay ahead in this fast-evolving industry.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Pages | Section | Content |

|---|---|---|

| 2–6 | Introduction | – |

| 7–8 | About Galen Growth | |

| 9–19 | Digital Health Headlines | 12 charts, 5 tables |

| 20–25 | Ecosystem Insights | 7 charts, 1 tables |

| 26–31 | Investment Insights | 7 charts, 1 tables |

| 32–37 | Cluster Focus | 3 charts, 2 tables |

| 38–44 | Therapeutic Focus | 4 charts, 2 tables |

| 45-51 | Key Information | – |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level