TL;DR — Why This Matters

Clinical trials have become the biggest bottleneck in global drug development, consuming over half of all R&D spend and stretching timelines by years. Despite breakthroughs in AI-powered drug discovery, progress often stalls when treatments enter the clinical phase.

Our latest Galen Growth report, Digital Innovation in Clinical Trials, reveals that funding for clinical-trial-focused ventures has dropped 46% over the past five years, even as demand for faster, safer, and more inclusive trials surges.

Yet, 2025 marks a turning point. With 99% of current funding in clinical trials going to AI-enabled ventures, digital health is poised to solve the trial bottleneck—if investors, regulators, and industry leaders act decisively.

The Bottleneck Slowing Global Drug Development

For all the promise of TechBio and AI-driven discovery, the pharmaceutical innovation engine still jams at the same point: clinical trials.

A single trial can cost anywhere from USD 1 million to USD 100 million, with an average of USD 15,000–50,000 per patient. Recruitment delays remain the single largest cause of cost overruns. Add rising regulatory demands, multicentre logistics, and the complexity of novel therapies—cell, gene, and precision medicine—resulting in an unsustainable R&D cost curve.

At a time when health systems are pushing back on prices—from UK rebate schemes exceeding 30% to US drug-price negotiations—the economics no longer add up. Clinical trials are no longer just a scientific hurdle but also a financial one.

Post-TechBio Boom: The Shift from Discovery to Delivery

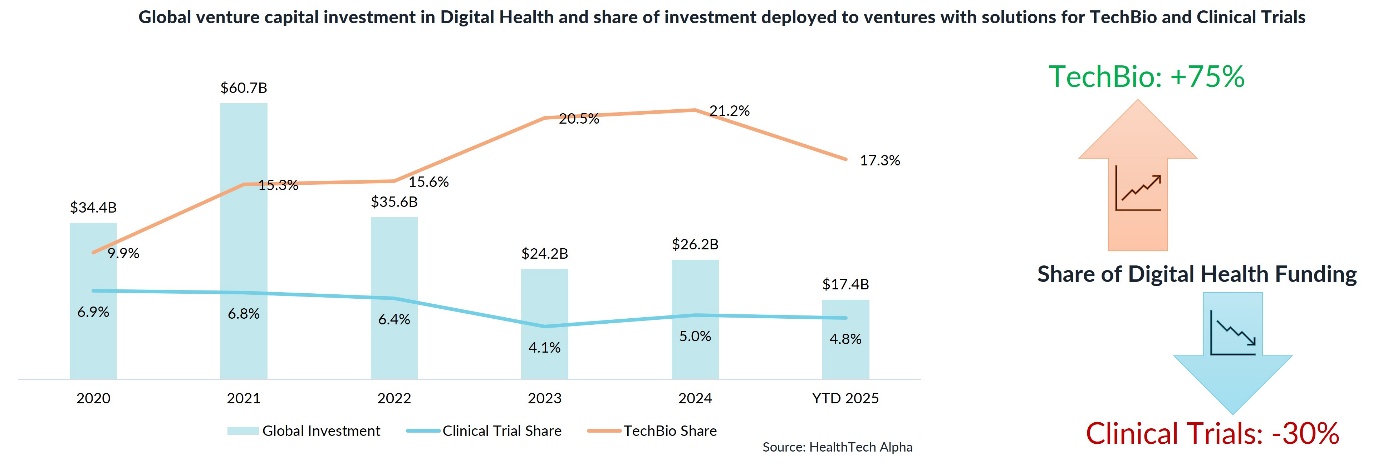

Between 2020 and 2024, venture capital poured into TechBio ventures, fuelling a 75% increase in AI-based drug-discovery tools such as DeepMind’s AlphaFold. But while those dollars accelerated early-stage discovery, they left the trial phase under-resourced.

Our data from HealthTech Alpha, Galen Growth’s proprietary actionable intelligence platform, shows a stark divergence:

- TechBio’s share of Digital Health funding rose from 9.9% in 2020 to 17.3% in 2025,

- while Clinical Trials’ share fell from 6.9% to 4.8% over the same period.

That’s a 30% reduction in capital allocation, precisely when the need for smarter trial execution is peaking.

In short, discovery is speeding up, but validation is lagging behind.

AI Is Already Transforming the Clinical Trial Lifecycle

Despite funding contraction, innovation is advancing rapidly. In 2025 YTD, 99% of all Clinical Trials funding has gone to companies integrating artificial intelligence—proof that investors recognise where the real efficiency gains lie.

According to HealthTech Alpha:

- 89% of ventures founded since 2023 have embedded AI in their products (up from 69% before 2023).

- 71% of ventures focused on trial matching, and 86% of those in trial design rely on AI.

- AI applications span feasibility modelling, protocol optimisation, risk-based monitoring, and real-time data cleaning—each improving precision, safety, and speed.

AI is not replacing clinicians; it’s augmenting decision-making. Tools such as TrialGPT (NIH) demonstrate how large language models can analyse patient histories and eligibility criteria at scale—dramatically reducing manual screening time and enabling more diverse, inclusive participant pools.

Decentralised and Hybrid Models Become the Norm

Digital health innovation also redefines where trials happen. The pandemic catalysed a permanent shift toward decentralised and hybrid clinical trials that combine remote monitoring, telehealth visits, and digital consent.

Decentralisation of trials expands access to participants in rural or underserved communities while improving retention and adherence, and decentralised clinical trials ventures focus on developing platforms to enable trial management tools. Ventures in this category have delivered the highest M&A exit rate—59% of all acquisitions in the cluster over the past five years—signalling strong demand and consolidation.

Meanwhile, digital data-collection tools and wearable devices embed continuous measurement into trials, turning episodic site visits into real-time evidence streams. A JAMA 2024 survey cited in the report found that biopharma adoption of remote-monitoring tools is expected to grow by more than 40% over the next five years.

The Business Case: Efficiency, Evidence, and Equity

Clinical trials are not only about science; they are about economics. R&D development costs have increased nearly 70% since 2013, according to Deloitte. Digital innovation directly counters this trend by:

- Reducing recruitment time through AI-driven patient matching and digital outreach.

- Lowering monitoring costs with automated data integrity checks and risk-based oversight.

- Improving diversity and inclusion is a growing regulatory expectation in the US and EU.

- Enhancing real-world evidence generation to enable regulators and payers to assess value faster.

The result? A faster path from molecule to market—and ultimately, to patients.

Investment Patterns: Short-Term Dip, Long-Term Opportunity

Between 2020 and 2024, global investment in digital clinical trial technologies declined from USD 2.4 billion to USD 1.3 billion, yet the average deal size nearly doubled to USD 49 million by mid-2025. This signals fewer but higher-value investments concentrated in proven, scalable models.

Notably, North America and Europe now account for over 95% of total funding, with Europe showing a 58% year-on-year increase in 2024, driven by investor appetite for AI-enabled decentralised-trial platforms such as Lindus Health (Series B USD 55 million) and Autonomize AI (Series A USD 600 million).

While Asia-Pacific funding dropped by 93%, this region remains a strategic growth frontier, focusing on decentralised trial infrastructure where institutional capacity is still developing.

Partnerships Are Powering the Ecosystem

More than 80 new partnerships were formed between 2024 and 2025 YTD, uniting startups, pharma, and health systems. The data show:

- Over half of health system collaborations now centre on decentralised-trial management.

- 74% of biopharma partnerships focus on solutions for remote or hybrid models, integrating EHRs and real-world data.

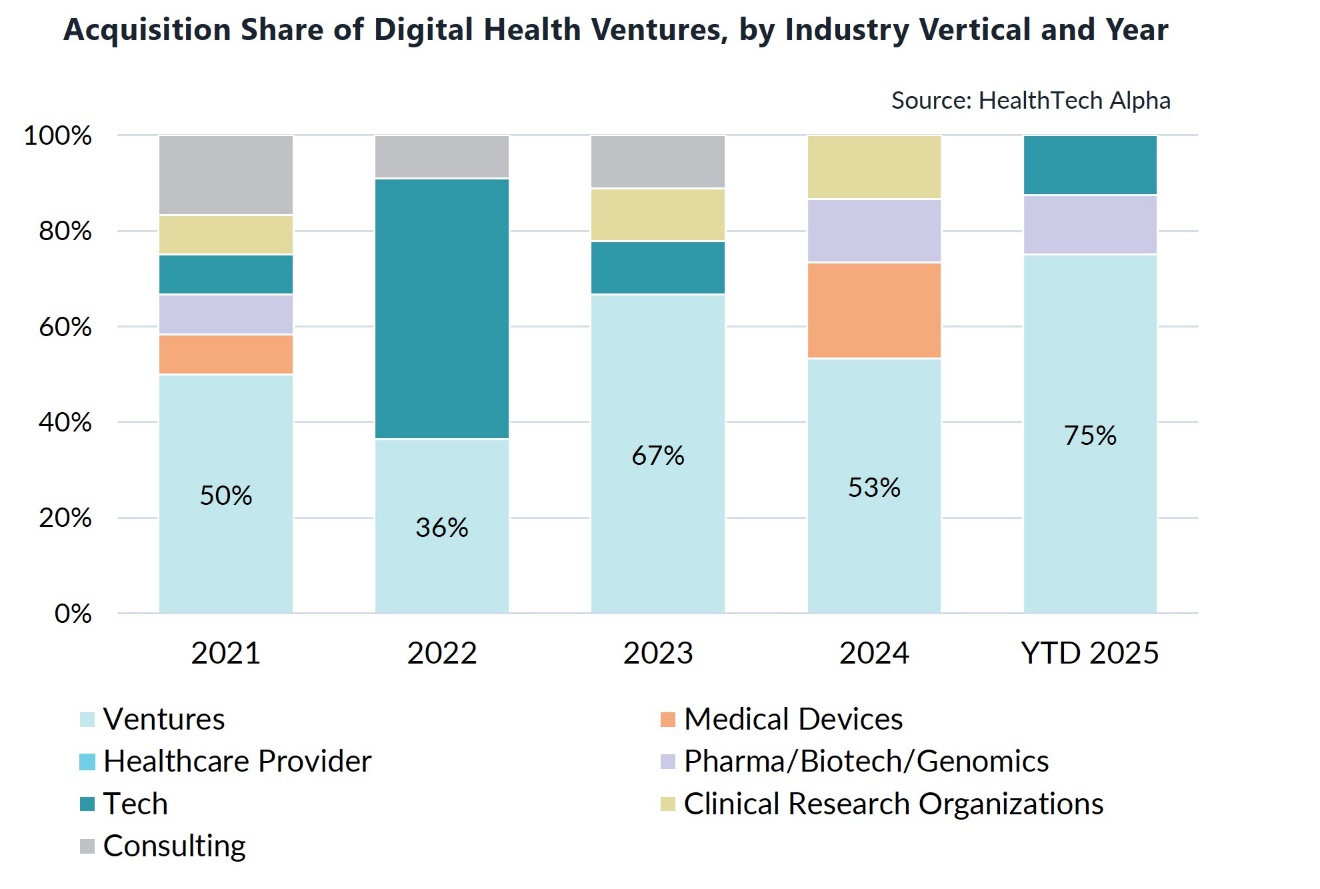

- Venture-to-venture M&A accounts for three-quarters of all exits, signalling an ecosystem consolidating around interoperability and scale.

This shift from siloed solutions to integrated trial platforms mirrors broader healthcare digitisation—collaboration has become the new competitive advantage.

Galen Growth Opinion: Realigning Capital with Need

At Galen Growth, we believe the next wave of value creation in healthcare will come not from discovering more molecules but from better delivering them.

The data from HealthTech Alpha show that clinical trial ventures outpace the global Digital Health ecosystem’s growth by two percentage points, yet capital deployment has lagged sharply. This misalignment between innovation potential and investor attention must change.

Our analysis underscores three imperatives:

- Rebalance funding portfolios — Investors must allocate capital beyond discovery to trial-execution technologies where ROI and exit rates are highest (17% of ventures have already exited).

- Adopt AI pragmatically — The goal is not automation for its own sake, but targeted efficiency across feasibility, monitoring, and compliance.

- Foster cross-sector partnerships. Regulators, CROs, and pharma need shared standards to scale digital and decentralised models responsibly.

The future of drug development depends on fixing the trial bottleneck—and Digital Health holds the key.

| Investor | # Clinical Trial Investments | Recently Investment | Date | Deal Value | |

| Merck Global Health Investment Fund (GHI) | 17 | N-Power Medicine | 07 / 2024 | undisclosed | |

| McKesson Ventures | 13 | Mural Health | 08 / 2024 | $13M | |

| GV | 12 | Paradigm | 01 / 2023 | $203M | |

| Khosla Ventures | 11 | Lightship | 10 / 2021 | $40M | |

| Lux Capital | 11 | Paradigm | 01 / 2023 | $203M | |

What Is HealthTech Alpha?

HealthTech Alpha™ is Galen Growth’s proprietary business actionable intelligence platform and the definitive source for global Digital Health innovation data and insights.

Tracking over 50,000 organisations and more than 1 billion data points, HealthTech Alpha provides evidence-based analytics on funding, partnerships, regulatory filings, clinical validation, and market traction.

Every insight in Digital Innovation in Clinical Trials is powered by HealthTech Alpha’s real-time data engine, which was built to help investors, corporations, and policymakers make informed decisions without bias, hype, or anecdote.

The platform now includes Alpha Edge, enabling subscribers to conduct custom analysis, and Alpha Copilot. This GenAI-powered assistant fuses HealthTech Alpha’s database with natural-language intelligence for instant insights inside enterprise GPT tools.

In short: Redefining Digital Health Intelligence.

Regional Outlook: North America Leads, Europe Gains Momentum

The United States remains the epicentre of digital trial innovation, led by ventures like Pathos (USD 365 million Series D) and Lindus Health. However, Europe is catching up fast, supported by the EMA’s digital-evidence frameworks and NHS initiatives to open trial databases.

By contrast, APAC’s limited infrastructure for decentralised trials—especially in regulatory harmonisation—presents both a barrier and a significant untapped opportunity. Strategic partnerships and public-private initiatives will be essential to bridge this gap.

The Call to Action: Invest Where Innovation Meets Impact

The tools to transform clinical trials already exist. AI models can optimise design, decentralised platforms can widen access, and real-time data can accelerate regulatory confidence. What’s missing is alignment: capital and need, innovation and implementation, and adoption within current workflows.

For pharma, this means prioritising partnerships with proven digital-trial ventures.

For investors, it means recognising that the next significant value inflexion in healthcare lies not in molecule discovery but in trial efficiency.

And for regulators, it means ensuring frameworks enable, not inhibit, digital adoption.

The next two years will determine whether the industry turns the trial bottleneck into a catalyst for accelerated innovation—or remains stuck in the slow lane of R&D.

Read the Full Report and Explore the Data

The full Galen Growth report, Digital Innovation in Clinical Trials, offers detailed funding analytics, regional snapshots, and category-level insights powered by HealthTech Alpha.

👉 Explore the data now on HealthTech Alpha

Gain access to all underlying datasets, peer comparisons, and Alpha Scores that define the global benchmark for Digital Health intelligence.

About Galen Growth

Galen Growth is the leading provider of actionable intelligence for evidence-based digital health. Independent and agenda-free, we empower investors, corporates, and innovators with the insights to make informed decisions and accelerate global health innovation.