AI dominates funding flows, but only ventures delivering clinical and operational impact make the cut

TL;DR – Key Takeaways

- U.S. digital health funding reached $7.5 billion in H1 2025—down 28% YoY, but still the global leader.

- AI-powered ventures made up 63% of total U.S. digital health investment.

- Oncology and Mental Health dominated therapeutically, drawing $1.09 billion and $726 million, respectively.

- Mega deals fell by 33%, signalling a shift to high-conviction, evidence-led investments.

- Health Management Solutions emerged as the top-funded cluster with $2.05 billion, up 42% YoY.

- Partnerships are shrinking in number but growing in strategic focus, especially with Health Systems.

- Five IPOs in H1 mark a cautious return to public markets, but M&A remains the dominant exit route.

Analyzing the U.S. Digital Health Funding reset in Q2 2025

Notably, the U.S. share of global digital health funding fell to a five-year low at 59%, while regions such as Europe and Asia-Pacific experienced relative growth. This indicates both international maturity and a redefined U.S. investor class, which is less focused on expansion and more on impact.

Bigger Bets, Fewer Deals: Trends in Digital Health Investment

Though the number of funding rounds has dropped—particularly in Q2 2025, with only 171 deals, the lowest in five years—the average deal size increased to $27.9 million. This suggests growing investor confidence in a more concentrated set of scale-ready ventures.

In fact, 39% of total venture funding came from just 16 “mega deals” (≥ $100 million), including Abridge ($300 million) and Pathos ($365 million). Yet this was 33% fewer mega deals than H1 2024, highlighting the heightened scrutiny even at the top.

Growth- and late-stage companies face added pressure: with only 44% of late-stage U.S. ventures having raised capital in the past 12 months, many will need to return to market before year’s end. But they’ll need a compelling story, not just burn rate extensions.

Selected Mega Deals from Q2 2025

- Commure: $200 million Series F led by General Catalyst and Customer Value Fund

- Caris Life Sciences: $168 million Private Equity from Braidwell

- SandboxAQ: $150 million Series E with existing and new investors, including BNP Paribas, Google, and NVIDIA

Is AI Dominating Healthcare? Yes, But Strategically

This purposeful deployment of AI isn’t just about automation. It’s about delivering tangible efficiencies and insights—traits that payers, providers, and regulators can measure.

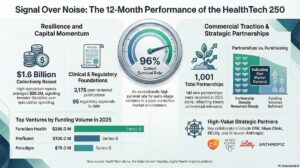

From Partnerships to Proof Points: Trends in Digital Health Partnerships

This tightening of partnership standards was underscored by high-profile dissolutions—such as Novo Nordisk ending its partnership with Hims & Hers—highlighting the demand for operational impact, not just press releases.

Therapeutic Focus: Oncology and Mental Health Lead the Charge in Digital Health Investment

Despite a 20% decline year-on-year, Oncology remained the top-funded therapeutic area at $1.09 billion, followed by Mental Health at $726 million. These two fields continue to draw outsized investment because of market size, clinical need, and AI applicability.

Cardiovascular Diseases stood out for bucking the broader funding trend, increasing year-over-year and attracting $454 million, fuelled by ventures like SandboxAQ and its quantum-enabled diagnostic platform.

Importantly, over 40% of ventures in these top therapeutic areas had a Clinical Evidence Signal score above 40, indicating peer-reviewed research, trials, or regulatory filings. That’s compelling for discerning investors and partners alike.

Top Therapeutic Areas by Venture Funding across Q1 and Q2 2025

• Oncology – $1.09 billion

• Mental Health – $726 million

• Neurology – $538 million

Health Management Solutions: The Standout Cluster in Digital Health Funding

Among the 18 clusters in Galen Growth’s taxonomy, Health Management Solutions surged ahead with $2.05 billion in funding, a 42% year-on-year increase. This cluster spans everything from EHR platforms to hospital operations optimisation tools—and is increasingly the canvas on which AI and cost-efficiency intersect.

Top Digital Health Clusters by Venture Funding across Q1 and Q2 2025

• Health Management Solutions – $2.05 billion

• Research Solutions – $1.41 billion

• Medical Diagnostics – $722 million

Exits Reopen Cautiously: Digital Health IPO & M&A trends

After nearly three years of subdued IPO activity, H1 2025 marked a subtle return to the public markets. Five U.S. digital health companies successfully listed in the first half of the year, surpassing the full-year total for 2024.

M&A remains the more active and preferred exit path. Of the 77 U.S. exits recorded in H1 2025, 72 were mergers or acquisitions, 75% of which were venture-to-venture transactions. These consolidations are less about distress and more about strategic fit, ecosystem consolidation, and scaling platform capabilities.

The public markets may have reopened slightly, but the outlook remains cautious. For most startups and their investors, exits in 2025 will be shaped more by integration strategies than IPO roadshows.

Conclusion: Toward a Sharper, Smarter Ecosystem

U.S. digital health is entering a phase of disciplined maturity. Gone are the boom-era dynamics of unchecked growth and speculative capital. What’s emerging is a more focused landscape—anchored by AI-enabled solutions, clinical validation, and partnerships that deliver operational outcomes.

Looking ahead, the second half of 2025 will likely favour ventures that can integrate seamlessly into care delivery, support value-based models, and withstand a tightening capital environment. IPOs may reappear, but strategic M&A will remain the dominant exit path. As regulatory scrutiny grows and health systems demand more than prototypes, the next wave of winners will be those building not just fast, but wisely.

The Point of View: Why This Analysis Matters

For Investors:

The U.S. digital health market is moving from speculation to sustainability. For investors, that means fewer, larger, higher-conviction bets. AI isn’t enough—proof is paramount. Understanding which clusters (Health Management, Diagnostics) and therapeutic areas (Oncology, Mental Health) are drawing validated investment can guide capital allocation strategies.

For Startups:

The bar is higher. Investors want revenue, evidence, and partnerships that lead to results. Clinical proof points, regulatory filings, and deployment in real-world settings are becoming minimum entry requirements, rather than differentiators.

For Health Systems and Corporations:

With capital more disciplined and technologies more mature, this is the moment to double down on transformative partnerships. But results—not prototypes—will win trust. Strategic alignment with scale-ready ventures in AI, diagnostics, and management infrastructure is key.

Frequently Asked Questions (FAQ)

1. How much funding was raised in digital health in the U.S. in H1 2025?

Despite a 28% year-on-year decline, the United States remains the most significant contributor to global Digital Health funding, with $7.5 billion invested across 355 deals in the first half of 2025. Investors have become more selective, prioritising evidence-backed ventures. The fall in volume is due to quality control, not a loss of interest.

2. What role does AI play in today’s digital health landscape?

AI powers the majority of leading digital health solutions in Health Management Solutions, Medical Diagnostics, and TechBio. However, success hinges on clinical and operational proof, not just technical potential.

3. Which therapeutic areas are most attractive?

Oncology and Mental Health remain top-funded due to strong clinical need and investment history. Ventures with solutions for Cardiovascular Diseases are attracting increased funding, suggesting an evolving investor thesis and shift of strategy to a focus on consumer healthcare, with an emphasis on preventive care.

4. Are partnerships declining in importance?

Not at all. While overall volumes are down, the nature of partnerships is more strategic and results-oriented, particularly with Health Systems and Tech providers.

5. What does this mean for digital health exits?

The IPO market remains tentative, with just five public listings so far in 2025. M&A continues to dominate, especially venture-to-venture transactions (72 of 77 exits).