The pharmaceutical industry is undergoing a profound structural shift, moving past billions spent on traditional direct-to-consumer (DTC) advertising toward building proprietary direct-to-patient (DTP) infrastructure. This evolution represents a strategic pivot from mere persuasion (DTC) to operational provision (DTP), aiming to control the patient journey from diagnosis to fulfilment and adherence. However, this burgeoning manufacturer-led ecosystem is now facing immediate disruption from a federal initiative, TrumpRx, which seeks to commoditise drug pricing through government aggregation and Most-Favoured-Nation (MFN) mandates.

This report provides a business analyst’s perspective on the DTP’s evolution, defining the new model, detailing major corporate launches, explaining the structure of TrumpRx, and forecasting the resulting strategic conflict between manufacturer-led convenience and federally mandated price clarity.

1. The Evolution of Pharma Direct-To-Patient

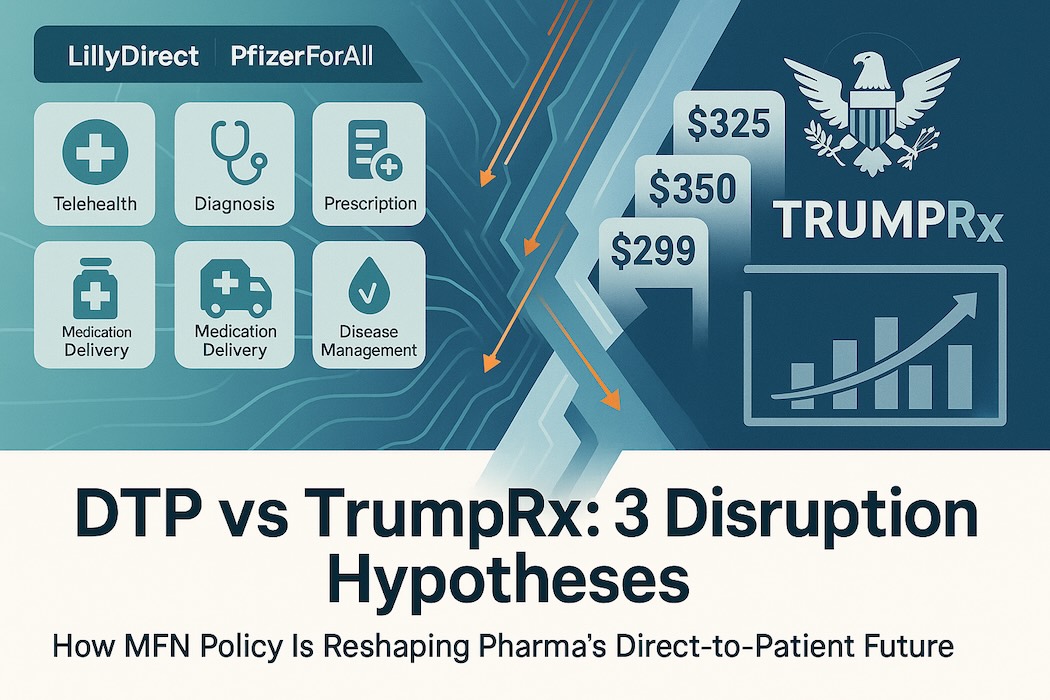

The new pharma DTP model is defined not merely by drug discounts, but by the establishment of a full-stack digital health infrastructure that serves as a “digital front door” for patients. This structural approach integrates what were previously fragmented steps—physician consultation, prescription, payment, and delivery—into a single, manufacturer-orchestrated experience.

1.1 The New Pharma DTP Model Defined

Measuring DTP maturity requires examining five critical elements that define these new platforms:

- Remote diagnosis: The initial patient intake and assessment phase.

- Telehealth: Connecting patients with independent prescribers for consultation and e-prescribing.

- Online pharmacy & distribution: Utilising third-party fulfilment services (e.g., Amazon Pharmacy, Alto) for direct home delivery.

- Disease management: Incorporating tools like digital therapeutics and reminders to boost adherence and track outcomes.

- Health InsurTech: Embedding eligibility verification, affordability programs, and payment plumbing directly into the platform.

The most sophisticated models, such as LillyDirect and PfizerForAll, are categorised as full stack because they operationalise all five elements.

1.2 Pharma Objectives and Favourability

The objectives driving this DTP shift are strategic and operational, moving beyond traditional brand awareness:

- Access and Speed: The platforms aim to compress the time-to-therapy from weeks to hours or days, which is transformative for chronic and high-demand conditions.

- Adherence and Outcomes: By embedding digital therapeutics and support programs, pharma increases persistence rates, which are critical for positive health outcomes.

- Transparency and Control: Transparent cash-pay pathways allow manufacturers to bypass the complex, rebate-driven economics of the Pharmacy Benefit Manager (PBM) system, providing net price clarity to consumers and payers.

- Authenticity and Safety: Centralising fulfilment through verified partners ensures patients receive authentic, FDA-approved medication, countering the risk of counterfeit or compounded products that surge during drug shortages.

The DTP model strongly favours Big Pharma companies with:

- Blockbuster products in high-demand, high self-pay elasticity categories: Primarily cardiometabolic diseases (obesity, diabetes) and neurology (migraine), where patient demand and insurance friction are high.

- Deep pipelines ready for digital integration: Companies poised to migrate new neurology and cardiometabolic therapies to DTP rails will gain first-mover advantage.

- Established digital partnership networks: The models rely heavily on orchestrating partners (telehealth, pharmacy, digital therapeutics) rather than building everything in-house.

1.3 Update on Major Pharma DTP Launches

Direct-to-patient programs are in the works at 94% of large pharmas, suggesting the model is set to become “standard practice”.

- Eli Lilly (LillyDirect): Launched in January 2024, focusing initially on obesity (Zepbound), migraine (Emgality), and diabetes (insulins, Mounjaro). It operates as a full-stack platform, partnering with entities like Amazon Pharmacy and telehealth providers for remote diagnosis and home delivery. Eligible cash-pay patients could access the 2.5-mg dose of Zepbound at $349 per month, with higher dosages at $499, before recent federal negotiations.

- Pfizer (PfizerForAll): Launched in August 2024, designed as a “benefits-native convenience” platform. It also covers all five DTP elements but emphasises compatibility with existing PBM and insurance benefits. It provides access to treatments for migraine (Nurtec), COVID-19 (Paxlovid), and vaccines, leveraging partners like UpScriptHealth, Alto Pharmacy, and Instacart.

- Novo Nordisk (NovoCare Pharmacy): Launched in early 2025, specifically as a transparent cash-pay anchor for its high-demand GLP-1 therapies, Wegovy and Ozempic. It offered Wegovy to self-paying patients for a consistent price of $499 per month. Novo Nordisk has also expanded access by collaborating with major telehealth providers, including Hims & Hers Health, LifeMD, and Ro, to ensure patients receive authentic, FDA-approved products.

- AstraZeneca (AstraZeneca Direct): Debuted in October 2025, this platform offers discounted prices for cash-pay patients, building on existing support programs. Examples include Farxiga (Type 2 diabetes/CKD/HF) available for $181.59 (a 70% discount off its $600 list price) and Airsupra (asthma) marked down to $249 (about half off its $489 list price).

- Bristol Myers Squibb (BMS Patient Connect): Announced for a January 2026 launch, this platform will offer the psoriasis medication Sotyktu to eligible cash-pay patients at an 86% discount, bringing the price down from $6,828 to $950 for a 30-day supply. BMS is also involved in a separate DTP program with Pfizer for the anticoagulant Eliquis.

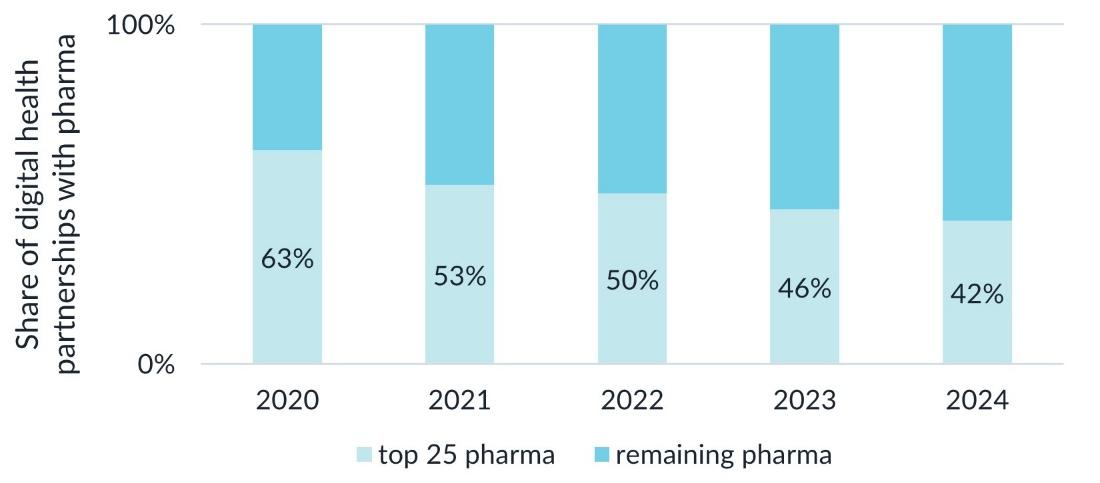

Although the top 25 pharmaceutical companies continue to lead in digital health and direct-to-patient (DTP) initiatives, their collective market share of digital health partnerships fell below 50% in 2023 and moved to 42% share in 2024 — highlighting the growing digital capabilities of smaller biopharma firms that are leveraging technology to expand their reach.

2. The Arrival of TrumpRx: Government as Price Aggregator

The proliferation of pharma DTP models, particularly those offering transparent cash-pay pricing, coincides with intensified political pressure to reduce US drug costs. This backdrop sets the stage for the federal countermeasure: TrumpRx.

2.1 What is TrumpRx?

TrumpRx is the brand name for the US government-run direct-to-consumer (DTC) website, previously slated to launch in early 2026 but now expected by year-end. Crucially, TrumpRx is presented as a federal price-finder or meta-portal. It is not currently designed to sell medications directly or to issue new prescriptions. Instead, it serves as a lobby that directs patients to manufacturers’ DTC websites, such as LillyDirect and NovoCare Pharmacy, highlighting discounted pricing.

The program’s underlying policy mechanism is the implementation of a “Most Favoured Nation” (MFN) push. President Donald Trump has called for drugmakers to enact this order, aimed at bringing US drug costs down to the lowest prices available in other developed countries.

2.2 Pricing Mandates and Key Deals

TrumpRx is powered by negotiated MFN-style deals with major pharma, resulting in significant price compression across key therapeutic areas.

- GLP-1s: Eli Lilly and Novo Nordisk agreed to MFN pricing for their blockbuster obesity treatments, Zepbound and Wegovy.

- Zepbound will be available via TrumpRx at $299 per month, with an expected decline to $245 within two years.

- Wegovy is priced at $350 per month, with a trend down to $245.

- For Medicare coverage (contingent on related comorbidities), the prices for Wegovy and Zepbound, and their diabetes counterparts Ozempic and Mounjaro, will be $245 per month, with beneficiary co-pays of $50 per month.

- Other Medications: Pfizer was the first to sign onto the MFN deal, and AstraZeneca and Merck KGaA followed. The initiative promised steep discounts on various medications, including a 50% reduction on migraine medication Zavzpret and 40-85% reductions on other targeted drugs.

These negotiated prices (e.g., $299 for Zepbound) are often steeper than the self-pay “anchor prices” initially established by the pharma DTP platforms (e.g., LillyDirect’s previous $399–$449 Zepbound pricing).

3. Strategic Conflict: Impact of TrumpRx on Pharma DTP Models

The arrival of a federally backed price aggregator fundamentally alters the competitive landscape for pharma DTP models. TrumpRx will severely commoditise the fulfilment and cash-pay pricing advantages of pharma DTP platforms. Still, it will simultaneously validate the utility of the DTP clinical integration model (telehealth/Rx initiation) as the primary point of differentiation.

This impact can be assessed by analysing the two primary steps in the patient journey, based on Galen Growth’s TrumpRx: Three Disruption Hypotheses analysis below:

3.1 Hypothesis 1: Re-intermediating Discovery (Initiation vs. Refills)

Pharma DTP models win today by bundling the entire patient journey: diagnosis, prescription, and fulfilment.

- New-to-Therapy Patients (Initiation): For patients who need a new diagnosis and prescription, pharma DTPs (like LillyDirect and PfizerForAll) retain a crucial edge due to their integrated telehealth and e-prescribing services. If TrumpRx remains strictly a price-finder and does not add care access (e.g., “book-a-consult” with independent prescribers), new starts will still face friction and must secure an Rx elsewhere—blunting TrumpRx’s disruption potential at the initiation stage.

- Existing Patients (Refills/Switches): This is where TrumpRx disruption is immediate and potent. Once a patient has a valid prescription, price dominates the choice of fulfilment channel. Since MFN-linked cash prices ($299–$350) reliably beat or match the brand DTP cash anchors ($499), patients have a strong incentive to bypass the brand portals at the fill stage and route their fulfilment through the channel to surface the lowest TrumpRx price. Reimbursement remains a key decision pivot for the patient.

3.2 Hypothesis 2: Price Compression and Flattened Cash Anchors

The core value proposition of NovoCare Pharmacy—transparent, affordable, cash-pay pricing—is directly undermined by TrumpRx. The MFN essentially mandates a new, lower cash anchor for the market.

For pharma, the DTP advantage of offering transparent self-pay pricing narrows significantly if a government-brokered cash price is reliably lower. This effect is magnified by the potential for TrumpRx to evolve into a Point-of-Sale (POS) standard—a universal price ID or card—which would commoditise fulfilment at the checkout stage, regardless of where the prescription originated.

3.3 Strategic Response: Doubling Down on the Clinical Moat

The strategic takeaway for pharma DTP teams must be a complete shift in focus from price to clinical value:

- Protect the Clinical Moat: Pharma must double down on the initiation step (assessment 🡪 Rx). This requires ensuring that the integrated telehealth systems are fast, independent, and strictly compliant to survive heightened regulatory scrutiny concerning anti-kickback violations and prescriber independence.

- Shift Differentiation to Outcomes: If price becomes commoditised by TrumpRx, differentiation must rely on non-price factors: superior adherence support, disease management resources, and overall service quality. For example, integrating digital therapeutics or specialised case management (like Astellas’ DIGITIVA model) will become critical.

- Design for “Bring-Your-Own Prescription”: Pharma DTP rails must assume TrumpRx will own price discovery. They need to make it trivially easy for any prescriber (GP, local clinic, or independent telehealth) to send e-scripts to their fulfilment partners while clearly showing the total cost of therapy against TrumpRx benchmarks.

4. Why It Matters: Implications for Key Stakeholders

The collision between pharma’s DTP strategy and TrumpRx is a pivotal moment in US healthcare, impacting pharma economics, patient access, and channel dynamics.

4.1 Implications for Pharma Companies (Industry Leaders)

For pharmaceutical companies, the DTP shift is a strategic repositioning. They are transforming from passive suppliers reliant on intermediaries into orchestrators of the patient journey.

- Financial Strain: The immediate impact of TrumpRx is negative, particularly for companies like Novo Nordisk, which expects a “negative low single-digit impact on global sales growth in 2026” due to MFN deals. While Lilly’s stock initially saw a slight bump, the ongoing price compression mandated by MFN deals fundamentally pressures US list-to-net prices.

- Manufacturing Commitment: To secure MFN deals and tariff reprieves, pharma must increase its commitments to US manufacturing. Lilly, for instance, committed to a new $10 billion US manufacturing site capable of end-to-end production of oral Wegovy.

- Focus on Compliance: The most immediate risk is regulatory exposure. Pharma must ensure Health Care Professional (HCP) independence and non-steering user experiences to protect the DTP model’s initiation advantage from anti-kickback scrutiny.

4.2 Implications for Patients (Consumers)

Patients stand to benefit from two parallel forces driving down friction and cost:

- Improved Access and Speed: Pharma DTP platforms offer rapid time-to-therapy and authentication verification, which are crucial during periods of high demand and heightened counterfeit risks (e.g., GLP-1s).

- Enhanced Affordability for Cash-Pay Patients: TrumpRx enforces highly competitive pricing ($299–$350 for GLP-1s), often beating the prices previously offered by the manufacturer DTP sites. This is particularly beneficial for the uninsured, underinsured, or self-pay patient cohorts.

- Equity Concerns: Experts warn that cash-pay transparency does not automatically equate to affordability for lower-income patients, for whom benefits-first pathways remain essential. Furthermore, some providers worry that manufacturer-led DTP models may erode the patient-provider relationship and introduce potential bias toward the manufacturer’s drug.

4.3 Implications for Channel Partners and PBMs (Key Stakeholders)

- Pharmacy Benefit Managers (PBMs): DTP rails do not replace PBMs, which remain indispensable for the insured majority. However, the transparent cash-pay pricing enforced by TrumpRx fundamentally re-prices the market and puts pressure on the PBMs’ rebate-heavy economic models. PBMs are expected to respond by implementing tighter formularies and offering outcomes-based guarantees as a strategy to maintain enrolment and preserve market share.

- Telehealth and Digital Health Ventures: The need for integrated DTP services means that startups solving specific frictions—like prior authorisation, adherence, or specialised fulfilment—become indispensable partners. Conversely, dependency on a single pharma rail can be existential if the partnership is pruned. Telehealth companies like Hims & Hers, LifeMD, and Ro have already become key partners for Novo Nordisk and Lilly.

- Providers: Healthcare providers express concerns about potential conflicts of interest and the erosion of the patient-provider relationship when drug companies insert themselves too deeply into the care journey. Close monitoring of patients remains vital, particularly for newer drugs like tirzepatide.

Conclusion: The Race for the Patient Journey

The DTP revolution, pioneered by LillyDirect and PfizerForAll, represents pharma’s successful execution of a full-stack patient journey that prioritises speed and convenience. The swift response from the Trump administration via TrumpRx and MFN deals, however, injects price competition directly into the core DTP value proposition.

The future competitive landscape will resemble a two-stage race. TrumpRx will likely dominate the “Refill” track, commoditising the fulfilment step through federally mandated low prices. In response, pharma DTP must concentrate its resources on the “Initiation” track, leveraging integrated telehealth, clinical support, and strict compliance as its competitive moat. Success will hinge not on who offers the lowest cash price—a field now dictated by government negotiation—but on who can provide the most compliant, convenient, and outcomes-driven initial clinical engagement.

The DTP ecosystem is not dissolving; it is being stress-tested. It will survive, but it must evolve from a low-priced provider to a highly sophisticated, clinically integrated patient management system. This systemic change moves pharma closer to the patient than ever before, simultaneously increasing their market control and regulatory scrutiny.