By Galen Growth Research — Updated 09 September 2025

Big Pharma is moving from DTC advertising to Direct-to-Patient (DTP) infrastructure—brand-owned digital front doors that stitch together telehealth → e-prescribing → home delivery → adherence support, led by LillyDirect, PfizerForAll, and NovoCare, with Astellas’ DIGITIVA signalling broader adoption.

TL;DR

- What changed? 2024–2025 saw pharma launch patient-centric, partner-powered platforms that reduce time-to-therapy and improve adherence, not just clicks.

- Who’s leading? LillyDirect and PfizerForAll are the only models that currently span the five critical DTP elements: Remote diagnosis, Telehealth, Online pharmacy & distribution, Disease management, Health InsurTech.

- Why it matters? These rails create transparent cash-pay pathways, manufacturer-verified authenticity, and net-price clarity—pressuring rebate-heavy flows while remaining compatible with benefits where needed.

- What’s the catch? Heightened advertising and anti-kickback scrutiny mean compliance needs to be designed into product flows, not bolted on.

How we got here: the short history (partners and break-ups)

Pharmaceutical giants have long spent billions on direct-to-consumer (DTC) advertising—familiar jingles, glossy television campaigns and a steady stream of online promotions. Yet what began as brand awareness has, by 2024, evolved into something more operational: direct-to-patient (DTP) infrastructure.

In 2024, Eli Lilly (LillyDirect), Pfizer (PfizerForAll) and Astellas (DIGITIVA) launched platforms that went beyond marketing. They offered integrated “digital front doors” connecting remote diagnosis, telehealth, e-prescribing, fulfilment and disease management. Novo Nordisk followed in 2025 with NovoCare Pharmacy, focused on stabilising access to its high-demand GLP-1 therapies Wegovy and Ozempic.

This shift was not merely a technological flourish. It was a structural pivot: from persuasion to provision; from clicks to continuity of care. For the first time, patients could enter a pharma-owned platform, speak to an independent clinician, receive an e-prescription, and have medicines shipped—often within days.

The facts that matter

The Galen Growth Pharma Innovation Index (2024) set the framework for measuring DTP maturity. Five elements define the field: Remote diagnosis, Telehealth, Online pharmacy & distribution, Disease management, and Health InsurTech.

- LillyDirect: The only platform that operationalises all five elements, spanning Amazon Pharmacy, Truepill, 9amHealth and Form Health. Therapy areas: obesity, migraine and diabetes.

- PfizerForAll: Also full-stack, integrating same-day telehealth and delivery through UpScriptHealth, Alto and Instacart—while staying compatible with pharmacy benefit managers (PBMs).

- NovoCare Pharmacy: A 2025 launch, distinct for transparent cash-pay rails. By publishing flat prices for GLP-1 therapies, NovoCare demonstrates both patient affordability and manufacturer control.

- Astellas DIGITIVA: More therapeutic-specific, blending clinical tools such as Eko and WellDoc. Still maturing in fulfilment and InsurTech.

The models compress time-to-therapy from weeks to hours, with profound consequences in areas where patient demand and insurance friction collide—obesity, migraine and diabetes. They also provide manufacturer-verified authenticity, countering counterfeit supply risks that emerge when demand spikes.

Comparison: capability lens (the five DTP elements)

| Dimension | LillyDirect | PfizerForAll | NovoCare | Astellas DIGITIVA |

| Remote diagnosis | ✔︎ | ✔︎ | Partial | Partial |

| Telehealth | ✔︎ | ✔︎ | ✔︎ | Partial |

| Online pharmacy & distribution | ✔︎ (Amazon, Truepill) | ✔︎ (Alto, Instacart) | ✔︎ (speciality) | Emerging |

| Disease management | ✔︎ (9amHealth, Form Health) | ✔︎ (programme add-ons) | ✔︎ | ✔︎ (WellDoc, Eko) |

| Health InsurTech | ✔︎ | ✔︎ | Maturing | Early |

| Overall posture | Hybrid (insured + cash-pay) | Benefits-native | Cash-pay anchor | Therapeutic-first |

Source: Galen Growth 2024 Pharma Innovation Index, Direct-to-Patient section.

What the models get right (and why they’ll endure)

The most striking achievement of these platforms is access & speed. What once took weeks—appointment, prescription, insurance wrangling, pharmacy pick-up—can now be compressed into a matter of days, sometimes hours. For chronic and high-demand therapies, this is transformative.

They also get adherence & outcomes right. Through digital therapeutics, reminders and case management, pharma is pushing persistence rates higher, a critical determinant of outcomes. WellDoc’s integration into Astellas’ DIGITIVA exemplifies how software supports not just access, but ongoing engagement.

Transparency is another feature. NovoCare’s cash-pay model illustrates the disruptive potential of net-price clarity. Employers, patients and even payers can see actual costs, challenging the opaque rebate-driven economics of the PBM system.

Finally, authenticity & safety is paramount. By centralising fulfilment through verified partners such as Amazon Pharmacy, Truepill and Alto, these platforms reduce the risk of counterfeit or compounded products infiltrating supply chains.

Model snapshots

LillyDirect (Eli Lilly) — full-stack access

What it is: A digital front door spanning independent telehealth, in-person HCP finders, online pharmacy fulfilment, disease-management partners, and affordability support. Coverage: obesity, migraine, diabetes. Partners: e.g., Amazon Pharmacy, Truepill (acquired), 9amHealth, Form Health.

Why it’s distinct: It operationalises all five DTP elements.

PfizerForAll (Pfizer) — benefits-native convenience

What it is: Same-day telehealth/in-person bookings, vaccine scheduling, home delivery of Rx/OTC/diagnostics, with savings/support when appropriate. Partners: UpScriptHealth, Alto (acquired), Instacart.

Why it’s distinct: Also covers all five DTP elements while remaining PBM-compatible.

NovoCare Pharmacy (Novo Nordisk) — GLP-1 cash-pay anchor

What it is (2025): Manufacturer-run DTP rails with transparent cash-pay pricing and speciality fulfilment to stabilise access for Wegovy/Ozempic cohorts.

Why it’s distinct: Extends the 2024 playbook to high-demand therapies and cash-pay elasticity. (2025 details from company announcements; complements our 2024 Index coverage.)

Astellas DIGITIVA — therapeutic-specific pathway

What it is: A patient-centric model that blends clinical tools (e.g., Eko, WellDoc) with health-system deployments; distribution and InsurTech are still maturing relative to their peers.

Concerns to design out (compliance is a product feature)

Yet enthusiasm should be tempered. With new rails come new risks.

Compliance is the most immediate. U.S. lawmakers are probing whether pharma-owned platforms could blur the lines between manufacturer, prescriber and distributor. The spectre of anti-kickback violations looms large. Ensuring independence of healthcare professionals, transparent advertising and non-steering patient journeys is critical.

Equity remains unresolved. Cash-pay transparency may improve choice but does not equal affordability. For lower-income patients, benefits-first pathways are still essential. Without them, digital front doors risk becoming premium gates.

Channel friction is also real. Pharmacies and healthcare providers worry about disintermediation. Unless pharma shares value across the chain, resistance may harden.

Finally, the operational complexity of prior authorisation, cold-chain logistics and case management should not be underestimated. The platforms are only as strong as the orchestration of their many partners.

PBMs: the impact in one page

The question inevitably arises: do direct-to-patient rails threaten to displace PBMs? The answer, at least for now, is no. PBMs remain indispensable for the insured majority, shaping benefit design, managing utilisation and handling specialty distribution.

What DTP does is re-price rather than replace. Transparent cash-pay rails create alternatives that expose the true net price of therapies. For PBMs, this pressures rebate-heavy models and undermines the spread economics that have historically driven profitability.

In categories with high self-pay elasticity—GLP-1s being the prime example—cash-pay pathways create leakage. Employers and payers are increasingly aware of these dynamics and may push PBMs towards tighter formularies, outcomes-based guarantees, and better mail-order user experiences to keep members within benefit designs.

The net effect: PBMs will not disappear, but their bargaining position is being recalibrated by the visibility of manufacturer-led channels.

Forecast (2025–2027): five crisp calls

Between now and 2027, five trends are likely to shape the landscape:

- Framework adoption: more pharma players will follow Lilly and Pfizer, using partnerships rather than green-field builds.

- Therapy expansion: cardiometabolic and neurology pipelines will migrate to DTP, given their digital diagnostic and disease-management readiness.

- Net-price forward: expect flat-price offers to proliferate, with employers pressing for net-price contracts.

- Compliance-by-design: platforms will only scale if eligibility rules, consented data use and HCP independence are baked into the user interface.

- Partner pruning and M&A: alliances will consolidate. Expect visible exits of partners that cannot meet compliance thresholds.

PBMs will not disappear. But their rebate-centric economics will face leakage as cash-pay rails expand. Tighter formularies and outcomes-based guarantees will be their response.

Why this matters: a point of view

For industry leaders, the DTP shift is more than a digital upgrade; it is a strategic repositioning. Pharma firms are no longer passive suppliers reliant on intermediaries—they are becoming orchestrators of patient journeys.

For investors, the platforms create investable signals. Full-stack models with strong partner networks are positioned to scale; those unable to embed compliance risk collapse. Expect M&A in telehealth, fulfilment and digital therapeutics as incumbents secure their rails.

For start-ups, the stakes are high. Platforms like LillyDirect or PfizerForAll are only as differentiated as their partners. Start-ups that solve specific frictions—prior authorisation, adherence, affordability—become indispensable. But dependency cuts both ways; being pruned from a major rail could be existential.

How Galen Growth Can Help

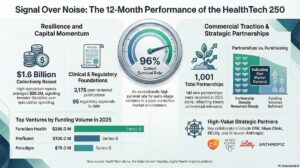

Pharmaceutical companies, Digital Health ventures and their investors face a rapidly shifting landscape as direct-to-patient (DTP) platforms evolve from marketing channels into fully integrated care pathways. Navigating this shift requires evidence, benchmarks, and foresight. This is where Galen Growth adds unmatched value.

- For Pharmaceutical Companies: HealthTech Alpha, our AI-powered intelligence platform, enables pharma leaders to map the maturity of DTP models, track competitive moves, and benchmark against peers. By analysing partnerships, adoption signals and compliance risks, we help pharma teams design patient-centric platforms with confidence, while avoiding pitfalls such as regulatory exposure or weak partner orchestration.

- For Digital Health Ventures: Start-ups and scale-ups looking to become indispensable partners to pharma can leverage our data to position themselves where the need is greatest—whether in telehealth, fulfilment, disease management, or affordability solutions. HealthTech Alpha highlights which ventures are gaining traction, where gaps remain, and how ventures can de-risk their dependence on single pharma rails.

- For Investors: With over a billion data points and proprietary signals such as the Alpha Score and Health Check, we help investors identify the ventures most likely to scale within pharma DTP ecosystems. Our analysis uncovers investable trends—such as cash-pay transparency, adherence optimisation and compliance-by-design—that are reshaping value chains.

By combining deep ecosystem intelligence with AI-powered analytics, Galen Growth enables smarter decisions across the DTP value chain. Whether you are building, partnering or investing, our insights ensure you move ahead with clarity and evidence, not noise.

FAQ

Q1. How is DTP different from traditional DTC advertising? DTC focuses on brand awareness through media campaigns, whereas DTP integrates care delivery rails—telehealth, prescribing, fulfilment, and disease management—directly into pharma-owned platforms.

Q2. Why are LillyDirect and PfizerForAll considered full-stack? Because they operationalise all five DTP elements: remote diagnosis, telehealth, online pharmacy & distribution, disease management, and Health InsurTech. NovoCare is close behind; Astellas DIGITIVA is still therapeutic-first.

Q3. What does DTP mean for patient access and outcomes? DTP models shorten time-to-therapy from weeks to hours and embed adherence tools, which can improve persistence and health outcomes, especially in high-demand areas such as obesity, diabetes and migraine.

Q4. Are PBMs at risk of being replaced? Not immediately. PBMs remain central for insured populations. However, cash-pay transparency from pharma DTP models pressures rebate-heavy PBM economics and forces them to adapt with tighter formularies and outcomes-based guarantees.

Q5. What are the biggest risks for pharma building DTP rails? Regulatory exposure, especially around anti-kickback rules and prescriber independence, is the most immediate. Other risks include affordability gaps, resistance from channel partners, and operational complexity (e.g., prior authorisation, cold-chain logistics).

Q6. What opportunities exist for Digital Health ventures? Ventures solving frictions in prior authorisation, adherence, fulfilment, affordability or compliance can become essential partners. Success depends on embedding seamlessly into pharma rails while diversifying to avoid over-dependency on a single platform.

Q7. How can investors identify winners in this space? Full-stack models with strong partner networks and compliance-by-design approaches are more likely to scale. Tools like Galen Growth’s HealthTech Alpha spotlight investable signals, from emerging ventures to consolidation-ready partnerships.

Q8. Where does Galen Growth fit in? We provide the intelligence layer. Our proprietary data and AI-powered analytics benchmark DTP maturity, track partnerships, and surface investable trends—helping pharma, ventures and investors make smarter, evidence-based decisions.

Glossary

- DTC vs DTP: DTC = advertising; DTP = care-to-delivery rails owned or orchestrated by the manufacturer.

- Health InsurTech (in this context): Eligibility, benefits verification, affordability and payment plumbing embedded in the patient journey.

- Authenticity signal: Assurances that product is manufacturer-verified, countering counterfeit/compounded supply.

- PBM: Pharmacy Benefit Manager