Re-priced. Re-proved. Re-focused.

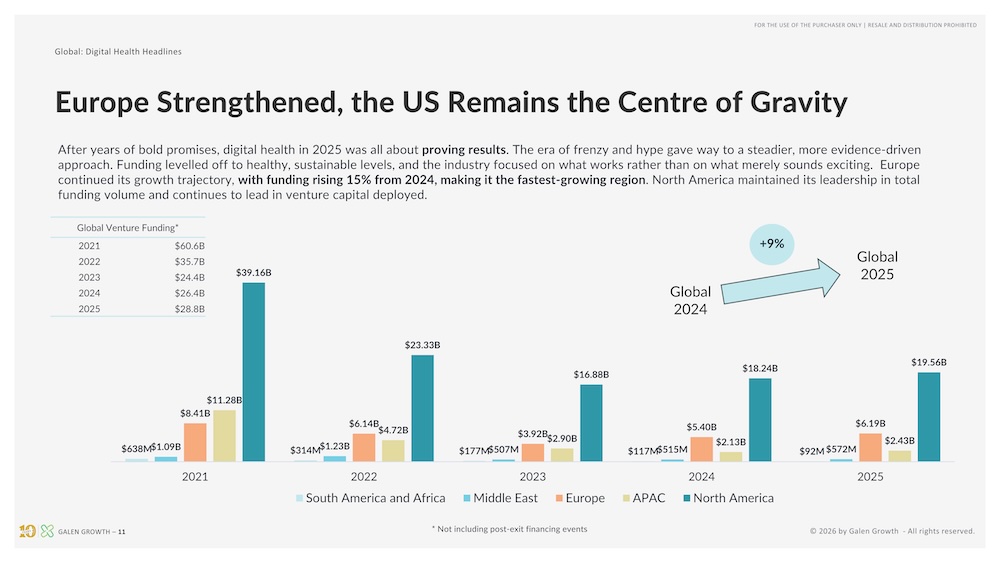

2025 was the year digital health re-priced and re-proved itself.

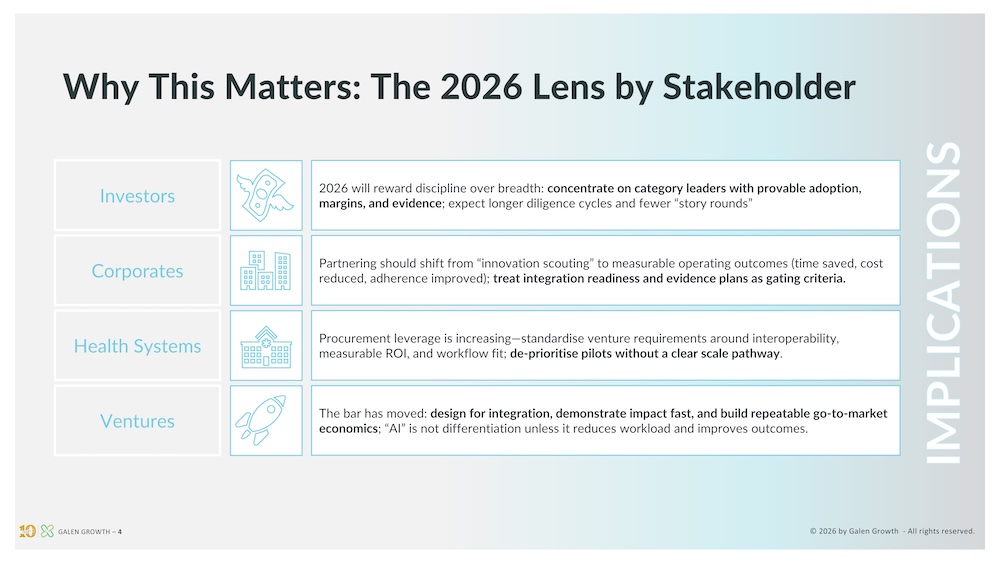

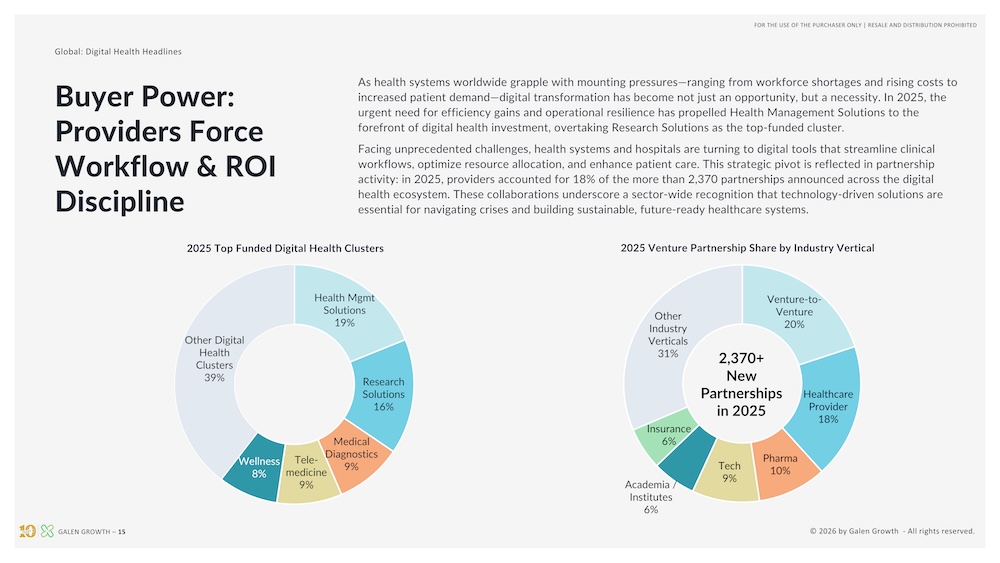

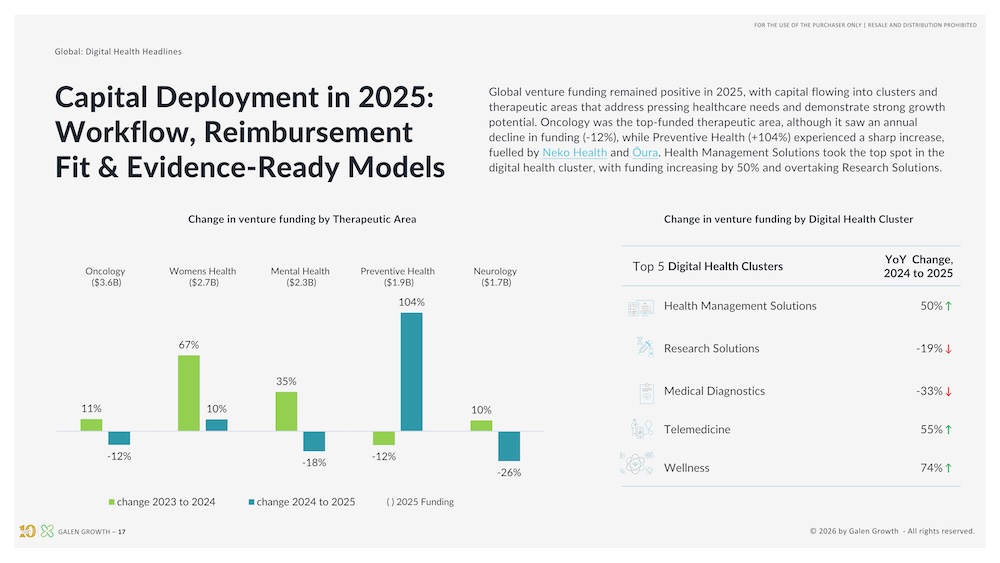

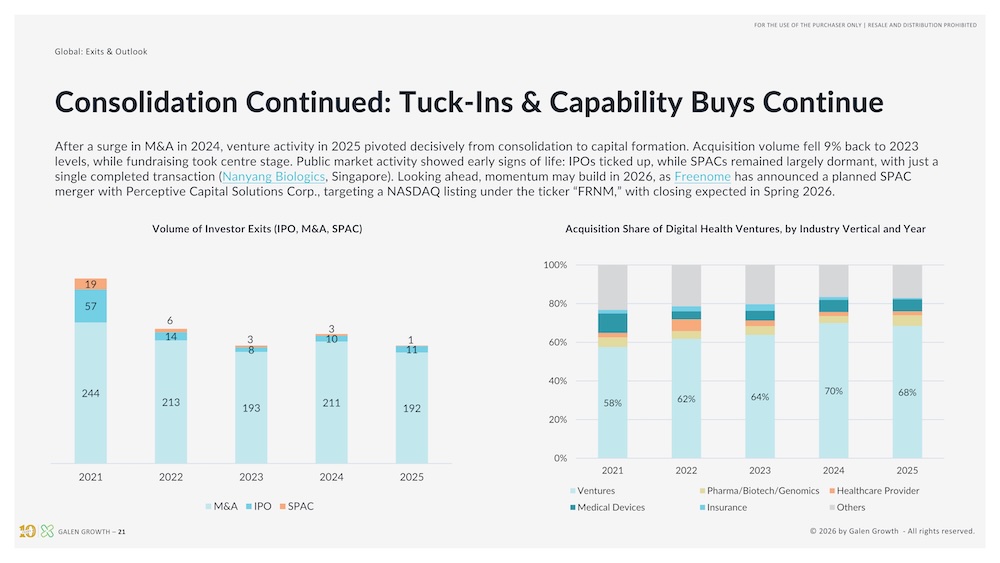

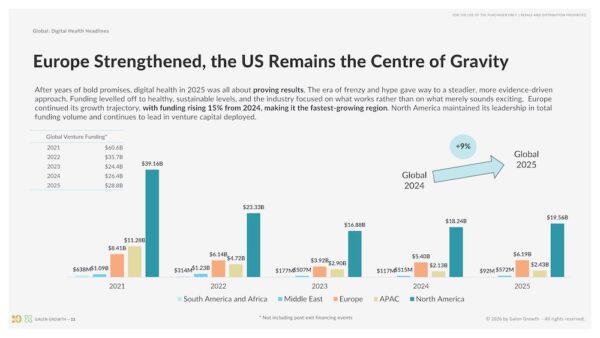

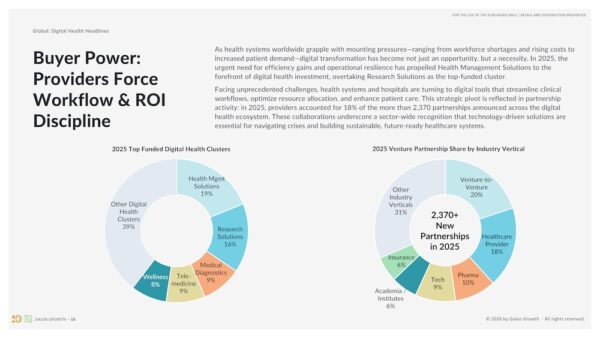

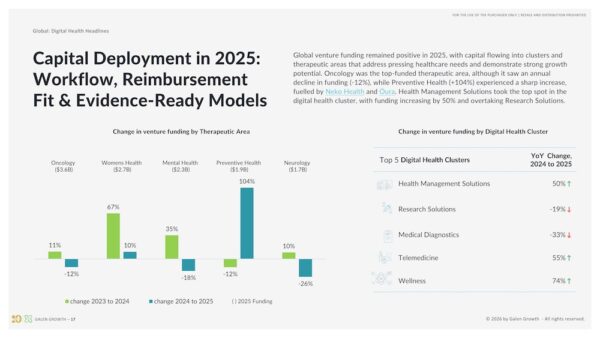

The easy money era is over, and the ecosystem has emerged from the funding winter more disciplined and selective. Capital is now flowing to teams that can demonstrate adoption, durable economics, and execution at scale. Health systems tightened the rules, demanding workflow fit and measurable ROI, forcing ventures to prove real-world impact—not hype. Evidence and distribution became the new power metrics, separating true operators from storytellers.

As the exits window begins to reopen, the winners are clearer than ever—and so are the consequences for anyone who can’t deliver.

For investors, the report shows how risk has shifted decisively toward venture execution. For pharma leaders, it highlights an ecosystem consolidating around fewer, higher-confidence partners in core categories. For health systems and hospitals, it is a clear signal to seize the momentum for change. And for innovators, it clarifies what the market now values most: evidence, interoperability, and measurable value creation.

Powered by HealthTech Alpha’s billion-plus data points, this report delivers a definitive retrospective on the global digital health ecosystem in 2025 and provides practical guidance for navigating the path forward.