The HealthTech 250 is Galen Growth’s selection of the 250 most promising

early-stage Digital Health ventures across the globe in 2022

Since 2017, Galen Growth has tracked and reported on the Digital Health innovation across the globe. HealthTech Alpha’s unmatched data, intel and insights allow us to uniquely assess, identify and showcase the most promising early stage Digital Health ventures in the world. Leveraging over 250 million data points and our proprietary venture signals analytics, we are proud to announce our HealthTech 250 – The Most Promising Early Stage Digital Health Ventures in 2022 and to share with you our data and analysis on each venture.

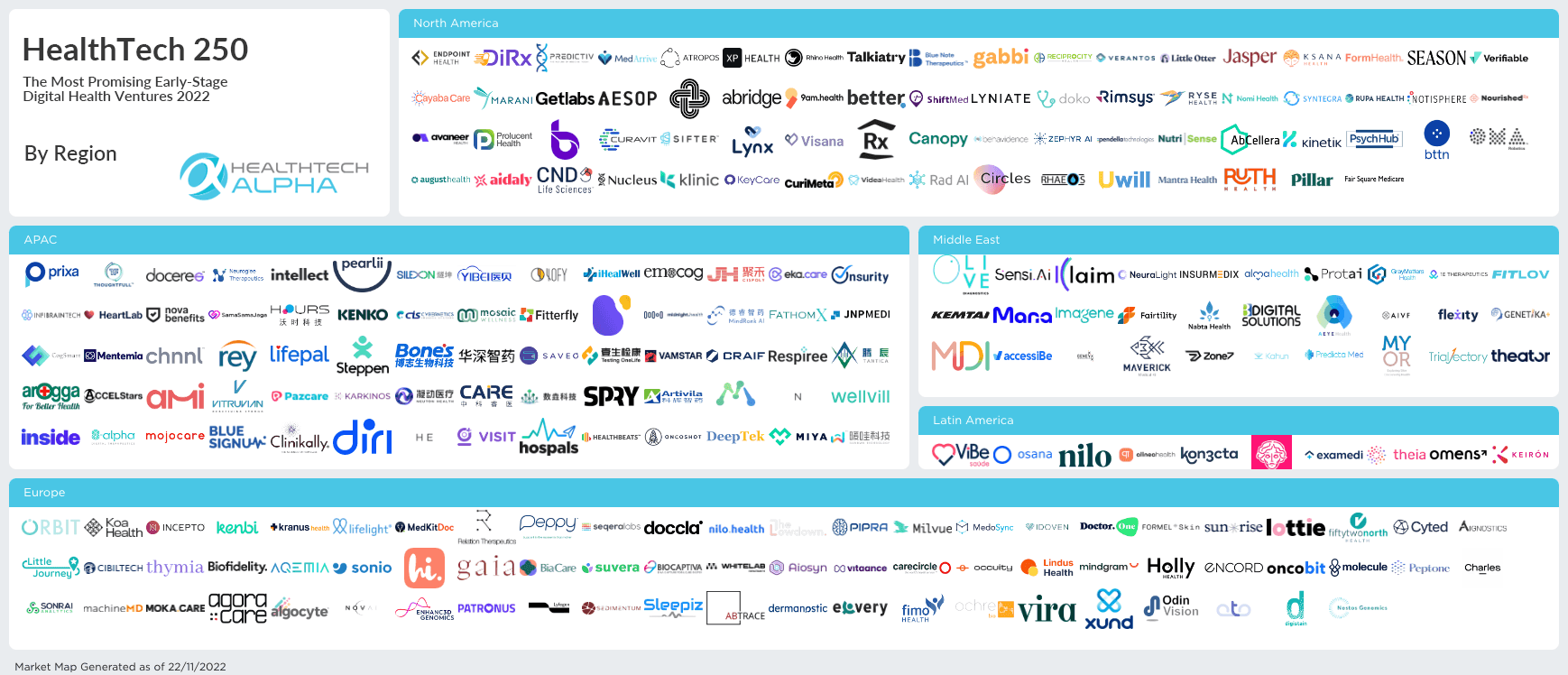

The ventures are located across the 5 largest regions for Digital Health – North and South America, Asia Pacific, Europe and the Middle East. All ventures provide solutions across the entire patient journey from prevention to reimbursement, including wellness solutions, digital therapeutics, omics related solutions, research, and clinical trial support.

Using our proprietary platform HealthTech Alpha, the largest aggregator for Digital Health ventures with more than 12,500 ventures globally, we have developed a selection algorithm that ranked the ventures based on indices, including our proprietary Alpha Score, recent partnerships, news sentiment, clinical strength, key team members, regulatory approvals and clinical strength. The market maturity and total volume of ventures within the key geographies were taken into account to generate a weighted distribution of ventures.

Click on view all ventures (bottom of the table) to open the entire HealthTech 250 as a venture matrix in HealthTech Alpha. (If you are new to HealthTech Alpha and don’t have a login, create one for free here.)

Methodology

The Galen Growth research team has created an evaluation algorithm to identify the HealthTech 250 of 2022.

This proprietary algorithm is based on a set of metrics and is centered around the venture’s relevance to the top trending Digital Health topics of the year, their investments, and partnership activity with key stakeholders within the ecosystem. The HealthTech 250 only highlights promising early-stage ventures. Each venture needs to be incorporated within the past 5 years and have not yet completed their Series A funding raise.

In our methodology, we included 6 key metrics, each contributing to a final score, and finally normalized based on the region where the venture is incorporated. These 6 key metrics are, as follows:

- Metric #1: The venture’s relevance to the top trending Digital Health topics of 2022

- Metric #2: The venture’s Alpha Score – our proprietary maturity assessment of Digital Health Ventures

- Metric #3: The number of partnerships and significance of the partnerships formed since incorporation

- Metric #4: Number of rounds of investments

- Metric #5: Total funding raised and graded based on other ventures in similar funding stages

- Metric #6: The funding and partnership velocity.

Analysis

Record-breaking partnerships

With more than 12,500 Digital Health ventures across the world, Digital Health is a fast maturing industry. After a record-breaking year with rocketing funding and headlines for Digital Health, the industry has garnered a growing interest. As of October of this year, more than $44 billion of venture capital funding were deployed. To learn more about the trends and funding of 2022, read our Global Digital Health Ecosystem 3rd Quarter Report which we have published at HLTH together with FINN Partners.

The HealthTech 250 ventures cumulatively raised a total of $4.9b in 2021. In June, Helixon, an AI drug discovery platform, raised approximately $75m led by CTC Capital, Neumann Capital and Gaorong Capital.

More than 1,500 partnerships with either corporations, academia or healthcare providers, were announced by Digital Health ventures this year, more than twice than the amount disclosed within the same period last year. With the maturing of the ecosystem, key partnerships with health systems, pharmaceutical companies, insurances and other key industries are critical for the success for all ventures and their partners.

The HealthTech 250 ventures have announced a total of 242 partnerships in 2022. Medical data aggregator Truveta announced 6 new partnerships including 4 health systems and Boston Scientific in September and pharmaceutical giant Pfizer in June. Psych Hub, a behavioural health provider, announced a partnership with HCA Healthcare and Columbia University’s Department of Psychiatry in February to provide online mental health education.

2022 YTD funding distribution

2022 YTD partnership distribution

- Healthcare Provider

- Pharmaceutical

- Tech

- Insurance

- Academia

- Medical Device

- Others

Most-represented clusters

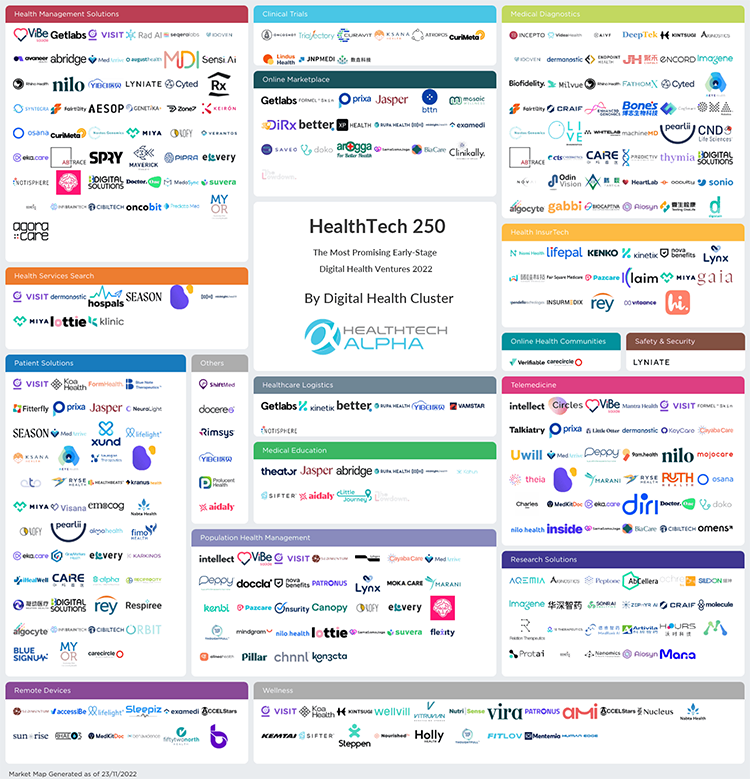

Galen Growth has built the most robust taxonomy for Digital Health ventures – each venture is classified at a minimum by one primary category and up to four supporting categories.

Health Management Solutions (20%), Medical Diagnostics (19%), and Patient Solutions (19%) feature the most winners with Telemedicine (14%) and Population Health Management (13%) rounding up the top 5.

Health Management Solutions (HMS) represents the largest cluster in our taxonomy. Comprising more than 1,900 ventures globally, HMS include B2B solution providers for healthcare providers, pharmacies as well as EHR solutions and Prescriptive Analytics platforms. Winners within the HMS cluster include radiology report generation platform Rad AI, open source workflow orchestration software Seqera Labs and participant-based network Avaneer Health.

Close to 1,300 ventures globally are are providing solutions that are classified under the Medical Diagnostics cluster, including omics-related services, medical imaging software, and other diagnosis tools to support healthcare providers in their work to provide faster and more accurate prognosis and diagnosis to patients. 31% of all Medical Diagnostics solutions provide services to better diagnose cancer, followed by Neurological Disorders (15%) and Cardiovascular Diseases (12%). Three promising ventures in the HealthTech 250 selection are medical imaging solution provider Incepto Medical, reproductive technology company AIVF and vocal biomarker developer Kintsugi to detect depression and anxiety.

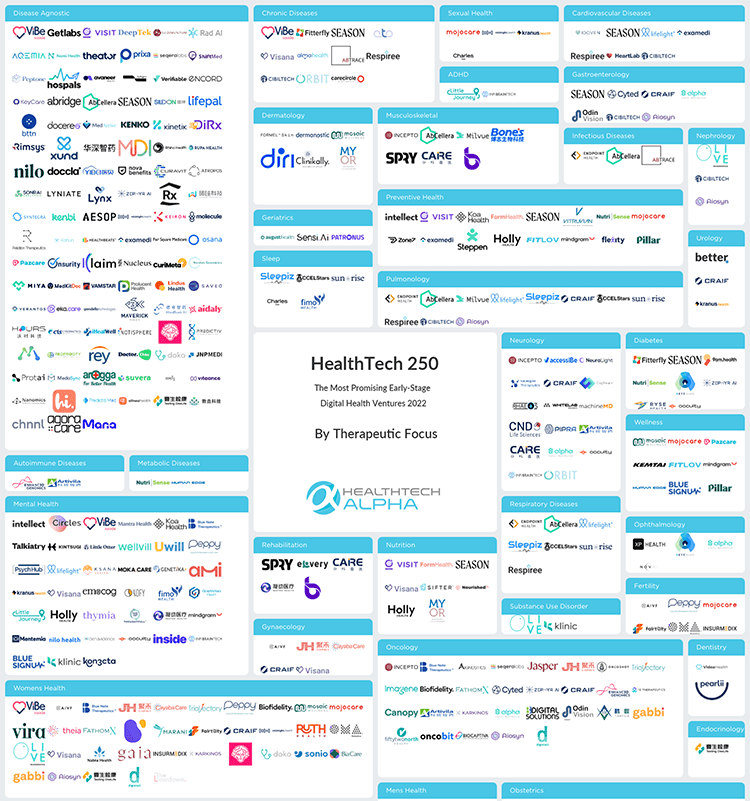

Target therapeutic areas

HealthTech Alpha currently features 78 therapeutic areas that are targeted by Digital Health ventures. Globally, Mental Health (7%) and Oncology (6%) represent the largest therapeutic areas, by volume of ventures.

Apart from the Disease Agnostic ventures, which feature solutions with no specific therapeutic area focus, Mental Health and Women’s Health represent the highest count of winners of the HealthTech 250.

Over the past three years, Digital Health solutions in Mental Health have moved firmly into the spotlight. The solutions stretch across the spectrum of Digital Health: Telecounseling and telepsychiatry have opened ways to provide intimate treatment to patients who fear stigmatization by others and have become a well-received addition to both corporate wellness solutions and insurance product offerings. Digital Therapeutics are providing companion chatbots used to manage patients mental wellbeing and are equally used as a solution by insurance companies. Vocal Biomarkers, a novel kind of digital biomarkers, have opened ways of better diagnosing mental diseases such as anxiety and depression but are equally used to predict neurological disorders such as Alzheimer’s Disease. Corporate Mental Health platform Intellect, on-demand and scheduled consultations application ViBe Saude, and cognitive behavioral therapy provider Koa Health are three of the winners of this years HealthTech 250.

The Women’s Health sector has garnered increased attention throughout 2022 and Digital Health ventures cater to variety of therapeutic disciplines within the sector. The industry shows applications including wellness, information and management applications to address fertility, obstetrics and menopause to the diagnosis of critical illnesses such as gynecologic cancers. Winners within the Women’ Health field include home-based pregnancy care provider Cayaba Care, health support platform Peppy and sexual wellness application Mojocare.

Funding and investors

The HealthTech 250 ventures cumulatively raised a total of $1.9 billion till date in 2022, up 41% as compared to the total raised in 2021. In June, Helixon, an AI drug discovery platform, raised approximately $75 million led by CTC Capital, Neumann Capital and Gaorong Capital. Also in June, Endpoint Health, a precision immunology startup, raised $52 million led by Mayfield Fund.

More than 2,700 unique investors announced their participation across more than 1,400 Digital Health deals in 2022. European early-stage investor Speedinvest disclosed a total of 9 Digital Health deals in 2022. With four of its investees amongst our HealthTech 250 winners (Seqera Labs, The Lowdown, Molecule and Nilo.health), Speedinvest is the most prolific early stage investor in 2022.

Hot Topics

Track the HealthTech 250 and other lists in the Hot Topics section on HealthTech Alpha.

Hot Topics are most requested thematics. These are interactive lists created by the Galen Growth research team aligned to our subscribers.