Analysing Funding, Exits, and Strategic Shifts in the Global Digital Health Venture Capital Ecosystem, with a Focus on Q2 2025 Trends and Future Outlook

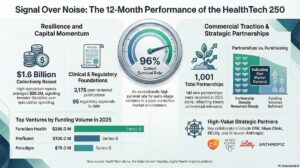

The first half of 2025 has presented a complex, yet evolving, landscape for the global digital health ecosystem. Moving out of a “roller-coaster” funding environment, the sector has transitioned into a “selective scale” phase, characterised by a heightened focus on proven value and tangible returns. While the overall venture capital market continues to grapple with liquidity constraints and market uncertainties, digital health is demonstrating resilience, albeit with capital flowing into more mature, high-potential ventures. This mid-year review examines the key performance indicators for digital health, highlighting significant shifts in funding, exits, and partnerships, with a particular focus on trends observed in the second quarter (Q2) of 2025.

Digital Health Funding Trends

Q1 and Q2 of 2025 saw a total investment of $12.1B in digital health funding, across 615 deals. This aggregate figure underscores continued investor interest, but a deeper dive reveals a nuanced story of concentration and cautious optimism.

Looking back at Q1 2025, the global Digital Health sector experienced a resurgence, attracting a robust $6.5B in funding. This quarter was notably defined by mega deals exceeding $100M, which accounted for a significant 51% of global Digital Health funding, indicating investors’ preference for more mature platforms with demonstrated clinical impact and scalability. AI-driven clusters such as Medical Diagnostics, Health Management Solutions, and Research Solutions (TechBio) were the top-funded areas, confirming the pervasive influence of Artificial Intelligence as a growth engine. Europe emerged as a “surprise contender,” securing $3.3B in funding (excluding exits), representing a 1.5x YoY increase, primarily driven by growth-stage mega deals from the private sector.

However, the momentum shifted somewhat in Q2 2025. While the total investment for Q1 2025 (January-March) within digital health ventures reached approximately $5.6 B, Q2 2025 (April-June) saw total funding of approximately $5.6B. This indicates an 18% QoQ moderation in funding from Q1 to Q2. The latest month in the half, June 2025, recorded $1.6 B in investment, showing a MoM decrease of 23.85% from May 2025’s $2.2 B. The average deal size for overall H1 2025 digital health funding was $32.1M, which is slightly higher than the $27.0 M average seen in Q1 alone.

The funding distribution by stage in Q2 2025 digital health funding indicates a continued flow across the venture lifecycle, with $431.3M in Early Stage, $595.1M in Growth Stage, and $633.3M in Late Stage funding during June 2025. The “selective scale” phase continues to dominate, with capital favouring AI ventures that demonstrate robust clinical validation and a clear pathway to profit (P2P). The emphasis remains on a “productivity premium” that shortens care pathways or reduces operational costs, rather than “AI-for-AI” narratives. Regulatory tailwinds, such as the new draft guidance FDA AI/ML guidance in Q2 2025, have also helped reduce the perceived risk associated with patient-facing algorithms, potentially encouraging further investment.

VC firms are prioritising increased selectivity and adopting a relationship-driven approach to diligence, reflecting a deliberate shift toward “value over volume”. They are applying stricter sourcing and diligence criteria, with a sharper focus on founder quality and growth potential.

In terms of therapeutic areas, the top-funded categories for the first half of 2025 include Oncology, with $1.86B, followed by Mental Health and Cardiovascular Diseases, both attracting $2B, Women’s Health, with $998M, and Neurology, with a total investment of $979M. This sustained investment reflects confidence in these areas to deliver significant impact and returns.

The Evolving Exit Landscape

The venture capital exit market in H1 2025 continued to navigate a challenging environment, marked by a mix of constrained IPO activity, a growing reliance on M&A, and the increasing prominence of secondary transactions.

For digital health specifically, at the end of Q2 2025 digital health saw a total of 113 exits globally, comprising 6 IPOs and 107 M&As for the whole of the first half of the year. The majority of these M&A deals had undisclosed value.

However, the QoQ trend for exits (including IPOs and M&As) reveals a significant decrease in Q2 2025. Q2 2025 recorded an exit value of $1.5 B, a substantial 49.61% decrease from Q1 2025’s $3.0 B. Despite this, the latest month (June 2025) showed $805.0M in exit investment, a 22.66% increase MoM from May 2025’s $656.3M.

Initial Public Offerings (IPOs): The anticipated return to a robust IPO market in 2025 appears unlikely, with projections suggesting continued sluggishness until year-end due to factors such as tariffs and trade war uncertainty. The proportion of public listings as a share of total exit activity has almost halved between 2023 and YTD 2025, reaching a historic low of 3.8%.

Despite these headwinds, several notable digital health IPOs have occurred. Companies such as Omada Health ($150.0M, June 2025), Hinge Health ($437.3M, May 2025), Beta Bionics ($204.0M, Feb 2025), MiRXES (Singapore)($139.0M, Jan 2025) have successfully listed. The overall market remains unstable, and a large “flood” of IPOs is not expected in the second half of the year. High-profile unicorns often continue to attract ample private investment, delaying their public market entry.

Mergers & Acquisitions (M&A) have solidified their position as an increasingly vital means of liquidity generation amid the prolonged IPO drought. Robust activity was observed in Q1 2025, with 55 deals recorded, and a further 52 deals in Q2 2025. Notably, 67% of these acquisitions involved US-founded ventures.

Strategic Partnerships & Industry Dynamics

Partnership activity in digital health in Q1 2025 totalled 762 partnerships recorded, versus 560 partnerships disclosed in Q2 2025, representing an 27% QoQ decline. The most active industry verticals across the first half of the year involved in these partnerships were Healthcare providers aka Health Systems (16%), Tech companies (13%), and Pharmaceutical firms (7%).

A significant shift in industry dynamics is the growing disillusionment with the hype surrounding startup innovation, leading to an expectation of concrete outcomes, greater focus, and less “spray and pray” investment. This is evidenced by high-profile breakups making headlines, such as Novo’s partnership with Hims & Hers.

Notable Digital Health Deals

The first half of 2025 witnessed significant capital movement in both funding and exit transactions within the digital health sector.

Top 5 Digital Health Funding Deals (H1 2025, by value):

- Isomorphic Labs received a $600.0M strategic investment in March 2025, highlighting continued large-scale investment in AI-driven drug discovery and health research solutions.

- Pathos secured $365.0M in Series D funding in May 2025, indicative of strong investor confidence in advanced patient solutions.

- Truveta raised $320.0M in Series C funding in January 2025, demonstrating investment in data-driven health insights and platforms.

- Abridge closed a $300.0M Series E round in June 2025, underscoring the growth of AI-powered health management tools.

- Innovaccer completed a $275.0M Series F round in January 2025, reflecting continued backing for health management solutions and data platforms.

Top 5 Digital Health Exit Deals (H1 2025, by value):

- CentralReach was acquired in an M&A deal for $1.7B in March 2025, representing a significant liquidity event within the sector.

- Accolade underwent an M&A transaction for $621.0M in January 2025, highlighting demand for patient navigation and health management services.

- Hinge Health completed an IPO in May 2025, valued at $437.3M, showcasing a successful, albeit adjusted, public market entry for a digital health unicorn.

- SomaLogic was acquired for $350.0M in January 2025, indicating strategic interest in precision health and diagnostics.

- 23andMe saw an M&A deal for $305.0M in January 2025, reflecting continued consolidation in consumer genomics and related health data spaces.

H2 2025 Digital Health Outlook & Forecast

The second half of 2025 for the digital health ecosystem is poised to be a period of continued discipline and re-acceleration, with several key trends shaping its trajectory.

Funding Forecast: Capital will continue to flow selectively, favouring AI ventures that can demonstrably convert clinical validation into tangible revenue. The “productivity premium” for solutions that shorten care pathways or reduce operational costs will remain paramount. Given that growth- and late-stage “funding strength” averages only around 12 months of runway, many scale-ups will need to return to the market before year-end. Internal forecasts for global digital health peg 2025 at $24.8 B under neutral conditions, suggesting that 2025 run rates could establish a new floor for investment. However, the sector’s resilience will be tested by lingering macroeconomic uncertainties, including rising tariff pressures, potential semiconductor duties, and currency fluctuations, which could increase hardware costs, disrupt supply chains, and squeeze margins, particularly for startups reliant on imported technologies. Access to capital and partnerships may also tighten if corporate operating costs rise and investor sentiment becomes more defensive.

Exit Forecast: The IPO market for digital health is expected to remain sluggish through the end of the year. While the second half of 2025 is expected to bring further IPOs, a large “flood” is not anticipated. A full-scale IPO recovery is unlikely until key policy uncertainties are resolved, and more companies follow suit. The trend of flat or declining valuations upon exit is expected to persist for many IPO candidates who have exhausted private capital options. Banker pipeline chatter indicates that at least three digital health ventures are preparing Q4 filings, and successful pricings could push overall funding into an upside band.

M&A activity is likely to continue being driven by smaller acquisitions, as large-scale deals remain scarce due to macroeconomic uncertainty and increased regulatory scrutiny. The anticipated regulatory shift that would boost larger M&As has not yet materialised. Therefore, while M&A will continue to be a crucial liquidity pathway, significant blockbuster deals might remain few and far between. The growing secondary market will remain a vital pillar for generating liquidity, particularly for high-valued unicorns seeking to provide liquidity to early investors and employees without a traditional exit.

Overall, H2 2025 will be critical in distinguishing “hype from habit-forming products,” laying the groundwork for a more durable growth cycle in 2026. The ongoing liquidity crunch will continue to pressure Limited Partners (LPs), potentially leading to persistent challenges in fundraising for venture capital funds overall. The impact of growing public listing attempts on LP liquidity and new fundraising activity is unlikely to materialise meaningfully until 2026. The digital health sector’s ability to adapt supply chains, strategically consolidate, and navigate shifting investor priorities will be key to its sustained growth.

Key Information

This article was written using analysis powered by HealthTech Alpha Copilot, the leading GenAI-powered search copilot for Digital Health.

Disclaimer: This article is provided for informational purposes only and does not constitute investment, legal, or medical advice. While every effort has been made to ensure the accuracy of the information presented, Galen Growth makes no guarantees regarding completeness or reliability. Readers should conduct their research and consult appropriate professionals before making any decisions based on this content.

Coming Soon: The Definitive Mid-Year 2025 Digital Health Trends Report

Galen Growth will publish its annual in-depth analysis of the key trends driving digital health in the first half of 2025 next week. This report provides a comprehensive examination of the forces shaping Digital Health globally and regionally, with a close look at how ongoing macroeconomic headwinds are affecting the sector. Subscribe now to be notified as soon as the full analysis is released.

About Galen Growth

Galen Growth helps healthcare leaders, investors, and innovators turn digital health data into a strategic advantage. As GenAI reshapes business expectations around efficiency and speed, organisations must rethink how they access and apply market intelligence. Galen Growth’s proprietary platform, HealthTech Alpha, combines healthcare expertise with GenAI to deliver targeted, clinically relevant insights, enabling clients to focus their resources on strategic decision-making rather than manual data gathering.