The landscape of digital health is characterised not only by rapid innovation but also by swift, often brutal, market corrections. The recent action by UnitedHealthcare (UHC) to dramatically roll back coverage for most Remote Patient Monitoring (RPM) programs, effective January 1, 2026, is more than a regulatory hurdle; it is a decisive market signal. This decision forces a systematic re-evaluation of the foundational economics and strategic viability of standalone RPM businesses—confirming what many industry insiders have long suspected: the treadmill of thin-margin, CPT-code-dependent models is under severe strain.

From the Galen Growth perspective, this development is an inflexion point, necessitating a pivot toward integrated digital health solutions that demonstrate verifiable clinical and economic outcomes, rather than relying solely on inconsistent fee-for-service reimbursement.

The UHC Policy: A Tectonic Shift in Payer Strategy

On November 7, 2025, UnitedHealthcare quietly implemented a major change to its coverage policies that could impact thousands of Medicare beneficiaries. UHC’s new policy asserts that RPM is only medically necessary in two instances: chronic heart failure (CHF) and hypertension during pregnancy. Crucially, the policy explicitly states that RPM will no longer be covered for two of its most common uses: Type 2 diabetes and non-pregnancy-related hypertension.

UHC argues that “remote physiologic monitoring is unproven and not medically necessary due to insufficient evidence of efficacy” for a wide range of conditions, including diabetes, chronic obstructive pulmonary disease, and mental health conditions. While UHC cites studies supporting RPM use in CHF and hypertensive disorders of pregnancy, it presents what it describes as inconclusive evidence for broader chronic disease use.

This restrictive policy stands in stark contrast to the trajectory set by regulatory bodies. Medicare has covered RPM services since 2019, and the Centres for Medicare & Medicaid Services (CMS) has consistently supported a broader view of coverage. Moreover, the physician pay rule issued by the Department of Health and Human Services under Health Secretary Robert F. Kennedy Jr. had expanded remote monitoring. It incentivised advanced primary care, which frequently includes RPM.

The Legal Aggression

What makes UHC’s move particularly concerning is the aggressive legal theory it advances. Legal experts have characterised UHC’s position as an “aggressive interpretation” of the private insurer’s role as administrator of Medicare Advantage (MA) plans. By law, MA plans must generally cover the same services available through traditional Medicare.

Lawyers note that UHC is ruling out coverage for specific diagnoses without conducting any “individualised patient analysis,” diverging from the narrow discretion MA plans typically hold when determining medical necessity. UHC’s attempt to define its own coverage limitations—absent a National Coverage Determination (NCD) or Local Coverage Determination (LCD)—suggests that when these regulatory guideposts are lacking, it becomes a “free for all,” a position legal experts strongly challenge. This test sets a dangerous precedent, opening the door for MA plans to claw back a “whole host of services potentially”.

The Unprofitable Economics of Standalone RPM

While legal challenges emerge, the UHC decision exposes the fragility of the standalone RPM business model. For many teams building and scaling digital health and RPM solutions, the rollback is unsurprising because the economics “simply don’t work for most companies”.

The fundamental constraints include:

- Razor-Thin Margins: Once essential operating costs—including hardware procurement, logistics (shipping, repair, calibration), the necessary clinical staff time for data review, and the inevitable delays in reimbursement—are factored in, the margins are “razor thin”.

- Inconsistent Payer Coverage: The reliance on CPT codes in a fee-for-service environment is volatile. Payer coverage is “inconsistent and constantly shifting,” a reality now starkly affirmed by the UHC policy change.

- Commoditisation Risk: Without specialised differentiation in clinical outcomes, RPM is easily relegated to a “commodity service,” making it difficult to establish a defensible, high-growth business engine.

The lesson is not that remote monitoring lacks clinical value—but that relying on it as a universal, CPT-driven business model has proven unsustainable. The focus must shift from chasing inconsistent fee structures to capturing measurable value through verifiable outcomes.

(See the Galen Growth evidence base: https://healthtechalpha.com)

The Strategic Threat: Payer Ecosystems and Epic’s Dominance

The economic challenges are amplified by a broader strategic threat: major insurers are consolidating ownership of the patient relationship and building integrated digital health ecosystems.

Insurers have little incentive to pay RPM startups to “insert themselves between the payer and the patient” when they can build or strategically partner at scale. This trend is already evident:

- United Healthcare has developed its own RPM application.

- Humana has aligned its strategy with major platforms like Epic and MyChart.

- Aetna is utilising a partner network.

Epic is arguably the largest existential threat to standalone RPM companies. With over 190 million people using MyChart, Epic is perfectly positioned to dominate the remote monitoring space if it chooses to move aggressively. While Epic does not typically handle hardware or logistics, these gaps can be easily bridged through partnerships—consolidating control of the entire workflow under a single platform.

If the dominant platforms already “own the patient relationship,” external startups dependent on CPT-code reimbursement become redundant costs, not strategic partners.

Why It Matters: Analysing Stakeholder Impact

The UHC decision creates cascading consequences across the entire healthcare ecosystem, affecting all stakeholders involved in the delivery, payment, and innovation of chronic care.

Patients

Patients stand to lose access to care models their physicians deem necessary. RPM provides physiologic data—blood pressure, weight, blood glucose—that enables timely adjustments to care plans and proactive chronic disease management. Eliminating coverage could worsen health outcomes and remove technology-enabled care approaches that have been shown to reduce costly downstream events.

Payors (Beyond UHC)

While payors may see short-term savings from restricting RPM, UHC’s legal manoeuvre carries major risks. If its interpretation of MA rules succeeds, it could allow payors to strip coverage for other non-NCD/LCD services, but also expose them to liability. Additionally, refusing effective RPM services may increase downstream events, running counter to value-based care goals.

Investors

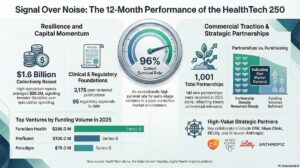

The investment thesis for many RPM companies has relied on scalable CPT code reimbursement. The UHC rollback is a significant de-risking event. Investors must reassess portfolios to determine which companies are defensible—those with deep integration, strategic payer/EHR partnerships, and independently verifiable ROI.

Providers (Hospitals, Clinics, Health Systems)

For hospitals and health systems, the policy adds complexity to an already shifting reimbursement landscape. Clinicians use RPM because they deem it appropriate for managing chronic conditions. UHC’s decision removes a valuable tool, forcing a return to less efficient, reactive care models. Systems dependent on external RPM vendors must re-evaluate internal capabilities, especially with CMS maintaining broader support for RPM.

The Digital Health Ecosystem

The ecosystem receives a clear mandate: value must equal outcomes. One cost and utilisation analysis demonstrated annual total savings of $1,308 per patient across three chronic disease programs (heart failure, hypertension, and Type 2 diabetes), driven primarily by a 27% reduction in hospital admissions. Similarly, a program at Geisinger showed significant savings ($216 per member per month) and reduced hospitalisations.

The future of digital health requires solutions integrated deeply into care delivery with robust clinical and economic proof—not reliance on transient CPT reimbursement mechanics.

The Galen Growth Imperative: Rethinking Value Capture

The UHC action is a harsh but necessary outcomes-based analysis. For digital health startups to survive this “RPM Reckoning,” they must abandon the illusion of easy CPT revenues and embrace the Galen Growth imperative: redefine value capture.

Success now requires:

- Deep Integration: Seeking embedded solutions within established care delivery pathways, rather than operating as bolt-on services.

- Strategic Partnerships: Leveraging partnerships with entities that already “own the patient relationship,” or with Integrated Delivery Networks (IDNs).

- Data-Driven Defence: Utilising robust randomised controlled trials (RCTs) and comprehensive cost analyses, like the one showing $1,308 in savings per patient due to a 27% reduction in hospital admissions, to aggressively counter payer claims of “insufficient evidence”.

The industry must resist the narrative that RPM is medically unnecessary outside two narrow diagnoses. When executed well, digital health demonstrably reduces hospital admissions and improves chronic disease control. Founders and investors must prove their solution is not a commodity, but an indispensable, cost-saving component of modern healthcare infrastructure.

The UHC rollback exposes flawed economics and signals that the era of standalone, CPT-reliant RPM is ending. What follows must be an era of deep clinical integration, strategic alignment, and undeniable outcome delivery.

Who is Galen Growth?

Galen Growth operates as a leading authority within the global Digital Health ecosystem. Our perspective is rooted in real-world data and rigorous analysis to guide stakeholders—from startups and investors to payors and providers—through market volatility and technological transformation. We dissect major industry events, such as the UHC RPM policy shift, to provide actionable insights and strategic imperatives aligned with sustainable, outcomes-driven value capture.