Galen Growth’s Unmatched Intelligence Identifies Digital Health’s Future Leaders

This is Part 2 of our two-part series on the HealthTech 250 — Galen Growth’s annual list of the 250 most promising early-stage digital health companies in the world. In Part 1, we profiled the 2025 cohort and detailed the selection methodology.

In this update, we use real-time HealthTech Alpha data to analyse the key trends since 1 January 2025 in digital health funding, deal activity, partnerships, and ecosystem performance, and we share our point of view on what to expect for the rest of the year.

📄 Read Part 1 here: HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2025

Digital Health Funding in 2025: Sharp Decline but Higher Selectivity

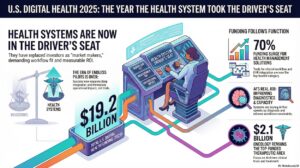

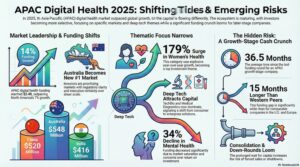

At the close of Q2, Digital Health funding in 2025 entered a period of flux across the globe, with an overall 13% decline in funding from H1 2024 to H1 2025. Political headwinds dominate the headlines, and investment markets are reacting with “selective scale” funding, characterised by a heightened focus on proven value and tangible returns. Ventures in Asia Pacific remained largely unaffected by the funding rollercoaster, while the U.S. funding dropped by 28% and European venture funding saw a 53% gain.

From 1 January to 1 August 2025, HealthTech 250 companies have raised USD 647 million across 33 disclosed funding deals. This marks a sharp decline for the early-stage companies, down from USD 1.4 billion for the first 7 months of the year in 2024, mirroring the tightening of funding across the global digital health ecosystem.

- Deal size: The average funding round has increased to USD 22.5 million, suggesting that ventures are beginning to seek growth-stage capital, and investors are concentrating capital into fewer, higher-quality early-stage digital health companies.

- Funding stages: Series A dominates, while32% of the funding deals indicated ventures moving into Series B and strategic rounds; Seed and Pre-A deals are rarer, reflecting investor caution.

- Top therapeutic areas by funding: Mental Health (USD 63M), Oncology (USD 64.5M), and Nutrition (USD 70M).

Insight: Investors are prioritising HT250 cohort companies that can show clinical validation, commercial traction, and scalable AI-driven healthcare solutions.

Digital Health Deal Volume: Activity Falls 80%

Deal activity has slowed sharply — only 33 funding deals so far in 2025, compared to 66 over the same period in 2024.

- Fundraising cycles: Average early-stage funding intervals have stretched to 25.7 months, signalling weaker funding strength.

- Concentration: Most deals are in Medical Diagnostics, Health Management Solutions, and Wellness clusters with a focus on AI-driven solutions.

Insight: The drop in deal count is forcing early-stage healthtech startups to explore bridge financing, structured deals, and M&A as alternatives to traditional VC rounds.

Digital Health Partnerships: Shift from Volume to Strategic Impact

Partnership announcements are down 50% year on year, with only 71 partnerships recorded by HealthTech 250 companies so far in 2025.

- Monthly trend: March peaked at 14 partnerships.

- Top therapeutic areas by partnerships: Mental Health (12), Oncology (10), Preventive Health (7), Wellness (7).

- Top clusters by partnerships: Telemedicine (15), Medical Diagnostics (12), Clinical Trials (11), Patient Solutions (10).

- Key partners: Mayo Clinic (2 partnerships), Intermountain Health, MSD, and Sanofi remain highly active.

Insight: Partnerships in 2025 are more selective, aimed at revenue generation, regulatory validation, and distribution scale, rather than broad experimentation.

Exit Tracker:

Venture acquisitions within the HealthTech 250 cohort indicate a healthy ecosystem with strong innovation that is attractive to the larger digital health ecosystem.

- Acquisition count: 4 M&A transactions announced between April and mid-August indicate significant interest in the cohort

- Deal size: deal size was not disclosed for any of the acquisitions

- Focus clusters: Telemedicine (2) and Medical Diagnostics (2)

Insight: Interest in high-potential ventures remains high, despite financial stress in the global ecosystem.

HealthTech 250 Cohort Signals: Strong Survival, Evidence-Led Growth

Despite market pressures, the HealthTech 250 ecosystem remains resilient:

- Survival rate: 95% of companies remain active in 2025.

- Exit rate: 2.5% of companies have been acquired in 2025.

- Evidence generation: 510 peer-reviewed publications, 10 clinical trials, and 11 regulatory approvals since January.

- Therapeutic focus: Mental Health (34 companies), Oncology (30), Women’s Health (23).

- Business model: 64% are disease-agnostic platforms, enabling scalability across multiple therapeutic areas.

Insight: Evidence-led innovation is now the core success driver — regulatory approvals and clinical trials are acting as currency in fundraising and partnerships.

HealthTech 250 Geographic Trends

- United States: Dominates both funding and partnerships with 155 active HealthTech 250 companies.

- APAC: South Korea, Israel, and Singapore are emerging hubs for AI diagnostics, clinical trial technology, and digital therapeutics.

- Europe: Strength in Oncology innovation and TechBio, but longer deal cycles due to regulatory complexity.

Insight: APAC is set to post the fastest growth in digital health partnerships in H2 2025, while Europe will lean on regulatory-grade validation as its competitive edge.

Top HT250 Performers in 2025 YTD

While large funding rounds grab headlines, the most investable early-stage digital health companies in 2025 are those combining fresh capital, high momentum score, and proven clinical evidence. Within the HealthTech 250, several ventures stand out for hitting this “triple benchmark” since 1 January 2025:

1. Delfina (US) – Alpha Score: 71.7

A leader in patient solutions for women’s health and obstetrics, Delfina specialises in adherence and disease management through virtual care and machine learning. Backed by a strong evidence base, its 2025 funding is set to accelerate deployment into broader women’s health networks.

2. Teal Health (US) – Alpha Score: 69.9

Operating in the diagnosis cluster, Teal Health provides on-demand lab tests targeting cervical cancer, gynaecological health, and women’s oncology. Its clinical evidence has made it a compelling choice for payers and providers seeking accessible, preventive diagnostic solutions.

3. PhaseV (Israel/US) – Alpha Score: 67.8

A research solutions company focused on AI-driven clinical trial design and optimisation. PhaseV’s 2025 funding round supports its mission to accelerate drug development timelines through adaptive trial methodologies and predictive analytics.

4. CND Life Sciences (US) – Alpha Score: 66.8

Specialising in medical diagnostics for neurological diseases such as Parkinson’s and stroke, CND Life Sciences brings validated diagnostic tools that can be integrated into both specialist and primary care settings.

5. Bioptimus (France) – Alpha Score: 66.2

A European research solutions venture leveraging foundation models and bioinformatics to accelerate drug discovery. Backed by proven clinical applications, Bioptimus is among the most internationally recognised deeptech players in the 2025 cohort.

6. Thatch (US) – Alpha Score: 65.8

Working in the health insurance and reimbursement space, Thatch has created a corporate health platform that integrates operational efficiency with disease-agnostic applicability. Its evidence-led approach has helped secure significant payer and employer partnerships.

7. First Ascent Biomedical (US) – Alpha Score: 56.1

Focused on omics-based diagnostics for paediatric oncology, First Ascent Biomedical applies precision medicine techniques to improve treatment outcomes for childhood cancers. Its combination of high-impact mission and clinical rigour positions it for growth in 2025 and beyond.

8. Imagene AI (Israel) – Alpha Score: 55.9

A medical diagnostics venture using AI for rapid biomarker detection in oncology. Its evidence-led platform supports precision cancer treatment decisions.

9. Reperio Health (US) – Alpha Score: 54.6

Operating in wellness diagnostics, Reperio Health delivers at-home health screening kits with clinically validated accuracy, expanding accessibility to preventive health checks.

10. Nucleus Genomics (US) – Alpha Score: 53.8

Focused on genetic testing and risk prediction, Nucleus Genomics combines advanced genomic analysis with actionable health insights to drive personalised medicine.

Insight: In 2025, early-stage digital health companies with Momentum Scores above 50, fresh funding, and validated clinical evidence are outperforming peers. These ventures demonstrate strong market readiness, scalable business models, and measurable patient impact. They share three competitive advantages:

- Evidence-based scalability — Proven outcomes that can be replicated across markets.

- AI and data-driven innovation — Technology that delivers measurable improvements in healthcare delivery.

- Clear value proposition — Solutions addressing high-burden, high-cost conditions.

As 2025 progresses, we expect these companies to maintain leadership positions in the evidence-led growth segment of the HealthTech 250, attracting both investor capital and strategic partnerships.

Risks and Opportunities for the Remainder of 2025

Key risks:

- Runway compression for companies needing to raise capital in the next 12 months.

- Evidence gap for ventures without robust clinical validation.

- Overcrowding in generic telehealth and wellness platforms.

Key opportunities:

- AI-powered clinical validation as a competitive differentiator.

- Cross-sector partnerships between pharma, providers, and technology firms.

- Multi-therapeutic platforms that can adapt to shifting payer priorities.

Insight: The remainder of 2025 will favour evidence-based, partnership-driven, and platform-oriented digital health companies.

Our Point of View: From “Growth at All Costs” to “Evidence at All Costs”

Since January, the HealthTech 250 cohort has been tested by its toughest market in years. Funding is scarcer, deals take longer, and partnerships are fewer, but the companies that remain active are more evidence-led, strategically aligned, and operationally focused than ever.

For the rest of 2025, we expect:

- Selective expansion: Only the most validated companies will secure funding, but those that do will reap significant benefits.

- Partnerships as growth engines: High-value alliances will replace scattershot market expansion.

- Evidence as the primary currency: Clinical trials, regulatory milestones, and peer-reviewed publications will be as decisive as capital in determining market leadership.

The early-stage digital health companies that embrace these realities will not just survive 2025 — they will position themselves to lead in 2026 and beyond.

FAQ: HealthTech 250 Mid-Year 2025 Review

Q1: What is the HealthTech 250?

The HealthTech 250 is Galen Growth’s annual ranking of the 250 most promising early-stage digital health companies worldwide, powered by HealthTech Alpha — the leading global digital health intelligence platform.

Q2: Who publishes the HealthTech 250?

Galen Growth, an authority on digital health analytics and market intelligence, publishes it.

Q3: What period does the 2025 mid-year review cover?

The review covers 1 January 2025 to 11 August 2025.

Q4: How much funding have HealthTech 250 companies raised in 2025 so far?

From 1 January to 1 August 2025, HealthTech 250 companies raised USD 676.4 million across 34 funding deals.

Q5: Which therapeutic areas received the most funding?

The top three are Mental Health (USD 63M), Oncology (USD 64.5M), and Nutrition (USD 70M).

Q6: How has deal volume changed in 2025?

Deal volume has dropped 48% year-on-year, with 34 deals between January and August 2025 versus 66 during the same period in 2024.

Q7: What are the main trends in partnerships?

Partnerships have fallen 50% year-on-year, with 71 announced so far in 2025. Mental Health and Oncology lead in partnership activity.

Q8: Which regions are most active in the HealthTech 250?

The United States dominates, but APAC (South Korea, Israel, Singapore) is growing fastest, and Europe remains strong in oncology innovation and digital therapeutics.

Q9: What is the survival rate of HealthTech 250 companies?

95% of HealthTech 250 companies remain active in 2025.

Q10: What is the outlook for the rest of 2025?

The second half of 2025 will favour evidence-based, partnership-driven, and platform-oriented digital health companies that can demonstrate clinical validation, commercial traction, and scalability.