TL;DR

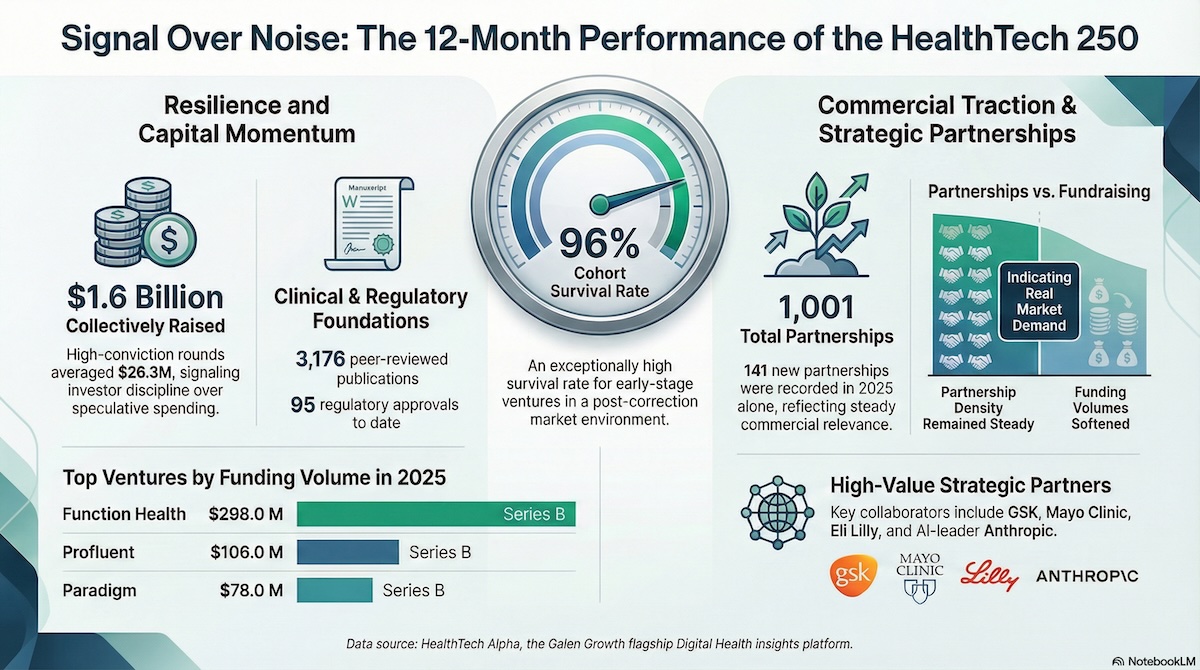

- Resilience: The HealthTech 250 cohort shows a 96% survival rate as of January 2026, highlighting unusual durability among leading digital health startups despite a tighter capital environment.

- Capital Concentration: Collectively raising approximately $1.5–1.6B, the cohort reflects a shift toward fewer but higher-conviction funding rounds in 2025.

- Commercial Traction: With 1,001 partnerships announced, buyer engagement—not fundraising cadence—has emerged as a primary performance signal.

- Evidence & Regulation: Across the cohort, 3,176 publications, 109 clinical trials, and 95 regulatory approvals underscore the growing importance of validation in digital health.

- Signal Over Hype: The HealthTech 250 demonstrates that digital health startups grounded in measurable outcomes, workflow integration, and ROI articulation are compounding value in a post-exuberance market.

Every year, Galen Growth identifies 250 early-stage digital health ventures that, based on evidence-led signals rather than narrative momentum, are most likely to compound value. The 2025 HealthTech 250 was selected in a market already past peak exuberance, with capital tightening and buyers demanding proof, not promise.

Twelve months on, sufficient empirical data exists to assess performance—not at the level of anecdotes or individual fundraising headlines, but across funding outcomes, partnership activity, evidence progression, and survival. The results offer a clear verdict: the cohort performed meaningfully better than the broader early-stage digital health universe, and the signal framework underpinning the selection has largely held.

Performance at cohort level: resilience in a selective market

Across the 250 digital health startups, the past 12 months delivered three headline outcomes.

First, survival and continuity. As of January 2026, 96% of the cohort remains active, an unusually high survival rate for early-stage digital health in a post-correction environment. The HT250 exports also record 10 ventures that were acquired in 2025, reflecting a market where exits are selective but still achievable for the strongest operators.

Second, capital attraction with discipline. Collectively, the cohort raised approximately USD 1.5–1.6 billion over the past year, with funding peaking in a few discrete windows across 2025 (as shown in the investment trend charts) rather than evenly distributed throughout the year. Average deal size was USD 26.3 million, reflecting fewer but higher-conviction rounds rather than spray-and-pray financing.

Third, partnership density. The cohort announced 1,001 partnerships in total, with 141 recorded during 2025 alone. Partnership formation remained steady even during quarters when funding volumes softened, reinforcing the point that commercial and clinical relevance—not fundraising cadence—has become the primary performance signal.

Stand-out performers: who actually pulled ahead

While the HealthTech 250 is not designed to produce a single “winner,” a subset of ventures clearly outperformed on objective metrics such as capital raised, partnership velocity, and strategic relevance.

Among the best-performing digital health ventures by funding momentum were:

- Function Health, which closed a Series B round of USD 298.0 million (Nov 2025), signalling strong investor conviction in longitudinal, data-driven preventive care models.

- Profluent, which closed a Series B round of USD 106.0 million (Nov 2025), reinforcing ongoing investor appetite for AI-native platforms supporting life sciences infrastructure.

- Paradigm, Nourish, and Belong Health, each securing sizeable Series B rounds that coincided with commercial scale-up rather than speculative expansion.

- CertifyOS, House Rx, Bioptimus, Plenful, and Optain Health also featured among the top-funded early-stage deals of 2025.

These companies share a common profile: they sit close to healthcare workflows, address measurable operational or clinical pain points, and can articulate ROI to buyers as clearly as they can articulate upside to investors.

| Venture Name | Founding Country | Last Funding Round Amount | Last Funding Series | Lead Investors |

| Function Health | United States | $298.0 M | Series B | Redpoint Ventures |

| Profluent | United States | $106.0 M | Series B | Altimeter Capital, Bezos Expeditions |

| Paradigm | United States | $78.0 M | Series B | ARCH Venture Partners |

| Nourish | United States | $70.0 M | Series B | JPMorgan Chase |

| CertifyOS | United States | $40.0 M | Series B | Transformation Capital |

| Bioptimus | France | $41.1 M | Series A | Cathay Innovation |

| Plenful | United States | $50.0 M | Series B | Mitchell Rales, Arena Holdings |

Partnerships as the leading indicator of real traction

If funding shows investor belief, partnerships reveal buyer intent—and here the HealthTech 250 performed particularly well.

Over the past 12 months, the most active and strategically significant partners included GSK, Mayo Clinic, Novo Nordisk, Eli Lilly and Company, and leading payer and services organisations such as Aetna. On the technology side, partnerships involving Anthropic highlight growing convergence between digital health and foundational AI platforms.

These relationships spanned clinical validation, data partnerships, commercial deployment, and AI infrastructure—suggesting that incumbents are no longer “experimenting” with digital health but are instead selectively integrating it.

Investor participation: conviction over coverage

Investor activity across the cohort remained selective. The HT250 exports track active-investor counts by month and show meaningful variation across 2025, consistent with a market characterised by episodic conviction rather than continuous deal flow.

Notably, the HT250 exports provided here do not list investor names by deal; they report deal counts and aggregate activity. As a result, investor-level conclusions should be drawn from the underlying deal tables rather than inferred from headlines.

Evidence, regulation, and the “quiet compounding effect”

Beyond funding and partnerships, the cohort demonstrated steady progress on harder-to-fake signals. Across the 250 ventures, the past five years have produced 3,176 peer-reviewed publications, 109 clinical trials, and 95 regulatory approvals, with incremental gains continuing through 2025.

This matters because it underpins durability. Ventures that invested early in evidence generation and regulatory readiness were better positioned to convert pilots into contracts and conversations into capital.

What this says about Galen Growth’s selection quality

Viewed holistically, the 2025 performance data support a clear conclusion: Galen Growth consistently identifies ventures that outperform on forward-looking indicators, not just retrospective hype.

The HealthTech 250’s high survival rate, partnership density, and concentration of capital into validated operators suggest that the underlying signal framework—powered by HealthTech Alpha—is doing what it is designed to do: filtering noise, surfacing momentum, and rewarding evidence.

In a market where many “top startup” lists still overweight storytelling or founder visibility, the HealthTech 250 has functioned as a leading indicator, not a rear-view mirror.

Looking ahead: the 2026 picks to watch

As digital health enters 2026, the bar will rise again. Capital will remain selective. Buyers will continue to demand proof. And AI-driven platforms will be judged not by model size, but by data quality and integration depth.

Against that backdrop, Galen Growth will shortly publish its “HealthTech 250 to Watch in 2026”, drawing on another year of enriched HealthTech Alpha signals. If the past 12 months are any guide, the next cohort is unlikely to be the loudest—but it will almost certainly be the most relevant.

For investors, partners, and founders alike, the message from 2025 is unambiguous: in digital health, signal compounds—and the data is already pointing to where the next wave of value will be built.