Galen Growth is pleased to share with you this report on the Global Digital Health Ecosystem in Mental Health. We focus our analysis on the venture funding key trends, noteworthy deals, exits, and investors for the therapeutic area of Mental Health in H1 2021.

With unmatched, unparalleled and indispensable coverage of the global digital health ecosystems, this report is powered by HealthTech Alpha, a Galen Growth proprietary solution, and the world’s leading on-demand digital health intelligence platform.

The World Health Organization describes mental health as a state of balance, both within and with the environment. Physical, psychological, social, cultural, spiritual and other interrelated factors participate in producing this balance. Therefore, Galen Growth encompasses both Mental Disorders as well as Mental Wellness/Well-Being in its definition of Mental Health for this report

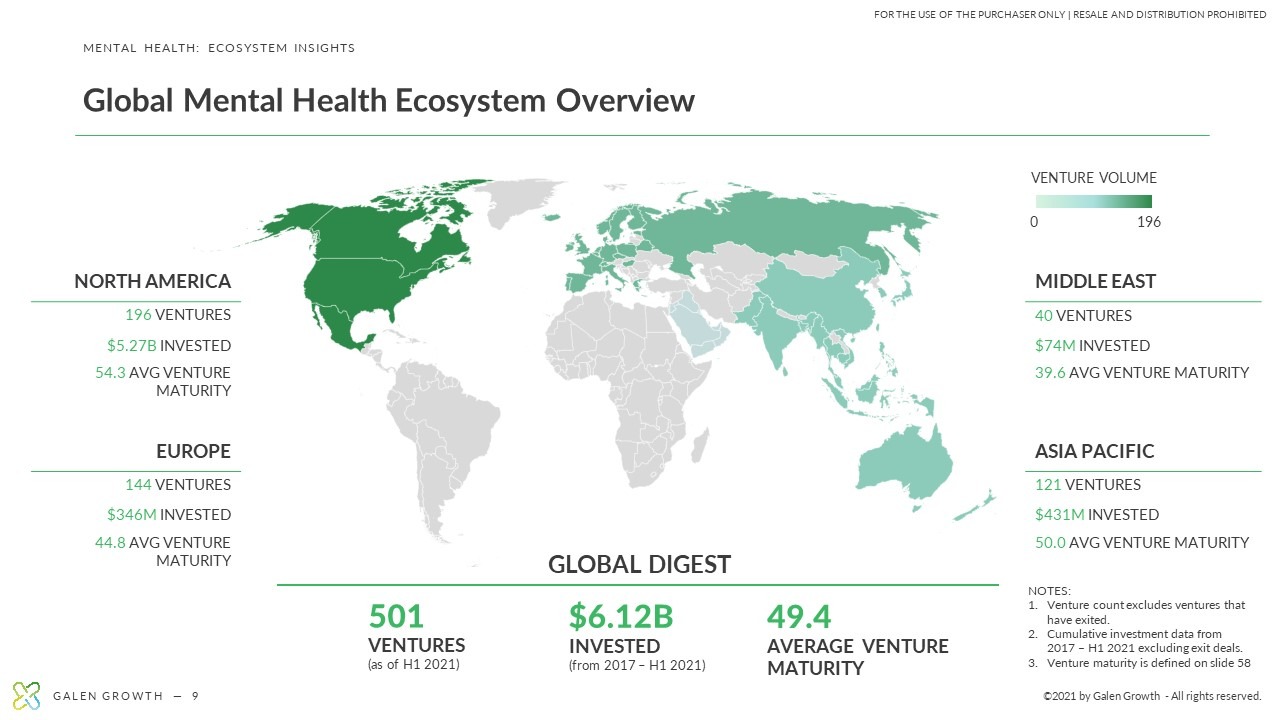

The global digital health ecosystem of ventures focusing on Mental Health is growing at a 5-year CAGR of 12%. Since 2017, 146 new ventures were incorporated, and 21 ventures have either been acquired or have issued a public offering. There are 501 active, private Digital Health ventures distributed globally with a solution in Mental Health, but only 12% of the $1.85B in venture funding raised in Mental Health was deployed to ventures outside of North America.

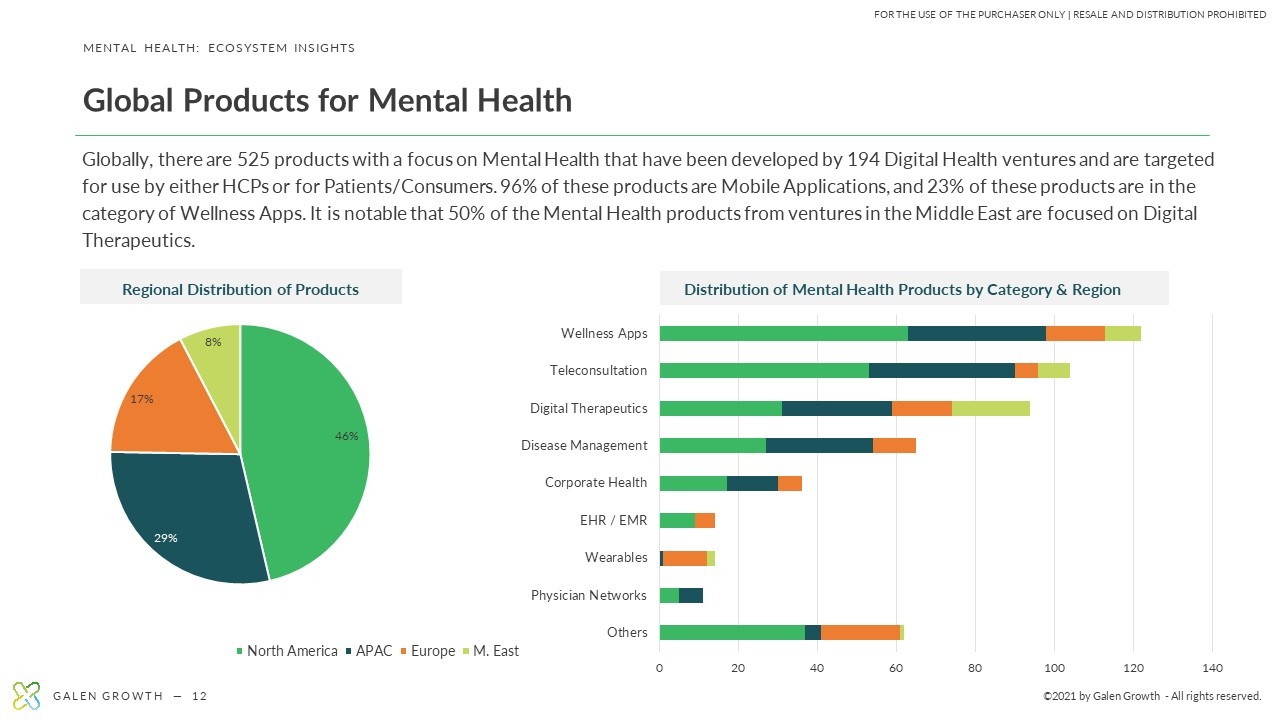

- 96% of the products developed by Digital Health ventures focused on Mental Health are Mobile Applications, 23% of which are in the Wellness Apps category.

- Insurance companies comprise 40% of the partnerships that have been announced for Mental Health ventures, while institutions and universities capture 20%.

- Mental Health is the top therapeutic area for venture funding value in North America and Europe, but it does not appear in the top 5 therapeutic areas in the Asia Pacific and the Middle East.

- Telemedicine and Patient Solutions have been the dominant clusters for venture funding value over the past 2 years. 71% of the Mental Health venture funding value for H1 2021 was deployed to ventures in these clusters